Steel producers willing to pay premium prices to secure higher-grade iron ore: report

Higher grade iron ore is becoming an in-demand product for Chinese steel mills. Image: Getty

- Higher-grade iron ore to expand its market share by 17.5 per cent by 2030

- An increasingly sought-after product for steel mills in Asia that commands a price premium

- ‘They [China] will buy more high-grade iron ore’ Fastmarkets expert

High-grade iron ore will increasingly become a sought-after product for steel mills as they strive to achieve higher quality production with fewer environmental emissions that can affect human health.

A growing segment of the global iron ore market, high-grade iron ore with an iron (Fe) content above 63.5 per cent is set to expand by 17.5 per cent over the decade of the 2020s.

This is according to Fastmarkets, a specialist price reporting agency for steel raw materials including iron ore, that publishes highly regarded pricing information and analysis on commodities markets.

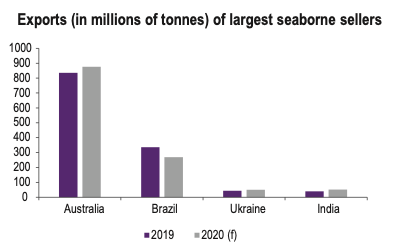

“Around 2.5 billion tonnes of iron ore is mined and the seaborne market is about 1.45 billion tonnes, of which about 540 million tonnes is defined as high grade iron ore (definition, that is over 63.5% Fe),” Fastmarkets iron ore expert, Brian Levich, director of consultancy and special projects told Stockhead.

“This rises to around 634 million tonnes by 2030,” said Levich of the high-grade iron ore sector.

Fastmarkets has produced an in-depth report, ‘Understanding the high-grade iron ore market’, that takes a deep dive into the iron ore sector and its pricing dynamics.

Increasing demand

Higher grade iron ore is increasingly an in-demand product for steelmaking as it can streamline the process, increase steel quality, and reduce airborne emissions such as carbon dioxide and fine particles.

For this reason, grades of iron ore above 63.5 per cent can attract higher prices than standard and lower grade iron ore, and this market pattern is likely to become more apparent with time.

“High grade iron ore does command a price premium for every additional 1 per cent you have over and above set benchmarks and there is a general flight to higher quality happening in iron ore (and across all major commodities) out to 2030,” said Levich.

The price premium for iron ore with a higher iron content is expected to continue to increase in the years ahead.

“Over the past five years the Fe 1 per cent price premium stood at around $US1.23 per tonne, but this has been rising whereby by 2021 we forecast that this will be well over $US2 per tonne and continue to rise into the future,” said Levich.

Customers for iron ore are also willing to pay a slight premium for higher grade ore with lower impurities such as alumina and silica which can affect the quality of steel production.

China’s ore imports

Imports of iron ore into China are set to stabilise up to 2025 and then gently edge lower as the country recycles more of its steel already present in buildings and infrastructure in the country.

“China is expected to import about 1.18 billion tonnes in 2025 and 1.12 billion tonnes in 2030 as we forecast crude steel rates in China declining having reached peak steel by then,” Levich said.

He went on to stress that although China’s steel production may peak mid-decade, it will use more higher-grade iron ore in its steel production.

“The share of high-grade iron ore would have increased in that total [1.12 billion tonnes] considerably in our view from not only higher-grade sinter feed but more significant use of pellets and lumps,” he said.

This market dynamic, coupled with better prices for higher-grade ore, stands to benefit a number of iron ore companies in Australia that are targeting higher-grade production, such as Magnetite Mines (ASX:MGT).

The company is planning to produce higher grade iron ore from a concentrator process at its Razorback project in South Australia that is scheduled to go into production in 2024.

Magnetite Mines welcomed Fastmarkets’ research findings into the higher-grade iron ore market.

“For Magnetite Mines we think the report is a good summary of how the steel industry and iron ore pricing works, and vitally supports the premiums for high-grade product that we are intending to produce,” said Magnetite Mines director Mark Eames.

“The prospects for iron ore are generally good, and for high-grade iron ore they are even better,” he said.

Grades in decline

A clear trend is emerging in the iron ore market, which is that the global market’s overall Fe grade is going down as miners consume the best available grades from existing mines.

For example, in Australia there is only one traded iron ore product with a grade that exceeds 62 per cent Fe, and that is a fines product from one company mined in the Pilbara region of WA.

In Brazil, also, average Fe content in iron ore shipments has declined to around 63 per cent currently compared with 65 per cent a few years ago.

“You have seen a general decline in Fe content,” said Levich.

There are some projects for higher grades of iron ore, for example in South America, that could offset some of the decline in iron content seen in Australia.

African countries such as Guinea are host to high-grade iron ore that a number of projects have sought to develop over the past 25 years, but most have stalled, and none have entered production.

Current high iron ore prices in the seaborne market of around $US170 per tonne are an encouragement to producers to bring more iron ore mines online, he said.

“The economic case certainly supports this, and with ESG considerations on the part of steelmakers requiring high-grade iron ore (which minimises the use of coking coal/coke in steelmaking) further supports this out to 2030,” said Levich.

“The challenge is finance and logistics as iron ore projects do take a number of years to set up and get established,” he said.

China’s buying pattern

Demand for higher-grade iron ore is on a rising trend and the main reasons for this centre around pollution concerns in China where more than half of the world’s steel is made.

“Yes, they will buy more high-grade iron ore,” said Levich of Chinese steel mills.

“They are already expanding pelleting capacity, looking to minimise polluting sintering operations and have even imported direct reduced iron/hot briquetted iron for the first time.”

Direct reduced iron (DRI) in the form of briquettes is produced by heating iron ore pellets or ore to reduce its oxygen content so it performs better in a blast furnace and creates fewer emissions.

Sintering is an intermediate process in steelmaking that turns iron ore, coke and other raw materials into an iron-rich product and feedstock for blast furnaces.

The DRI process eliminates the need for sintering which can produce significant emissions and dust material, but currently it is used in only around 8 per cent of global primary iron production, or about 100 million tonnes per year.

This is possibly due to cost as the DRI process requires a lot of fuel either in the form of gas or coal which can be expensive, although there are moves to substitute hydrogen in its production.

Chinese authorities have been actively working to reduce emissions of particulates and fine dust from steel plants in the country as they are linked to health issues and respiratory illnesses.

This was demonstrated recently when Chinese officials instructed steel plants in China’s Tangshan region, a steelmaking hub, to cut production in order to improve local air quality.

Coke-making is another inherently dust generating industry that is integral to making steel.

Coke is used to provide the carbon content in steel and is manufactured from coking coal.

Higher-grade iron ore can help to reduce some of the emissions in the steel-making process and increase efficiency while at the same time improving the quality of finished steel products.

Blast furnace method dominates

Most of the steel produced in China is through the blast furnace route at close to 90 per cent.

Blast furnace technology has been in use since the industrial revolution in Europe, and possibly longer, and uses carbon in the form of coking coal to remove oxygen from a molten iron product.

“At the moment in China around 90 per cent of steel is made using the basic oxygen furnace (BOF) route and 10 per cent is electric arc furnace (EAF),” said Levich.

“By 2030 we think that it would be 86 per cent BOF route and 14 per cent EAF,” he said.

The basic oxygen furnace process is allied to the traditional blast furnace process and feeds highly pressurised air into a blast furnace to smelt iron ore, coke and limestone into pig iron, a hot metal that forms the basis for steel.

Another way of producing steel is through the electric arc furnace route which uses steel scrap that is melted down back into hot metal and poured into ingots or moulds.

This recycling route for steel is not expected to increase dramatically in China, as much of its steel consumption is relatively recent.

Therefore, many of the buildings and infrastructure in China that have used steel still have a long life ahead of them and are not ready to be scrapped for some time yet.

Hydrogen-based steel production as seen in projects like Sweden’s H2 Green Steel plant are not expected to take over from the blast furnace method of steelmaking in the short term.

“This may develop but it would be relatively small scale and relatively still immature by 2030.

“Green steel will be more a EU-led initiative predominately in the beginning, I think,” added Levich.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.