ASX Small Caps Lunch Wrap: Anyone else feeling a little forgetful this morning?

News

News

Local markets are up this morning, with the ASX 200 rocking a 0.6% jump in early trade to get the week off to a decent start. There’s probably a reason for it, but it’s my first day back after a few weeks off and I’ve genuinely no idea what’s been happening – so stand by for some incredibly vague insights into what the market’s doing today.

But first, some excellent news for a certain section of the ageing male population, after a study published in the Journal of Alzheimer’s Disease has revealed that erectile dysfunction drugs such as Viagra could hold one of the keys to bringing the disease to its knees.

According to the boffins behind the research at the 100% legit-sounding Cleveland Clinic found that people who often took drugs containing Viagra’s active ingredient (sildenafil, it’s called) had a 30% to 54% reduction in the risk of developing Alzheimer’s – which is not a statisistically insignificant finding.

There’s more to the report, but I forget what it said…

The ASX 200 is enjoying a morning in the sunshine, in the wake of US markets taking pause on Friday after what I’m assured was a belter of a week for Wall Street – more on that in a moment.

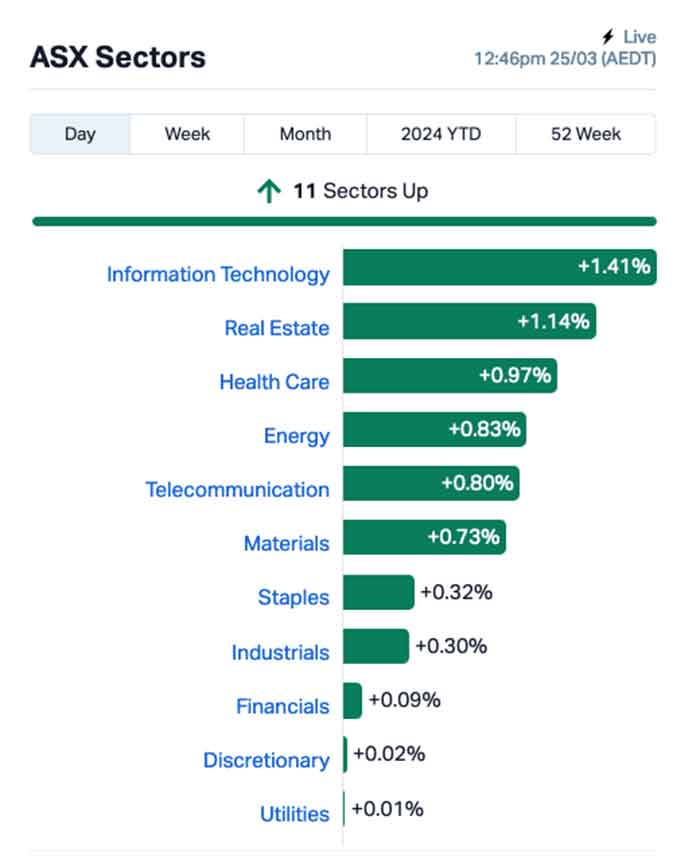

As we trundle into lunchtime today, the local benchmark is up and as of 12:30-ish, there’s not a dud sector in sight – and here’s a photo I just took to prove it.

Among the large caps, the headline news is that Star Entertainment Group (ASX:SGR) has – again – shed a fine selection of senior staff in a bid to stop regulators from yanking the company’s licence to operate its Sydney casino.

Group CEO Robbie Cooke and CFO Christina Katsibouba have both reportedly fallen on their swords to varying degrees, as the weight of a Queensland government decision to crack down on gambling and the latest in a series of inquiries in NSW proved too much for Cooke’s tenure to withstand.

Star says chair David Foster will shoulder the added burden of responsibility while the company searches for a unicorn to take the reins – a cleanskin that won’t bring baggage to the table, and who would actually want to grasp the poison chalice.

Also losing ground up the big end of town today is ALS (ASX:ALQ), with a surprising -4.5% dip on news that the company is set to acquire the remaining 51% of Nuvisan Pharma – which includes Nuvisan GmbH and Innovation Campus Berlin – “at nil cost”.

Briefly, Wall Street had a mixed day on Friday that saw the S&P 500 fall by -0.14%, the blue chips Dow Jones index was down by -0.77%, while the tech-heavy Nasdaq lifted by +0.16% to yet another record high.

Earlybird Eddy Sunarto reported this morning that volatility has been easing across assets, and the stock market has shown no signs of pulling back as traders expect the Fed to cut possibly 50 basis points before the November election.

They’ve been wrong about that before, though, so… yeah. I’ll believe it when I see it.

To US stock news, the biggest movers on Friday included FedEx, which jumped +7% after surprising the market with better-than-expected Q3 earnings.

Athletic apparel retailer Lululemon plunged -15% after the company issued guidance that came in below analysts’ expectations, citing “a shift in U.S. consumer behaviour”.

Turns out that there’s only so much tubby American butt that can be adequately contained by yoga pants before it becomes an unsightly mess.

With nearly half of all American states laying claim to adult populations with obesity levels above 35% (that’s according to the US CDC) and a finite global supply of high-tensile lycra, something’s gotta give – and you’re gonna want to stand back when it does.

Nike also fell about 7% after warning of lower sales in the first half of FY25. ‘Nuff said, really.

It’s a different story in Japan this morning, where the Nikkei is down 0.16% in early trade, giving back gains made on Friday by auto and financial stocks.

And things are mixed in Chinese markets this morning, with Shanghai down 0.25% and Hong Kong’s Hang Seng up a modest 0.2% in early trade.

Here are the best performing ASX small cap stocks for 25 March [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap JAV Javelin Minerals Ltd 0.002 100% 2470000 $2,176,231 VMC Venus Metals Corp 0.13 46% 668447 $16,885,853 REZ Resources & Energy Group 0.011 38% 2816880 $3,998,446 NRX Noronex Limited 0.015 36% 23726293 $5,153,249 AXE Archer Materials 0.63 34% 4091298 $119,778,096 MRD Mount Ridley Mines 0.002 33% 200000 $11,677,324 JPR Jupiter Energy 0.021 31% 11600 $20,378,435 FAU First Au Ltd 0.0025 25% 370000 $3,323,987 MCT Metalicity Limited 0.0025 25% 14640716 $8,970,108 MEA McGrath Ltd 0.585 24% 1968609 $74,813,429 OPL Opyl Limited 0.031 24% 31250 $4,228,223 AUQ Alara Resources Ltd 0.068 24% 2186650 $39,494,815 AKN Auking Mining Ltd 0.023 21% 357644 $4,471,720 IBG Ironbark Zinc Ltd 0.006 20% 6945647 $7,969,363 NTM NT Minerals Limited 0.006 20% 157240 $4,299,515 NPM Newpeak Metals 0.013 18% 49473 $1,099,469 BFC Beston Global Ltd 0.007 17% 905280 $11,982,281 EPM Eclipse Metals 0.007 17% 764597 $13,257,933 M4M Macro Metals Limited 0.007 17% 34656940 $19,392,401 RNX Renegade Exploration 0.007 17% 416500 $6,022,018 OLI Oliver's Real Food 0.022 16% 332672 $8,373,906 IMC Immuron Limited 0.115 15% 1182270 $22,799,835 TGN Tungsten Min NL 0.115 15% 190311 $78,641,427 AUR Auris Minerals Ltd 0.008 14% 218879 $3,336,382 AGN Argenica 0.65 14% 343784 $56,852,269

Top of the news-making winners was Venus Metals (ASX:VMC), charging more than +40% on news that drilling at its 100%-owned Youanmi lithium project has confirmed that the company has, in fact, hit a significant, high-grade lithium deposit, with some of the best results coming at or near surface.

Top intersections such as 24m @ 1.71% Li2O, including 14m @ 2.54% Li2O from 0-14m, and 15m @ 1.34% Li2O, including 8m @ 2.19% Li2O from 0-8m have the team pretty excited.

Shares in real estate company McGrath (ASX:MEA) are up 26% in morning trade after founder and CEO John McGrath struck a 60c/share takeover deal with a consortium of global real estate consultancy Knight Frank and New Zealand’s largest private held real estate agency Bayleys.

According to the ASX announcement McGrath will receive the unlisted scrip alternative for his 23.3% stake, and will continue as CEO, backed by his existing management, of the business in the deal valuing MEA at ~$95.5m.

Archer Materials (ASX:AXE) is also enjoying a boost this morning, on news that it and research partner PFL have developed a pulsed electron spin resonance chip, advancing Archer’s 12CQ quantum technology project.

I will confess my own inadequacies in understanding WTF any of this actually means, but the company says: “The p-ESR microsystem is a tiny, integrated device designed to detect and analyse the behaviour of unpaired electrons, that potentially carry spin quantum information, in materials at a very small scale.”

“It measures 0.7 mm2 in size and it includes integrated circuit components like micro coils, amplifiers, filters, and mixers, all working together to detect and amplify signals related to the behaviour of unpaired electrons.”

I am assuming that’s all good stuff, because Archer was up 34% this morning – but I’m scared to check what it is now in case I effect the outcome of the morning’s trading by observing it.

And Auking Mining (ASX:AKN) rounded out the winners list early with news that it has signed a memorandum of understanding with Saudi operator Barg Alsaman Mining Company – a subsidiary of the expansive Segia Gulf Group – for the purpose of jointly exploring and developing mineral projects in the Kingdom of Saudi Arabia.

Here are the most-worst performing ASX small cap stocks for 25 March [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap AXP AXP Energy Ltd 0.001 -50% 10,093,161 $11,649,361 RMX Red Mount Mining 0.001 -50% 3,400,000 $5,347,152 RFT Rectifier Technolog 0.02 -44% 13,408,867 $49,751,422 ADX ADX Energy Ltd 0.12 -37% 14,429,887 $81,478,288 SIH Sihayo Gold Limited 0.001 -33% 350,000 $18,306,384 VPR Volt Power Group 0.001 -33% 200,155 $16,074,312 SI6 SI6 Metals Limited 0.003 -25% 4,751,721 $9,475,438 IS3 I Synergy Group Ltd 0.007 -22% 118,000 $2,736,723 SLM Solis Minerals 0.098 -22% 48,003 $9,759,656 ROG Red Sky Energy 0.004 -20% 73,395 $27,111,136 EOS Electro Optic Systems 1.7075 -18% 1,628,160 $356,170,892 AQX Alice Queen Ltd 0.005 -17% 10,328 $4,145,905 GTI Gratifii 0.005 -17% 3,725,163 $8,215,336 RML Resolution Minerals 0.0025 -17% 1,700,000 $3,779,990 SIS Simble Solutions 0.005 -17% 99,500 $4,194,234 WA8 Warriedar Resources 0.042 -14% 44,000 $26,113,193 1MC Morella Corporation 0.003 -14% 65,000 $21,625,798 ALY Alchemy Resource Ltd 0.006 -14% 300,000 $8,246,534 DXN DXN Limited 0.024 -14% 137,946 $5,176,902 ILA Island Pharma 0.06 -14% 607,961 $5,688,793 PVT Pivotal Metals Ltd 0.012 -14% 658,950 $9,857,656 SHN Sunshine Metals Ltd 0.012 -14% 5,357,213 $17,136,118 CVR Cavalier Resources 0.155 -14% 6,262 $5,729,205 EVR Ev Resources Ltd 0.0095 -14% 27,134,646 $14,533,986 JLL Jindalee Lithium Ltd 0.67 -14% 8,371 $46,879,841

Recruitment and dosing for LTR Pharma (ASX:LTP) SPONTAN erectile dysfunction pivotal clinical study is now complete.

All patients recruited for the bioequivalence clinical study of the nasal spray treatment have received their second and final dose.

Data collected from the study will be used to support pre-submission meetings with the FDA and prescriptions of SPONTAN via the early access scheme in Australia.

Analysis is under way with the data read-out expected in mid-2024.

Meanwhile, Conico (ASX:CNJ) is raising almost $3 million from a placement and rights offer to fund proposed exploration work across its Ryberg and Mestersvig base metals projects in Greenland, as well as the Mt Thirsty cobalt-nickel-manganese project in Western Australia.

RM Corporate Finance will act as lead manager to the pro-rata non-renounceable rights offer which is seeking to raise up to $2.71 million if fully subscribed.

Lead manager fees for both the rights offer and placement are being paid to RM Corporate which is a company associated with Conico director Guy Le Page, who is also a regular columnist for Stockhead.

At Stockhead, we tell it like it is. While Conico and LTR Pharma are Stockhead advertisers, they did not sponsor this article.