Resources Top 5: Wildcat bares its claws for a +80pc gain as fellow lithium juniors soar

Getty Images

- Assay results from Wildcat Resources’ Tabba Tabba lithium project are in … and they’re good

- Meanwhile, Bubalus and Venus Metals are moving on up on their own pegmatite stories

Here are the biggest small cap resources winners in early trade, Monday September 18.

Wildcat Resources (ASX:WC8)

This Pilbara-lithium-exploring junior is roaring up the ASX today on the back of a major discovery at the Tabba Tabba lithium-tantalum project near Port Hedland, WA.

The assay results WC8 investors have been sweating on have finally arrived. They do not disappoint and show huge potential for a large-scale lithium camp across an extensive 3.2km trending pegmatite system.

The $292m market capped explorer has had a barnstorming year to date with a 1,733% gain in 2023. And today’s +85% pump (it was +100% earlier) extends its impressive trading narrative.

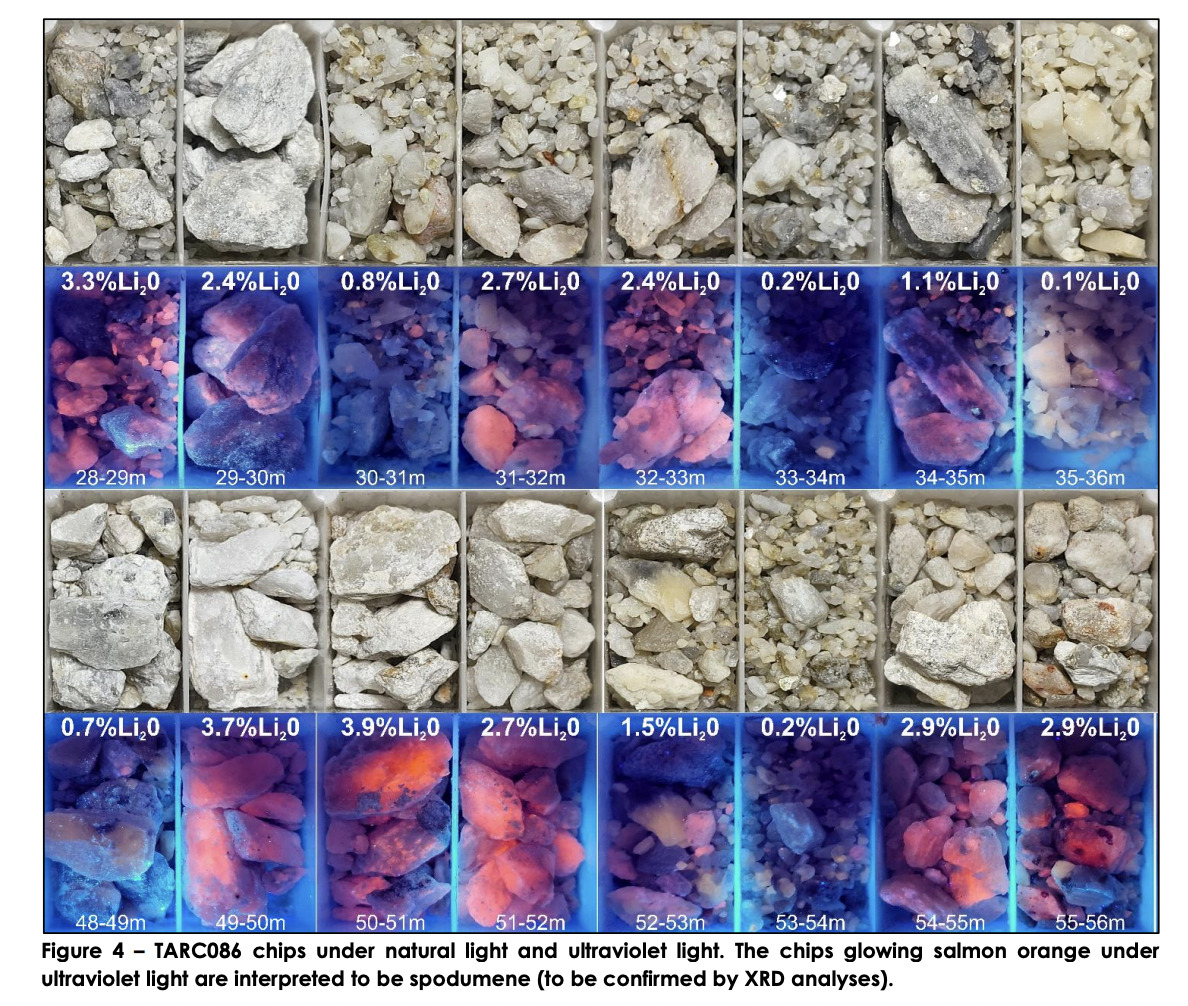

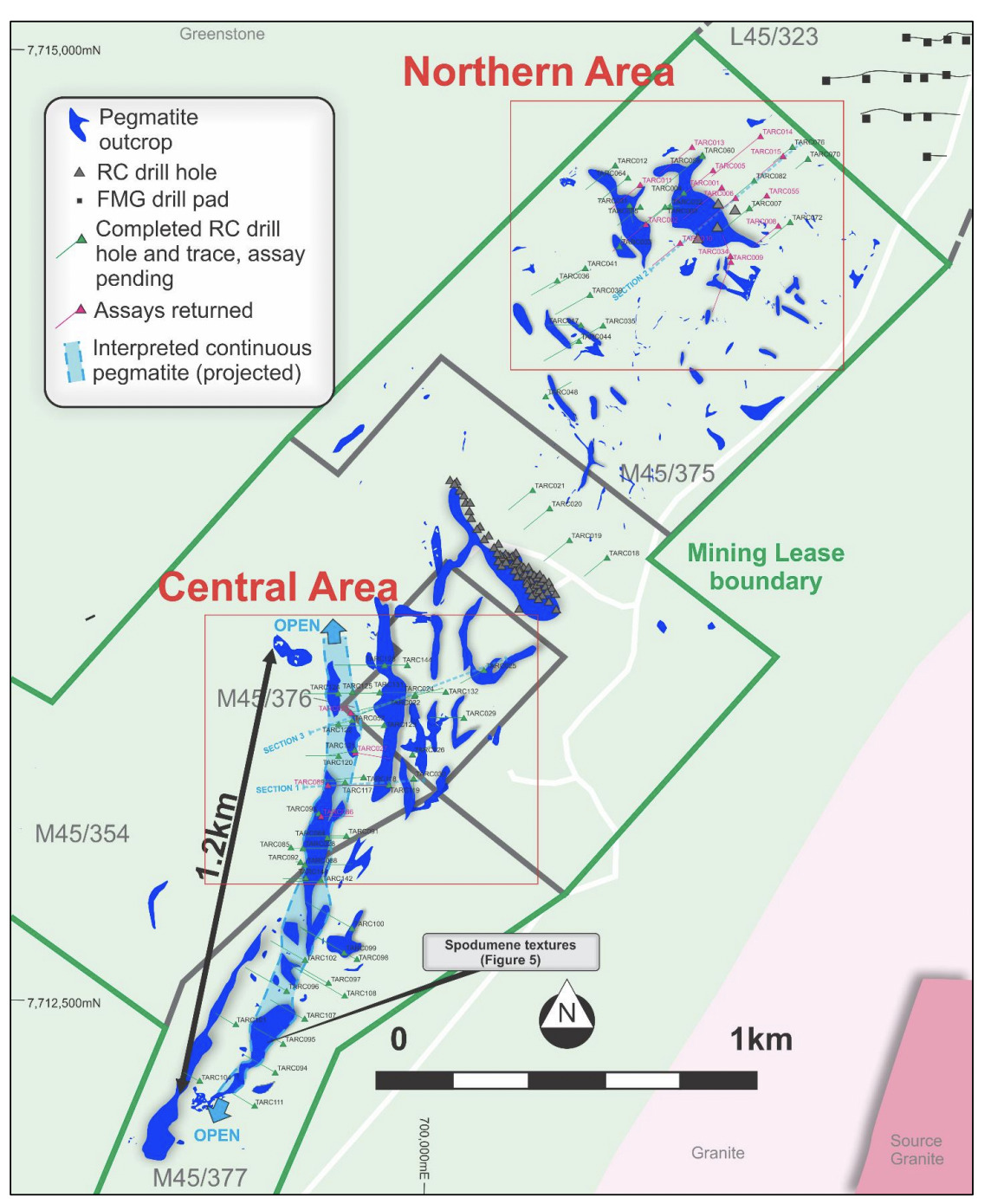

The company notes initial results from 21 RC-drilled holes confirming pegmatite structures that contain “significant widths and grades of lithium mineralisation.”

Wildcat’s initial batch of assays comprises 17 holes from the northern pegmatite cluster and four holes from the central pegmatite cluster.

Initial scout drilling commenced in the north of its leases, confirming shallow north easterly dipping, stacked pegmatites. Further south in the central area, meanwhile, multiple wide, sub-vertical (70°) dipping pegmatites were found, and a second rig was added.

“The first intercepts from the central area were fast-tracked through the laboratory so they could be included in the first batch of results to aid exploration planning,” sayeth Wildcat.

The Tabba Tabba project is near some big-hitting, world-class hard-rock lithium mines. It’s 47km from Pilbara Minerals’ (ASX:PLS) 414Mt Pilgangoora Project and 87km from Mineral Resources’ (ASX:MIN) 259Mt Wodgina Project.

In fact it was once held by Pilbara Minerals as its flagship asset before Pilgangoora emerged into the monster is today and took the $13 billion miner’s focus.

Also, Andrew Forrest’s Fortescue Metals Group (ASX:FMG) is sniffing around right next door. As reported by Stockhead‘s Josh Chiat recently, FMG is known to have drilled for lithium out at its own Tabba Tabba tenements, next to the old tantalum mine now being explored by Wildcat.

First assay results from maiden drilling at the Tabba Tabba Lithium Tantalum Project in the Pilbara, WA confirm high-grade #lithium mineralisation in the northern and central pegmatite clusters.

More results due soon; 3rd rig heading to site. #ASX: https://t.co/s6DzgP05av #WC8 pic.twitter.com/BqWUsmryih

— Wildcat Resources (ASX:WC8) (@WildcatRes_WC8) September 18, 2023

Managing Director Samuel Ekins said: “I’m confident we are in the early stages of a major discovery at Tabba Tabba and it’s been a welcome surprise to see the size of the system.

“Over 95% of all holes to date have intersected pegmatites and we eagerly await further rounds of assays. Our central pegmatite is now over 1.2km long (open to the north), subvertical and outcropping at widths of over 50m which is very significant.”

WC8 share price

Venus Metals (ASX:VMC)

This $26m market-capped diverse metals explorer is also in surging territory today based on, yep, you guessed right – lithium.

VMC has made a new discovery out at its Deep South prospect within its Youanmi lithium project in WA, mapping out two new zones with outcropping LCT pegmatites, south from Lithium-rich pegmatites it recorded late August, boasting up to 4.6% Li2O.

The Deep South mineralisation is now shaping up as a significant lithium find for the company.

Geological mapping has identified the prospect’s Central (with up to 4.5% lithium oxide), East and North (up to 4.6%) zones as common areas of high lithium grades “associated with coarse-grained petalite”.

What’s petalite? Glad you asked. It’s a lithium mineral with similar composition to spodumene and known to occur alongside spod in other lithium deposits in the region – for example Mount Holland, some 350km further south.

Matt Hogan, MD of Venus said: “These follow-up rock sampling results received are outstanding with up to 4.6% Li2O and expand the lithium-rich pegmatites over 300m X 200m into three known zones which potentially only represent a small section of the mineralised system in this poorly exposed area.”

Bubalus Resources (ASX:BUS)

Like WC8, Bubalus caught a fast-moving BUS this morn, carrying with it some strong lithium news of its own.

The $6m capped junior has jumped on some prime ground next door to maybe kinda takeover target Delta Lithium (ASX:DLI), as detailed by Stockhead in a special report this morning.

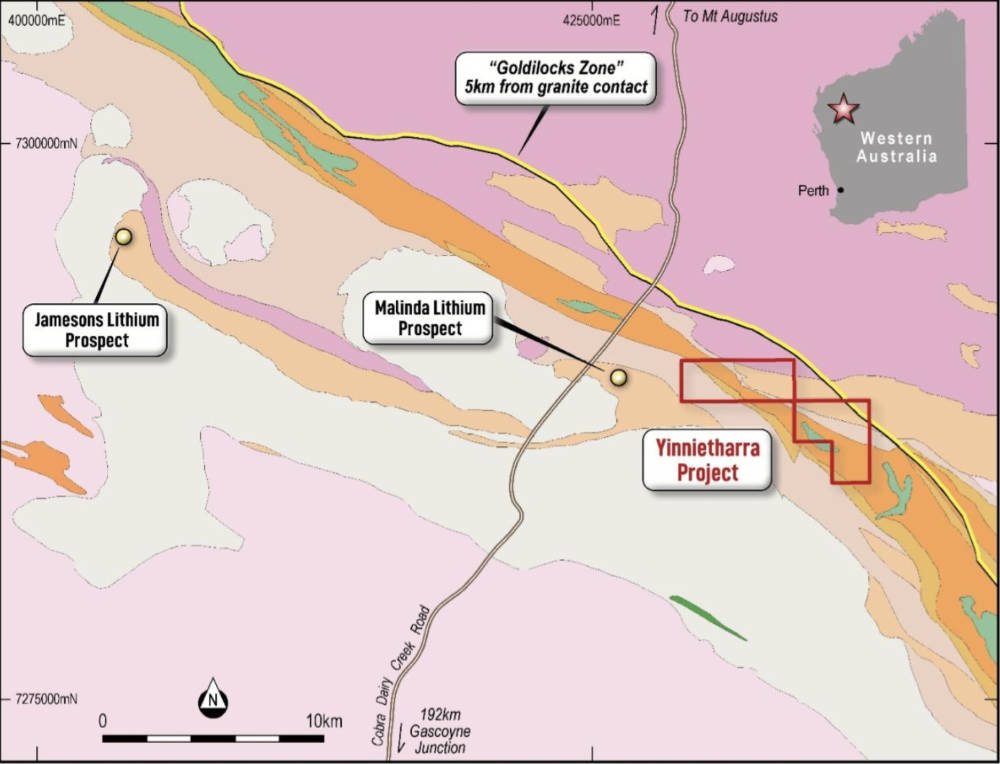

Bubalus’ newly acquired prospective lithium tenements – the Yinnietharra project – are in the Gascoyne Region of Western Australia, 2km east of Delta Lithium’s Malinda Prospect.

The company announces it’s executed a binding asset sale agreement with Hardy Metals Pty Ltd to acquire the tenements and noted the prospectivity given the fact drilling at Malinda by Delta has identified spodumene-hosted lithium mineralisation over a distance of 1.6 km and to a depth of 350m.

No drilling has yet been undertaken on the Yinnietharra project.

The project lies less than 3km from the contact with the Thirty Three Supersuite, a series of granitic bodies believed to be the source for lithium mineralisation in the Yinnietharra area.

The major shareholders of the vendor group are also the same core group that vended the Malinda project to Delta.

Bubalus Resources $BUS has acquired tenements prospective for #Lithium mineralisation in the Gascoyne Region of Western Australia

The Yinnietharra Project lies 2km east of Delta Lithium’s Malinda Prospect. Plans are underway to to commence soil sampling as soon as possible pic.twitter.com/D8ZXGf84uE

— Bubalus (@Bubalus_ASX) September 17, 2023

Riversgold (ASX:RGL)

Earlier this month, RGL announced it was increasing its lithium portfolio with the purchase of seven spodumene-bearing landholdings in the James Bay lithium district in Quebec, Canada – collectively called the Abigail lithium project.

Today, it gave a progress report update on its newly acquired hunting grounds, noting that, in addition to strong activity at its Australian lithium operations in Western Australia, the company’s Quebec exploration teams are currently mobilising to commence due diligence activities at Abigail.

#lithium activity at @Riversgold_Ltd really picking up as of now. Lots going on in Western Australia and Quebec. Just announced this morning. $RGL.ax So lots of news flow to come now. pic.twitter.com/y5IwDI29LG

— David Lenigas (@DavidLenigas) September 18, 2023

The Abigail project is between TSXV-listed, C$330m capped Critical Element’s Rose and Nemaska’s Whabouchi deposits, which have reserves of 26.3Mt @ 0.87% Li2O and 36.6Mt @ 1.3% Li2O respectively.

It’s comprised of 602 staked claims in seven blocks for a total area of 312 km2 and includes the West, T22, T4, East, Star, South and Southeast projects.

Lithium is Riversgold’s key focus and its CEO, Julian Ford, noted:

“The coming weeks and months will see regular update announcements relating to RGL’s lithium projects in Western Australia and Quebec – from extensive soil sampling programs being completed, rocks chip and mapping results being obtained and released and a drilling campaign to be undertaken.

RGL share price

Castle Minerals (ASX:CDT)

Some non-lithium news for you. CDT is double-digits up on news that commercial grade bulk fine flake graphite concentrate grading 95.1% has been successfully produced by test work using a conventional grind and flotation concentration circuit.

And that’s out at Castle’s Kambale project in Ghana.

Look we did say this wasn’t lithium news, but it’s still very much connected to the burgeoning electric vehicle narrative, with Castle Minerals very much gunning to become an important cog in the EV battery supply chain with its graphite production potential.

Castle’s MD, Stephen Stone spoke to that in this morning’s ASX announcement:

“This heralds a major advance in our fast-track evaluation of Kambale as a possible supplier of concentrate to be ultimately used in the production of anodes for lithium-ion batteries to power the world’s fast-growing fleet of electric vehicles.

“An additional 100M to 120M light EVs are forecast to be on the road by 2030. Each vehicle contains between 30kg and 60kg of battery grade graphite and each kg of that is derived from 3kg of natural flake concentrate.”

Stone also noted that forecasters are predicting a major natural graphite concentrate supply deficit “as current supply is wholly inadequate” and pointed to the “extreme reliance” of USA and EU vehicle manufacturers on Chinese supplied anodes and batteries.

The point is, believes Stone, battery gigafactories will need to source their graphite requirements from somewhere other than just China and CDT’s Ghanaian operation is well positioned to supply.

#CDT MD, says producing a commercial grade #graphite concentrate of 95.1% TGC from just completed test work on samples from its Kambale Graphite Project, Ghana heralds a major advance in the Company’s fast-track evaluation of the project as a possible supplier of graphite.

— Castle Minerals Limited (@Castle_Minerals) September 18, 2023

CDT share price

At Stockhead we tell it like it is. While Bubalus Resources and Riversgold are Stockhead advertisers at the time of writing, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.