You might be interested in

Mining

Monsters of Rock: BHP's $60 billion Anglo American gambit far from a done deal

Mining

FMG Results: Fortescue stunned by 'mind-blowing' China renewables rollout, says steel demand is diversifying

Mining

Mining

2021 is turning out to be a landmark year for the iron ore market with spot prices this week surpassing their February 2011 high of $US188 per tonne and they could soon reach $US200 per tonne.

At one stage mid-week iron ore spot prices almost hit $US190 per tonne ($245.20/tonne) before slipping back to $US188 per tonne, which is still a new record in Australian currency terms.

“It is worth noting that spot iron ore prices on Wednesday were at the highest level on record in Australian dollar terms,” analysts at Commonwealth Bank of Australia said in a note.

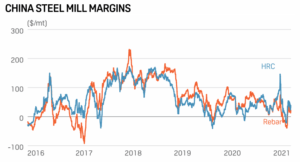

“We continue to believe that iron ore prices will stay elevated as long as steel mill margins in China remain high,” they added.

Chinese steel plants are currently receiving around $US780 per tonne for their reinforcing bar product which is used in construction projects for everything from bridges and buildings to infrastructure.

This price represents a 12-year high and low inventory levels in China are adding to upward pressure on prices for steel products including rebar and hot rolled coil.

The price acceleration has defied naysayers and forecasters alike and is all the more remarkable in the context of the COVID-19 pandemic which set back growth in the world economy.

“The market has been perennially surprised by stubbornly high prices for iron ore, but we have not,” said Todd Warren, an iron ore and commodities markets expert and head of research at Sydney-based Tribeca Investment Partners.

Some market participants may have underestimated the strength of the iron ore market and China’s steel production because they have extrapolated individual data points to forecast a long-term trend.

“The reality is that steel mill margins are still running incredibly hot, and they are not going to stop producing steel while those margins are incredibly robust, which is why iron ore is at the price it is at ~$US180 per tonne,” Warren said.

“The price is going in one direction, and the market has been wrong.”

Warren said that while Tribeca does not make price forecasts for iron ore, on a personal level he is confident that high prices are likely to stay around in the immediate term.

“Do not be surprised therefore to see the price go to $US200 per tonne, we are already at $US180 and change,” he said.

Higher prices for iron ore will lead to more cashflow for producers in Australia such as BHP (ASX:BHP), Fortescue Metals Group (ASX:FMG), Rio Tinto (ASX:RIO) and Hancock Prospecting’s Roy Hill operation, all in WA.

Market talk that China is going to reduce its steel output to address air pollution concerns in eastern China has caused some ‘hand wringing’ among market participants for iron ore, said Warren.

China, of course, is conscious of the impact that its policy commentary has on commodity markets in terms of sentiment for prices, and naturally it has an innate interest in talking down iron ore prices.

“You have to look through the commentary to understand what is the end game, and that is to continue its robust economy because that means a happy society and social harmony,” said Warren.

Reports of Beijing taking drastic action to curb steel production to tackle air pollution around its industrial centres such as Tangshan has clouded market sentiment for iron ore, but appear unrealistic.

“This [Tangshan] is a province that is reliant on heavy industry, and they are not going to just turn the blast furnaces off. This is a short-term pollution-related issue,” said Warren.

“Then there are headlines regarding China capping its steel production, and that is more hand-wringing. Let’s stop and think about this,” he said.

Added to this, Shandong province has announced this week some closures of deep, underground coal mines.

“China is producing an awful lot of steel because the margins are good, and the demand is there,” said Warren.

Latest production figures show China produced 94 million tonnes of steel in March, a mind-blowing year-on-year increase of 19 per cent, and equivalent to an annual output of 1.13 billion tonnes.

“You are going to produce a lot of steel if you can sell it and make money on it even though prices of iron ore are at $US180 per tonne,” Warren said.

“That tells you the market for steel in China is pretty robust at the moment.”

A lot of China’s steel production finds its way into the domestic market where it is used in construction for new cities and transport infrastructure that links these together.

Indeed, China’s government has set ambitious targets in its latest five-year plan, including a pledge to build 160 new airports and 32,000km of high-speed railway by 2035.

“2020 clearly saw China more broadly press the fiscal expansion button repeatedly and that has clearly helped the demand for steel and its various raw material inputs,” Warren said.

“The reality is that we are going to continue to see fiscal expansion in China.”

China is looking to streamline its industrial base, including its steel industry, in order to increase its productivity, efficiency and the quality of its production while addressing some of its pollution.

“Now that its industry is more mature, China wants to high grade it by shutting down some sub-scale operations and concentrating them into larger operations that are more economic.

“This way you get better environmental, financial and safety performance and more consistent production,” said Warren.

China is constantly riding a delicate balance between stimulating and driving its economy and preventing its economy from overheating, he said.

It wants to avoid a repeat of its post-GFC experience when its economy was over-stimulated and commodity prices went through the roof adding to the costs of production for Chinese industry.

In terms of supply response, major Australian iron ore producers are investing in new mines, although much of this is replacement capacity rather than additional production.

“Are there big new tonnes coming out of Australia? No, there is not. The demand for iron ore has been very strong, but the supply side has been constrained,” said Warren.

The contribution of new, junior iron ore producers to the seaborne market is welcome, but their shipments are dwarfed by Australia’s existing large-scale producers.

“If Rio Tinto misses its shipment target by 2 per cent, that takes 7 million tonnes out of the market on an annualised basis,” said Warren.

Iron ore market expert and Magnetite Mines (ASX:MGT) director, Mark Eames, has consistently said that production capacity for iron ore in Australia has not kept up with rising demand.

This means that Australian shippers cannot easily crank out more volume even if they wanted to, and the pipeline of new projects is relatively thin.

“A rapid supply response is very unlikely from the majors,” said Eames.

Magnetite Mines is developing its Razorback iron ore mine in South Australia which is expected to ship its first cargo in 2024.

The explorer is one of a few emerging iron ore producers in Australia, after the industry’s lower tier became hollowed out in the last market downturn.

“There is a limited [supply] response from smaller companies that have continued operations. Many of the smaller miners in WA went out of business five years ago,” Eames added.

Brazilian iron ore producers are unlikely to surprise in terms of exceeding their production guidance for iron ore in the South American country, another critical supplier for China.

Warren has been involved in resources investing for 20 years and said he has yet to see some larger Brazilian iron ore producers meet their production targets.

“They operate differently in terms of setting expectations. Can they increase their production? Absolutely. Whether they do so is a whole other discussion,” he said.

There may be an underlying incentive for seaborne iron ore producers to keep a tight rein on shipments and to produce more higher grade product in order to secure higher market prices.

“Suddenly the economics of producing a lower number, when you are producing a premium product that gets a higher price, makes a huge amount of sense,” he said.

Environmental concerns in China about pollution from steel-making do play into the hands of higher-grade iron ore producers, including some in Brazil and Australia.

“If you are shipping 65 per cent Fe iron ore, you are a massive beneficiary of this value-in-use argument, and the positive premiums for higher grade iron ore are only going to grow,” stated Warren.

“That plays into the hands of Brazilian and some high-grade Australian producers,” he added.

In fact, some high-grade iron ore producers are already achieving market prices of more than $US200 per tonne when current premiums of $US30 are added to spot prices for standard-grade iron ore.

Among these is Champion Iron (ASX:CIA) which operates a high-grade iron ore mine in Canada’s Quebec province.

At Stockhead we tell it like it is. While Magnetite Mines is a Stockhead advertiser, it did not sponsor this article.