Want a chart that shows good things could be on the cards for copper? OFC you do

Pic: Nomadsoul1/iStock via Getty Images

- Copper inventories are back at dire levels, with the LME holding less than two days of global demand

- Westpac has ratcheted up its copper forecasts despite not being ‘perennial bull’

- Predicts US$9700/t by end of 2025 with supply continuing to struggle

Even analysts who say they aren’t copper bulls are being forced to shift their forecasts in favour of higher prices.

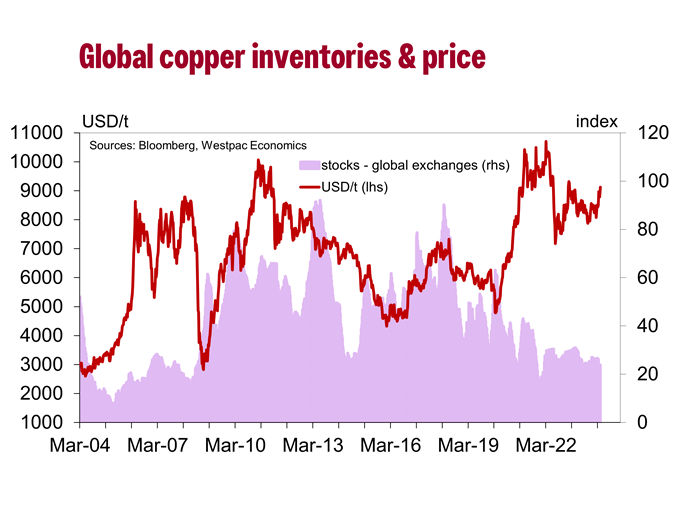

Take a look at this chart from Westpac.

As you can see, when exchange inventories are drawn down copper prices tend to look exciting, give or take some macroeconomic hurdles.

Current conditions are looking pretty tasty for copper bulls.

On Friday the LME held official copper inventories of ~115,500t — around 1.75 days of global demand. That, uh, is not a lot.

By way of comparison, the LME held over 600,000t of stock back in 2013 when global demand was substantially lower.

Contango is at its widest level in three decades, meaning experts are betting on prices rising in the months ahead. Treatment and refining charges have pointed the way to higher metal prices as well.

Mined supply is struggling to keep up with a major expansion of processing capacity in China, where demand for copper for renewables and electric vehicles is surging.

Even bears are getting on board

Westpac is the latest bank to get on board with the idea of higher copper prices.

Its latest commodity forecasts have seen the Big Bank lift its December quarter average 2024 outlook from US$8300/t to US$9000/t and December quarter average 2025 from US$9000/t to US$9600/t.

LME copper for three-month delivery is currently trading at US$9330/t.

“While not perennial copper bulls, our longer-term view on the red metal has a very constructive foundation based on rising demand from the electrification as the world de-carbonises,” Westpac senior economist Justin Smirk said.

“However, so far in 2024 base metals have faced some fundamental headwinds, including: (1) the hoped-for improvement in China macro/property data failed to materialise at the expected pace; (2) a sustained lift in US/EU demand, and the restocking of inventories, was not as robust as the market has assumed; and (3) expectations for Fed rate cuts have been pushed back further into the year.

“In contrast, the supply side for copper is looking far more constructive, in that conditions have tightened, with material downgrades to 2024 mine production guidance.

“What has also capped the upside for copper prices, so far this year, has been the strong production of refined product in the face of above-mentioned lacklustre demand.

“As shortages of concentrate bites, and refiners cut back on output at the same time as demand firms due to restocking, then copper is set to find further support in the second half of 2024.”

Those supply challenges are growing starker.

Here’s ANZ’s Madeline Dunk, Brian Martin and Daniel Hynes with the skinny:

“Codelco Chair, Maximo Pacheco Matte, said the world’s biggest copper producer churned out almost 300,000t in the first quarter,” they reported in a note yesterday.

“This suggests it’s yet to bounce back from the lowest levels in a quarter of a century. It officially produced 326,000t in the same period last year.

“Meanwhile, Canada’s Ivanhoe Mines reported a 6.5% quarterly drop in output at its Kamoa-Kakula mine in the DRC. Drought conditions in neighbouring Zambia are also putting the country’s planned expansion of mined output at risk. This comes following cutbacks to Anglo’s copper mines in Chile and the closure of the Cobre Panama copper mine late last year.”

How are copper stocks responding?

The top copper stocks on the ASX — sparse though they are — are all in resoundingly positive territory this month as the market digests the recent run in copper prices.

Sandfire Resources (ASX:SFR) is up 18% to $8.96. At a market cap of $4.1 billion, the former owner of the DeGrussa mine which is seeking to become a 100,000tpa miner for the first time with its MATSA mine in Spain and Motheo in Botswana was only trading higher at one point in 2018.

Sandfire is the largest pure play copper exposure on the ASX since OZ Minerals was taken over by BHP (ASX:BHP).

Despite the issues afflicting 29Metals (ASX:29M) at its Capricorn mine, where heavy rain has forced its closure for a second straight year, the EMR Capital backed firm has rebounded almost 30% in the past month.

Cobar mine owner Metals Acquisition Corp (ASX:MAC) is up 12% over the last 30 days.

At the smaller end of the spectrum Hillgrove Resources (ASX:HGO), which just reopened the Kanmantoo copper-gold mine in South Australia, is up 30% in the past month, with a market cap of $161m.

While many of these companies have struggled from an operational perspective, the issues copper miners had ramping up production have provided the fuel for higher prices to emerge.

The logic is that stronger returns will be needed to incentivise new projects, with Westpac’s Smirk saying the pipeline ‘continues to shrink’.

History doesn’t support the idea Cobre Panama could miraculously come back online or that other large operations could outperform, he said.

“Getting copper projects off the ground is becoming increasingly difficult and through recent history, we continue to observe that miners are consistently overly optimistic about potential project starts and copper production growth,” he said.

“This lack of compelling supply growth has seen us revise up our copper forecasts, from US$8,200 at end-2024 and US$9,100 end-2025 to US$9,000 and US$9,700 respectively.”

Copper miners share prices today:

At Stockhead, we tell it like is, while Hillgrove Resources was a Stockhead advertiser at the time of writing, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.