Guy on Rocks: This small cap JV is right over the fence from Galileo’s new PGE discovery

Pic: StephM2506, iStock / Getty Images Plus

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions: Judgement day arrives early

Chris Joye (Coolabah Capital, 13/5/2022) likens cryptocurrencies to a giant Ponzi scheme, targeted at naïve investors exposed to an unregulated market.

Even the “stablecoins” have become “unstable” with TerraUSD off 73% wiping out US$14 billion in recent weeks.

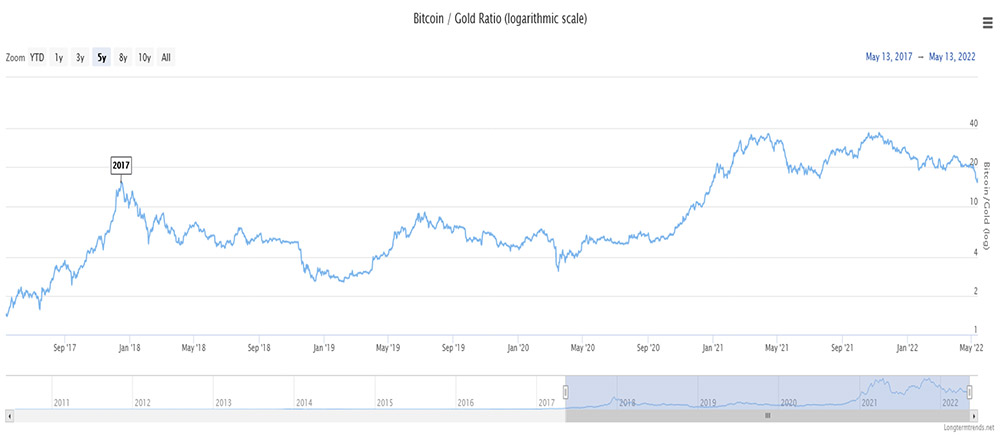

Our Bitcoin v gold index (figure 1) seems to be tipping over even as gold was off in its worst week in a year at US$1,810/ounce or 4% on the back of a stronger dollar.

US Treasury Bonds finished at 1.0456, representing a 19-year high.

Platinum and palladium followed suit, down 2.1% and 6% respectively.

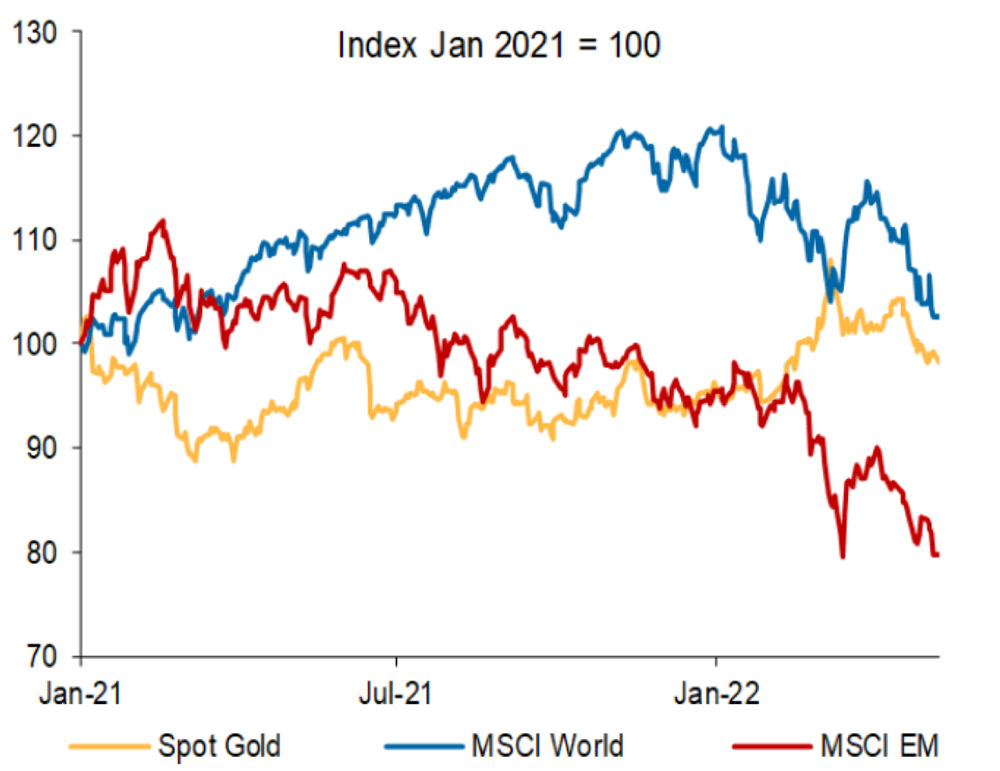

Gold (figure 2) does appear to be outperforming Bitcoin (figure 1) and also the MSCI Index (figure 3); on this basis you could say that gold has been a safe haven alternative, even though it has underperformed the US dollar.

I think “turmoil and “uncertainty’ characterise commodity markets in May with the energy markets at the top of the pile.

While the EU has scrapped plans to ban Russian crude oil over the next six months and refined oil products later this year, the ban on the provision of services by European vessels and companies linked to Russian petroleum/products from mid-year is proceeding.

This may have a similar effect on Russian energy supply. Russia may still see this less drastic move as close to an act of “war” which could still have significant implications for global energy prices in the short to medium term.

Copper consumers will be breathing a sigh of relief as the Chilean Constitutional Convention failed to pass legislation to replace a concession model with a system of temporary and revocable permits.

The vote required a two-thirds majority to progress to a referendum on 4 September 2022.

Good news as Chile is the world’s largest copper producer at just under 6 million tonnes of copper per annum or 30% of global copper production.

On the downside, Saturday’s vote will result in the absence of a mining statute in the draft constitution, so it doesn’t appear that there is significant uncertainty moving forward.

Peru (the second largest producer with 2.8Mt of copper per annum and equivalent to 1% of Peru’s GDP) on the other hand is experiencing problems with locals around the Chinese owned (China MMG) Las Bambas Copper Mine (300,000 tpa or 2% of world copper production) where each family affected by the mine received US$500,000 for relocation costs.

Apparently this is insufficient and protesters are now occupying the mine site, suspending operations yet again.

Copper (figure 4) finished the week around US$4.09 per pound.

I think the uncertainty around copper is reflective in the copper futures that oscillate between contango and backwardation going out five months.

Interestingly Barrick Gold Corporation, which prided itself on its gold focus, is actively on the hunt for copper assets in Africa due to the looming supply shortfall and elevated prices. The company operates the Lumwana copper mine (Zambia) through its acquisition of Rangold in 2019.

At the recently concluded Indaba Mining conference in Cape Town, billionaire mining magnate Robert Friedland believes that around 700Mt of copper has been mined, about the same amount that will be required in the next 22 years to keep up with the green energy movement.

Africa and the Arabian shield are the countries he believes can fill this supply gap.

With US consumer confidence at an 11-year low, and inflation last week coming in at 8.1% (consensus 8.4%), a risk off environment highlighted by a 9.5% decline in the TSX-V Index in Canada might persist for a while longer.

Powell is due to give another speech in New York this week so that could again influence precious metal markets (and the broader market).

He is remarkable for his inaccurate forecasting which is nothing short of spectacular. Mind you he has been preceded by luminaries such as Ben “Helicopter” Bernanke and Alan “the Undertaker” Greenspan, so we shouldn’t be too hard on him.

New Ideas

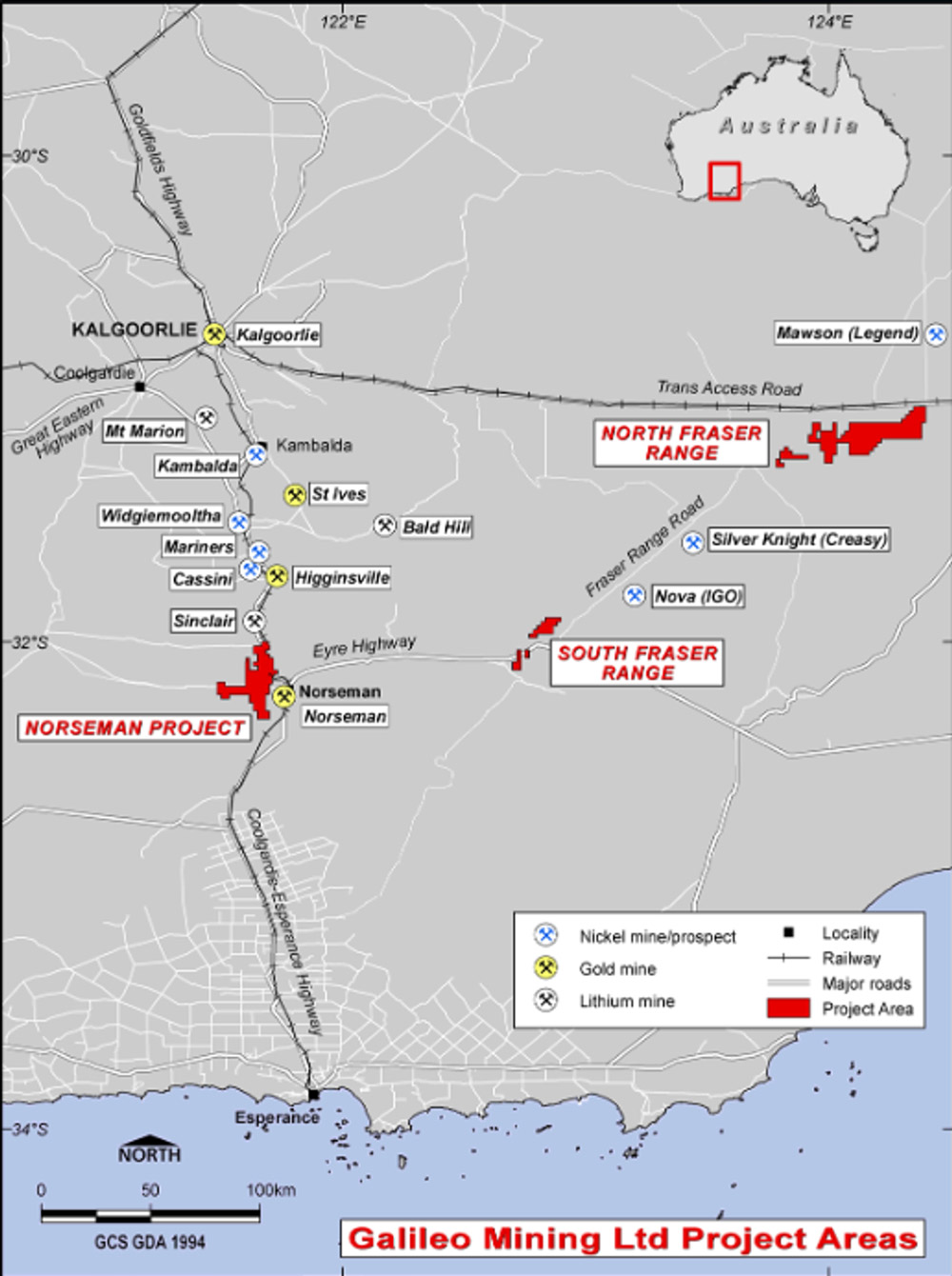

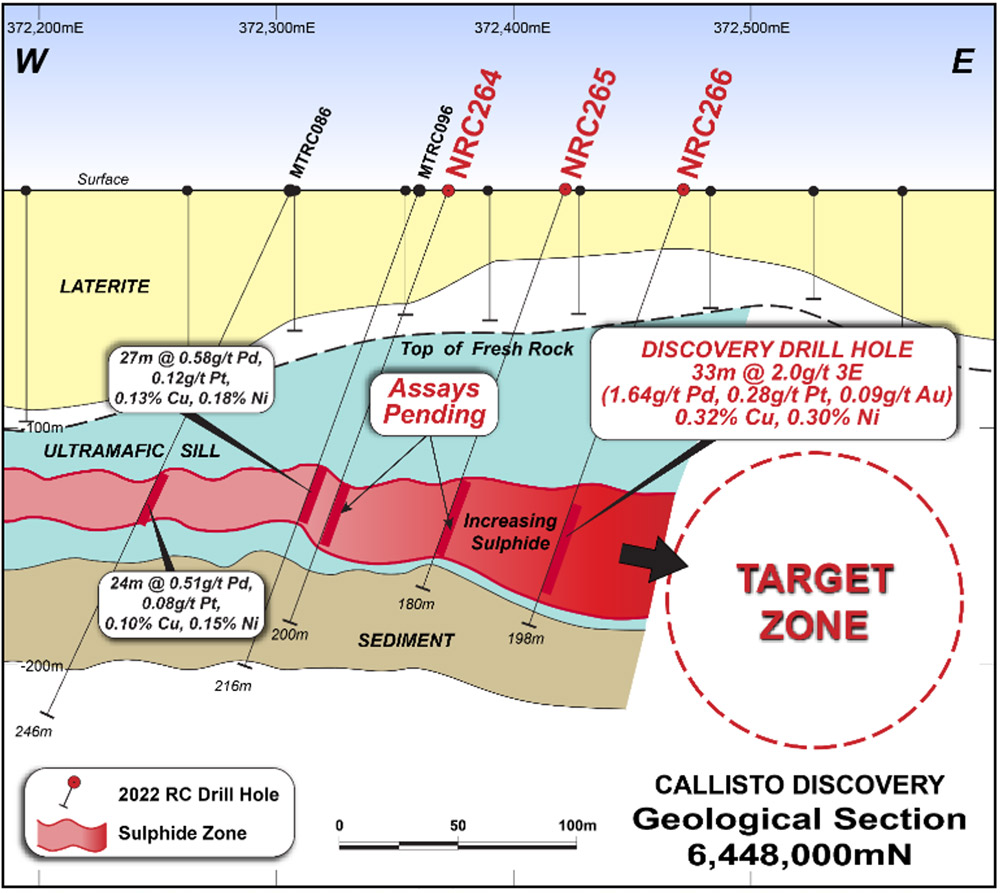

Galileo Mining (ASX:GAL) came out swinging (figure 5) last week (GAL ASX Announcement, 11 May 2022) with the announcement of a cracking palladium-platinum-gold-copper-nickel hole at its 100% owned Norseman project (figure 6) with NRC 266 returning 33m @ 2g/t 3E (1) (1.64g/t Pd, 0.28g/t Pt, 0.09g/t Au), 0.32% Cu & 0.30% Ni from 144m (Figure 7) including;

- 6 metres @ 2.69g/t 3E (2.21g/t Pd, 0.37g/t Pt, 0.11g/t Au), 0.41% Cu & 0.36% Ni from 159m downhole.

This hole occurred within a wider 55m disseminated sulphide zone from 126-181m downhole suggesting the potential for a broader mineralised system.

Early days, however the company is comparing the mineralising encountered in NRC 266 known as the Callisto Prospect (Callisto was one of the goddess Artemis’ huntress companions who swore to remain unwed) to South Africa’s Platreef palladium-platinum-gold-rhodium-copper-nickel deposits.

Assay results from a further five drill holes are pending together with the balance of assays from NRC 266.

Based on the geological continuity between drill holes, the company appears confident of further encouraging results with the sulphides appearing to increase in an easterly direction with approximately 5km of prospective strike that remains untested.

Rhodium (and all other platinum group elements) assays from NRC 266 are due shortly.

Not a bad day on the tools for another Mark Creasy generated company. While this is early days, the grades in NRC 266 look much higher than Chalice Mining’s (ASX:CHN) Julimar Project (mind you one hole doesn’t make a resource) and at an EV of just over $80 million, there may be some further upside with assays pending.

The company remains well funded with over $8 million in cash and despite the ridiculous beard being sported by managing director Brad Underwood (maybe time for some manscaping?) there may be some blue sky left in GAL yet.

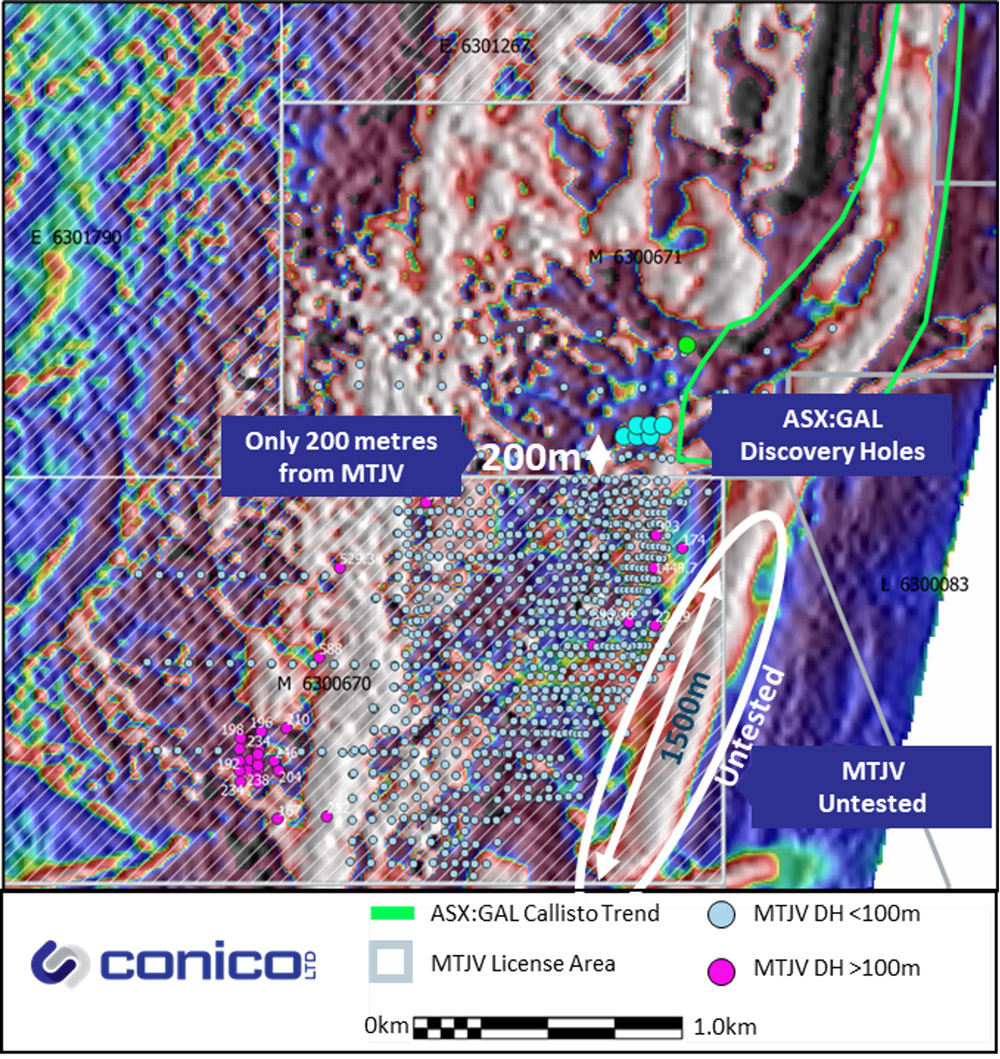

The Stockhead faithful will be pleased to know that prospective horizons from GAL appear to trend on to ground held by the Mt Thirsty Joint Venture (50% Conico (ASX:CNJ); 50% Greenstone Resources (ASX:GSR)) with enterprise values of $16 million and $22 million respectively.

It appears around 1.5km of this layered intrusion (Mission Sill) appear to strike on to the JV ground (figure 8) and remain largely untested.

Full disclosure – the author is a director and shareholder of CNJ and rejoicing in the GAL success. I believe a 14-year-old Balvenie should provide further clarity for the MTJV and its future exploration programs.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.