You might be interested in

Mining

MinRes remains bullish on lithium, and it could take a host of WA explorers along for the ride

Mining

Resources Top 4: Juniors charge 115-130% on Canadian lithium acquisitions, copper finds

Mining

Mining

Here are the biggest resources winners in early trade, Monday October 23.

Wildcat is at it again, nimbly bounding up an ASX limb with strong double-digits gainage – currently more than 28% to lead the local ressie stocks gains pack at the time of writing.

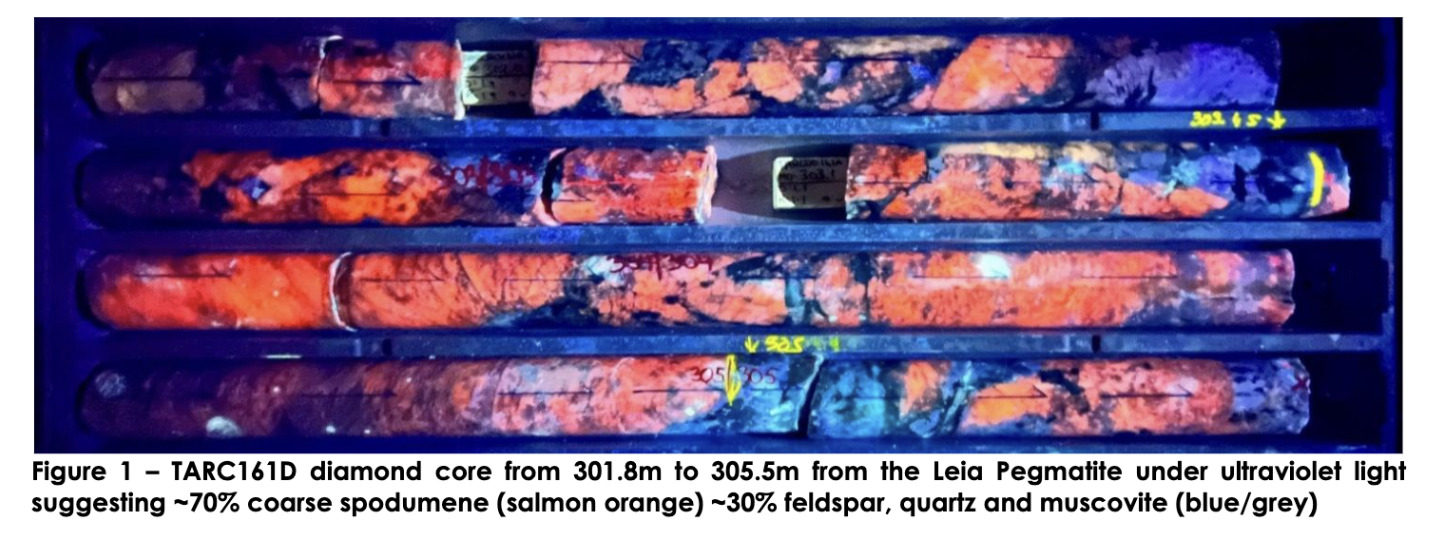

The Pilbara-lithium-exploring junior has announced it’s drilled into some broad, high-grade lithium intersections at the promising Tabba Tabba lithium-tantalum project near Port Hedland, WA.

These latest assay results continue the rich vein of form the company has been digging up since it delivered its batch of figures from an extensive 3.2km trending pegmatite system at the project in September.

Today’s announced results come from a specific pegmatite system within that area, dubbed Leia, and they provide the best yet from the Central Cluster structure, including, as the headline highlight:

85m at 1.5% Li2O from 133m (including 9m at 3.0% Li2O from 199m and 13m at 2.3% Li2O from 136m).

That’s some thick, spod-tastic action right there, folks…

The company notes that pending results from a further 58 RC holes (22 of them are from Leia) indicate that Tabba Tabba has potential to host a Tier-1 lithium deposit.

Further broad, high-grade #lithium intersections including 85m at 1.5% Li2O highlight the significant scale of our Tabba Tabba Lithium Project in WA and the potential for a Tier-1 lithium deposit at the Leia Pegmatite. Further results pending. https://t.co/BQHx3fpRa6 #WC8 #ASX pic.twitter.com/Rqy48MMnqg

— Wildcat Resources (ASX:WC8) (@WildcatRes_WC8) October 22, 2023

Wildcat MD Samuel Ekins said:

“We continue to be encouraged by the Leia Pegmatite’s scale, grade and tabular consistency having still not found the edges of it with drilling. It really feels as though we are in the midst of a Tier 1 lithium discovery at Tabba Tabba.”

Vaguely related sidenote… Calidus Resources (ASX:CAI) is up today after Chilean chemical company SQM announced it’s buying 40% of Pirra Lithium from Haoma Mining NL. Calidus owns 30% of Pirra, which is hunting lithium 20km down the road from Wildcat at Tabba Tabba.

WC8 share price

We’ll get to the graphite news in a sec. But first …

Coming off a trading halt after a highly anticipated announcement this morning, the hot Victorian gold explorer SXG is looking to continue its recent run of form.

The market’s been a bit fickle on this one, though, with SXG rising sharply as the news was released before settling back to a ~5% gain a bit before 1pm AEDT, and potentially further back to its 78c open since. A blink-and-missed-it surge.

Nevertheless, it’s still worth a mention as the company is looking to hit the antimony-gold jackpot at its Sunday Creek project.

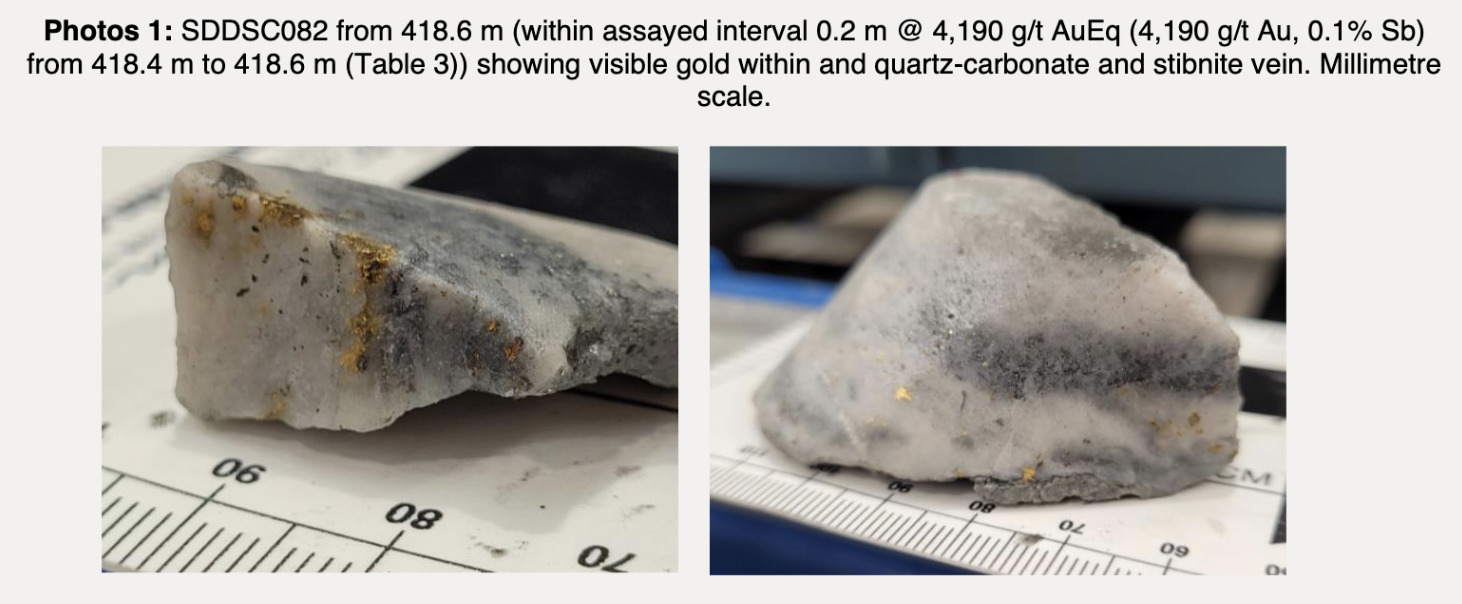

This morning it announced what it called its best hole (SDDSC082) it’s drilled to date at the project, intersecting 18 high-grade veins.

It’s a find SXG describes as a “spectacularly long and high-grade intersection of gold-antimony mineralisation”.

Specifics? It’s talking 331.5m at 6.8g/t Au from 413.6m (uncut) in a 180m to 290m (average 200m) down dip extension of a previously drilled mineralised zone.

The hole contains the highest grades (up to 4,190 g/t Au) and includes three of the top five individual intersections made at Sunday Creek so far, including: 13.1 m at 91.7g/t Au from 413.6m, 68.5m at 4.8g/t Au from 506.3m and 5m at 60.9g/t Au from 588m.

Located in a vein-system of the project known as Rising Sun, the area remains open with assays pending for 18 holes.

Southern Cross Gold’s managing director, Michael Hudson, said:

“Great projects generally keep getting better, and Sunday Creek is proving to be no exception. SDDSC082… is the best and most significant hole drilled at Sunday Creek and incredibly, on average, a 200m down dip extension from SDDSC077B, our previous best hole.

“We are delighted by the continuity of the separate high-grade veins, with the main Rising Sun vein now traced from surface to 550m depth.”

SXG share price

and

Evolution Energy Minerals (+18% at time of writing) is a spinout entity of Marvel Gold (also well up today with a +18% gain).

It’s a mineral exploration company focused on graphite, specifically on the development of the Chilalo graphite project in southern Tanzania.

And it’s not the only graphite play doing well on the ASX today, with Syrah Resources -SYR (ASX:), Talga Resources (ASX:TLG), International Graphite (ASX:IG6), Renascor Resources (ASX:RNU), Black Rock Mining (ASX:BKT), Walkabout Resources (ASX:WKT) and Castle Minerals (ASX:CDT) (see further below), all posting strong gains today at the time of writing.

There’s a reason for this, and we refer you to a report in The Australian, regarding China announcing imminent export restrictions on the EV battery metal, as well as EV battery anodes.

For context, China is by far the world’s dominant graphite producer and, per info gathered by analysts at Benchmark Mineral Intelligence, it’s set to produce 67 per cent of global natural graphite this year.

Per The Australian:

“The Chinese move follows the US imposing new limits on the types of semiconductors which can be sold to Chinese firms, and the EU announcing last month it would investigate whether to impose tariffs on Chinese-made EVs, which the European Commission says are benefiting from government subsidies.”

The Aus continued, citing analysts at Shaw and Partners, who noted:

“Given the pre-existing forecasts for graphite supply shortages coming, and that there are few shovel-ready projects poised to meet the forecast demand anywhere in the world, graphite prices must move up to incentivise new production.

“In the medium-term, the policy will accelerate the still nascent build-out of battery anode supply chains in the West.”

EV1 share price

Another small Aussie graphite player, Castle Minerals is faring well today not only on the wider Chinese-restrictions-related graphite narrative mentioned above, but on the back of some of its own news.

This morning, the company announced it’s upgraded its Kambale graphite project mineral resource estimate by 38% to 22.4Mt at 8.6% TGC containing 1.9Mt of graphite.

Kambale is the company’s flagship project located in Ghana. The previous Mineral Resource figure stood at 15.6Mt at 9% TGC containing 1.41Mt of graphite.

Castle says the new estimate also includes a “55% increase in contained graphite in the higher confidence indicated mineral resource which now stands at 43% (9.6Mt at 8.8% TGC containing 843,000t of graphite) of the overall MRE (previously 39%).

#ASX $CDT This comes at the same time as China this weekend sent the EV battery manufacturing world into shock with a ban on exports of graphite and electric vehicle battery anodes, which are made from it.

🔗: https://t.co/SLheNwmp7Z

🔗: https://t.co/KFjATwjYHO https://t.co/KjB0L1fYsR— Castle Minerals Limited (@Castle_Minerals) October 23, 2023

CDT share price

At Stockhead we tell it like it is. While Southern Cross Gold is a Stockhead advertiser at the time of writing, it did not sponsor this article.