Bulk Buys: China’s record steel prices support iron ore, coking coal demand cools

Mining

Mining

Reports of potential steel production cuts in China this year and a rise in Brazil’s exports in February trimmed $US1.50 off iron ore prices this week to $US174.50 per tonne ($225/tonne).

Chinese buying interest in iron ore cargoes from Australia has settled down after a strong rush after China’s mid-February’s Lunar New Year holidays.

“Chinese traders started the year of the Ox in a bullish mode amid prospects of a busier-than-normal season for manufacturing and construction,” said ANZ analysts in a report.

They noted that iron ore prices have stayed above $US170 per tonne as investors expect stimulus measures to maintain firm demand in China’s economy for the short term.

The ANZ analysts noted that thinner profit margins for Chinese steel plants based on higher raw material costs may lead to a curb in steel production volume.

Analysts have expressed some concern at a decline in forward purchasing intentions among Chinese manufacturers.

The official purchasing managers index in China moved closer to a neutral position in February, dipping to 50.6 points from January’s 51.3 points.

Constraints on existing supply chain capacity which has not kept pace with demand mean that Australian shippers cannot easily crank out more volume even at higher prices.

“A rapid supply response is very unlikely from the majors,” said Magnetite Mines (ASX:MGT) director, Mark Eames.

Magnetite Mines is developing its Razorback iron ore mine in South Australia which is expected to ship its first cargo in 2024.

The company has increased its landholding in the Braemar iron ore region with the acquisition of the Muster Dam tenement this week.

The explorer is one of a few emerging iron ore producers in Australia, after the industry’s lower tier became hollowed out in the last market downturn.

“There is a limited [supply] response from smaller companies that have continued operations. Many of the smaller miners in WA went out of business five years ago,” Eames added.

Brazil lifted its shipments of iron ore by nearly 11 per cent in February to 24.05 million tonnes, up from 21.7 million tonnes in February 2020.

Vale and other producers of iron ore in Brazil have got their operations back on track after a period of underperformance following the Brumadinho dam failure in January 2019.

Febuary’s shipments equate to an annualised volume of 288 million tonnes, providing Brazilian iron ore miners can maintain this level of performance.

This is about 28 million tonnes higher than the annualised February 2020 export number.

Vale said in a recent update that its 2020 iron ore production came in at 310 million tonnes, and it is targeting an output for 2021 of 330 million tonnes.

April-settlement futures prices for iron ore are trading at $US167 per tonne Tuesday, and the forward price curve is in a gentle backwardation out to the end of the year.

The December iron ore futures contract was trading at $US133 per tonne, according to market data from CME Group.

| Code | Company | Price | %Wk | %Mth | %Yr | MktCap |

|---|---|---|---|---|---|---|

| GRR | Grange Resources. | 0.58 | 30 | 76 | 158 | $677.0M |

| MGT | Magnetite Mines | 0.032 | 23 | 23 | 970 | $94.3M |

| FMS | Flinders Mines Ltd | 1.64 | 6 | 38 | 65 | $276.9M |

| EUR | European Lithium Ltd | 0.067 | 5 | 6 | -16 | $58.3M |

| AKO | Akora Resources | 0.4 | 3 | 11 | 0 | $20.7M |

| MAG | Magmatic Resrce Ltd | 0.145 | 0 | -3 | -49 | $25.4M |

| MGX | Mount Gibson Iron | 0.9 | -1 | 7 | 30 | $1.1B |

| ADY | Admiralty Resources. | 0.015 | 0 | 25 | 150 | $17.4M |

| FEX | Fenix Resources Ltd | 0.24 | -2 | 14 | 471 | $106.9M |

| MIN | Mineral Resources. | 38.51 | -3 | 11 | 133 | $7.3B |

| CIA | Champion Iron Ltd | 5.39 | -3 | 5 | 170 | $2.7B |

| SRK | Strike Resources | 0.185 | -5 | -16 | 363 | $48.2M |

| FMG | Fortescue Metals Grp | 21.84 | -12 | -2 | 117 | $69.8B |

| TI1 | Tombador Iron | 0.08 | -12 | 16 | 280 | $59.5M |

| LCY | Legacy Iron Ore | 0.017 | -32 | -39 | 750 | $118.7M |

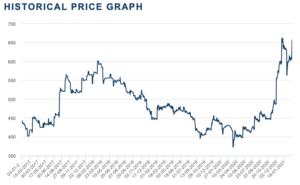

Chinese steel mills are seeking higher prices this week for their steel reinforcing bar (rebar) which are trading at their highest for 10 years at $US720 per tonne.

At the Shanghai trading hub rebar is selling for $US720 per tonne, representing an on-week rise of $US20 per tonne, according to Metal Bulletin.

“While the increase can be linked to demand hopes as construction projects resume following the Lunar New Year holiday period, policy support may be a factor too,” analysts at the Commonwealth Bank of Australia said in a report.

The Chinese government has published a new policy report that prioritises action in developing steel-intensive infrastructure in China’s countryside areas and remote regions.

The CBA analysts said higher steel product prices in China have alleviated some of the pressure on steel plant profit margins from higher prices for raw materials including iron ore.

“The recent increase in steel prices has led steel mill margins in China to positive territory, providing key support for iron ore prices,” said CBA in a report.

The rise in Chinese steel rebar prices is matched by a sharp upturn in prices for the LME’s steel rebar futures contract which this week is back to trading at near record highs.

Futures contracts for rebar steel for month-ahead delivery changed hands at $US656.50 per tonne on Monday, according to LME data.

Prices for the contract had touched $US658 per tonne in early January.

Prices for hard coking coal shipped from ports in Queensland, Australia, slipped $US10 per tonne on week to $US119.20 per tonne, according to Metal Bulletin.

Spot shipments of premium grade Queensland hard coking coal were offered at $128.50 per tonne free-on-board basis, according to market reports.

“Offer prices for March shipment cargoes of premium hard coking coal in the FOB market are decreasing and end users are in no hurry to give bids,” a trader told Metal Bulletin.

Futures prices for Australian coking coal were trading at $US133.80 per tonne for April settlement, and at $SU139.20 per tonne for June, according to the Singapore Exchange.

For December 2020 and January 2021 futures contracts, prices were steady at $SU150 per tonne and $US153 per tonne, respectively

This slight premium to spot prices may indicate the futures market is not expecting much material change in demand and supply dynamics for Australian coking coal.

Chinese buyers appear to have pivoted to North American supplies of hard coking coal amid ongoing uncertainty about the import status of Australian coal destined for China.

Steel mills in China have increased their consumption of North American coking coal from mines in Canada and the US and are taking less volume from Australia.

American and Canadian cargoes are landing in China at a price of $US218 per tonne, representing a hefty premium to offer prices for similar grade Australian coking coal.

China’s steel sector is also taking more volume from its neighbour, Mongolia, reported Reuters.

Considerable uncertainty surrounds the Australia to China trade in coking coal cargoes with market participants waiting on port clearances for laden ships off China’s coastline.

Stranded vessels are still waiting for berthing slots at Chinese ports to offload their cargoes of Australian coal and some have been resold to other markets.

“Some cargoes are looking for new buyers as most cargo owners do not expect the ban to be lifted in the first half of 2021,” a trader told Metal Bulletin.

Japanese and Korean buyers buy mostly on a long-term contract basis and have limited appetite for spot purchases of Australian coking coal even at distressed prices.

Import data for January show Japan took delivery of 5 million tonnes of coking coal, down 10 per cent from December 2020’s volume, reported Argus Media.

Australian shipments to Japan fell 13 per cent on month, and by 20 per cent from a year ago, to 2.46 million tonnes.

Weaker demand from Japan’s manufacturing sector and a second wave of COVID-19 cases has dampened demand for steel in the Asian country.

| Code | Company name | Price | %Wk | %Mth | %Yr | MktCap |

|---|---|---|---|---|---|---|

| NAE | New Age Exploration | 0.012 | 9 | 0 | 300 | $14.6M |

| CKA | Cokal Ltd | 0.072 | 6 | -9 | 95 | $66.6M |

| PAK | Pacific American Hld | 0.022 | 5 | -4 | 9 | $7.0M |

| JAL | Jameson Resources | 0.1 | 4 | -5 | -44 | $30.30 |

| MCM | Mc Mining Ltd | 0.14 | 4 | -7 | -69 | $21.6M |

| BCB | Bowen Coal Limited | 0.054 | 2 | 8 | 10 | $51.9M |

| WHC | Whitehaven Coal | 1.55 | 2 | 1 | -23 | $1.6B |

| ATU | Atrum Coal Ltd | 0.25 | 0 | -4 | -4 | $145.4M |

| AKM | Aspire Mining Ltd | 0.098 | -2 | 1 | 13 | $50.8M |

| YAL | Yancoal Aust Ltd | 2.35 | -4 | -2 | -16 | $3.2B |

| NCZ | New Century Resource | 0.17 | -6 | -11 | 48 | $205.7M |

| MR1 | Montem Resources | 0.17 | -6 | -29 | 0 | $34.2M |

| BRL | Bathurst Res Ltd. | 0.04 | -7 | -17 | -60 | $75.2M |

| PDZ | Prairie Mining Ltd | 0.26 | -7 | 4 | 58 | $59.4M |

| AHQ | Allegiance Coal Ltd | 0.08 | -9 | -9 | -30 | $72.8M |

| SMR | Stanmore Coal Ltd | 0.7 | -10 | -13 | -12 | $213.6M |

| TIG | Tigers Realm Coal | 0.007 | -13 | -30 | -10 | $91.4M |

| LNY | Laneway Res Ltd | 0.005 | -17 | -29 | 0 | $18.9M |

| CRN | Coronado Global Res | 1.03 | -18 | -21 | -34 | $1.4B |

| TER | Terracom Ltd | 0.098 | -25 | -32 | -53 | $71.6M |

Canada coking coal project company Montem Resources (ASX:MR1) has completed a $5.2m capital raising for a scoping study for its Chinook coking coal project.

Several new Australian and institutional investors have joined Montem Resources’ share register after the share placement to sophisticated and professional investors.

The company said it plans to use the fresh capital to advance a scoping study for its Chinook project and to restart mining at its Tent Mountain project, both in Western Canada.

Montem Resources is on target to submit a mining licence application for the Tent Mountain mine in mid-year and to restart production in early 2023.

“The placement affirms our belief in the potential of our projects and provides a clear signal that the investment community understands the opportunity and differentiation Montem presents in the region,” managing director and chief executive, Peter Doyle, said.

The Chinook project covers historical mines that exported hard coking coal to Japanese steel mills and has the potential to develop into several open-cut mines.

Meanwhile, former Stanmore Coal managing director Nick Jorss has joined the board of Bowen Coking Coal (ASX:BCB).

Jorss is appointed executive chairman of Bowen Coking Coal to lead the company into coal production, just as he did with Stanmore Coal which has generated $1.1bn over the past four years and now produces 3 million tonnes per year.

At Stockhead we tell it like it is. While Magnetite Mines is a Stockhead advertiser, it did not sponsor this article.