Iron ore in 2021 is looking like… iron ore in 2020

Pic: Schroptschop / E+ via Getty Images

- Iron ore prices are forecast to moderate to below $US100 per tonne in the years ahead

- ‘Falling steel mill margins in China and rising iron ore port stocks would be catalysts for lower iron ore prices’: CBA

- ASX iron ore companies are rushing to bring on production on healthy demand from China

The fate of the market for iron ore — Australia’s most valuable export at $102bn in the 2019-2020 financial year — is squarely in the hands of its largest customer, China.

As the world’s largest producer of steel at 1.1 billion tonnes in 2020, China consumes massive volumes of iron ore, much of it shipped from Australia.

“China usually accounts for ~70 per cent of the world’s iron ore imports,” said analysts at the Commonwealth Bank of Australia in a December report.

This market share has risen to as high as 75 per cent in the first nine months of 2020, as China’s rapid post-COVID-19 economic recovery led it to suck in more imports of the reddish ore.

Australia’s government said it foresees China’s pull on Australian iron ore exports remaining strong in the next few years.

“Mining exports are expected to fall by 0.5 per cent in 2020-2021 and grow by 5 per cent in 2021-2022,” it said in its mid-year economic report.

Iron ore exports from Australia have been supported by robust demand from China, said the report released in the lead up to Christmas.

Iron ore forecast to ease to $US80-$US90/tonne in 2021

Despite this bullish outlook, the Australian government’s commodity research unit in the Department of Industry is pointing to easing prices for iron ore.

“The iron ore price is forecast to be around $US100 a tonne over the final quarter of 2020, before easing to around $US80 a tonne by the end of 2021, and $US75 a tonne by the end of 2022,” said the latest report from the Australian government’s commodity research unit.

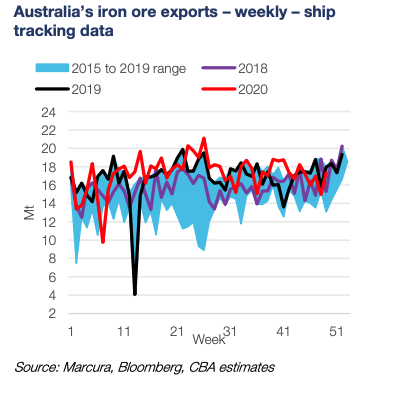

“Export volumes are expected to grow from an estimated 860 million tonnes in 2019-2020 to 905 million tonnes by 2021-2022,” its report added.

Some iron ore market analysts also agree with the Australian government’s outlook for iron ore, and expect prices to moderate over the next two years.

S&P Global Ratings said in a report on Brazilian miner Vale it expects iron ore prices to average $US85 per tonne in 2021, and $US70 per tonne in 2022.

Commonwealth Bank of Australia said in a report that iron ore prices could slip below $US100 per tonne next year.

“We still think that iron ore prices still have a good chance of averaging $US90 per tonne by Q4 2021, despite near term prices likely to stay high in the short term,” said CBA analysts in a December report.

Supply imbalance in iron ore market grows

These price forecasts may appear conservative in the current feverish market for iron ore, where prices are trading at $US155 per tonne.

And doubly so, given forecasts by various industry and market experts of a growing supply and demand imbalance in the seaborne market.

Five years ago — a time of oversupply for the iron ore industry — China was producing 800 million tonnes of steel per year.

That production figure for China had ballooned to 1 billion tonnes in 2019 and, is currently running at 1.1 billion tonnes on an annualised basis in 2020.

“That extra 300 million tonnes requires in the order of 400 million tonnes of iron ore, as there is 1.6 tonnes of iron ore to one tonne of steel,” said Mark Eames, director of Magnetite Mines (ASX:MGT).

“In the same five-year period, annual iron ore supply out of Australia and Brazil has gone up by less than 50 million tonnes,” he said.

Iron ore prices include shipping costs to China

It should be remembered that iron ore reference prices are based on the cost of cargoes at the point of entry in China.

This is known as a delivered price, and includes the cost of shipping iron ore cargoes from Australia to Chinese ports.

Shipping can be a significant cost, but it has fallen lately as ship owners struggle to rent out their bulk carriers to coal shippers in a declining market.

As a result, more ships are available to carry iron ore cargoes on the Australia to China trade route, putting downward pressure on shipping prices.

Iron ore cargo shipping costs from Australia to China averaged a relatively modest $US15 per tonne in Q4 2020, according to freight market experts.

“It’s because the freight market is being dragged down by the lack of coal cargoes this year, while the iron ore trade is doing very well,” Ralph Leszczynski, research director at Genoa-based shipping consultancy Banchero Costa told S&P Global Platts.

After subtracting shipping costs at current rates, next year’s price forecasts for iron ore delivered to ports in China appear quite modest.

And, perhaps not enough to incentivise more production to enter the market.

The free-on-board price of Australian iron ore cargoes at Pilbara ports net of shipping costs would be only $US65-$US75 per tonne, based on the forecasts.

The economics of a good many iron ore projects would look precarious at this price level, especially projects lacking economies of scale.

Explorers rush to bring mine projects online

Forecasts for a sharp decline in iron ore prices also clash with the current trend in the market for expansion among marginal iron ore players.

Several ASX iron ore companies are accelerating their plans to bring new production online, and to bring mothballed mines back into production.

In this category are Magnetite Mines with its Razorback project in South Australia, Strike Resources (ASX:SRK) with its Paulsens East project in WA, and Grange Resources (ASX:GRR) with its plan to expand its Tasmania mine.

“The average Australian dollar price received during the quarter of $182.50 per tonne ($US130.20/tonne) FOB Port Latta, increased by 6.8 per cent from $170.90 per tonne for the June quarter,” said Tasmania-based Grange Resources in its September report.

They are following in the footsteps of iron ore miners in the Northern Territory that have brought idled operations back to life in recent months.

Nathan River Resources, a subsidiary of UK company British Marine Group, has reawakened the Roper Bar mine which is processing two to three shipments each month.

NT Bullion is on track to export 2 million tonnes per year of iron ore from its Frances Creek mine which started in August.

The company is currently shipping ore from its mine stockpile and has a marketing agreement with Anglo American.

Established producers chase after demand

Major Australian iron ore producers are continuing to invest in new supply sources, said the Australian government’s commodity research unit.

An example is Fortescue Metals Group (ASX:FMG) which brought online in December, and ahead of schedule, its Eliwana iron ore mine in WA.

“We expect seaborne iron ore demand to be well-supported in the medium term,” Fortescue sales and marketing director, Danny Goeman, said at the company’s investor day in December.

“Clearly in this market, any opportunity to put more tonnes through the system we are absolutely looking at for the next year or two. That holds true for our hematite operations and we seek to maximise throughput,” FMG chief operating officer, Greg Lilleyman, said at the event.

BHP Group’s (ASX:BHP) South Flank mine, is coming online in 2021, but is a direct one-to-one replacement for its 80 million-tonne per year Yandi mine.

Rio Tinto (ASX:RIO) is constructing its Koodaideri mine for 43 million tonnes per year and set to begin production in 2022.

But despite their best efforts, iron ore exporters in Australia are struggling to keep up with demand including from China.

“Effectively, the major iron ore miners need to build two or three new mines every year just to sustain their output,” said Eames.

“You have got to see a continual pipeline of new production. You have to run to stand still,” he said.

Steel producer profits squeezed by higher ore prices

Only two headwinds could swerve the current strong iron ore market off its current bullish course, according to several market analysts.

They would be, firstly, high iron ore prices squeezing profit margins for steel mills in China, and secondly, rising stocks of the raw material at Chinese ports.

Some commodity analysts believe China’s fiscal stimulus measures will start to wear off next year, weakening its demand for steel-related commodities.

“Falling steel mill margins in China and rising iron ore port stocks would be catalysts for lower iron ore prices,” said analysts at CBA bank.

Analysts at S&P Global Ratings suggest that higher iron ore prices are starting to eat into profit margins for China’s steel producers.

“We believe steel margins will be under pressure for the rest of the year, given elevated iron ore prices, before improving in 2021 based on what we assume will be moderating iron ore prices,” the ratings agency said in a December report.

Indeed, China’s steel industry is starting to complain about the level of iron ore prices and is calling for Beijing to act on the issue.

The call has come from the China Iron and Steel Association, the trade organisation that represents the views of the industry.

“The iron ore market pricing mechanism has failed and steel companies unanimously call on the State Administration for Market Supervision and the China Securities Regulatory Commission to take effective measures to intervene… in a timely manner and crack down on possible violations of regulations,” said the CISA in a statement.

Portside stocks in China are still high

Stock levels of imported iron ore at China’s ports remain quite high, but are starting to decline as steel mills increase consumption, according to reports.

At Chinese ports they are currently around 130 million tonnes, down from a recent peak, but are still above levels of 105 million tonnes mid-year.

A wild card for the seaborne iron ore market is Brazil, and whether its major producer Vale can ramp up production to sate China’s demand.

Vale’s forecast 2020 iron ore output of 305 million tonnes is lower than its 310 million tonnes of output in 2018 — the time of its Brumadinho dam accident.

The miner’s Brazilian ore production is forecast to reach 330 million tonnes in 2021, representing an addition to the market next year of only 25 million tonnes.

Market experts said Vale’s lower-than-expected production will leave China having to find at least 20 million tonnes of iron ore from alternative sources in 2021.

The Brazil-based miner wants to achieve a production capacity for iron ore of 400 million tonnes in 2022, rising to 450 million tonnes as a longer-term goal.

This lofty goal may appear a pipe dream, considering the company has struggled to return to production levels of a few years ago.

Barring some unforeseen market event, prices for the sought-after reddish ore look well-supported for years to come given its stretched supply.

ASX share prices for BHP Group (ASX:BHP), Fortescue Metals Group (ASX:FMG), Grange Resources (ASX:GRR), Magnetite Mines (ASX:MGT), Rio Tinto (ASX:RIO), Strike Resources (ASX:SRK)

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.