ASX Small Caps and IPO Weekly Wrap: Goldies ruled the roost as we got teased by a 10-bagger

News

News

It’s the end of a short week in the lead-up to Easter, the traditional religious holiday that celebrates the time when a fella called Jesus fed 6,000 orphans for three days with just a single Cadbury Creme Egg. Allegedly.

In the interests of knocking off early to make the long weekend even longer, here’s what’s been happening up to this moment in time – just after lunch on Thursday. Please note – if something terrible or amazing happens, I’ll begrudgingly come back and amend this… probably on Tuesday, but.

The biggest Small Cap story of the week came courtesy of Aussie medtech Osteopore (ASX:OSX), which had pulses racing on Wednesday when some pretty good – not amazing – news sent its share price into a post-ballistic frenzy.

At its peak, it was up +1076% – and had more than a few market watchers ready to bust out the bubbly – a proper 10-bagger is the stuff of dreams, and rarer than hen’s teeth.

It’s the ASX equivalent of catching Bigfoot boning a unicorn atop a pot of gold at the end of a triple rainbow.

But… the more folks looked at it, the more questions arose. Why was this news sending it soaring? Why was it valued at such a pittance at the start of the day?

… Why was there a $3 million cap raise at an unheard-of 99% discount earlier in the month?

WTF is going on here?

The answer, unfortunately, could take quite a bit of time to tease out – but by the end of the day, OSX closed at $0.30 a share, from a previous close of $0.065.

The fact that, in all that volatility, someone made more than a couple of dollars is without question – and the fact that more than a few people will have aped in at various junctures is also apparent.

But… the next morning, OSX dropped a bombshell, calling for a voluntary suspension until the end of April to give it time to finalise a long overdue December 2023 Annual Report.

“The Directors do not consider that trading of the Company’s securities should occur while the Annual Report remains un-lodged,” Thursday morning’s announcement read.

(As I said at lunchtime, just so we’re 100% clear – I’m not suggesting any kind of malfeasance or anything here…)

There’s undoubtedly more to this story to shake out in the coming days or weeks – I’ll do my best to keep you posted.

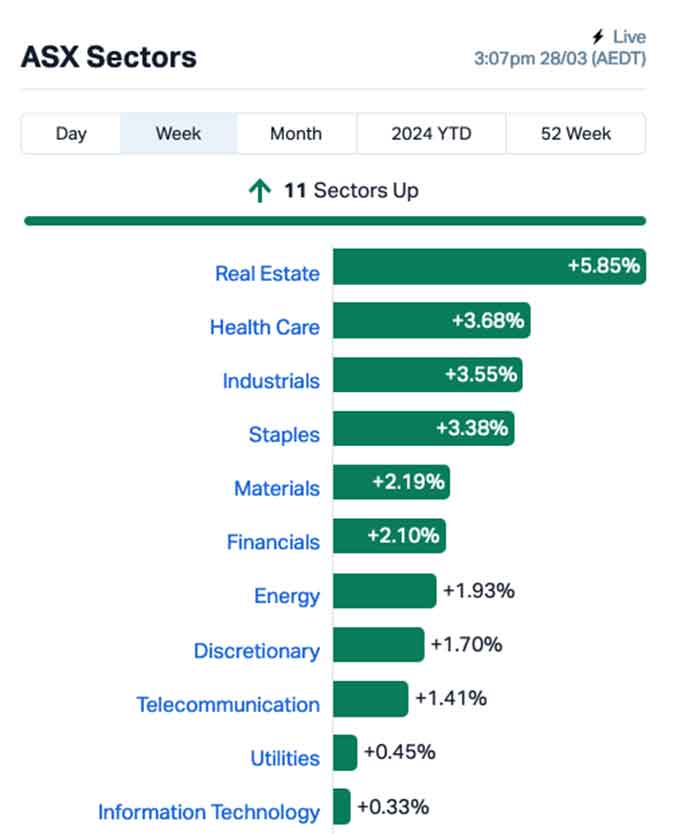

It was a great week for the Real Estate sector, which – at the time of writing – was a very healthy 5.5% ahead of where it was at the tail end of last week.

The rest of the sectors look like falling into line on the right side of break-even for the week as well, to varying degrees, as this handy chart illustrates.

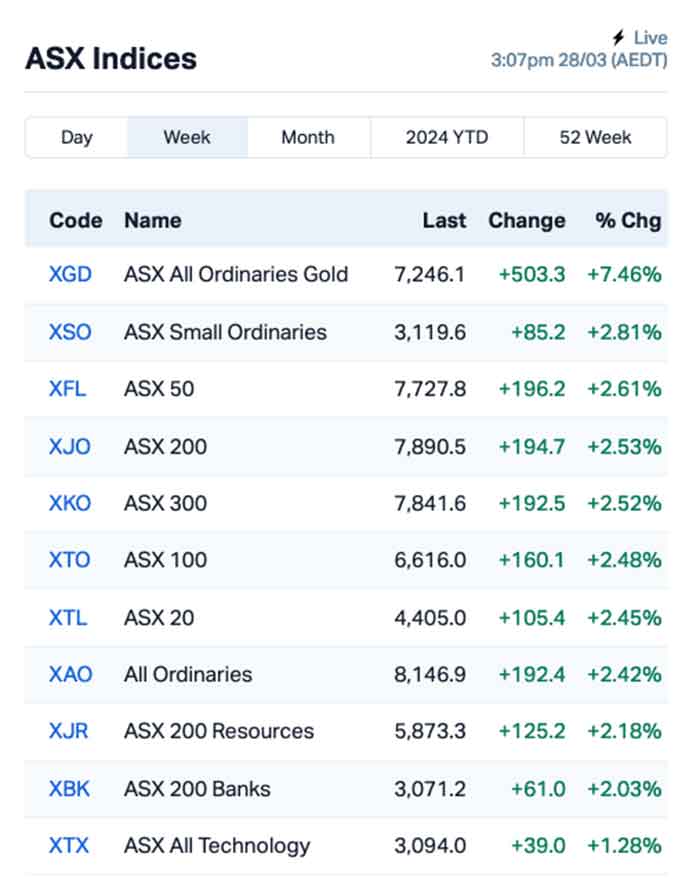

But a more granular look at the market’s performance this week shows that the gold medal quite deserves to hang around the neck of the goldies.

The ASX XGD Gold Index cranked out a banger, up better than 7.4% for the week, putting it up more than 17.5% for the month – which is clearly nothing to sneeze at.

Guy Le Page has lent his considerable nous and expertise to teasing out what is on the horizon for gold with this great story – but the short version is that certain market watchers are bullish on the precious metal, and can see US$2,300 in its near future, adding support to the sector’s growth this week.

So… which Small Cap officially won the week? Let’s find out together…

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| MPK | Many Peaks Minerals | 0.205 | 141% | $8,193,570.59 |

| APS | Allup Silica Ltd | 0.062 | 107% | $1,115,835.93 |

| JAV | Javelin Minerals Ltd | 0.002 | 100% | $4,352,461.57 |

| MSB | Mesoblast Limited | 0.58 | 73% | $564,652,316.75 |

| EXT | Excite Technology | 0.012 | 71% | $15,950,900.78 |

| ZNO | Zoono Group Ltd | 0.12 | 62% | $26,709,674.25 |

| JPR | Jupiter Energy | 0.025 | 56% | $31,841,304.70 |

| PTR | Petratherm Ltd | 0.031 | 55% | $6,967,285.31 |

| AD1 | AD1 Holdings Limited | 0.009 | 50% | $8,087,835.39 |

| AYM | Australia United Mining | 0.003 | 50% | $5,527,732.46 |

| GCR | Golden Cross | 0.003 | 50% | $3,291,768.33 |

| TMR | Tempus Resources Ltd | 0.006 | 50% | $3,654,993.74 |

| WEL | Winchester Energy | 0.003 | 50% | $3,061,265.72 |

| CKA | Cokal Ltd | 0.105 | 48% | $124,079,132.70 |

| SRL | Sunrise | 0.67 | 46% | $55,941,048.76 |

| STM | Sunstone Metals Ltd | 0.016 | 45% | $45,508,470.10 |

| KCC | Kincora Copper | 0.045 | 45% | $8,312,618.08 |

| TTT | Titomic Limited | 0.065 | 44% | $58,415,469.25 |

| PVT | Pivotal Metals Ltd | 0.02 | 43% | $11,265,892.56 |

| TLM | Talisman Mining | 0.24 | 41% | $46,138,485.51 |

| M4M | Macro Metals Limited | 0.007 | 40% | $25,856,534.05 |

| BAS | Bass Oil Ltd | 0.063 | 37% | $16,103,666.28 |

| GLV | Global Oil & Gas | 0.041 | 37% | $22,293,347.04 |

| NRX | Noronex Limited | 0.015 | 36% | $7,027,158.00 |

| WNR | Wingara Ag Ltd | 0.015 | 36% | $2,633,137.56 |

| ASP | Aspermont Limited | 0.019 | 36% | $44,201,424.65 |

| FRX | Flexiroam Limited | 0.023 | 35% | $15,010,656.56 |

| G50 | Gold50Limited | 0.135 | 35% | $14,754,150.00 |

| ASV | Asset vision Co | 0.02 | 33% | $14,516,731.30 |

| GMN | Gold Mountain Ltd | 0.004 | 33% | $11,902,022.75 |

| HCD | Hydrocarbon Dynamic | 0.004 | 33% | $3,234,329.45 |

| ICU | Investor Centre Ltd | 0.032 | 33% | $9,399,139.27 |

| RIE | Riedel Resources Ltd | 0.004 | 33% | $6,671,506.90 |

| SRY | Story-I Limited | 0.004 | 33% | $1,505,619.43 |

| TNC | True North Copper | 0.1 | 33% | $30,075,087.53 |

| FEG | Far East Gold | 0.165 | 32% | $36,062,156.90 |

| CC9 | Chariot Corporation | 0.29 | 32% | $23,309,112.03 |

| TRE | Toubani Res Ltd | 0.15 | 30% | $18,741,193.24 |

| AXE | Archer Materials | 0.585 | 29% | $146,537,032.48 |

| ACU | Acumentis Group Ltd | 0.09 | 29% | $19,199,365.24 |

| MMC | Mitre Mining | 0.45 | 29% | $34,328,491.89 |

| KAU | Kaiser Reef | 0.16 | 28% | $25,656,584.10 |

| AEI | Aeris Environmental | 0.07 | 27% | $17,198,618.57 |

| JAY | Jayride Group | 0.014 | 27% | $3,308,327.65 |

| LML | Lincoln Minerals | 0.007 | 27% | $13,632,362.01 |

| MEA | McGrath Ltd | 0.59 | 27% | $93,914,729.72 |

| CGR | CGN Resources | 0.285 | 27% | $28,595,130.17 |

| EQN | Equinox Resources | 0.22 | 26% | $22,764,375.68 |

| CAT | Catapult Grp Int Ltd | 1.545 | 26% | $372,802,960.32 |

| 1AG | Alterra Limited | 0.005 | 25% | $3,482,762.74 |

So… nominally, Osteopore is at the top of the ladder, but its missing from the charts today because there’s still a bit of an asterix next to the result, and the shares are now suspended for about a month – or until the company is able to present a 2023 annual report that the market’s going to accept – whichever comes first.

But for those of you playing at home, the end result for OSX was that it closed at $0.30 before it was suspended, putting it on a +361.5% jump for the week.

Minus the asterixes, it was Many Peaks Minerals (ASX:MPK) out in front, after the company entered into a binding agreement with Turaco Gold (ASX:TCG) to acquire 89% of CDI Holdings, handing it the reins of four (count ’em… four!) well-progressed West African gold concerns.

Allup Silica (ASX:APS), a microcap explorer in southern WA, came in hot in second place, briefly hitting at least +270% early Thursday before easing, on news the its Cabbage Spot silica is really, really good quality.

Micro-priced Javelin Minerals (ASX:JAV) doubled up to $0.002, so it’s got a 100% next to its name for the week, and medtech Mesoblast dropped news that the US FDA has informed the company that following additional consideration the available clinical data from its Phase 3 study MSB–GVHD001 appears sufficient to support submission of the proposed Biologics License Application (BLA) for remestemcel–L for treatment of pediatric patients with steroid–refractory acute graft versus host disease.

I only know about half those words, but apparently it’s pretty good news.

SMALL CAP LAGGARDS THIS WEEK

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| AS1 | Asara Resources Ltd | 0.008 | -11% | $7,057,402.80 |

| AUR | Auris Minerals Ltd | 0.008 | -11% | $3,813,007.66 |

| CTO | Citigold Corp Ltd | 0.004 | -11% | $12,000,000.00 |

| DMG | Dragon Mountain Gold | 0.008 | -11% | $3,157,373.32 |

| GBZ | GBM Rsources Ltd | 0.008 | -11% | $10,183,648.30 |

| KTA | Krakatoa Resources | 0.008 | -11% | $3,776,857.76 |

| POW | Protean Energy Ltd | 0.008 | -11% | $5,204,903.70 |

| G6M | Group 6 Metals Ltd | 0.065 | -11% | $70,281,599.64 |

| UBN | Urbanise.Com Ltd | 0.325 | -11% | $20,858,665.75 |

| HMY | Harmoney Corp Ltd | 0.49 | -11% | $53,021,356.44 |

| 3DP | Pointerra Limited | 0.041 | -11% | $29,074,223.44 |

| DY6 | Dy6Metalsltd | 0.041 | -11% | $1,651,616.65 |

| CTM | Centaurus Metals Ltd | 0.29 | -11% | $146,024,214.42 |

| ZEO | Zeotech Limited | 0.025 | -11% | $43,335,576.63 |

| R8R | Regener8 Resources NL | 0.125 | -11% | $3,591,875.14 |

| VTM | Victory Metals Ltd | 0.25 | -11% | $20,756,912.28 |

| HFR | Highfield Res Ltd | 0.38 | -11% | $156,873,493.20 |

| EEG | Empire Energy Ltd | 0.17 | -11% | $123,743,587.68 |

| TGN | Tungsten Min NL | 0.085 | -11% | $66,845,213.12 |

| ARV | Artemis Resources | 0.017 | -11% | $28,750,334.53 |

| COV | Cleo Diagnostics | 0.17 | -11% | $12,597,000.17 |

| FIN | FIN Resources Ltd | 0.017 | -11% | $11,686,836.60 |

| NTL | New Talisman Gold | 0.017 | -11% | $7,506,002.44 |

| XST | Xstate Resources | 0.017 | -11% | $5,144,306.40 |

| EMS | Eastern Metals | 0.026 | -10% | $2,225,508.62 |

| HRN | Horizon Gold Ltd | 0.26 | -10% | $37,658,379.98 |

| ARN | Aldoro Resources | 0.07 | -10% | $9,423,662.01 |

| MGA | Metals Grove Mining | 0.035 | -10% | $1,302,017.50 |

| LIN | Lindian Resources | 0.1125 | -10% | $138,230,668.32 |

| BMO | Bastion Minerals | 0.009 | -10% | $2,816,099.34 |

| CMD | Cassius Mining Ltd | 0.009 | -10% | $4,878,040.46 |

| CRS | Caprice Resources | 0.018 | -10% | $4,468,405.52 |

| DOU | Douugh Limited | 0.0045 | -10% | $4,869,310.14 |

| ECT | Environmental Clean Technologies | 0.0045 | -10% | $11,457,241.52 |

| EQS | Equity Story Group | 0.027 | -10% | $1,150,599.49 |

| HLX | Helix Resources | 0.0045 | -10% | $9,292,583.37 |

| HVY | Heavy Minerals | 0.072 | -10% | $4,533,551.06 |

| NGS | NGS Ltd | 0.009 | -10% | $2,261,046.57 |

| RLF | RLF Agtech | 0.072 | -10% | $6,629,727.96 |

| RRR | Revolver Resources | 0.054 | -10% | $14,279,334.47 |

| TIA | Tian AN Australia | 0.225 | -10% | $21,652,207.50 |

| TSL | Titanium Sands Ltd | 0.009 | -10% | $15,949,841.81 |

| AMA | AMA Group Limited | 0.055 | -10% | $102,965,002.41 |

| ST1 | Spirit Technology | 0.046 | -10% | $34,144,483.02 |

| AVA | AVA Risk Group Ltd | 0.14 | -10% | $40,981,778.56 |

| CMG | Critical Mineral Group | 0.14 | -10% | $5,396,240.36 |

| WC8 | Wildcat Resources | 0.655 | -10% | $844,595,008.60 |

| MAU | Magnetic Resources | 0.94 | -10% | $248,970,572.25 |

| SPA | Spacetalk Ltd | 0.019 | -10% | $8,949,406.77 |

| TER | Terracom Ltd | 0.24 | -9% | $184,222,234.05 |

Monday 25 March, 2024

Top of the news-making winners was Venus Metals (ASX:VMC), charging more than +20% on news that drilling at its 100%-owned Youanmi lithium project has confirmed that the company has, in fact, hit a significant, high-grade lithium deposit, with some of the best results coming at or near surface. Top intersections such as 24m @ 1.71% Li2O, including 14m @ 2.54% Li2O from 0-14m, and 15m @ 1.34% Li2O, including 8m @ 2.19% Li2O from 0-8m have the team pretty excited.

McGrath (ASX:MEA) was up 25% after founder and CEO John McGrath struck a 60c/share takeover deal with a consortium of global real estate consultancy Knight Frank and New Zealand’s largest private held real estate agency Bayleys.

Likewise, MMA Offshore (ASX:MMA) rose 10% after getting a buyout proposal from Cyan, a subsidiary of Cyan Renewables, for a cash amount of $2.60 per MMA share.

Archer Materials (ASX:AXE) also enjoyed a boost on news that it and research partner PFL have developed a pulsed electron spin resonance chip, advancing Archer’s 12CQ quantum technology project.

Auking Mining (ASX:AKN) has signed a memorandum of understanding with Saudi operator Barg Alsaman Mining Company – a subsidiary of the expansive Segia Gulf Group – for the purpose of jointly exploring and developing mineral projects in the Kingdom of Saudi Arabia.

Argenica Therapeutics (ASX:AGN) jumped +15% on the back of an FDA-related announcement. The brain tissue focused biotech says the US FDA has granted its neuroprotective drug ARG-007 a Rare Pediatric Disease Designation (RPDD) for the treatment of Hypoxic Ischaemic Encephalopathy (HIE) in newborn term infants. An RPDD is given by the FDA to those drugs that show promise in preventing, diagnosing or treating a rare disease or condition in the pediatric population (children 18 years and younger).

Tuesday 26 March, 2024

The clear standout was Many Peaks Minerals (ASX:MPK), which surged ahead by +174% for the day.

Many Peaks has entered into a binding agreement with Turaco Gold (ASX:TCG) to acquire 89% of CDI Holdings (Guernsey) – a holding company for the Ivorian subsidiary party to a JV which has earned into a 65% stake in four Ivorian permits, and holds the right to earn-in to an 85% interest by sole funding any project within four mineral licences in Cote d’Ivoire through feasibility study.

Mesoblast (ASX:MSB) jumped 50% after announcing that US FDA has informed the company that following additional consideration the available clinical data from its Phase 3 study MSB-GVHD001 appears sufficient to support submission of the proposed Biologics License Application (BLA) for remestemcel-L for treatment of pediatric patients with steroid-refractory acute graft versus host disease (SR-aGVHD). Mesoblast now intends to file the resubmission during the next quarter, seeking to address all remaining product characterisation issues.

Sarama Resources (ASX:SRR) also moved up nicely earlier in the day, probably because West African gold is looking like hot property, for obvious reasons.

Cokal (ASX:CKA) managed to secure itself a 12-month revenue stream by chartering barges to “ensure continuous delivery” of its coal to market. That revenue stream is in effect, with the company announcing it had received payment from the loading of 7,500 tonnes of product coal on to barges at the Batu Tuhup Jetty. Said barges will transport 7,500 tonnes of high-grade thermal coal product to Sumbar Global (SGE), which has been sold under the existing offtake contract.

Trek Metals (ASX:TKM) rose on good on news regarding its Champagne Pool epithermal gold target within the Pincunah Project in the Pilbara region of WA. The news is, basically, drilling has been announced to commence in the coming weeks at the untested, high-potential target. The company says there is every indication that strong surface geochemical indicators are suggestive of a cap to an epithermal gold system, with the gold zone likely ‘intact’ sub-surface.

Titomic (ASX:TTT) was celebrating a noteworthy sale, after the Netherlands Army purchased 10 of the company’s D523 Cold Spray systems, with the sale worth more than 770,000 Euros.

In the larger end of town, specialty retailer Premier Investments (ASX:PMV) rose 4% after reporting statutory first half NPAT of $177.2 million. The company also declared a record interim fully franked ordinary dividend of 63 cps, up 16.7% on the pcp.

Wednesday 27 March, 2024

Talisman Mining (ASX:TLM) jumped nicely on news that follow-up diamond drilling has intersected multiple zones of massive sulphide galena-sphalerite-chalcopyrite (lead-zinc-copper) mineralisation at the Durnings Prospect, part of the 100%-owned Lachlan Project in NSW.

Similarly, Argent Minerals (ASX:ARD) spiked after revealing that two major mineralisation extensions from the Kempfield Deposit have been discovered through surface sampling along strike from Lode 300 Mineralised Block, which contains 5.1Moz Ag @ 102 AgEq (g/t), totalling 65.1 Moz Silver equivalent resource. The company notes that high-grade surface rock chips highlight big potential here.

Medtech company Echo IQ (ASX:EIQ) climbed after telling the market that it has completed its US Reader Study, a “key step” towards securing final FDA clearance for its cardiology decision-support technology, and an important milestone in Echo IQ’s commercial development.

And EZZ Life Science (ASX:EZZ) has risen after dropping an investor prezzo, which included news that the company has lifted revenue 43% from $15.1m in 1H FY23 to $21.7m in 1H FY24, with a gross margin of 70% stable for the period.

Osteopore (ASX:OSX) announced that it has received clearance from two regulators, namely Singapore’s Health Sciences Authority (HSA) and Vietnam’s Department of Medical Equipment and Construction (DMEC), for its aXOpore product, which is essentially a porous lattice that is used around existing bones, which mimics the natural bone microstructure to promote new bone growth.

However… this massive spike comes on the tail of a recent huge fall in share price for Osteopore, after the company went to market seeking $3,000,000 through a placement priced at a massive 94.42% discount to last closing price. That came about through a number of factors, including an ill-timed 15:1 consolidation.

Thursday 28 March, 2024

Way out in front on Thursday morning was a surging Allup Silica (ASX:APS), a microcap explorer that had punched through +240% at one point in early trade on news that it’s sitting on a deposit of very high quality silica in southern WA.

The company reports that results from 43 surface samples have returned SiO2 grades greater than 98%, with an average grade of 98.6% – and the best of them coming in at 99.4% SiO2.

What it means is that the silica is of sufficient purity for use in important applications, such as photovoltaic cells, with a minimum of processing required to have it application-ready.

That, coupled with the location of the Cabbage Spot project less than 200km from a couple of major WA ports, has investors pretty excited.

Megado Gold (ASX:MEG) enjoyed a boost off the back of its (late) December 2023 Annual Report – which I haven’t had time to read all of, because it’s quite long and very complicated. I’m assuming the news is good.

Argenica Therapeutics (ASX:AGN) surged on news that the first patient in the company’s Phase 2 clinical trial in acute ischaemic stroke patients has been successfully dosed.

HyTerra (ASX:HYT) is rising on news it is undertaking a capital raising of approximately A$6.1 million (before costs) through a placement to sophisticated and professional investors, and a subsequent fully underwritten non-renounceable rights issue to eligible shareholders, with the money slated for use in a multi-well exploration drilling campaign planned to begin in Q3 2024 at its Kansas operation.

And 360 Capital Group (ASX:TGP) rose after it announced that it has sold its strategic stake in Hotel Property Investments (ASX:HPI), for $96.9 million. Happy days.

Nothing to see here this week…

All dates are sourced from the ASX website. They can, and frequently do, change without notice.

Proposed Listing: 04 April, 2024

IPO:$7 million at $0.20 per share

Blinklab describes its main activity as “the development and commercialisation of a smartphone-based application with an e-Platform that serves as a medical device to perform neurometric tests to aid in the diagnosis of Autism, ADHD, Schizophrenia and other neurodevelopment and neuropsychiatric disorders.”

Annnnd that’s it from me for the week. Have a happy, and above all safe, Easter break – we’ll see you back here on Tuesday when the market opens and all this mayhem starts again.