Closing Bell: Real estate, tech stocks succumb to rates pivot; Krakatoa doubles on new copper-gold prospect

ASX falls after soaring US inflation kills prospect of 3 rate cuts. (Pic via Getty Images)

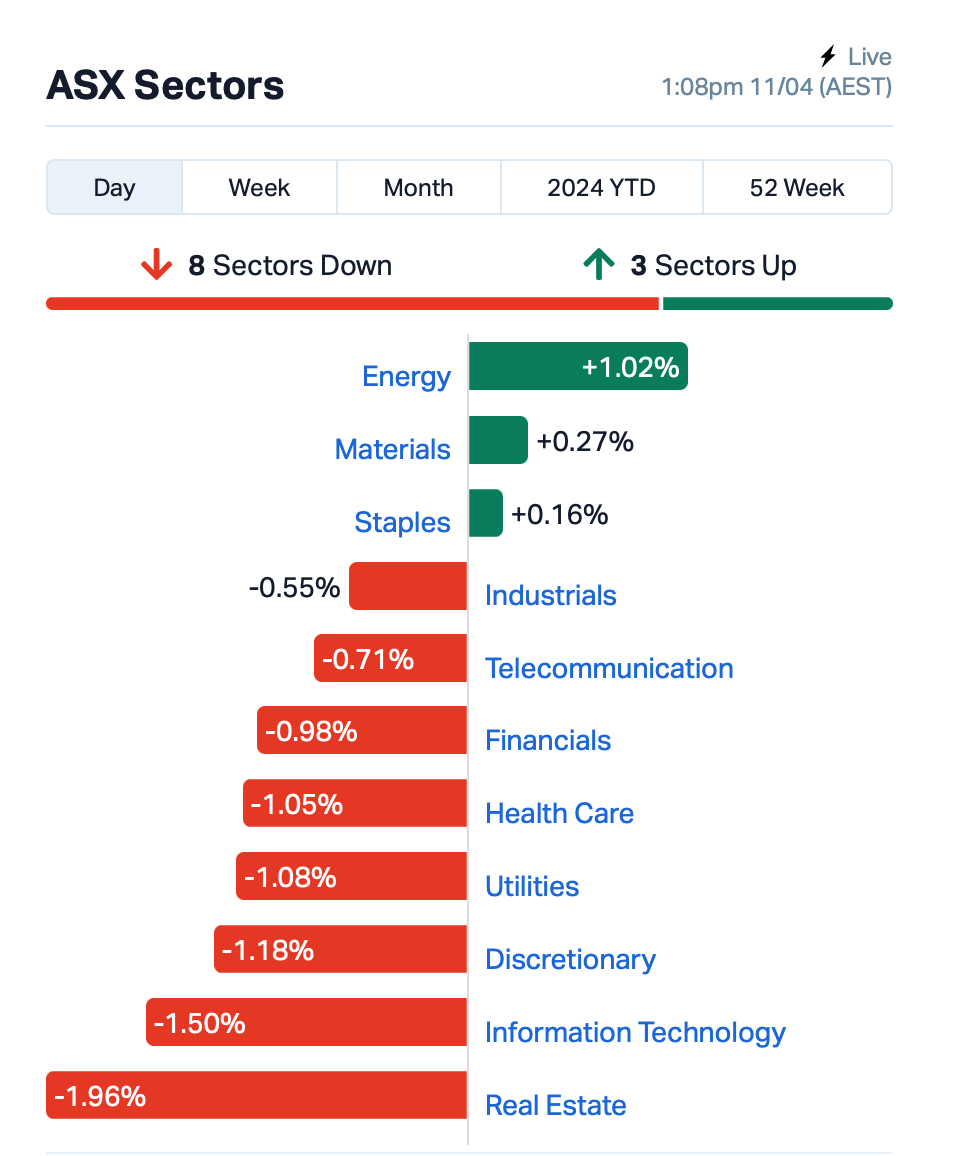

- ASX falls after soaring US inflation kills prospect of three rate cuts

- Rates sensitive Real Estate and Tech stocks led the losers’ list

- Energy stocks and goldies meanwhile overperformed

Real Estate and Tech stocks pushed the ASX lower today as the prospect of just two Fed rate cuts this year dampened sentiment for rates-sensitive stocks. At the close of Thursday, the ASX200 index was down by around -0.44%.

Overnight, US stocks slumped after the US inflation for March came shockingly at 3.5%, up from 3.2% in February and higher than the consensus forecast of 3.4%. Fed swaps are now showing bets of only two rate cuts for 2024, from the the three rate cuts before the inflation report.

“The [inflation] data is simply not providing cover for the Fed to cut in June or July as yet,” said Andrew Canobi, director of Australia Fixed Income for Franklin Templeton Fixed Income.

“It may start to do so but core inflation has accelerated since Q4 2024, so things need to reverse course pretty quickly for this to be a chance. Take out a June or July cut and cuts become difficult for the Fed this side of the Presidential election.”

The USD staged a bullish breakout against major currencies after the CPI report. Against the Japanese yen, it has popped to almost 153 yen, the highest since 1990. Against the Aussie dollar, it’s appreciated almost 2% to US65.20c.

To stocks, goldies once again led, with the ASX All Ordinaries Gold (XGD) up by +1%.

There is more good new coming via the Energy sector, with heavyweights on that roster posting decent gains, including Woodside (ASX:WDS) and Whitehaven (ASX:WHC).

Elsewhere…

The strong US CPI print has triggered a bond selloff (bond yields higher).

Overnight, the benchmark 10-year US Treasury yield surged by 18bp to 4.55%.

Aussie bond yields followed suit today, falling by 10bp. Overall, the global bonds index suffered its worst performance since February 2023.

Over in China, data released today shows that consumer prices barely increased from a year earlier and industrial prices continued to slump – as deflationary pressures continue to hamper the country’s recovery.

China’s CPI rose just 0.1% in March from the prior year, while producer prices fell 2.8% from a year earlier in March.

“The price data clearly mirrors the weak domestic demand,” ANZ’s Raymond Yeung told Bloomberg.

ASX LARGE CAP WINNERS TODAY:

Code Name Price % Change Volume Market Cap ERA Energy Resources 0.06 5% 34,007 $1,196,008,156 GOR Gold Road Res Ltd 1.78 4% 4,342,177 $1,852,519,203 CPU Computershare Ltd 27.91 3% 1,559,317 $16,082,709,325 ANN Ansell Limited 27.29 3% 719,715 $3,301,831,501 KAR Karoon Energy Ltd 2.34 3% 1,830,131 $1,818,814,879 APM APM Human Services 1.24 3% 1,250,507 $1,105,204,245 NST Northern Star 15.43 3% 3,826,897 $17,242,308,645 DYL Deep Yellow Limited 1.44 3% 2,489,805 $1,231,747,215 MAD Mader Group Limited 6.21 3% 57,666 $1,210,000,000 EMR Emerald Res NL 3.55 3% 2,177,777 $2,165,556,882 ILU Iluka Resources 7.43 2% 813,240 $3,102,521,718 WHC Whitehaven Coal 7.76 2% 3,472,072 $6,341,433,943 LYC Lynas Rare Earths 6.09 2% 2,332,830 $5,570,920,383 WAF West African Res Ltd 1.37 2% 2,222,037 $1,381,467,905 PLS Pilbara Min Ltd 4.00 2% 10,265,917 $11,798,106,171 WDS Woodside Energy 30.55 2% 2,817,841 $56,905,530,637 SLR Silver Lake Resource 1.33 2% 1,989,882 $1,224,515,076

Northern Star Resources (ASX:NST) announced preliminary production results for the three-month period ended 31 March.

Gold sold for the March quarter totalled 401koz, impacted by significant weather events across the Northern Goldfields. The company says it remains on track to deliver its FY24 Group gold sold guidance of 1.60-1.75Moz (9 months to date: 1.18Moz) based on positive momentum leading into an expected strong June quarter, driven predominantly by increased grade and mill utilisation rates.

The events during the quarter have led the company to revise its FY24 AISC guidance to $1,810-1,860/oz, up from $1,730-1,790/oz.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| KTA | Krakatoa Resources | 0.019 | 138% | 53,576,719 | $3,776,858 |

| RNX | Renegade Exploration | 0.010 | 67% | 11,079,444 | $6,022,018 |

| EPM | Eclipse Metals | 0.008 | 60% | 5,268,749 | $11,048,278 |

| TKL | Traka Resources | 0.002 | 33% | 275,962 | $2,625,988 |

| CR1 | Constellation Res | 0.165 | 32% | 177,642 | $7,410,053 |

| EMP | Emperor Energy Ltd | 0.015 | 25% | 2,011,038 | $4,088,850 |

| ENT | Enterprise Metals | 0.003 | 25% | 662,493 | $1,603,942 |

| KPO | Kalina Power Limited | 0.005 | 25% | 250,131 | $8,840,512 |

| PSC | Prospect Res Ltd | 0.160 | 23% | 5,343,164 | $60,233,155 |

| PEC | Perpetual Res Ltd | 0.011 | 22% | 4,227,478 | $5,760,265 |

| SGC | Sacgasco Ltd | 0.011 | 22% | 1,378,111 | $7,017,184 |

| R3D | R3D Resources Ltd | 0.039 | 22% | 127,628 | $4,875,890 |

| BPP | Babylon Pump | 0.006 | 20% | 1,424,909 | $12,497,745 |

| VUL | Vulcan Energy | 3.410 | 19% | 1,974,670 | $492,128,803 |

| ENX | Enegex Limited | 0.025 | 19% | 79,800 | $7,747,236 |

| WWI | West Wits Mining Ltd | 0.019 | 19% | 20,305,824 | $38,886,266 |

| CYM | Cyprium Metals Ltd | 0.026 | 18% | 10,996,001 | $33,543,671 |

| NWM | Norwest Minerals | 0.052 | 18% | 2,389,027 | $17,077,258 |

| SHN | Sunshine Metals Ltd | 0.020 | 18% | 24,969,331 | $26,010,179 |

| IMI | Infinitymining | 0.070 | 17% | 34,600 | $7,125,203 |

| 1MC | Morella Corporation | 0.004 | 17% | 761,211 | $18,536,398 |

| LNR | Lanthanein Resources | 0.004 | 17% | 3,496,471 | $5,864,727 |

| TTI | Traffic Technologies | 0.007 | 17% | 1,096,667 | $5,227,924 |

| BTH | Bigtincan Hldgs Ltd | 0.180 | 16% | 7,402,681 | $95,519,229 |

| WA1 | WA1 Resources | 15.030 | 2% | 206,354 | $901,644,551 |

Krakatoa Resources (ASX:KTA) has updated the market on its ongoing reconnaissance work on new prospects at the Turon Project. New copper-gold prospect on Turon Project defined with rock-chip assays to 1.24g/t Au, 10.45% Cu, with anomalous Mo, and Sn. Four samples returned over 1% Cu, averaging 4.83% Cu to a maximum of 10.45%

Aura Energy (ASX:AEE)’s drilling has defined two new areas of extensive shallow, high-grade uranium mineralisation at Tiris. Assays including 9m at 310ppm U3O8 have defined mineralisation over a strike length of +8km at Hippolyte South. Results are expected to deliver upgrade to current contained resource of 58.9Mlb U3O8.

Prospect Resources (ASX:PSC) continued its upward trajectory, building on Tuesday’s announcement that the company has acquired an 85% interest in the large-scale Mumbezhi copper project, located in the Zambian Copperbelt, a prized geological jurisdiction.

Cyclone Metals (ASX:CLE) jumped this morning after announcing an upgraded Indicated and Inferred Mineral Resource of 16.6 billion tonnes containing 29.3% total Fe and 18.2% magnetic Fe, cut-off grade 12.5% magnetic Fe at Project Iron Bear. The Indicated portion of the Mineral Resource is 2.15 billion tonnes containing 28.68% total Fe and 19% magnetic Fe.

Renegade Exploration (ASX:RNX) announced that its found a very large magnetic anomaly just north of the Mongoose prospect at its flagship Cloncurry Project, which it now plans to drill in May, with the help of a $300,000 Collaborative Exploration Initiative (CEI) grant from the Queensland Government.

And Cosmos Exploration (ASX:C1X) says that high-grade rock chip assays up to 2.20% TREYO (33% NdPr) have been received from its Leatherback L1 mineralised trend, and the results significantly surpass previous high of 1.09% TREYO previously collected from the L2 trend.

ASX SMALL CAP LAGGARDS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| CNJ | Conico Ltd | 0.001 | -33% | 2,539,445 | $2,707,642 |

| AXP | AXP Energy Ltd | 0.002 | -25% | 173,469 | $11,649,361 |

| MRQ | Mrg Metals Limited | 0.002 | -25% | 5,290,440 | $5,050,237 |

| TD1 | Tali Digital Limited | 0.002 | -25% | 27,892 | $6,590,311 |

| OPN | Oppenneg | 0.004 | -20% | 4,398,881 | $5,645,898 |

| AEV | Avenira Limited | 0.007 | -19% | 6,780,712 | $18,792,272 |

| OLY | Olympio Metals Ltd | 0.050 | -18% | 276,168 | $4,285,966 |

| AU1 | The Agency Group Aus | 0.025 | -17% | 95,633 | $12,857,298 |

| CCA | Change Financial Ltd | 0.050 | -17% | 176,179 | $37,659,683 |

| ADY | Admiralty Resources. | 0.005 | -17% | 40,000 | $9,776,844 |

| MHC | Manhattan Corp Ltd | 0.003 | -17% | 200,000 | $8,810,939 |

| NTM | Nt Minerals Limited | 0.005 | -17% | 1,070,076 | $5,159,417 |

| RR1 | Reach Resources Ltd | 0.003 | -17% | 559,876 | $9,836,169 |

| TMR | Tempus Resources Ltd | 0.005 | -17% | 2,806,905 | $4,385,992 |

| LYN | Lycaonresources | 0.180 | -14% | 28,961 | $9,251,813 |

| BFC | Beston Global Ltd | 0.006 | -14% | 10,000 | $13,979,328 |

| GTR | Gti Energy Ltd | 0.006 | -14% | 379,002 | $14,349,630 |

| HXL | Hexima | 0.012 | -14% | 956,058 | $2,338,555 |

| PIL | Peppermint Inv Ltd | 0.012 | -14% | 9,541,892 | $29,629,017 |

| TMK | TMK Energy Limited | 0.003 | -14% | 828,151 | $23,645,002 |

| ZMI | Zinc of Ireland NL | 0.014 | -13% | 779 | $3,410,308 |

| SHG | Singular Health | 0.105 | -13% | 225,911 | $23,442,367 |

| IMC | Immuron Limited | 0.110 | -12% | 526,072 | $28,499,793 |

| SRR | Saramaresourcesltd | 0.022 | -12% | 235,535 | $2,010,477 |

| FG1 | Flynngold | 0.045 | -12% | 262,244 | $8,371,186 |

AVITA Medical (ASX:AVH) plunged -10% after reporting a sluggish trading update. For the quarter ended March 31, 2024, AVITA Medical says it expects commercial revenue to be in the range of US$11.0 million to US$11.3 million. This range is below the previously provided revenue guidance of US$14.8 million to US$15.6 million.

IN CASE YOU MISSED IT

Haranga Resources (ASX:HAR) has received more thick, uranium hits from the final 19 holes of its recently completed RC drill program at the Saraya project. Laboratory assays from the program will feed into an upcoming revision of the project’s resource estimate.

Koba Resources (ASX:KOB) is expanding its uranium portfolio with the acquisition of the high-grade Harrier project in eastern Canada. The project sits within same underexplored belt that hosts Paladin Energy’s 278Mlbs Michelin project.

Lanthanein Resources (ASX:LNR) has completed an extensive soil sampling program at the Lady Grey lithium-tantalum project in WA that will provide information on potential drill targets.

Sunshine Metals (ASX:SHN) has mobilised a second drill rig to accelerate exploration at its Liontown project in Queensland by testing extensions to high-grade gold mineralisation delineated in the footwall.

Toubani Resources’ (ASX:TRE) resource definition drill program at the 2.4Moz Kobada project in Mali has returned near-surface, high-grade hits of up to 55.9g/t gold. Results from the ongoing 10,000m program will inform a resource upgrade.

West Wits Mining (ASX:WWI) expects a new prospecting right to be granted soon after an appeal contesting its application was dismissed by the South African Minister of Forestry, Fisheries and the Environment. PR 10730 is adjacent to the company’s granted mining right at its Witwatersrand Basin project. This is expected to be a significant step toward a material updating of the company’s existing 4.28Moz resource.

TRADING HALTS

Strickland Metals (ASX:STK) – pending an announcement in relation to a material acquisition.

Linius Technologies (ASX:LNU) – pending the release of an announcement about a capital raising.

Findi (ASX:FND) – pending an announcement in relation to an update to the White Label ATM Licence Application in India.

Dart Mining (ASX:DTM) – pending the release of a placement announcement.

Butn (ASX:BTN) – pending the release of an announcement about a potential capital raising.

NextDC (ASX:NXT) – pending an announcement to be made to the ASX in connection with an equity raising.

At Stockhead, we tell it like it is. While West Wits Mining, Haranga Resources, Koba Resources, Krakatoa Resources and Sunshine Metals are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.