ASX Small Caps Lunch Wrap: Who’s made an epic first impression in court this week?

"If that's the best defence you can muster, Mr Stronach, then I've no choice but to sentence you to 5 years of soft labour." Pic via Getty Images.

Local markets have started the week on a bumpy note, rising quickly to +0.25% before sinking quickly back to zero just before 10.30am, as a trio of Large Caps went well into double-digit losses in time for morning tea.

I’ll get into the details in a moment, but first there’s news of an extraordinary court appearance in Dublin over the weekend that has set the bar pretty high for crazy outbursts from the dock.

Joseph Davis, 51, made the appearance before Judge Marie Quirke at a weekend sitting of Dublin District Court, setting the tone of the session by turning up completely nude and refusing to wear clothes.

Local media, as straight-faced as possible, described the scene thusly: “Mr Davis entered the stunned courtroom naked with his hands over his private parts, but within seconds he stood with arms outstretched to argue his case after rejecting the services of a lawyer, telling him to ‘f*** off’.”

As far as first impressions go, this probably isn’t the best way to make one.

Davis was appearing in court over a minor traffic offence, refusing to follow police instructions and for not “keeping his car stationary during an alleged incident on Friday evening”.

However, Mr Davis appeared unconcerned about the charges, and was mostly interested in the whereabouts of his emotional support cat, which he alleged had disappeared during his arrest.

Acting for the police, officer Eva Mahedy did not object to Davis being released on bail with a €100 cash lodgement, prompting the judge to comment “I don’t see his wallet on him today.”

Local media reports that Mr Davis remained on his feet, naked as a jaybird, for the entirety of a nine-minute tirade, during which he claimed that had been bashed by police, and that he had been on his way to deliver documents pertaining to a different court case in the High Court – with his emotional support cat “Oliver” – when he was stopped and arrested on Friday.

Davis was led from the courtroom after pounding on the glass enclosure that surrounds the witness dock in the courtroom, demanding that the court return his cat.

He was eventually released on bail, but will be required to attend court again on Tuesday to answer to the charges, but I can tell you that turning up naked to defend yourself rarely, if ever, works well… the last time I tried it, the judge seemed very disappointed that the evidence I was providing failed to stand up in court.

(Ed: OBJECTION)

TO MARKETS

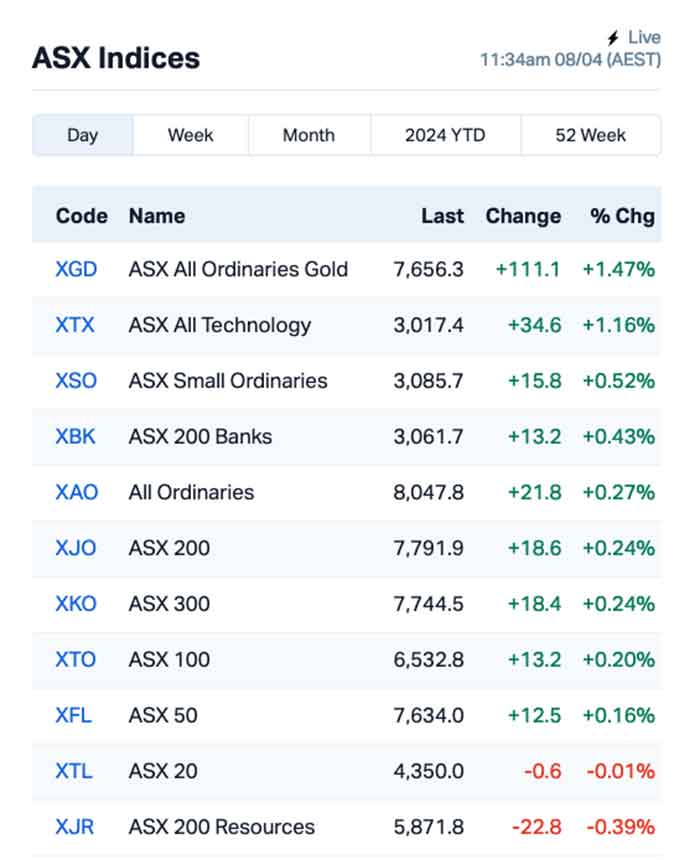

Local markets were struggling a little this morning, with the needle wavering between 0 and +0.25% as the benchmark hunted for traction – and three Large Caps went deep into double-digit loss territory early in the session.

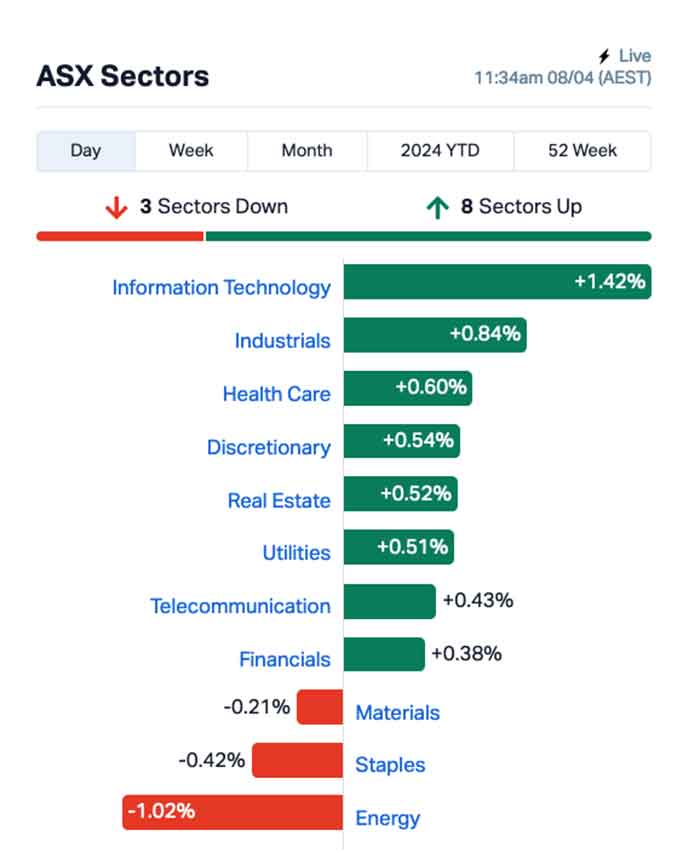

Around the rest of the market, it looks like it’s back to ‘business as usual’ – InfoTech (+1.42%) is soaring above everything else, and the goldies are staging yet another breakaway performance as well, surging +1.47%, despite gold dipping -0.9% to US$2,308.35 an ounce.

As you can see, the Energy sector’s doing it tough this morning, and – as you’ll see in a minute or two – there’s a pretty clear reason for that happening, so read on…

Up the tubby end of town, there are three Large Cappers doing it tough today – let’s start with Elders (ASX:ELD), though, because there’s a clear reason for it tanking this morning.

The company dropped an announcement this morning that set more than a few investors’ pulses racing, but for all the wrong reasons – after Elders admitted that the first half of the financial year to September 2024 was “significantly below expectations”.

From the announcement come the reasons:

- Subdued client sentiment following an El Niño declaration by the Bureau of Meteorology, particularly impacting the first quarter.

- Lower crop protection prices compared to the prior corresponding period, impacting sales revenue and margin.

- Cattle and sheep prices significantly below the 10-year mean, particularly impacting the first quarter.

- Subdued trading in March due to a later start to winter crop in Western Australia which is a key broadacre market.

- Margin pressure evident in some key agricultural chemical products.

All that added up to a rapid-fire sell-off this morning, sending Elders down -24.7% in under 30 minutes.

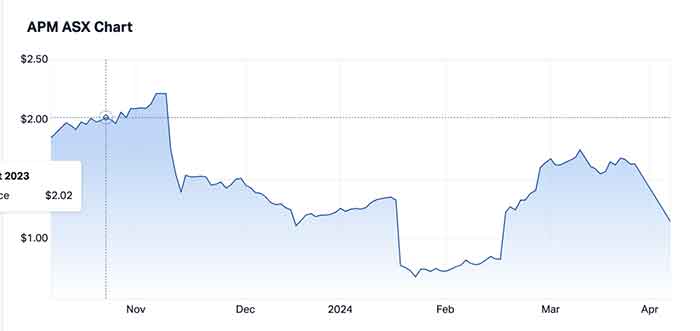

Also on the chopping block was APM Human Services (ASX:APM), and there’s a bit to unpack here…

APM had received a non-binding acquisition offer from CVC Asia Pacific a while ago, which looked to have fizzled out on 28 March when CVC indicated that it was going to be unable to proceed to finalise a transaction on terms consistent with the offer on the table.

That notice coincided with the end of CVC’s exclusivity period on the offer, and it looks like another group – Madison Dearborn Partners (MDP), which already holds a 29% stake in the company with three seats on the board – is ready to pounce with an offer of its own of $1.40 cash per share by way of a scheme of arrangement.

APM had previously formed an Independent Board Committee while all that was happening, and that IBC has said that the offer from MDP is “disappointing” – hardly surprising considering that APM’s price has been a lot higher in recent times, albeit a little on the volatile side.

Last on the Large Cap sinkers list this morning was Beach Energy (ASX:BPT), which shed as much as -19% on news that things aren’t going very well at its Waitsia Joint Venture, in which it’s got a 50-50 split with Mitsui E&P Australia.

Beach had been encountering issues during during pre-commissioning of systems at the Waitsia Gas Plant, including rebuilding compressors, and replacing valves and flanges – work which had been close to complete.

However, “further quality issues are emerging as pre-commissioning activities progress”, the company says… and the delays and remediation costs are really starting to bite.

“It is extremely disappointing to be continually encountering quality and execution issues given the late stage of the project,” CEO and MD Brett Wood said.

“Having to redirect existing onsite labour to remedial works is slowing the progress of pre-commissioning activities, resulting in further delay and cost increases.”

NOT THE ASX

In the US on Friday, it was a festive end to the week, thanks to a shockingly large jump in employment figures that saw 303,000 jobs added in March 2024, far more than the expectations of 205,000, while at the same time, the US jobless rate slipped to 3.8% as participation rate rose.

The S&P 500 rose by +1.11% , the blue chips Dow Jones index was up by +0.80%, and the tech-heavy Nasdaq lifted by +1.24%.

In US stock news, Trump Media fell -12% on no news. I’m shocked … shocked, I tell you … that a company that reported in a filing last week sales of just over US$4 million as net losses reached nearly US$60 million for the full year might have been egregiously overvalued at IPO, and that a lot of people are losing a lot of money as its prices sinks slowly into a bog, deep in the Florida swamps.

Tesla slumped further, this time by -3.6% after a report on Reuters suggested the company has scrapped its plans for a more affordable EV.

Krispy Kreme surged +7% after Piper Sandler upgraded its rating on the company from Neutral to Overweight, citing the recent partnership with McDonald’s – proving that Earlybird Eddy Sunarto, who penned that sentence, is secretly a comedic genius.

In Asian market news, Japan’s Nikkei is climbing this morning, up 1.45% while Chinese markets are making a muted return from an extended holiday period, leaving Shanghai markets down -0.06% and Hong Kong’s Hang Seng up +0.25% in early trade.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 08 April [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap NES Nelson Resources. 0.005 67% 19,465,510 $1,840,783 LNU Linius Tech Limited 0.003 50% 6,466,614 $10,393,481 VPR Volt Power Group 0.0015 50% 379,336 $10,716,208 CTN Catalina Resources 0.004 33% 250,000 $3,715,461 IEC Intra Energy Corp 0.002 33% 1,755,560 $2,536,172 LPD Lepidico Ltd 0.004 33% 10,580,450 $22,914,924 QOR Qoria Limited 0.405 29% 6,286,223 $369,131,455 BDG Black Dragon Gold 0.024 26% 1,705,601 $4,289,586 AIV Activex Limited 0.015 25% 7,216 $2,586,031 FFF Forbidden Foods 0.015 25% 64,357 $2,422,327 AD1 AD1 Holdings Limited 0.011 22% 1,447,778 $8,087,835 AQX Alice Queen Ltd 0.006 20% 11,878,850 $3,454,950 GES Genesis Resources 0.006 20% 20,000 $3,914,206 OSL Oncosil Medical 0.006 20% 177,034 $11,277,706 KNI Kuniko Limited 0.29 18% 131,087 $21,227,846 LDR Lode Resources 0.13 18% 224,884 $11,746,256 360 Life360 Inc 14.27 18% 1,181,495 $2,494,535,455 RTG RTG Mining Inc 0.027 17% 278,875 $24,958,094 NYR Nyrada Inc 0.14 17% 3,656,593 $21,529,044 TMK TMK Energy Limited 0.0035 17% 1,306,907 $20,267,144 SPL Starpharma Holdings 0.145 16% 1,757,575 $51,505,078 C7A Clara Resources 0.015 15% 255,589 $2,457,507 VN8 Vonex Limited 0.015 15% 62,828 $4,703,772 SPQ Superior Resources 0.0115 15% 5,237,149 $20,012,204 ANR Anatara Ls Ltd 0.039 15% 12,732 $5,708,387

Linius Technologies (ASX:LNU) was climbing well on Monday morning, up +50% off the back off last week’s news that the company had signed a new agreement to provide its sports solution, Whizzard, to the Lone Star Conference – one of the college-level football (the weird kind where you can throw the ball wherever you want) sporting associations in the United States.

Meanwhile, Lepidico (ASX:LPD) rose sharply after announcing that eligible directors and key management confirmed they will participate in an Entitlement Offer.

Qoria (ASX:QOR) surged after knocking back a takeover proposal from K1 Investment Management that it received late last week, which had K1 offering $0.40 cash per Qoria share for 100% of the company. No prizes for guessing that Qoria has since climbed in value to just over that offer amount.

Mining minnow Alice Queen (ASX:AQX) was up +20% on news that its largest shareholder, Gage Resource Development, has agreed to invest a further $3.6 million to help advance its gold exploration activities. Gage currently holds an 18.67% stake in the company.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 08 April [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap TD1 Tali Digital Limited 0.001 -33% 299,435 $4,942,733 APM APM Human Services 1.155 -29% 2,517,217 $1,495,006,572 ARC ARC Funds Limited 0.1 -26% 38,830 $5,075,384 ERL Empire Resources 0.003 -25% 6,141,601 $4,451,740 MRQ MRG Metals Limited 0.0015 -25% 5,000,000 $5,050,237 ELD Elders Limited 7.465 -24% 3,218,095 $1,546,947,375 ADO Anteotech Ltd 0.027 -23% 15,041,546 $76,875,485 ECT Env Clean Tech Ltd. 0.004 -20% 246,426 $14,321,552 OAR OAR Resources Ltd 0.002 -20% 1,700,000 $6,633,277 ROG Red Sky Energy 0.004 -20% 11,715,083 $27,111,136 8CO 8Common Limited 0.03 -19% 405,136 $8,291,511 MSG Mcs Services Limited 0.005 -17% 3,000,000 $1,188,598 ODE Odessa Minerals Ltd 0.005 -17% 478,122 $6,259,695 TYX Tyranna Res Ltd 0.01 -17% 212,664 $39,449,104 BPT Beach Energy Limited 1.5975 -16% 23,833,733 $4,323,127,278 RGS Regeneus Ltd 0.011 -15% 618,625 $3,983,680 BFC Beston Global Ltd 0.006 -14% 498,558 $13,979,328 CDT Castle Minerals 0.006 -14% 4,967,356 $8,571,451 GTR Gti Energy Ltd 0.006 -14% 170,201 $14,349,630 LML Lincoln Minerals 0.006 -14% 250,715 $11,928,317 TAR Taruga Minerals 0.006 -14% 6,632 $4,942,187 TNY Tinybeans Group Ltd 0.12 -14% 33,544 $11,814,228 OAK Oakridge 0.055 -14% 54,640 $1,126,362 ENV Enova Mining Limited 0.019 -14% 8,959,553 $15,061,112 NAG Nagambie Resources 0.013 -13% 639,133 $11,949,535

ICYMI – AM EDITION

GCX Metals (ASX:GCX) is pleased with the progress of its maiden reverse circulation program at the Dante copper, gold and PGE project in Western Australia and has moved to expand the program from 30 holes to 47 holes.

Samples from the first 17 holes have been dispatched to the laboratory for assaying and the remaining 30 holes will be drilled across four priority prospects.

Drilling has started at the Cronus magmatic copper-gold sulphide target before moving to the Crius copper, gold, PGE reef and the Hyperion copper, gold, PGE reef, where the field team have identified a new gossan near planned drilling.

Ora Banda (ASX:OBM) has settled its dispute with Greenstone Resources (ASX:GSR) relating to their 2007 joint venture by forking up $3.4m in cash and $3m in OBM shares.

This dismisses all proceedings brought by Greenstone, Riverina Resources and Abbotsleigh while granting the company all nickel rights. Importantly, it paves the way for OBM to complete its $16m joint venture with Wesfarmers Chemical, Energy & Fertilisers (WesCEF).

Western Yilgarn (ASX:WYX) has remobilised its auger drilling geochemistry team to continue Phase IV field activities focused on prospective copper-nickel sulphide targets identified in previous phases at its Ida Holmes Junction project.

The first three phases had produced 24 copper-nickel-PGE and lithium-caesium-tantalum pegmatite targets across the project.

Notable examples include two high-priority nickel-copper-PGE targets close to the Ida Fault and Holmes Dyke Junction that were followed up by previous explorers BHP/Nickel West in 2011 and St George Mining in 2015.

At Stockhead, we tell it like it is. While GCX Metals, Ora Banda Mining and Western Yilgarn are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.