Resources Top 5: Galileo says ‘discovery confirmed!’ as near term copper producer makes waves

Gif: Harrison Eastwood, DigitalVision/ Getty Images

- Galileo Mining up ~550% since hitting the PGE-nickel-copper jackpot at ‘Callisto’ early this month

- R3D Resources aiming to be small copper producer in the second half of 2022

- Ragusa Minerals (lithium), Resource Mining Corp (nickel) up; on no news

Here are the biggest small cap resources winners in early trade, Thursday May 26.

RAGUSA MINERALS (ASX:RAS)

(Up on no news)

Another morning of outsized gains for this lithium minnow, which picked up an additional 570sqkm on the ‘Litchfield’ pegmatite belt in the NT on Monday.

The $17m market cap stock is now 35% over the past week to 52-week highs.

The acquistion complements a previous acquisition announced mid-March.

“This is a significant opportunity to combine Ragusa’s existing NT lithium projects to create a combined ‘supergroup’ project area comparable to neighbours Core Lithium (ASX:CXO) and Lithium Plus (ASX:LPM), and utilise our exploration and development experience to rapidly progress our NT Lithium Project in a Tier 1 jurisdiction close to major infrastructure,” Ragusa chair Jerko Zuvela says.

“With four currently granted tenements and considerable historic works to reference, Ragusa is in a strong position to rapidly accelerate the development of our project at a time of record lithium prices and within a proven high quality lithium district.”

Ragusa intends to start exploration works to target outcropping pegmatite rocks identified from prior exploration, to develop a more comprehensive lithium exploration program.

It had $3.2m in the bank at the end of March.

GALILEO MINING (ASX:GAL)

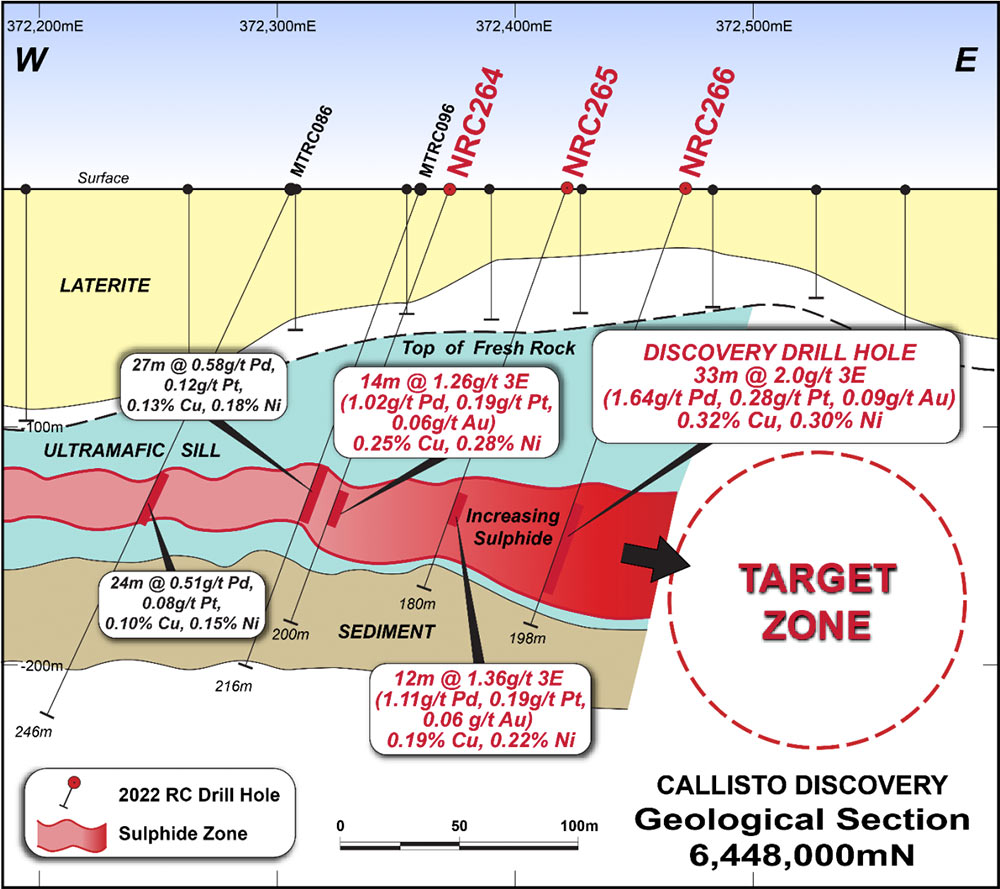

“Discovery confirmed!” says GAL, which has now surged ~550% since hitting the PGE-nickel-copper jackpot in hole number one at ‘Callisto’ early this month.

Assays from all drill holes at the prospect, part of the Norseman project in WA, contain significant zones of mineralisation and confirm initial results from the discovery drill hole NRC266.

New highlights include 28 metres @ 1.58g/t 3E (1.29g/t Pd, 0.22g/t Pt, 0.07g/t Au), 0.27% Cu & 0.26% Ni from 137m.

There’s strong geological continuity between the holes, spaced 50m apart, GAL says.

Reported assays also occur within wider disseminated sulphide zones “indicating the potential for a large mineralised system”.

New drilling will kick off next week, focused on the “thickest and highest grades in the easterly direction”, says managing director Brad Underwood.

AKA the ‘TARGET ZONE’:

“The same program of drilling will then continue to the north as we aim to move from discovery drilling to advanced and detailed resource drilling,” he says.

“The extensive prospective strike, combined with the thick and consistent mineralisation drilled to date, indicates the potential for a large mineralised system.

“Approximately 20 holes will be undertaken in the coming round of drilling and we look forward to updating the market with results from this exciting new discovery.”

RESOURCE MINING CORP (ASX:RMI)

(Up on no news)

This unremarkable, tightly held nickel explorer is up a remarkable 170% over the past month, which gives it a market cap of +$50m.

RMI has a few early-stage projects in the mineral-rich but volatile African jurisdiction of Tanzania.

It recently inked an all-share deal to buy a bunch of projects from major shareholder, director, and serial project vendor Asimwe Kabunga earlier this month.

The deal complements its existing Kabulanywele nickel project, the company says.

The new ‘Kabanga North’ project is notably along strike from Kabanga Nickel’s ‘Kabanga Project’ which is host to a total mineral resource of 58mt @ 2.62% Ni.

The company has not specified its exploration plans for the coming quarters.

NARRYER METALS (ASX:NYM)

Led by former Cassini boss Richard Bevan, this explorer listed in April with an initial focus on giant nickel-copper-PGE discoveries in South Australia and WA.

But there was also potential for clay rare earths at the ‘Ceduna’ and ‘Sturt’ projects in South Australia, similar to Krakatoa Resources’ (ASX:KTA) recent REE discovery at Mt Clere.

Sturt is also just 25km from Petratherm’s (ASX:PTR) ‘Comet’ clay REE discovery.

A new “cost effective” REE exploration program at these projects has now kicked off, starting with the analysis of old, untested drill core.

A further ~1,300km2 of tenure is also now under application in the Ceduna project area.

The $6m market cap stock is trading at its listing price of 20c per share. It has about $5m in the bank.

NOW READ: Why are ASX stocks so in love with clay rare earths projects? A punter’s guide

R3D RESOURCES (ASX:R3D)

(Up on no news)

The former failed public relations firm reskinned as a copper-gold explorer mid 2021 via its takeover of Tartana Resources.

It main focus is to advance its small copper sulphate project in Queensland into production in the second half of 2022.

The copper sulphate plant on R3D’s Tartana mining leases comprises a heap leach – solvent extraction – crystallisation plant which operated for a decade before being placed on care and maintenance in 2014.

It is currently being refurbed at a cost of ~$1.21m, the company says.

R3D aims to produce 6,000 to 7,000tpa of copper sulphate, which was selling for about $3,513/t late April.

That is a decent margin at production costs of about $854/t.

A drilling program is also underway to upgrade previously identified copper mineralisation on its Tartana mining leases.

The $14m market cap stock is down 16% year-to-date. It had ~3.7m in the bank following a recent placement and cap raise.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.