Closing Bell: ASX200 flat and earthbound as Nyrada CEO exclusively shares 3 reasons for stunning +420pc session

News

News

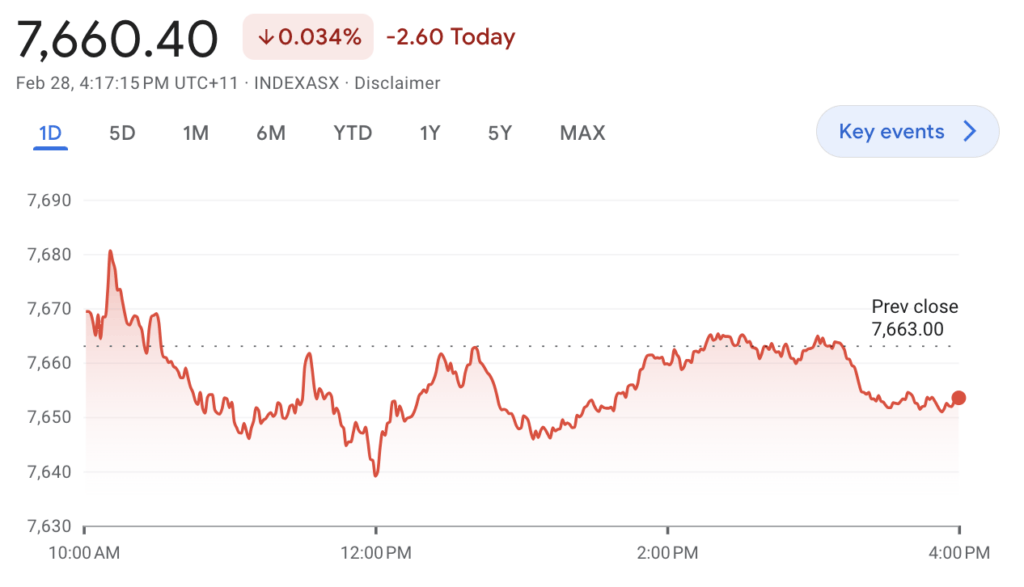

Despite a return to form for lithium and a stunning 420% rally for little local drugmaker Nyrada, the ASX200 was the little index that just couldn’t on an action-packed, fun-filled Wednesday in Sydney.

At 4.15pm on February 28, the S&P/ASX200 was down 2.5 points or 0.034% to 7,654…

What an odd day. So much great stuff to discuss.

But, most importantly the man behind the super-heroic Aussie small cap, drug discovery and development company Nyrada (ASX:NYR) CEO James Bonnar, explained to Stockhead just a few of the reasons behind the company’s extraordinary outperformance on Thursday.

For those still searching the skies for traces of Nyrada as it leaves the ionosphere… NYR earlier today released new data from it’s brain injury drug candidate (NYR-BI03) and has since lapped local markets and continued ever skywards.

A picture perhaps does the scene more justice:

“The results from our stroke study are powerful for three reasons,” James told Stockhead on Wednesday arvo.

“Firstly, the drug candidate is a first-in-class molecule which means it offers a new therapeutic approach to treating brain injury.

“Secondly, the pathology behind brain injury is common across both stroke and traumatic brain injuries, such as those caused by a car accident, sports injury or military wound. This means our drug candidate has potential for treating patients in two important markets: stroke and traumatic brain injury.

“Lastly, the target our drug candidate hits is novel, making Nyrada pioneers in an area that no other biotech is currently working in, to our knowledge.”

And that, lads and ladies, is why small caps are best.

Lithium is lit…

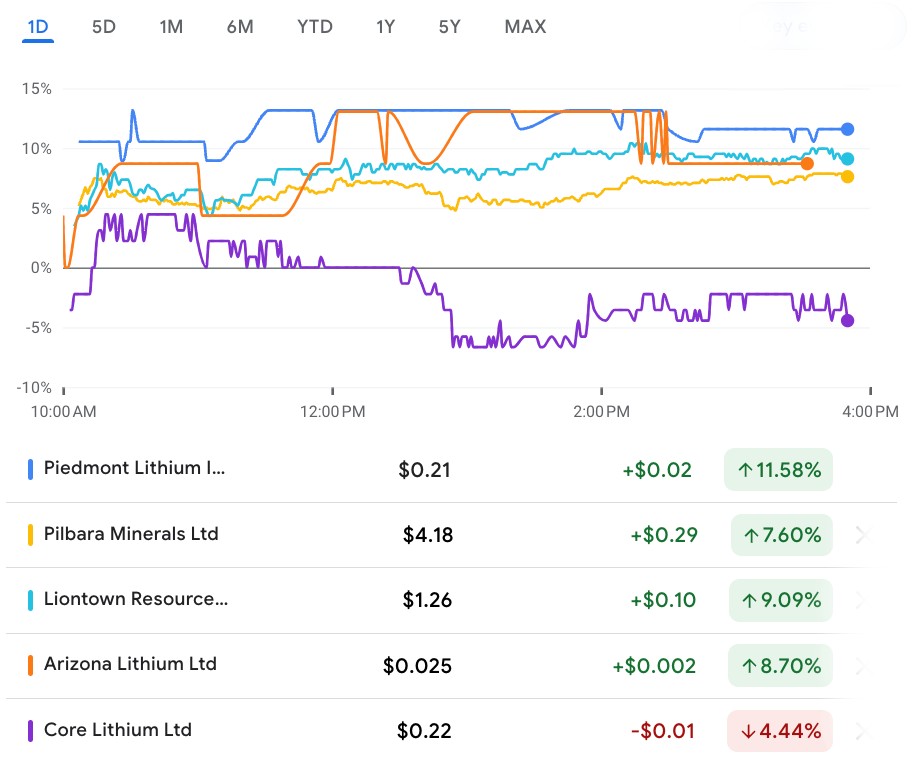

It’s been a while since we’ve seen lithium stocks jump out of the blocks like that.

Lithium futures in Guangzhou were up more than 1% higher when business clocked off in Sydney on Tuesday.

By 8:00am our time, lithium futures in those same Chinese markets ended 3.5% higher to 106,650 yuan, the toppiest watermark for the battery metal in China since 2023.

Local lithium stocks spent the morning putting on their money pants and collecting the difference with some familiar small caps heading into lunch at terrific differentials.

Large caps like IGO (ASX:IGO) and Pilbara Minerals (ASX:PLS) jumped around 5%, while Piedmont Lithium (ASX:PLL) +10.5%, Galan Lithium (ASX:GLN) +10%, Arizona Lithium (ASX:AZL) +8.25% – all went into lunch major beneficiaries.

Those gains have come off a little as Chinese lithium futures opened less crazy this afternoon, but it’s still been a welcome return to form for fans of the sector.

Of course, Core Lithium missed out again because you will not find justice in money markets, someone said.

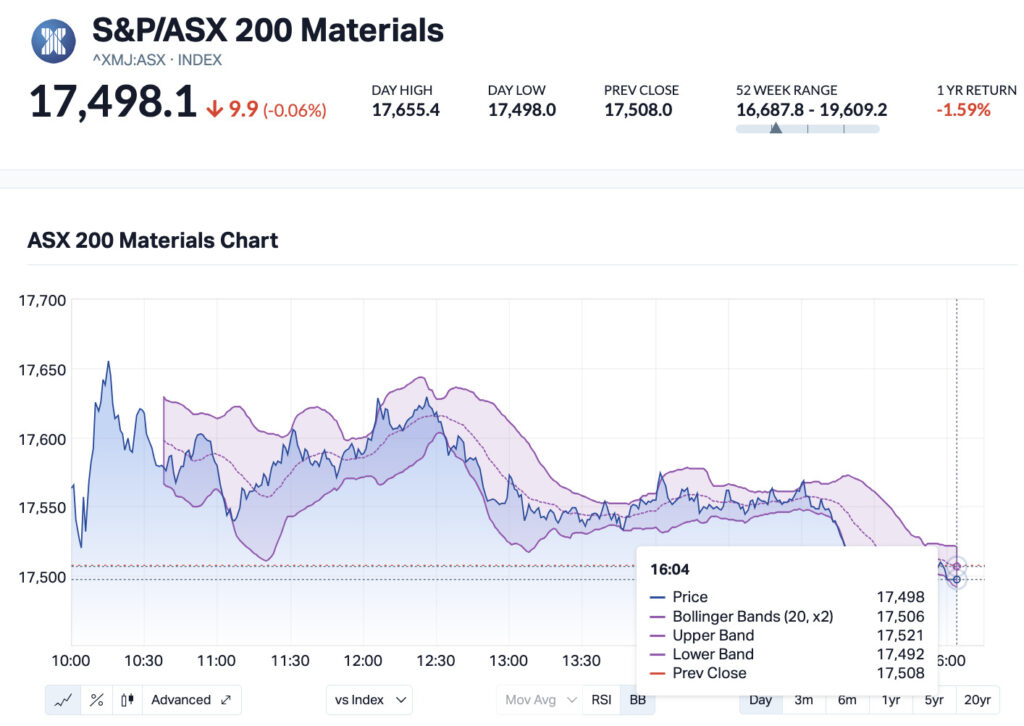

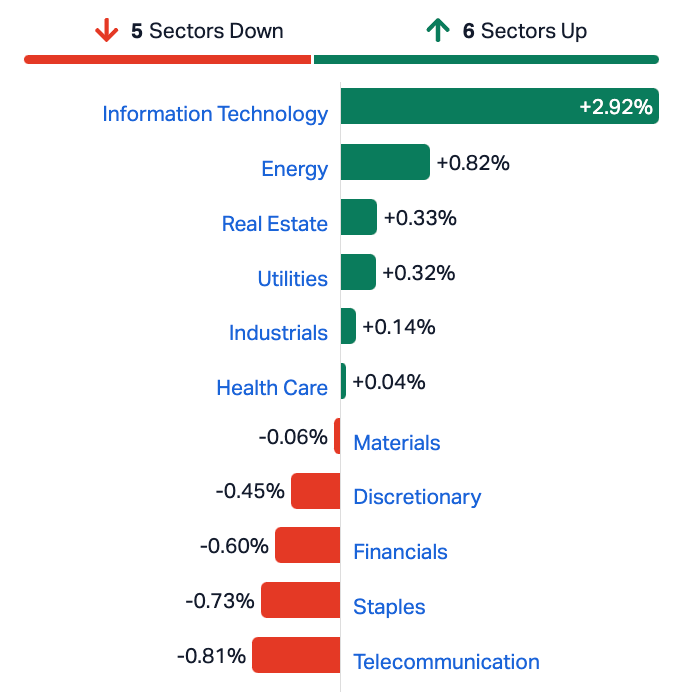

The Materials sector was up almost 0.5% lifted by the battery metals gains which offset the global weakness in iron ore – those prices are at near 3-month lows – but the entire sector has come into the close of trade in the red.

Not even the Dougie Bollinger bands could save this sector from a haircut.

Meanwhile in Aussie tech…

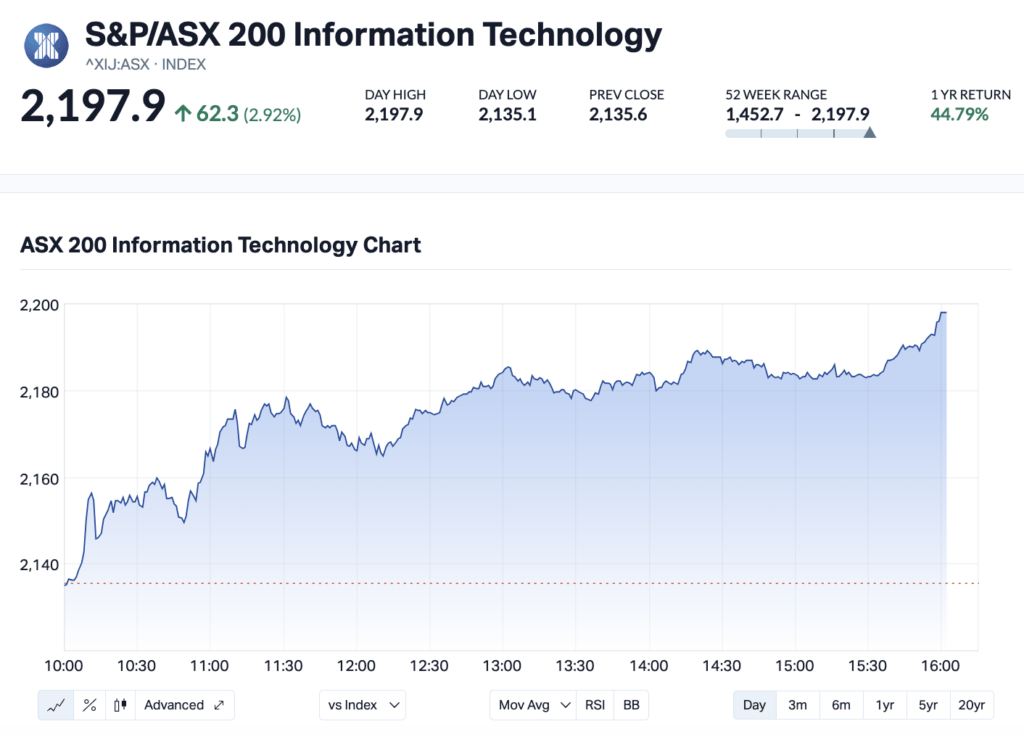

Not worried about any of that is the local IT sector which has jumped almost 3% today, driven by the promise of lower rates, sooner and a return of love for growth stocks.

Also lending a hand is sector biggie NextDC (ASX:NXT) where the stock price has clocked a sneaky all-time high, after dropping a 1H loss larger than this time last year to the power of 1o to -$22.5m.

Yes a tenfold increase in first half losses, although investors seem more pumped that revenue is up by almost a full third to $209.1mn, as the data centre maker reports it’s well on track to hit FY revenue guidance ($400mn to $415mm).

The ASX XIJ: It’s been a good year already…

Local markets reacted in curious ways to the happier-than-hoped-for domestic inflation figures.

Certainly the Pacific Peso (AUD) didn’t dig it. The Aussie fell to around $0.65, slapping head long into near 1-month lows.

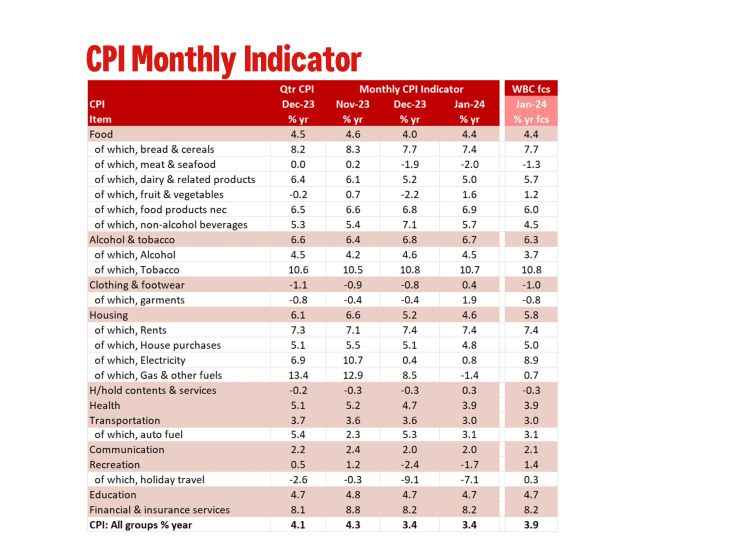

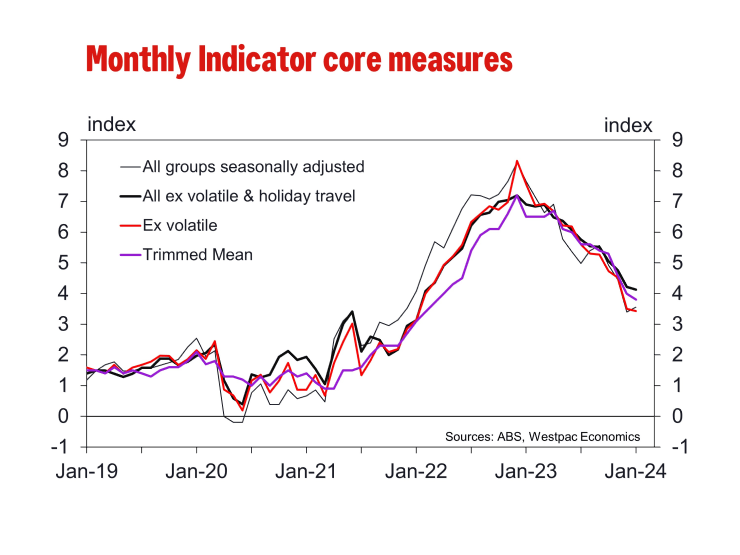

The ABS-borne January inflation data described a CPI holding pretty comfy at a two-year low of 3.4%, same-as from December and coming in a wee bit below forecasts of 3.6%.

Core inflation – with the volatile things like petrol stripped out – was also steady, which is good news too.

If you’d care for some detail, Westpac has unpacked it all here:

Traders who’ve been betting madly on the timing of central bank rate cuts are scrambling back to last week’s RBA minutes of which they’ll recall involved Gov M. Bullock and her mates actually pondering a rate rise.

That said, Westpac also has a great squiggly line indicator I also like…

The RBA also says it needs “more time to be confident that inflation is heading back to its target” before ruling out any further rate increase.

This January read will do its bit in that regard.

So. Local markets were facing an uphill battle with mixed leads, weak iron ore and a good bunch of major names going ex-div on Thursday.

Bell Financial Group (ASX:BFG) is paying 4 cents fully franked

Beach Energy (ASX:BPT) is paying 2 cents fully franked

ECP Emerging Growth (ASX:ECP) is paying 2.3 cents fully franked

EVT Limited (ASX:EVT) is paying 14 cents fully franked

Fortescue Ltd (ASX:FMG) is paying 108 cents fully franked

Gryphon Capital (ASX:GCI) is paying 1.4 cents unfranked

Mitchell Services (ASX:MSV) is paying 2 cents unfranked

Maxiparts Limited (ASX:MXI) is paying 2.57 cents fully franked

MyState Limited (ASX:MYS) is paying 11.5 cents fully franked

Ooh!Media Limited (ASX:OML) is paying 3.5 cents fully franked

Perpetual Cred Trust (ASX:PCI) is paying 0.6395 cents unfranked

360 Capital Mortgage (ASX:TCF) is paying 3.5 cents unfranked

The Lottery Corp (ASX:TLC) is paying 8 cents fully franked

Telstra Group (ASX:TLS) is paying 9 cents fully franked

Woolworths Group Ltd (ASX:WOW) is paying 47 cents fully franked

Around the ‘hood…

Tokyo markets have paused for a sec with the Nikkei 225 Index lower at lunch while the broader Topix Index looked almost flat (but not quite, ahead 0.1% to 2,681) in mixed trade at lunch on Wednesday.

Japanese shares may actually be consolidating the gains after this historic rally that brought the Nikkei to all-time highs last week.

Meanwhile, they’re doing the 24/25 budget in Hong Kong on Wednesday and the city’s finance chief Paul Chan Mo-po has come out with the only trump card he’s got left – Honkers, he says, will remove ALL restrictions on property purchases as part of the Beijing-endorsed government’s solution to Hong Kong’s own economic and property crisis.

Hong Kong’s economy has been a tepid mess of late while the city’s shrinking fiscal reserves are compounding the Hang Seng’s fall from grace as a key gateway into Chinese stocks.

Mainland markets are resting for a breather at near 3-month highs at around lunchtime in Shanghai, buoyed by following a drip-feed of pro-market measures to revive equities and boost investor confidence.

Beleaguered investors will have to hope that there’ll be something a little extra for markets at the upcoming National People’s Congress which kicks off on March 5.

US Markets…

US stocks held near their record levels after a quiet day of trading.

The S&P 500 added 0.2 per cent, to 5,078.18 and is just off its all-time high set last week. The Dow Jones dipped 0.25 per cent and the Nasdaq composite rose 0.4 per cent.

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| W2V | Way2Vatltd | 0.032 | 60% | 132,081,482 | $13,032,169 |

| EXL | Elixinol Wellness | 0.009 | 50% | 2,377,022 | $3,797,230 |

| AVW | Avira Resources Ltd | 0.0015 | 50% | 150,285 | $2,133,790 |

| RKT | Rocketdna Ltd | 0.01 | 43% | 47,769,028 | $4,592,804 |

| BP8 | BPH Global Ltd | 0.002 | 33% | 167,999 | $2,931,174 |

| AHK | Ark Mines Limited | 0.2 | 33% | 105,902 | $8,316,962 |

| PL3 | Patagonia Lithium | 0.17 | 31% | 235,497 | $6,386,705 |

| LSA | Lachlan Star Ltd | 0.052 | 30% | 981,979 | $8,302,928 |

| BVS | Bravura Solution Ltd | 1.245 | 30% | 7,928,441 | $430,419,842 |

| OSL | Oncosil Medical | 0.009 | 29% | 1,212,315 | $13,821,788 |

| SKN | Skin Elements Ltd | 0.005 | 25% | 311,471 | $2,357,944 |

| ZEO | Zeotech Limited | 0.031 | 24% | 824,895 | $43,335,577 |

| INV | Investsmart Group | 0.155 | 24% | 5,000 | $17,835,061 |

| COY | Coppermoly Limited | 0.011 | 22% | 90,394 | $6,265,219 |

| WCN | White Cliff Min Ltd | 0.017 | 21% | 8,775,065 | $18,702,031 |

| TTM | Titan Minerals | 0.023 | 21% | 3,390,284 | $32,221,079 |

| MOZ | Mosaic Brands Ltd | 0.205 | 21% | 194,260 | $30,346,095 |

| AYT | Austin Metals Ltd | 0.006 | 20% | 655 | $6,425,957 |

| CHK | Cohiba Min Ltd | 0.003 | 20% | 11,322,357 | $6,325,575 |

| HIQ | Hitiq Limited | 0.025 | 19% | 27,743 | $7,388,744 |

| PKD | Parkd Ltd | 0.025 | 19% | 507,094 | $2,184,292 |

| STP | Step One Limited | 1.45 | 19% | 1,388,326 | $226,115,155 |

| XF1 | Xref Limited | 0.13 | 18% | 106,430 | $20,479,392 |

| PXX | Polarx Limited | 0.013 | 18% | 6,947,947 | $18,035,785 |

| MTM | MTM Critical Metals | 0.092 | 18% | 7,011,913 | $9,695,116 |

Strap in for some detail, because just mauling markets like an incensed bull shark of no fixed address is the suddenly punchy Aussie drug discovery and development company Nyrada (ASX:NYR).

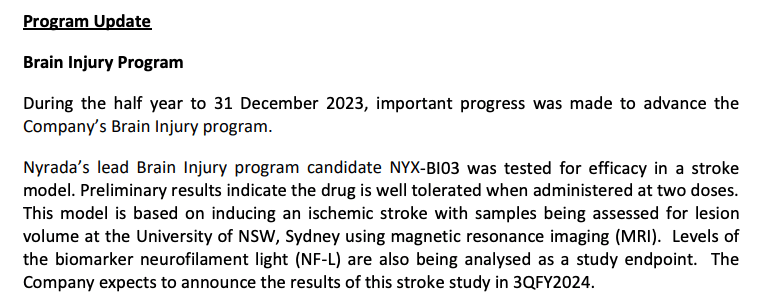

Nyrada’s lead Brain Injury Program drug candidate NYR-BI03 – “a first-in-class therapy with a novel mechanism of action targeting significant market opportunity” – demonstrated strong efficacy in reducing injury in a preclinical study, the company has reported.

NYR specialises in novel small molecule therapeutics to treat neurological and cardiovascular diseases. As well as jumping almost 380% on a brief update dropped on the ASX some 5 hours ago.

The stock is soaring on some real positive results from NYR’s preclinical study evaluating the efficacy of its Brain Injury Program drug candidate NYR-BI03.

That might be worth writing down: NYR-BI03.

Supporting NYR-BI03’s favourable safety profile, the current study had no drug-related adverse effects.

The collaboration with UNSW, the company induced “a focal ischemic stroke using a photothrombotic model” – basically, they brain injured 16 test animals (but in a minimally invasive way) and then treated with either NYR-BI03 or a placebo (vehicle) 30 mins after the induced brain injury.

The treatment went for 72 hours via continuous intravenous infusion while MRI (Magnetic Resonance Imaging) scans quantified the brain injuries.

“These MRI data determined tissue damage in the penumbra region, the area of secondary brain injury that the NYR-BI03 neuroprotection drug targets,” the company says.

These analyses were performed blinded – ie: where the experimenter didn’t know if a particular animal received NYR-BI03 or vehicle.

“The MRI brain imaging showed that a statistically significant neuroprotection was achieved when animals received NYR-BI03 treatment.

“On average, NYR-BI03 therapy rescued 42% of the brain injury in the penumbra region seen in animals receiving vehicle,” the company told the ASX.

Nyrada CEO James Bonnar says the study results are very big for NYR’s Brain Injury program.

“These study results mark a significant milestone in our Brain Injury program, providing strong evidence that our drug candidate NYR-BI03 has the potential to protect the brain from secondary injury. The magnitude of rescue achieved in this study is a compelling outcome and signals a significant therapeutic and market opportunity.

“This work is critical for our development pathway for NYR-BI03, giving us confidence as we advance it through to GLP safety and toxicology studies ahead of a first-in-human clinical trial currently planned to commence in the second half of this calendar year.”

The company reported 1H last week and this is where they were then with the program, so progress is afoot:

Making big moves this arvo is the everywhere-listed EcoGraf (ASX:EGR) after reporting positive findings from a research program completed by the Helmholtz Institute in Germany, where EcoGraf ‘s proprietary processing technology has been used to purify graphite particles recovered from end-of-life lithium-ion batteries.

EcoGraf purified the recovered graphite particles to battery grade specification.

The German Government funded program then compared the electrochemical performance of (the recycled) EcoGraf HFfree™ graphite with a number of commercial battery graphite products. And there was much rejoicing.

The company says further research is required before anyone sells the house.

Finally, 5E Advanced Materials (ASX:5EA) is still killing it on Wednesday.

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| RBR | RBR Group Ltd | 0.002 | -33% | 110 | $4,855,214 |

| STX | Strike Energy Ltd | 0.215 | -26% | 69,221,034 | $830,045,499 |

| TKL | Traka Resources | 0.0015 | -25% | 250,000 | $3,501,317 |

| ADR | Adherium Ltd | 0.043 | -22% | 85,887 | $18,339,199 |

| AXN | Alliance Nickel Ltd | 0.036 | -20% | 587,539 | $32,662,783 |

| ATH | Alterity Therapeutics | 0.004 | -20% | 400,196 | $21,913,774 |

| CAV | Carnavale Resources | 0.004 | -20% | 12,537,500 | $17,117,759 |

| CNJ | Conico Ltd | 0.002 | -20% | 400,000 | $3,925,237 |

| IEC | Intra Energy Corp | 0.002 | -20% | 100,000 | $4,226,954 |

| PRX | Prodigy Gold NL | 0.004 | -20% | 3,326,102 | $8,755,539 |

| PUR | Pursuit Minerals | 0.004 | -20% | 150,323 | $14,719,857 |

| RDS | Redstone Resources | 0.004 | -20% | 200,000 | $4,626,892 |

| RMX | Red Mount Min Ltd | 0.002 | -20% | 2,611,228 | $6,683,940 |

| VML | Vital Metals Limited | 0.004 | -20% | 6,660 | $29,475,335 |

| SGR | The Star Entertainment Group | 0.45 | -20% | 133,580,546 | $1,606,461,291 |

| HUM | Humm Group Limited | 0.56 | -19% | 5,008,926 | $353,184,666 |

| HAL | Halo Technologies | 0.11 | -19% | 61,536 | $17,481,854 |

| ASV | Asset Vision Company | 0.015 | -17% | 1,937,297 | $13,065,058 |

| FTC | Fintech Chain Ltd | 0.015 | -17% | 48,964 | $11,713,853 |

| BMO | Bastion Minerals | 0.01 | -17% | 6,397,167 | $3,737,329 |

| ECT | Env Clean Tech Ltd. | 0.005 | -17% | 253,915 | $17,185,862 |

| LRL | Labyrinth Resources | 0.005 | -17% | 238,200 | $7,125,262 |

| MSI | Multistack International | 0.005 | -17% | 2,929 | $817,824 |

| NSM | Northstaw | 0.04 | -17% | 4,000 | $6,714,038 |

Frontier Energy (ASX:FHE) has revealed robust economics for its Waroona Stage 1 solar and battery project, including EBITDA of $68 million per annum over the first five years and post-tax IRR of 21.6%, putting the company on a firm path towards becoming a significant renewable energy provider in WA.

It was also study reveal day for PharmAust (ASX:PAA) which flagged significant improvements in life expectancy for sufferers of motor neurone disease in preliminary data released with the Phase 1 MEND trial.

Dimerix (ASX:DXB) is on track to release an interim analysis outcome next month from its Phase 3 trial of DMX-200 for kidney disease focal segmental glomerulosclerosis (FSGS) after collecting data from all 72 patients.

Fintech leader MoneyMe (ASX:MME) has delivered a 77% increase in statutory NPAT for H1 FY24 despite a higher interest rate environment, persistent inflation and growing cost-of-living challenges affecting Australian consumers.

Preliminary pXRF data indicates Zinc of Ireland’s (ASX:ZMI) existing 11.3Mt zinc-lead resource at Kildare may host significant levels of germanium, another critical mineral used in high-tech applications under the weight of Chinese control over supply.

Future Battery Minerals (ASX:FBM) has received ministerial approval for a Conservation Management Plan (CMP) on the northern and most prospective part of its Kangaroo Hills lithium project in WA.

Green Technology Metals (ASX:GT1) has reported grades up to 2.92% Li2O in its latest round of drilling results, reaffirming the strong continuity of mineralisation at the North Aubry deposit within its Seymour project in Ontario.

The resurgent Ora Banda Mining (ASX:OBM) has stumbled upon a new high-grade lode intersecting up to 17g/t gold at its Sand King prospect, part of the overall Davyhurst project in WA’s Eastern Goldfields region, leading the company to consider the prospect’s future underground mine potential.

Bubalus Resources (ASX:BUS) has delineated multiple lithium-in-soil anomalies at the Yinnietharra project, just 2km east of Delta Lithium’s (ASX:DLI) Malinda prospect where drilling is under way.

First-pass aircore drilling has intersected a new gold structure at the Celia South prospect, a potential lookalike of the Millrose deposit that Strickland Metals (ASX:STK) sold to Northern Star Resources (ASX:NST) for $61m last year.

And Adavale Resources (ASX:ADD) has discovered scores of historical electromagnetic survey data for exploration licences which form part of its Mundowdna uranium project in South Australia, potentially saving the company significant amounts of time and early-phase exploration costs.

Ora Banda (ASX:OBM) –pending the release of an announcement regarding a proposed capital raising.

BikeExchange (ASX:BEX) – pending the expected release of an announcement relating to an accelerated non renounceable entitlement offer.

Athena Resources (ASX:AHN) – pending the release of an announcement regarding a proposed capital raising.