US President Joe Biden just handed Aussie infant formula maker Bubs a golden ticket

Kiss the baby. US President Joe Biden (Photo by Justin Sullivan/Getty Images)

On Friday, US President Joe Biden tweeted that 1.25 million tins – or the equivalent of 27.5 million bottles (I guess they’ll round up) – of Bubs Australia (ASX:BUB) infant formula was on its way to save the milk powder day in the States, where formula has become more precious than babies.

I’ve got more good news: 27.5 million bottles of safe infant formula manufactured by Bubs Australia are coming to the United States.

We’re doing everything in our power to get more formula on shelves as soon as possible.

— President Biden (@POTUS) May 27, 2022

It’s a handy shout out and there’s a lot of focus as the ASX opens on what kind of response Bubs will have from investors.

Needless to say, Bubs says it’s already on the job – Eddy Sunarto is on the money – ready to send half-a-million cans of powdery boob in a tin and wheels are in motion to up production to meet the order so it can ship “at least” 1.25 million tins to help meet what has become a nationwide crisis according to the US Food and Drug Administration (FDA) which also confirmed the deal on Friday.

The FDA’s extraordinary decision means Bubs can instantly release six products to be imported and sold in the states – the usually militant gatekeepers at the FDA calling Bubs’ full range – “safe, clean and nutritionally sound for American babies”.

Right time, right formula

Bubs Australia CEO and founder Kristy Carr has been in the States for well over a week, telling the SMH on Monday the company was way out ahead of the curve on meeting the crisis.

“We were actually the first infant formula manufacturer in the world to submit our application to the FDA under this new infant formula enforcement discretion policy,” Carr said.

“This was a very unique opportunity.”

Paul Jensz, executive director of PAC Partners, says this apparent lucky break for BUB has been 16 years in the making.

Jensz told Stockhead, the company’s positioning in the States has been accelerating into the opportunity.

BUB launched its Toddler Milk (12+ months) with “Aussie Bubs” organic (small goat and A2 Casein) through mainly eCommerce and some bricks and mortar in 2022 after two years planning.

“The FDA Trials for infant formula (these are the 0-12 months ) are a massive 80%-90% of the total market, but usually require a 24-month trial process. BUB was just six months into this process a few months ago, but the US shortage has accelerated both formula rollouts,” Jensz says.

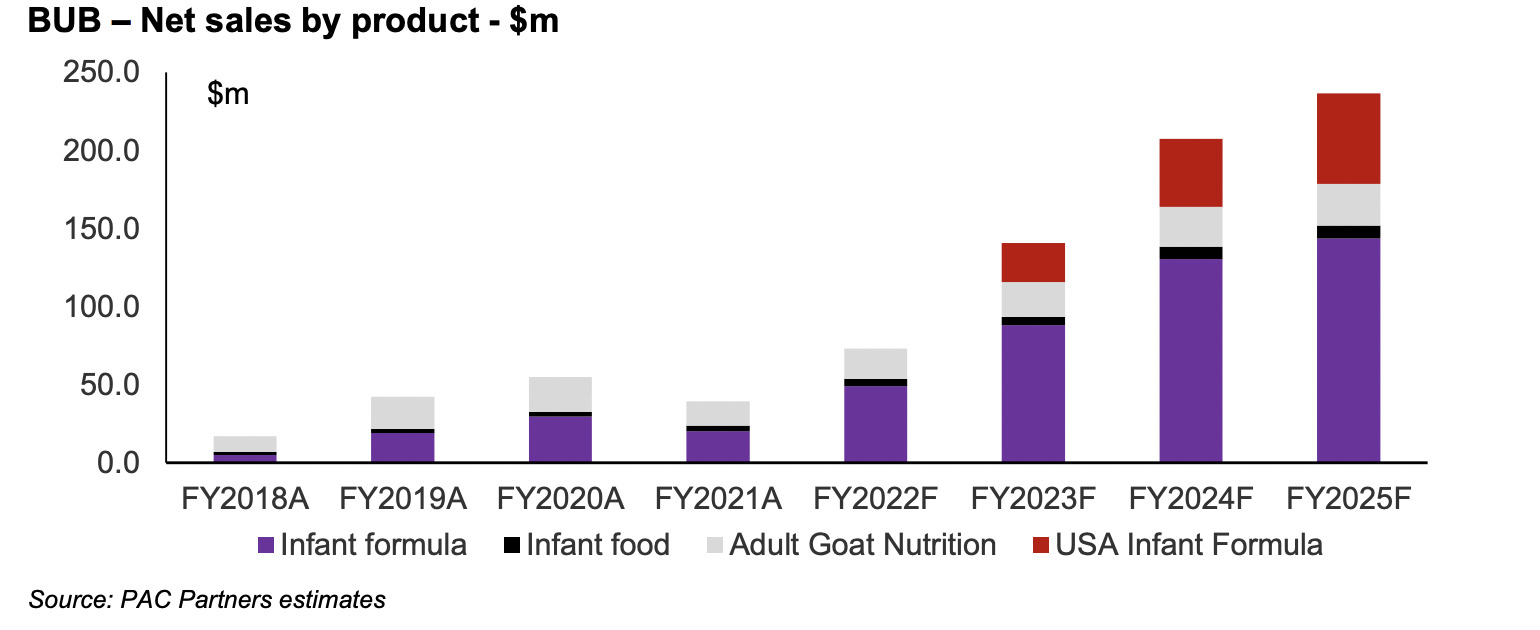

“It represents a step-change to the growth and premium for Bubs. We believe the endorsement of USFDA and the US President will fast track 20% of group sales into the US and enhance ‘Bubs’ as a premium brand.”

The company’s infant nutrition platform started with organic food in 2006, and added premium infant formula with three steps: goat in 2015, organic in 2019 and A2 beta-casein in 2022, a process which has delivered traction at home as well as abroad.

BUB has a 5% market share in Australia with #1 goat infant formula in Australian supermarkets and a cracking position within Woolies’ Chemist Warehouse (the leader was Danone’s ‘Karicare’, btw).

Bubs has given both its local market and state of readiness a bit of a shout out, telling Aussie customers:

“Due to our strong control of our supply chain security and our wholly owned production facility, we have already manufactured what is required and have been able to take steps to immediately increase the level of our future production, as needed.”

Elsewhere the brand is looking pretty good; Jensz says that BUB is also well entrenched in the premium end of the mega-lucrative Chinese market via e-ommerce which accounts for some 60% of FY’22 Group sales.

BUBS: Price targets, recommendations

Paul says PAC partners is lifting its 12 Month Price Target on BUB by 29% to $0.85/share.

He cites the extra US sales and improved premium for “Bubs” brands from USFDA and President of United States endorsements.

BUB is a Buy “because it is the #1 Australian challenger brand for infant formula in offshore markets” with:

- Solid 16-year track record delivering nutrition to Australasian and Off-Shore infants and adults with reliable people, vertically integrated platform and multi-channel distribution partners

- Differentiated premium nutrition across goat milk, organic bovine milk and A2 beta-casein with more than 70% local ingredients and authenticity

- Scalable supply with existing relationships from farmers and processors from 100% ownership of Deloraine Tinner (South-East Melbourne) with $10m capital to expand throughput from 10mtin to 30mtin/annum

- Willis Trading and other e-Commerce partners in China.

- US e-Commerce (Walmart, Amazon, Thrive Market, Vitacost), Californian Retail (Ralphs, Smart & Final, buy buy Baby, Frys, Food 4 Less; and Food Distributors (DPI, KeHE, UNFI).

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.