This is what UBS reckons Ozempic is doing to the big US food stocks

Experts

The very busy humans at UBS just grabbed 500 GLP-1 users across the US and chewed the fat over the drug made famous by Novo Nordisk’s Ozempic and Wegovy.

500’s not a massive cohort, but enough – even though UBS expects that by next year the worldwide total of GLP-1 users will top almost 17 million, up from just 3m at the beginning of last year.

There’s estimates the Danish pharma giant which makes Ozempic and Wegovy will sell as much as $US4bn in the States alone this year.

Unsurprisingly, Novo’s stock is up by 40% over the past year and has doubled over the past two.

NVO’s undergone a total of five stock splits. The most recent stock split is the most obvious one below on September 20th, 2023.

One NVO share bought prior to April 18th, 1994 would equal to 200 NVO shares today. Pretty handy.

Also known as glucagon-like peptide 1, they’ve actually been on the market for almost 20 years.

GLP-1 has shown efficacy in stabilising HbA1c (blood glucose levels) and has also stunned punters with its weight loss results.

Over the last two years, the growth of GLP-1s has been the focal topic for the global pharmaceutical sector and, according to UBS, the “subsequent read-across has had significant traction across the wider capital markets.”

GLP-1 growth has predominantly been driven by the latest products from key industry players in the pharmaceutical sector.

UBS estimates global GLP-1 model forecasts 40m people on GLP-1s by 2029, with 44% in the US. This translates into $US126bn sales by 2029, a 2023-2029 sales CAGR of 30%.

Circa 8.5m GLP-1 patients will be Americans by next year.

That’s a lot of chocolate and frozen yoghurt eaters.

So, unsurprisingly, UBS also want to know for themselves what – if anything – has thus far been the impact on leading US consumer stocks from this stupendously enthusuaistic adoption of the Ozempic-styled weight-loss drugs.

Specifically, across the different food categories which are under attack from a potential tsunami of healthy living Americanoids.

The UBS survey population was evenly split between diabetic and non-diabetic patients.

When asked about the change in their eating habits while they were taking GLP-1 drugs, the survey results were interesting in that smaller portion sizes did not necessarily translate into less money spent on food:

1. 56% of respondents said they had started to consume smaller portion sizes.

2. 22% mentioned that they now tend to snack “on-the-go” more rather than having a proper sit-down meal.

3. Across respondents who reduced their calorie intake, 45% said that they ate 251-500 calories less, which is equivalent to a typical breakfast.

4. When asked about lifestyle changes, 40% of respondents said they started to appreciate healthier food choices and have generally changed their eating habits.

5. The shift towards healthier (and often higher-priced) foods could explain the fact that consumers did not materially change the amount of money spent on food.

6. Indeed, purchase levels for 65% of respondents remained within -10%/+10% of the “pre-GLP1” base, with 35% saying that the amount they spend on food was unchanged.

7. Among other noteworthy lifestyle changes included greater interest in the VMS (vitamins, minerals and supplements) category and intake of supplements to prevent muscle loss.

8. GLP-1 impact on smoking appears to be limited.

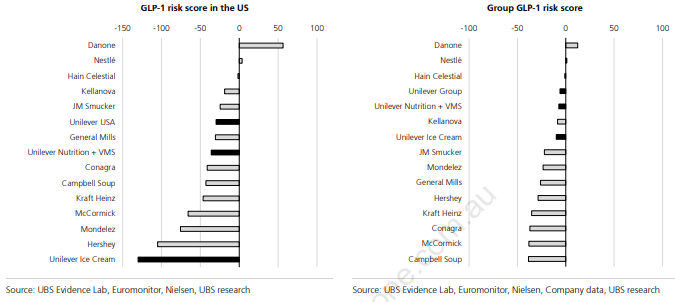

Based on the responses regarding dietary changes, UBS constructed a GLP-1 risk score metric, with positive values indicating increased consumption and negative values pointing towards lower consumption.

The results indicate that ice cream and fast foods are most negatively impacted, while water, vegetables and fruits are benefitting from GLP-1 adoption.

UBS further highlighted increased interest in yogurt (“yoghurt”), a reduced consumption of sugary snacks and chocolate, a lower intake of alcohol and fizzy drinks, broadly no change for coffee, milk or rice.

1. Danone stands out as a beneficiary of GLP-1 adoption given its exposure to yogurt (“yoghurt”), plant-based dairy, and water.

2. While Nestlé has exposure to riskier categories (i.e., through its Frozen portfolio of ready-to-eat meals), its overall portfolio in the US does not appear to be at major risk given the company derives ~35% of its sales from pet food (clearly, not impacted by GLP-1) and ~13% of sales from VMS/nutritional supplements (which could benefit from GLP-1 adoption)

3. For Unilever, ice cream is the most impacted category; however, since the company derives only ~15% of its sales in the US from the segment, the ultimate impact on the company’s US portfolio looks likely to be limited.