Who Made the Gains? Here are the top 50 resources stocks for January

Mining

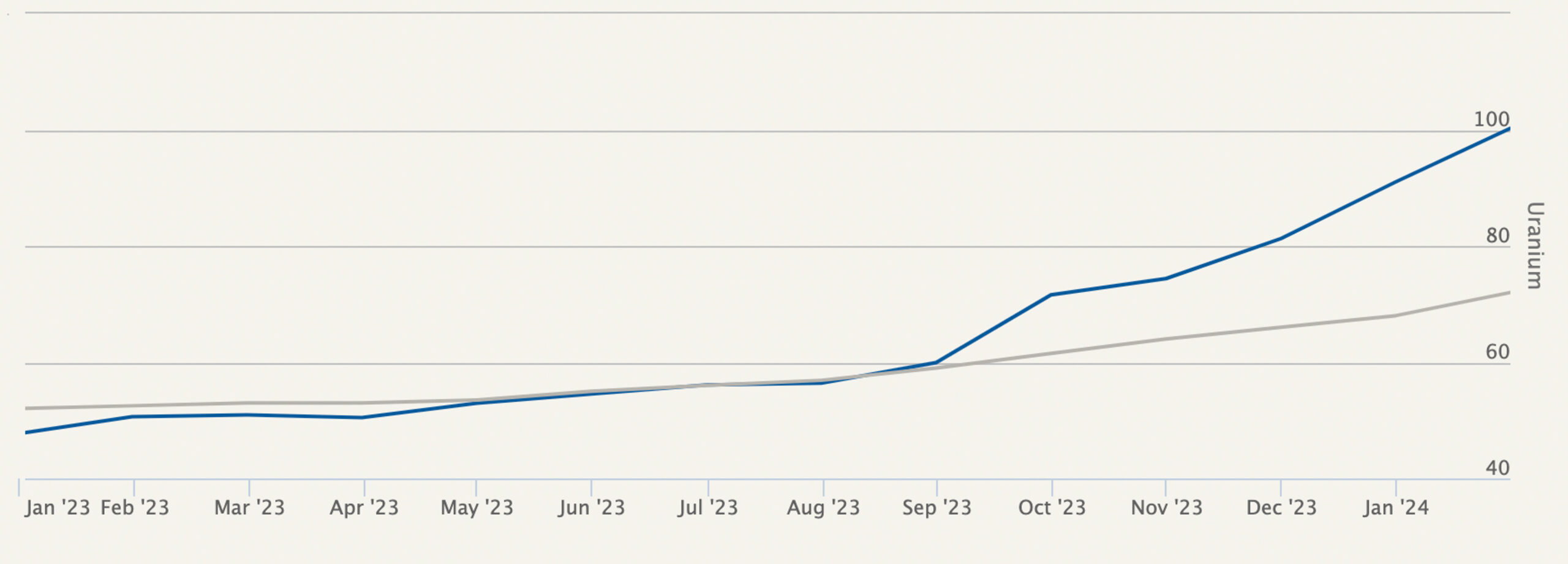

In 2023 and 2024 uranium prices are soaring, as predicted — albeit a few years later than many expected.

What wasn’t necessarily predicted were some other industry tailwinds, like widespread global political support for new nuclear buildouts, Russia’s fall from grace, and the inability for producers like global #1 Kazatomprom to hit production targets.

Frustrating for uranium lovers has been the sluggish response to this parabolic price action from yellowcake stocks.

In 2023 there was no froth in the market. Despite the spot price action – up a barely believable 102% — only 3 uranium stocks made our top 50 for the year.

It has launched into 2024 in the same bullish fashion and stocks are now responding.

You can read more about January’s commodity winners (and losers) in Up, Up, Down Down.

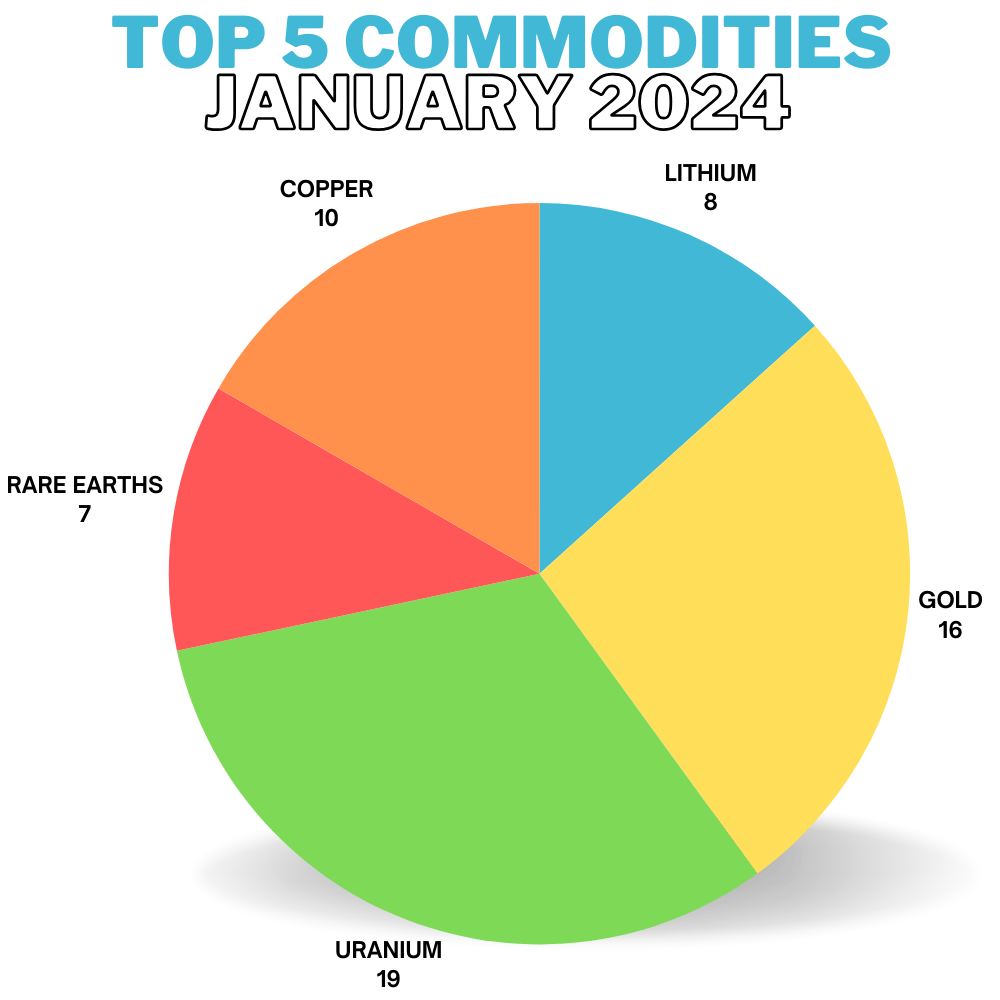

In a weak month for resources stocks overall, 19 ASX companies in our January top 50 had uranium exposure — a new record for Gains — across the spectrum from $5m tiddler to +$1bn mainstay.

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | JANUARY RETURN | SHARE PRICE | MARKET CAP | COMMODITIES |

|---|---|---|---|---|---|

| KOB | Kobaresourceslimited | 121% | 0.155 | $16,339,583 | URANIUM, LITHIUM |

| AKM | Aspire Mining Ltd | 105% | 0.215 | $109,141,952 | COAL |

| EEL | Enrg Elements Ltd | 83% | 0.011 | $11,109,615 | URANIUM, LITHIUM |

| FHS | Freehill Mining Ltd. | 83% | 0.011 | $32,932,179 | GOLD, INDUSTRIAL |

| WCN | White Cliff Min Ltd | 78% | 0.016 | $21,373,749 | COPPER, URANIUM |

| ERA | Energy Resources | 65% | 0.061 | $1,351,046,250 | URANIUM |

| CBE | Cobre | 64% | 0.072 | $20,657,592 | COPPER, GOLD, SILVER |

| CXU | Cauldron Energy Ltd | 63% | 0.039 | $44,979,563 | URANIUM |

| PXX | Polarx Limited | 57% | 0.011 | $18,035,785 | COPPER, GOLD |

| BMG | BMG Resources Ltd | 55% | 0.017 | $10,774,552 | LITHIUM, GOLD |

| BSN | Basinenergylimited | 54% | 0.185 | $11,521,801 | URANIUM |

| EMU | EMU NL | 50% | 0.0015 | $3,037,157 | COPPER, SILVER |

| A1G | African Gold Ltd. | 48% | 0.04 | $6,772,448 | GOLD |

| SMI | Santana Minerals Ltd | 47% | 1.48 | $263,190,632 | GOLD |

| CZR | CZR Resources Ltd | 45% | 0.305 | $71,899,067 | IRON ORE |

| EQX | Equatorial Res Ltd | 44% | 0.18 | $23,660,164 | IRON ORE |

| VMS | Venture Minerals | 43% | 0.01 | $22,100,130 | IRON ORE, RARE EARTHS |

| DAF | Discovery Alaska Ltd | 42% | 0.027 | $6,324,337 | GOLD |

| CPO | Culpeominerals | 40% | 0.049 | $6,653,746 | COPPER |

| NMR | Native Mineral Res | 40% | 0.028 | $5,873,014 | COPPER, LITHIUM |

| VAR | Variscan Mines Ltd | 40% | 0.014 | $5,306,005 | ZINC, LEAD |

| GTR | Gti Energy Ltd | 38% | 0.011 | $22,549,418 | URANIUM |

| EL8 | Elevate Uranium Ltd | 36% | 0.605 | $186,610,181 | URANIUM |

| MRL | Mayur Resources Ltd | 36% | 0.265 | $89,066,817 | INDUSTRIAL |

| ARE | Argonaut Resources | 35% | 0.135 | $25,627,781 | URANIUM |

| NWF | Newfield Resources | 35% | 0.135 | $122,740,997 | DIAMONDS |

| BMN | Bannerman Energy Ltd | 35% | 3.63 | $554,811,995 | URANIUM |

| DYL | Deep Yellow Limited | 34% | 1.46 | $1,116,387,490 | URANIUM |

| E79 | E79Goldmineslimited | 34% | 0.075 | $6,100,056 | GOLD |

| VAL | Valor Resources Ltd | 33% | 0.004 | $16,693,339 | URANIUM, RARE EARTHS, LITHIUM |

| IPX | Iperionx Limited | 31% | 1.82 | $414,535,418 | TITANIUM, ZIRCON, RARE EARTHS |

| DTR | Dateline Resources | 30% | 0.013 | $17,284,230 | GOLD, RARE EARTHS |

| MKG | Mako Gold | 30% | 0.013 | $8,611,322 | GOLD, MANGANESE |

| EME | Energy Metals Ltd | 29% | 0.155 | $32,500,913 | URANIUM |

| AGE | Alligator Energy | 29% | 0.076 | $293,535,484 | URANIUM |

| CUF | Cufe Ltd | 29% | 0.018 | $20,630,023 | IRON ORE, LITHIUM, RARE EARTHS |

| RCR | Rincon | 29% | 0.036 | $7,961,449 | RARE EARTHS, COPPER, GOLD |

| LOT | Lotus Resources Ltd | 28% | 0.365 | $631,643,777 | URANIUM |

| PAM | Pan Asia Metals | 28% | 0.16 | $26,850,684 | LITHIUM |

| GUE | Global Uranium | 28% | 0.125 | $26,526,122 | URANIUM |

| AQD | Ausquest Limited | 27% | 0.014 | $11,552,089 | COPPER, LITHIUM, NICKEL, ZINC, RARE EARTHS |

| BKY | Berkeley Energia Ltd | 27% | 0.35 | $156,028,850 | URANIUM |

| NFL | Norfolkmetalslimited | 26% | 0.195 | $6,888,374 | URANIUM, GOLD |

| PGD | Peregrine Gold | 25% | 0.3 | $20,098,944 | GOLD |

| PEN | Peninsula Energy Ltd | 24% | 0.13 | $267,865,582 | URANIUM |

| LEG | Legend Mining | 21% | 0.017 | $49,376,112 | NICKEL, COPPER |

| AQX | Alice Queen Ltd | 20% | 0.006 | $4,145,905 | GOLD |

| AS1 | Asara Resources Ltd | 20% | 0.012 | $9,512,771 | GOLD |

| CRB | Carbine Resources | 20% | 0.006 | $3,310,427 | SILICA SAND |

| TMR | Tempus Resources Ltd | 20% | 0.006 | $4,141,740 | GOLD, COPPER |

🚀 Energy Resources of Australia (ASX:ERA) +65%

🚀 Deep Yellow (ASX:DYL) +34%

🚀 Lotus Resources (ASX:LOT) +28%

🚀 Bannerman Energy (ASX:BMN) +35%

KOBA RESOURCES (ASX:KOB) +121%

South Australia has become a go-to uranium jurisdiction during this current boom, as speculative stocks look to replicate the success of mine developer Boss Energy (ASX:BOE) and long-time producer Heathgate.

Former lithium play KOB is joining minnows like Marmota (ASX:MEU) , Norfolk Metals (ASX:NFL), Power Minerals (ASX:PNN) and Adavale Resources (ASX:ADD) in the hunt for a uranium company maker in Australia’s third largest state.

KOB will buy an 80% interest in uranium rights at the 4000sqkm Yarramba project from copper-gold play Havilah Resources (ASX:HAV) for 25m shares, and another 10m milestone shares on announcement of a +15Mlb resource.

KOB will need to spend $6m over four years on exploration, with HAV’s 20% interest ‘free-carried’ until completion of a feasibility study.

Drilling is pencilled in for Q2 this year.

“The Yarramba project is centred on 4.6 million pounds of U3O8 at the Oban deposit which provides a great foundation on which substantial resources can be built,” KOB boss Ben Vallerine says.

“No exploration has been undertaken at Yarramba since 2012, therefore the 4,000km2 project provides us excellent opportunities to make sizeable discoveries in close proximity to existing infrastructure.”

Vallerine says the explorer will also “aggressively pursue additional uranium assets”.

ASPIRE MINING (ASX:AKM) +105%

Coal from AKM’s 281Mt Ovoot project in China-adjacent Mongolia has been designated super high quality, or “fat”, making it ideal for steelmaking.

Premium quality coking/met coals are in great demand by steel producers, as good coke maximises blast furnace productivity.

“We are very excited by this confirmation which places our coal into the ‘fat coal’ market, which will attract a hard coking coal premium,” AKM’s Sam Bowles says.

“In recognition of the distinctly unique qualities of this coal, the company will be branding the coal produced from the OCCP as Toson Coal.

“In Mongolian, ‘Toson’ is an adjective meaning ‘fat’ or ‘fatty’.”

It is currently working through the approvals process and feasibility studies to move Ovoot towards production by the end of 2025.

In his November chairman’s address Michael Avery told shareholders coking coal demand wasn’t going away.

“On a world stage, our view is that there is currently minimal capital being invested in the development or expansion of coking coal projects, where green policies are not differentiating between coking and thermal coals,” he said.

“At the same time, the demand for coking coal continues to increase and remains an irreplaceable input into commercially viable processes of making steel, which is an essential material required to achieve many of the United Nations Sustainable Development Goals.

“In such context, as a veteran of the coal industry, the prospect of developing the Ovoot Project excites me tremendously.

“In my view there are few, if any greenfield coking coal deposits equal or better in terms of size, quality, or proximity to market.”

WHITE CLIFF MINERALS (ASX:WCN) +79%

Another former lithium explorer chasing what’s hot. WCN plans to acquire a historical uranium project in the remote Northwest Territories of Canada called Radium Point, which produced 13.7Mlb uranium, plus silver, copper gold, nickel and lead pre-1982.

According to this doco, Port Radium provided 11% of all the uranium used in the Manhattan project.

WCN says exploration has been largely non-existent in the area since uranium production ceased in the ’60s and silver and copper mining stopped in early ’80s.

Initial exploration will focus on finding extensions to previously exploited orebodies, as well as known outcropping prospects throughout the licence area that have never been followed up.

Radium Point was secured via licence applications and cost the company just CAD$150,000 in shares to a Canadian consultant.