ASX Small Caps and IPO Weekly Wrap: A short week for a small win on the ASX

Reuben, a thoroughly disillusioned new father, arrived at the shops with strict instructions to purchase two boxes of baby wipes. Pic via Getty Images.

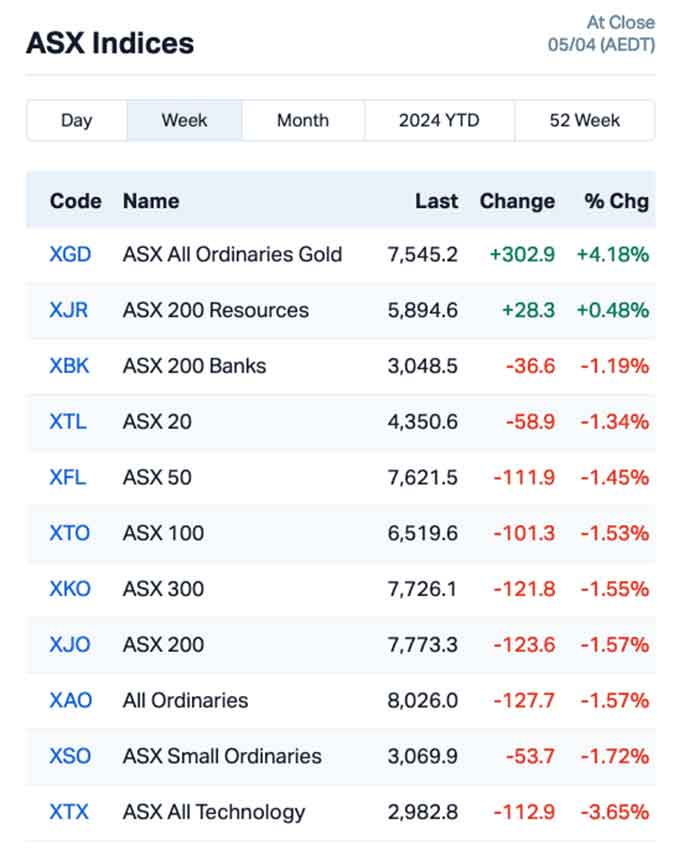

- The ASX 200 added 0.42% for the short week after Easter

- Just two sectors finished on positive numbers. The rest were a bit crap.

- Regeneus (ASX:RGS) was the best of the Small Caps, but not by very much…

It’s the end of a short week after Easter, the annual celebration of pre-diabetic children and adults who reckon it’s okay to have a cheat day once a year, and consume their own bodyweight in tiny chocolate eggs.

All up, it’s been a pretty ordinary string of sessions for the ASX, with the broader market managing to eke out a +0.4% gain across the four days of trading, but it’s not been without some iffy results along the way.

The main factors driving things on the ASX were ongoing interest rate talks in the United States – US Fed representatives have done their damndest to (hopefully) finally thump into Wall Street’s collective heads that rates aren’t going to be cut for quite a while.

Rampant speculation earlier in the year that cuts were coming sooner rather than later led to a solid uplift in New York – that flowed onto Aussie markets in a more muted way – but now that the message is clearer, it’s unsurprising that there are sell-offs like we’ve seen this week as the market corrects those January mistakes.

It’s not been quite so volatile for local markets – but the pressure from Wall Street has definitely been playing its part, pushing investor sentiment around like a bullied toddler and generally sucking the wind out of the sails for several ASX sectors that had banked some really significant wins up until this week.

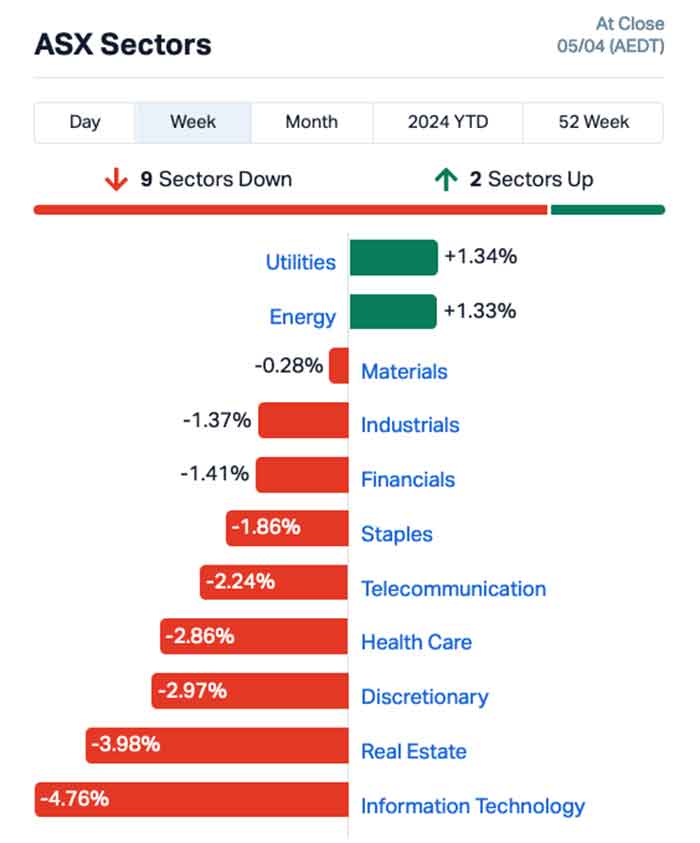

WHAT THE SECTORS DID

Utilities and Energy caught the best of the action since Tuesday, finishing the week on healthy if unremarkable totals around +1.5% apiece.

But the biggest kicking was saved for the InfoTech sector, which saw more than -4.8% wiped off the bottom line as investors ran for safer havens – specifically, gold.

The goldies did well, thanks to the confluence of record high prices for the precious metal, and the need for investors with tech heavy portfolios to reduce some of their risk as that sector floundered.

Rising commodity prices were another determining factor for markets this week – specifically copper and nickel joined gold in the mini rush, with silver not far behind while iron ore stayed largely flat, dipping slightly into negative territory a couple of times.

So… which Small Cap officially won the week? Let’s find out together…

SMALL CAP WINNERS THIS WEEK

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| RGS | Regeneus Ltd | 0.012 | 140.00 | $1,532,185 |

| DTM | Dart Mining NL | 0.039 | 129.41 | $10,468,663 |

| PEC | Perpetual Res Ltd | 0.013 | 85.71 | $8,960,412 |

| CYQ | Cycliq Group Ltd | 0.005 | 66.67 | $2,145,100 |

| FXG | Felix Gold Limited | 0.056 | 60.00 | $11,396,831 |

| ME1 | Melodiol Glb Health | 0.008 | 60.00 | $3,057,850 |

| TMG | Trigg Minerals Ltd | 0.008 | 60.00 | $3,348,394 |

| MSB | Mesoblast Limited | 0.86 | 54.96 | $1,026,640,576 |

| ARD | Argent Minerals | 0.017 | 54.55 | $20,668,144 |

| PNM | Pacific Nickel Mines | 0.038 | 52.00 | $15,893,618 |

| MOM | Moab Minerals Ltd | 0.006 | 50.00 | $4,271,781 |

| SIH | Sihayo Gold Limited | 0.0015 | 50.00 | $18,306,384 |

| BAS | Bass Oil Ltd | 0.094 | 49.21 | $23,081,922 |

| ACR | Acrux Limited | 0.069 | 43.75 | $20,059,463 |

| BML | Boab Metals Ltd | 0.165 | 43.48 | $32,105,985 |

| TPC | TPC Consolidated Ltd | 11.43 | 42.88 | $124,771,427 |

| YRL | Yandal Resources | 0.13 | 42.86 | $29,458,838 |

| AME | Alto Metals Limited | 0.045 | 40.63 | $28,860,927 |

| EXL | Elixinol Wellness | 0.007 | 40.00 | $7,594,459 |

| NXM | Nexus Minerals Ltd | 0.064 | 39.13 | $23,343,608 |

| ENX | Enegex Limited | 0.025 | 38.89 | $6,640,488 |

| NVO | Novo Resources Corp | 0.18 | 38.46 | $14,040,725 |

| NSB | Neuroscientific | 0.065 | 38.30 | $9,543,921 |

| GBZ | GBM Rsources Ltd | 0.011 | 37.50 | $12,446,681 |

| VML | Vital Metals Limited | 0.0055 | 37.50 | $29,475,335 |

| JBY | James Bay Minerals | 0.225 | 36.36 | $7,673,925 |

| AM7 | Arcadia Minerals | 0.095 | 35.71 | $9,269,259 |

| SHN | Sunshine Metals Ltd | 0.019 | 35.71 | $29,070,201 |

| 29M | 29Metalslimited | 0.5025 | 34.00 | $371,900,596 |

| AHN | Athena Resources | 0.004 | 33.33 | $4,281,870 |

| ALY | Alchemy Resource Ltd | 0.008 | 33.33 | $9,424,610 |

| ERL | Empire Resources | 0.004 | 33.33 | $4,451,740 |

| HCD | Hydrocarbon Dynamic | 0.004 | 33.33 | $2,425,747 |

| LNU | Linius Tech Limited | 0.002 | 33.33 | $10,393,481 |

| MTL | Mantle Minerals Ltd | 0.002 | 33.33 | $12,394,892 |

| SRY | Story-I Limited | 0.004 | 33.33 | $1,505,619 |

| TYX | Tyranna Res Ltd | 0.012 | 33.33 | $36,161,679 |

| WA1 | Wa1Resourcesltd | 14.39 | 32.63 | $878,336,732 |

| GPR | Geopacific Resources | 0.025 | 31.58 | $19,721,217 |

| EXR | Elixir Energy Ltd | 0.093 | 30.99 | $80,418,171 |

| DGR | DGR Global Ltd | 0.017 | 30.77 | $17,742,789 |

| BB1 | Blinklab Limited | 0.26 | 30.00 | $15,127,826 |

| CBE | Cobre | 0.07 | 29.63 | $22,185,896 |

| LGM | Legacy Minerals | 0.175 | 29.63 | $16,872,800 |

| AUN | Aurumin | 0.044 | 29.41 | $19,236,276 |

| KAL | Kalgoorliegoldmining | 0.031 | 29.17 | $4,438,020 |

| LV1 | Live Verdure Ltd | 0.62 | 29.17 | $73,471,414 |

| WEC | White Energy Company | 0.049 | 28.95 | $5,548,531 |

| AYA | Artryalimited | 0.38 | 28.81 | $29,907,517 |

| GSR | Greenstone Resources | 0.009 | 28.57 | $10,944,908 |

| VAR | Variscan Mines Ltd | 0.009 | 28.57 | $3,411,003 |

| CAI | Calidus Resources | 0.1475 | 28.26 | $110,338,365 |

| WR1 | Winsome Resources | 1.12 | 27.27 | $190,785,051 |

| HMX | Hammer Metals Ltd | 0.048 | 26.32 | $42,547,553 |

| CR1 | Constellation Res | 0.145 | 26.09 | $7,236,287 |

| LRV | Larvottoresources | 0.087 | 26.09 | $18,559,767 |

Out in front by the close of play Friday was Regeneus (ASX:RGS) , after it announced that it has successfully completed a big merger with Cambium Medical Technologies sending Regeneus shares up +180%.

The merger will also see a name change for the entity, and there’s been paperwork lodged with the ASX to rebrand to Cambium Bio (ASX:CBL), while work on the company’s leading collaboration, the development of Elate Ocular, a novel biologic for dry eye disease, continues.

In second place, it was Dart Mining (ASX:DTM) – which kicked off the week with a meteoric rise that prompted the ASX Highway Patrol to issue a speeding ticket and a please explain – which a number of us here in the office were watching for very closely indeed.

So you can imagine there was more than a spot or two of mirth to be found when Dart explained to the ASX that it was, in their opinion, most likely our very own Garimpeiro, Barry FitzGerald, who had struck again, turning that burning, steely gaze of his at Dart Mining and staring at it until its share price got superhot and exploded, like a kernel of solid gold popcorn beneath the concentrated power of the sun.

And in third spot, it was Perpetual Resources (ASX:PEC) , rising fast after it announced a significant expansion of its exploration landholding in the Itinga region of Minas Gerais, Brazil, known as “Lithium Valley”, through the execution of two option agreements.

Perpetual says tht preliminary look-arounds in the area likely indicate that the company’s on the money with this play, with early (not 100% reliable) field testing suggesting multiple confirmed lithium soil anomalies and peak value rock chips up to 2.1% Li2O – with the numbers yet to be confirmed by assays.

SMALL CAP LAGGARDS THIS WEEK

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| AXP | AXP Energy Ltd | 0.001 | -50.00 | $5,824,681 |

| MRD | Mount Ridley Mines | 0.001 | -50.00 | $11,677,324 |

| GEN | Genmin | 0.09 | -43.75 | $61,670,649 |

| CLZ | Classic Min Ltd | 0.011 | -35.29 | $2,835,935 |

| BP8 | Bph Global Ltd | 0.001 | -33.33 | $1,954,116 |

| CT1 | Constellation Tech | 0.001 | -33.33 | $1,474,734 |

| GCR | Golden Cross | 0.002 | -33.33 | $2,194,512 |

| M2R | Miramar | 0.012 | -33.33 | $2,084,174 |

| CTN | Catalina Resources | 0.0035 | -30.00 | $4,953,948 |

| MCL | Mighty Craft Ltd | 0.018 | -28.00 | $6,572,379 |

| PLC | Premier1 Lithium Ltd | 0.022 | -26.67 | $3,840,630 |

| PFE | Panteraminerals | 0.039 | -26.42 | $9,898,319 |

| VAL | Valor Resources Ltd | 0.048 | -26.15 | $11,380,796 |

| AI1 | Adisyn Ltd | 0.018 | -25.00 | $3,526,992 |

| AYM | Australia United Min | 0.003 | -25.00 | $5,527,732 |

| BXN | Bioxyne Ltd | 0.009 | -25.00 | $17,114,809 |

| JAV | Javelin Minerals Ltd | 0.0015 | -25.00 | $3,264,346 |

| NES | Nelson Resources. | 0.003 | -25.00 | $1,840,783 |

| WFL | Wellfully Limited | 0.003 | -25.00 | $1,478,832 |

| MMM | Marley Spoon Se | 0.064 | -23.81 | $8,240,708 |

| ALA | Arovella Therapeutic | 0.115 | -23.33 | $120,767,967 |

| UBN | Urbanise.Com Ltd | 0.25 | -23.08 | $14,761,517 |

| AL3 | Aml3D | 0.053 | -22.86 | $12,484,582 |

| AEV | Avenira Limited | 0.007 | -22.22 | $19,733,144 |

| CTQ | Careteq Limited | 0.014 | -22.22 | $3,768,757 |

| WTM | Waratah Minerals Ltd | 0.07 | -22.22 | $11,949,160 |

| LVH | Livehire Limited | 0.025 | -21.88 | $9,890,249 |

| ZNO | Zoono Group Ltd | 0.094 | -21.67 | $20,299,352 |

| ASP | Aspermont Limited | 0.015 | -21.05 | $39,290,155 |

| BMO | Bastion Minerals | 0.008 | -20.00 | $3,444,671 |

| BTE | Botalaenergyltd | 0.072 | -20.00 | $6,588,178 |

| CHR | Charger Metals | 0.1 | -20.00 | $8,129,126 |

| GMN | Gold Mountain Ltd | 0.004 | -20.00 | $11,902,023 |

| H2G | Greenhy2 Limited | 0.008 | -20.00 | $4,187,558 |

| IRX | Inhalerx Limited | 0.04 | -20.00 | $7,590,678 |

| LPD | Lepidico Ltd | 0.004 | -20.00 | $30,553,232 |

| MSI | Multistack Internat. | 0.004 | -20.00 | $681,520 |

| NMR | Native Mineral Res | 0.02 | -20.00 | $4,197,010 |

| RDS | Redstone Resources | 0.004 | -20.00 | $3,701,514 |

| ROG | Red Sky Energy. | 0.004 | -20.00 | $21,688,909 |

| EIQ | Echoiq Ltd | 0.12 | -20.00 | $56,942,753 |

| CTT | Cettire | 3.24 | -20.00 | $1,250,461,362 |

| NNL | Nordicnickellimited | 0.145 | -19.44 | $10,967,827 |

| MRZ | Mont Royal Resources | 0.057 | -18.57 | $4,846,698 |

| OXT | Orexploretechnologie | 0.022 | -18.52 | $4,103,729 |

| PIL | Peppermint Inv Ltd | 0.014 | -17.65 | $29,629,017 |

| BDG | Black Dragon Gold | 0.019 | -17.39 | $4,063,818 |

| SNS | Sensen Networks Ltd | 0.019 | -17.39 | $15,469,510 |

| SEG | Sports Ent Grp Ltd | 0.19 | -17.39 | $60,892,130 |

| MXO | Motio Ltd | 0.024 | -17.24 | $6,704,959 |

HOW THE WEEK SHOOK OUT

Tuesday 02 April, 2024

Dart Mining (ASX:DTM) went soaring 135% in the opening minutes of play Tuesday, only to have the ASX throw on the handbrake because there wasn’t any announcement that warranted that kind of early morning action.

Mesoblast (ASX:MSB) was second on the list because of last week’s news that the FDA has effectively reversed a call that cratered the company stock price in July last year.

NeuroScientific Biopharmaceuticals (ASX:NSB) was also on the rise on news that the company has filed a Pre-Investigation New Drug Application (‘pre-IND’) meeting request with the US Food and Drug Administration (‘FDA’) for EmtinB for treatment of advanced glaucoma in adults.

Additionally, NSB also announced that it has appointed current non-executive director, Dr Tony Keating as executive director, initially on a part-time basis following the resignation of Dougal Thring as chief operating officer.

Power and gas retailer TPC Consolidated (ASX:TPC) attracted a takeover offer from Beijing Energy International at $8.77/sh cash, plus special dividend and/or return of capital of up to $2.64/sh and the right to potential earn out scheme consideration of up to $4.41/sh. The TPC board recommends the deal, by the way.

Pot stock Melodiol (ASX:ME1) announced Canadian subsidiary Mernova has approvals to launch new products across several provincial markets. It delivered $1.75m of unaudited revenue in Q1 2024, up 13% on Q1 2023, with the Q2 order book already sitting at $373,000. It was up 60% this morning to $0.008.

Lord Resources (ASX:LRD) was up on an update from its Jingjing Lithium project, located 50km northeast of Norseman, in Western Australia. The company said that an infill soil sampling program is set to commence this week, to refine four priority lithium targets in advance of inaugural drilling, anticipated Q3 2024.

Wednesday 03 April, 2024

Acrux (ASX:ACR) and its partner TruPharma announced the launch of a generic of Dapsone 5% Gel, which is a prescription medicine used to treat acne vulgaris. The market in the US for this product is estimated to be worth around US$15 million a year – a large enough market to push Acrux up a staggering 70% in early trade, before easing to a far less blemish-covered +36% at close.

West African Resources (ASX:WAF) continued its recent run of gains on the back of a well-timed 2023 sustainability report that had lots of funky numbers in it, like “226,823 oz Annual gold production” and “$661 million Annual revenue” and other things that tend to make investors happy.

Clara Resources Australia (ASX:C7A) was up 25% on no news. It did get a Please Explain from the ASX on 26 March 2024 about its recent announcement of a scoping study for its Ashford coking coal project in NSW, and has responded. The response is thorough – 22 pages long, – with lots of details about the scoping study.

Perpetual Resources (ASX:PEC) announced “significant expansion” of its land in the Itinga region of Minas Gerais, Brazil – aka within ‘Lithium Valley’.

Two options agreements are in play here, with the new landholdings containing multiple confirmed lithium soil anomalies and peak value rock chips up to 2.1% Li2O (based on initial LIBS analysis, still to be confirmed by assay). The permits reportedly include “historic artisanal mines exploiting large pegmatites” with confirmed lithium soil anomalies.

Terra Uranium (ASX:T92) said it will very likely expand its Canadian uranium hunt further with a capital raise of $500,000 from “sophisticated professional investors” to help advance the company’s acquisition of another promising prospect – Amer Lake. Amer Lake is in a proven uranium field, with typical assay values ranging from 5,000 to 15,000 ppm U3O8 (0.5 to 1.5% U3O8). That, says Terra, is “over 0.2 metre thicknesses enclosed in greater thicknesses of 1.5 – 2.0 metres above cut-off of 100ppm U3O8″.

Pacific Nickel Mines (ASX:PNM) said its March Nickel DSO shipment from its 80% owned Kolosori Nickel Project in the Solomon Islands has now completed. As anticipated. The company notes that the loading of its third 60,000 tonne bulk carrier was completed in less than six days with the ship departing site on March 24.

Large cap Ramelius Resources (ASX:RMS) was up after hitting record gold production of ~87,000oz – and free cash flow of $125.3m – in the March quarter… a result that “obliterated guidance of 70,000 – 77,500oz”. RMS says Q3 AISC (all-in sustaining costs) will be materially lower than guidance due to record gold production.

Thursday 04 April, 2024

Cycliq (ASX:CYQ) announced new product news that has investors excited about the future of riding bikes. It’s called the Fly-6 Pro, and it’s a headlight/4K Camera combo unit that has a list of features that far outstrips anything I thought would ever be needed on a bicycle headlight… but, it’s 2024, and if your gadget can connect to the internet and broadcast you riding full-tilt into a car door in the middle of the CBD, then it’s probably going to fly off the shelves.

RooLife Group (ASX:RLG) announced a proposed placement to China-based e-commerce and supply chain business, Fujian Jushi Supply Chain Management Co., at a proposed placement price of $0.0085 per fully paid ordinary share.

Blinklab (ASX:BB1) – “a company focused on developing new smartphone-based AI-powered mental healthcare solutions” – made its market debut. The stock closed the day at 25.5c, up 27.5% on the listing price of 20c.

Kula Gold (ASX:KGD) has reported results of a recent rock chipping and mapping programme in the vicinity of the historical Camilleri/Donnybrook Mine with an assay result of up to 11.19g/t gold, which is pretty juicy.

Westar Resources (ASX:WSR) announced it has commenced a detailed review of historic gold exploration activities as a first step in unlocking the gold potential at the Mindoolah Mining Centre, which is part of the company’s Mindoolah project in Western Australia’s Murchison Region.

Hillgrove Resources (ASX:HGO) has completed the second copper production campaign from the Kanmantoo underground copper mine. The copper production has ramped up from 239 tonnes in February to 589 tonnes in March. The next two-week milling campaign is underway, with copper sales planned next week. The copper price has risen above US$4/lb for the first time since April 2023.

Geopacific Resources (ASX:GPR) says detailed exploration assessment has identified known mineralisation and priority drill targets, with strong potential to increase the existing 1.56Moz Woodlark Resource. These new target areas are all close to the current Resources, and the known mineralisation in each remains open and largely untested.

Pioneer Lithium (ASX:PLN) announced that it has applied for 37 tenements for a total of 73,061ha in Bahia state in Brazil, prospective for Rare Earths. The newly defined ‘Verde Valor’ Project will complement Pioneer Lithium’s other critical minerals projects. The company considers the Verde Valor Project a valuable addition to its lithium tenements in Ontario, Canada.

Friday 05 April, 2024

The big news for Friday came via Regeneus (ASX:RGS), after it announced that it has successfully completed a big merger with Cambium Medical Technologies sending Regeneous shares up +180%. The merger will also see a name change for the entity, and there’s been paperwork lodged with the ASX to rebrand to Cambium Bio (ASX:CBL), while work on the company’s leading collaboration, the development of Elate Ocular, a novel biologic for dry eye disease, continues.

Elixir Energy (ASX:EXR) also had a solid day, revealing that the company decided to test the free-flowing capacity of the Lorelle Sandstone between 4,200 and 4,217 metres, following a recent successful suite of Diagnostic Formation Integrity Tests (DFITs) conducted at Daydream-2. The fresh testing has been deemed a success, with a maximum rate of 2.3 Million Standard Cubic Feet Per Day (MMSCFPD) and stabilised flow rate of 1.3 MMSCFPD (through a 20/64 choke), which the company understands is the deepest unstimulated flow of gas in onshore Australia East of the Perth Basin.

And Biotron (ASX:BIT) has dropped some happy-happy news on the market, announcing that preliminary analyses of data from the BIT225-010 Phase 2 clinical trial of the company’s lead antiviral drug BIT225 provide confirmation, and extension, of the positive results of previous trials in people infected with HIV-1.

Estrella Resources (ASX:ESR) announced that results from initial rock-chip samples are in, which the company says were taken before the granting of Exploration and Evaluation Licences and Reconnaissance Permits for ESR in Timor-Leste. The samples were then brought back to Australia for further analysis. And that turned up an assay result of 60.8% manganese – one of four samples taken during initial limited reconnaissance. Estrella also notes that multiple manganese exposures have been documented across the 503.7km2 leases in Lautém with no modern exploration undertaken.

Tungsten Mining (ASX:TGN) has been conducting infill RC drilling at Mulgine Hill East, which has defined significant molybdenum-tungsten mineralisation over 520 metres of strike. What else? Project engagement with potential partners is reportedly progressing.

Kula Gold (ASX:KGD) has identified significant gold prospectivity at its Brunswick project in WA near a historical production area after rock chipping and mapping returned assays of up to 11.19g/t gold.Brunswick sits within the Donnybrook-Bridgetown Shear Zone just 35km from Greenbushes, the world’s largest hard rock lithium mine.

Pancreatic cancer treatment device company OncoSil Medical (ASX:OSL) continues to expand, with the first Austria-based patients receiving treatments involving the OncoSil device.

IPOs that happened

Blinklab (ASX:BB1)

Proposed Listing: 04 April, 2024

IPO:$7 million at $0.20 per share

Blinklab describes its main activity as “the development and commercialisation of a smartphone-based application with an e-Platform that serves as a medical device to perform neurometric tests to aid in the diagnosis of Autism, ADHD, Schizophrenia and other neurodevelopment and neuropsychiatric disorders.”

It finally went live on Thursday, and did pretty well on debut, rising to $0.265 a share on Day 1, but that eased a little through Friday, thanks to tough market conditions. A bumpy week to launch into, but BB1 appears to have held its own through it all.

That’s it from us for the week. Join us again next week, because this is all just gonna relentlessly keep on truckin’ along…

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.