ASX Small Cap May Winners: Galileo. Galileo. Galileo. And some other stocks

News

News

May. Let’s start with US markets.

Because May in the US started with the Dow making its biggest gain since 2020, followed within 24 hours by its biggest loss in 2022, perfectly summing up what kind of month May was to become.

The US Fed raised interest rates by 0.50%, the biggest single hit since 2000, helping extend the April-long losing streak for another three weeks. It finally broke for the last week, so the bear market was put on hold. But the S&P 500 ended May down `14% from its January high.

May market news in the States was dominated by economic data and earnings calls roundly summarised as “worse than expected”. SNAP – worst month on record, down 50%. Walmart – biggest drop since 1987. Target – 25% drop. Something about supply chains, something about inflation.

China started making noises about ending a two-month Covid lockdown. The Shanghai government rolled out as many as 50 stimulus measures to restart the local economy – the Action Plan to Accelerate Recovery and Revitalization of the Economy. That might help allay a little of the alarm Chinese Premier Li Keqiang caused last week with a mildly out-of-step call that China’s economy was facing “an even greater challenge than at the start of the pandemic in 2020”.

The ASX had its worst monthly decline since January, down 3% overall. Tech and emerging companies were the main drags, down 6% and 7.6% respectively for the month.

The ASX also got a new index. The AgBiz index will begin quotation as a real-time index on July 1. Its aim – to unite “companies whose principal business activity involves the creation of agricultural products, or the production of commodities used in those products”.

Food. It’s becoming kind of a big deal.

And finally, house prices took a tumble. It wasn’t huge – CoreLogic and REA’s PropTrack both had the national average down 0.1 per cent – but it’s the first in 20 months. Sydney dropped 1.0%; Melbourne 0.7%. Cash rate increases work, it seems.

Oh yeah, we got a new government. What a time to be in charge of making sure everyone’s being fiscally responsible.

It all sounds a bit grim… but let’s pretend it isn’t happening and focus on the positives.

(Stocks highlighted in yellow rose after making announcements during the trading day).

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | PRICE | 1 MONTH RETURN % | MARKET CAP |

|---|---|---|---|---|

| GAL | Galileo Mining Ltd | 1.445 | 557% | $258,377,936 |

| TYX | Tyranna Res Ltd | 0.019 | 245% | $29,114,853 |

| CNJ | Conico Ltd | 0.036 | 200% | $48,897,679 |

| RMI | Resource Mining Corp | 0.15 | 194% | $60,850,962 |

| LIN | Lindian Resources | 0.086 | 177% | $68,216,341 |

| AR1 | Austral Resources | 0.5 | 144% | $122,606,795 |

| DAF | Discovery Alaska Ltd | 0.075 | 114% | $16,742,602 |

| RAS | Ragusa Minerals Ltd | 0.155 | 74% | $19,476,964 |

| MYD | Mydeal.Com.Au | 1.015 | 69% | $262,709,716 |

| OKU | Oklo Resources Ltd | 0.145 | 69% | $73,151,989 |

| BBX | BBX Minerals Ltd | 0.19 | 65% | $87,404,080 |

| E33 | East 33 Limited. | 0.065 | 63% | $17,482,498 |

| MTC | Metalstech Ltd | 0.385 | 60% | $64,165,867 |

| GSR | Greenstone Resources | 0.048 | 52% | $44,709,777 |

| MEK | Meeka Gold Limited | 0.07 | 52% | $64,426,969 |

| HAV | Havilah Resources | 0.265 | 51% | $82,098,791 |

| RFX | Redflow Limited | 0.057 | 50% | $81,986,661 |

| RKN | Reckon Limited | 1.22 | 47% | $138,219,695 |

| QGL | Quantum Graphite | 0.45 | 45% | $131,850,000 |

| TIG | Tigers Realm Coal | 0.023 | 44% | $300,534,154 |

| BEZ | Besragoldinc | 0.079 | 44% | $13,576,147 |

| ASR | Asra Minerals Ltd | 0.04 | 43% | $53,599,033 |

| AGR | Aguia Res Ltd | 0.074 | 42% | $29,592,385 |

| BUB | Bubs Aust Ltd | 0.62 | 41% | $379,920,860 |

| UBN | Urbanise.Com Ltd | 0.64 | 41% | $36,169,011 |

| IFM | Infomedia Ltd | 1.71 | 36% | $642,553,603 |

| EM2 | Eagle Mountain | 0.46 | 35% | $123,065,244 |

| PBX | Pacific Bauxite NL | 0.135 | 35% | $5,559,638 |

| OPT | Opthea Limited | 1.365 | 34% | $480,688,220 |

| TER | Terracom Ltd | 0.765 | 34% | $576,509,837 |

| RXH | Rewardle Holding Ltd | 0.012 | 33% | $6,315,858 |

| VMG | VDM Group Limited | 0.002 | 33% | $13,855,322 |

| PTX | Prescient Ltd | 0.17 | 31% | $111,186,213 |

| PNV | Polynovo Limited | 1.235 | 30% | $817,184,734 |

| IND | Industrialminerals | 0.305 | 30% | $8,967,000 |

| AZI | Altamin Limited | 0.097 | 29% | $37,996,525 |

| ESR | Estrella Res Ltd | 0.027 | 29% | $32,418,402 |

| BBL | Brisbane Broncos | 1 | 28% | $98,040,631 |

| DRX | Diatreme Resources | 0.032 | 28% | $97,221,844 |

| B4P | Beforepay Group | 0.51 | 26% | $17,261,709 |

| FRM | Farm Pride Foods | 0.17 | 26% | $9,380,630 |

| AVR | Anteris Technologies | 21.3 | 25% | $292,565,852 |

| BFC | Beston Global Ltd | 0.075 | 25% | $64,784,956 |

| OSM | Osmond Resources | 0.26 | 24% | $7,306,000 |

| OZZ | OZZ Resources | 0.13 | 24% | $4,342,796 |

| SHE | Stonehorse Energy Lt | 0.021 | 24% | $14,373,137 |

| TAS | Tasman Resources Ltd | 0.021 | 24% | $14,094,198 |

| IMM | Immutep Ltd | 0.42 | 24% | $363,820,722 |

| OZM | Ozaurum Resources | 0.185 | 23% | $10,584,960 |

There’s only one story in ASX Small Caps Land in May, so let’s get through it. It’s Galileo (ASX:GAL), up 557%.

By all reports, he knew his way around a telescope, but even Galileo would have struggled to spot the ASX explorer that took his name at the stratospheric heights it soared to in May.

Let’s lay out one of the more remarkable months for an ASX small cap so far this year:

May 4: The carnival begins with an announcement it had hit “nickel and copper sulphides at the company’s 100% owned Norseman project in WA.

“Highly encouraging” Galileo’s MD Brad Underwood said. Encouraging enough for shareholders to pick it up off a 20c mat where it had been hovering for, ooh, the better part of a decade.

May 9. They didn’t get long to pile in, because GAL went into a Trading Halt. Excite!

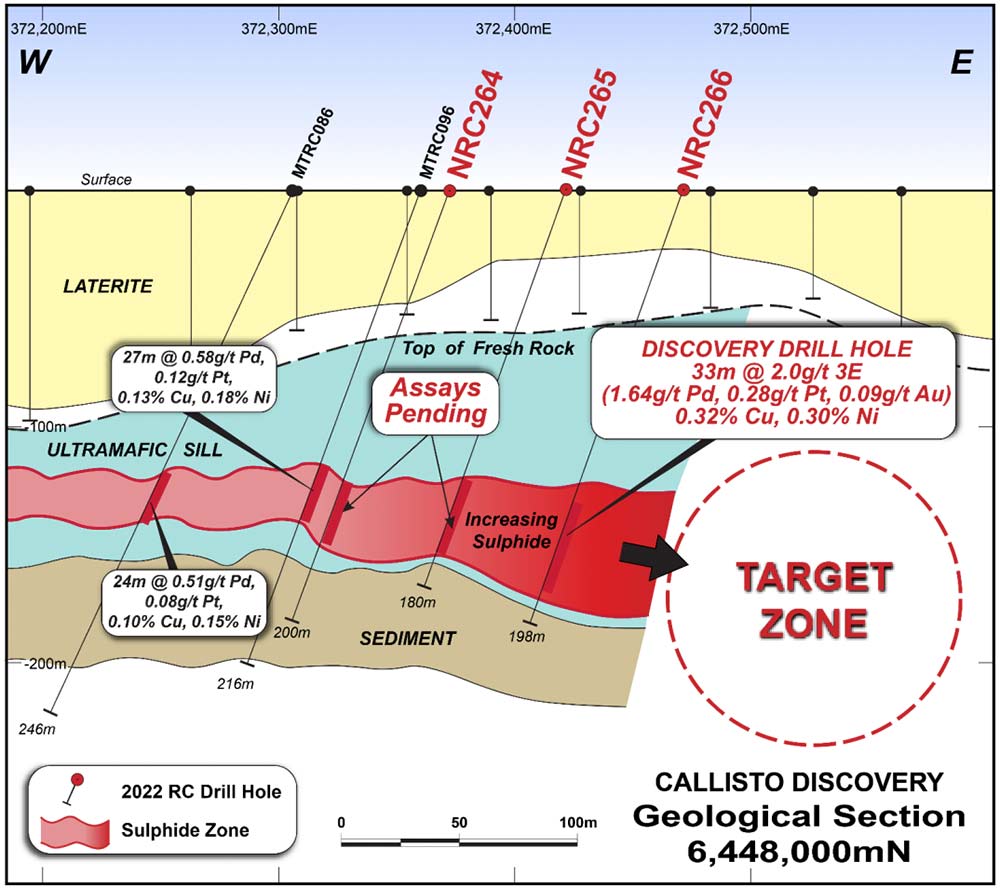

May 11: Boom. Yeah, it’s a biggie. The discovery hole returns 33m @ 2g/t 3E (1.64 g/t palladium, 0.28 g/t platinum, 0.09 g/t gold), 0.32% copper & 0.30% nickel from 144m. Underwood says “every drillhole” intersects mineralisation.

There’s talk of geological similarities to South Africa’s colossal ‘Platreef’ palladium-platinum-gold-rhodium-copper-nickel deposits.

Share price heads to 53 cents.

Oh, and reports in most media about the hit casually drop that GAL is a Mark Creasy-backed venture (24.6%, and now several million dollars richer). Buckle up.

And that’s just from 33m, with 5km of untested ground to cover – including the actual target zone:

May 12: An investor presentation the following day – handy – helps shares rise to 66 cents. More than 240% in a week.

May 16: Even at 58 cents, GAL was irresistible to Creasy. It’s announced he dropped another $1.75m into the kitty. As it hits 85 cents on that news alone, he’s basically writing million-dollar cheques to himself at this point.

The Creasy Rush is on. Within four days, GAL is at $1.18.

May 24: We’re back down to 94 cents as the too-good-to-be-True Believers exit. Oh dear.

May 25: Trading Halt #2.

May 26: “Discovery confirmed!” says GAL. More highlights with big numbers in them, and news drilling’s about to start on the the actual thick and high grade stuff next week. Share price hits $1.41.

Creasy’s $1.75m investment 12 days ago alone is worth $4.25m now. And it was just a 2% top-up on his 24% stake.

But wait, there’s more…

May 27: Rhodium struck. Assays from the Norseman project are now confirming the presence of rhodium. It’s only one of the rarest and most valuable precious metals in the world, currently selling for $US15,500/oz.

Most global rhodium production is used in catalytic convertors, which control emissions in ICE and hybrid vehicles.

GAL hits its high of $1.91. About 800pc on its price three weeks earlier. Creasy’s stake has roughly popped from $9m to somewhere north of $70m. What a ride.

Galileo finishes the month at $1.44, after some of the more giddy participants exited the rollercoaster.

Breathtaking stuff.

We’d be remiss not to mention Conico Resources (ASX:CNJ) among all of this. It was, after all, up a tidy 200% in May.

As pointed out by Stockhead regular Guy Le Page, prospective horizons from GAL “appear to trend on to ground held by the Mt Thirsty Joint Venture”.

That JV is a 50% Conico, 50% Greenstone Resources (ASX:GSR) project. And “appear to trend on to ground” is a roundabout way of hailing that a bit of the old “nearology” could be in play.

CNJ enjoyed the piggyback most, up 200% for the month to 0.034 cents. As did Le Page, the famed geologist and stockbroker who also holds – along with a deadlift world record – directorship of and shares in Conico.

Tyranna Resources (ASX:TYX) actually outshone even CNJ, up 245% in May.

Look, it’s a tiddler, but everyone starts somewhere. And in May, Tyranna Resources ventured into Africa to secure a lithium exploration project in Angola.

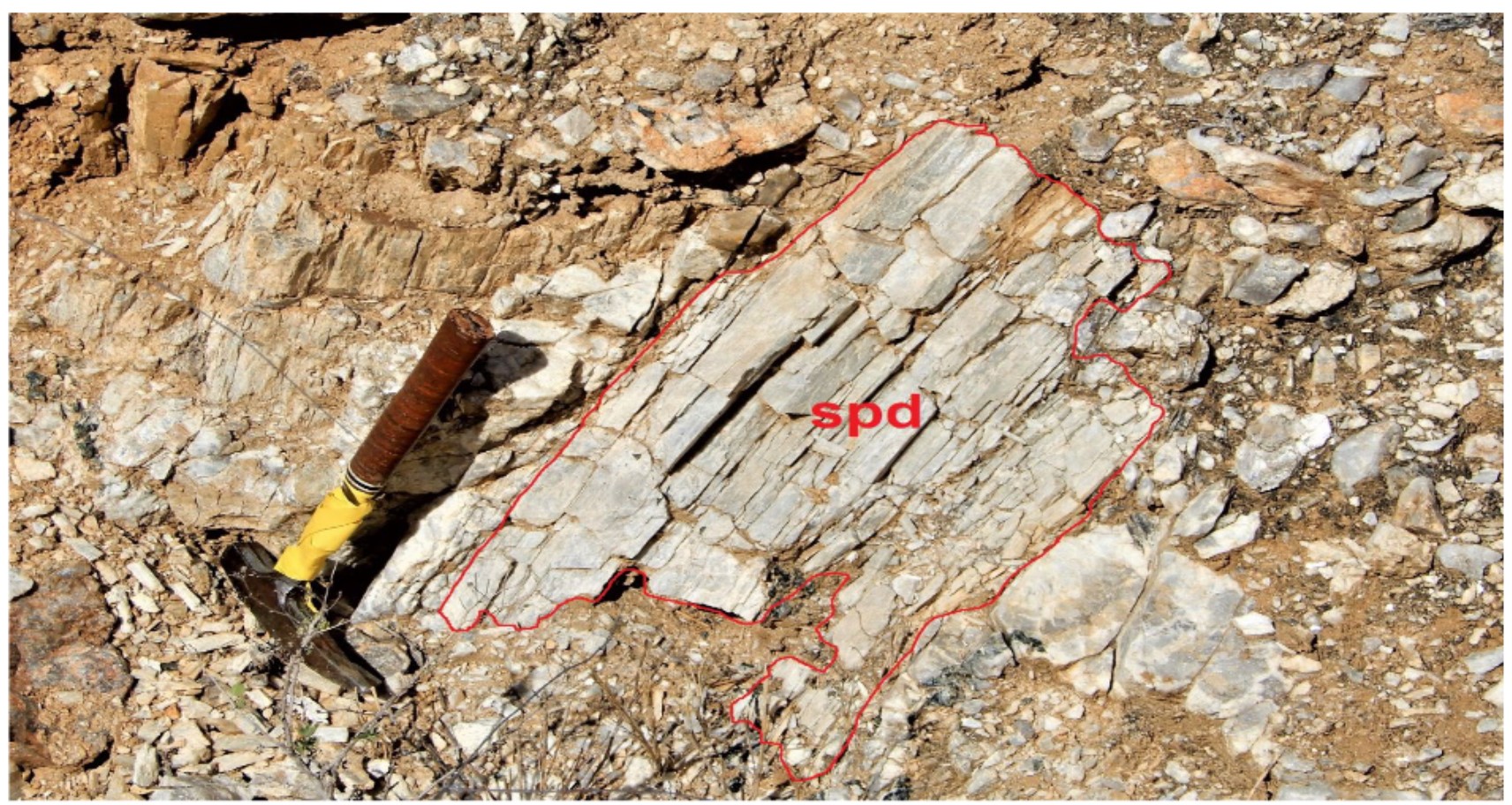

Two weeks after announcing that, it released assays of historical rock-chip sampling completed in 2019 and 2021 of pegmatites that showed 7.49% Li2O from high purity spodumene. Solid enough to spark a flame under its 0.009c share price. (That’s less than a cent, i.e. a proper, old-fashioned penny stock.)

Somebody noticed. The next day, TYX cracked the cent mark and beyond, soaring to 2.2 cents.

It’s very early days though. The company noted “only 16 of the estimated 600 (identified) pegmatites” had been sampled so far, and lithium mineralisation confirmed at 6 of those. Still, it helps when you’re basically tripping over the stuff:

A 245% growth for the month though is a promising start. And it’s still going cheap…

Happiest TYX holder? CPS Capital Group founder and managing director Jason Peterson, who on May 17 had increased his holdings from 9.99% to 11.52%.

Outside of resources, the action was slim. Non-existent, actually, which should come as no surprise if you’d paid attention to the sector breakdowns earlier.

It was a good month to get acquired. MyDeal (ASX:MYD) shares rose 56% immediately on news Woolworths wanted to acquire an 80% controlling interest in the online retail marketplace.

B2Gold put in a bid for Mali gold explorer Oklo (ASX:OKU) for a 127% premium to its closing price, and premium to any closing share price over the past 12 months. (Run, you fools!)

And milk is back. For unfortunate reasons, with apologies to any US parents whose poor wee one was affected by formula made in Abbott Laboratories, which was associated with bacterial infections in infants. Cue infant formula shortage, and US President Joe Biden making ASX market-moving announcements on Twitter before the official release of such:

I’ve got more good news: 27.5 million bottles of safe infant formula manufactured by Bubs Australia are coming to the United States.

We’re doing everything in our power to get more formula on shelves as soon as possible.

— President Biden (@POTUS) May 27, 2022

That’s a 41% share price rise for Bubs (ASX:BUB) in May, thank you very much.