Gold Digger: Production goes nuts as all time gold mining record nears and long-term road looks solid

"Follow the…" (Pic via Getty Images

- New World Gold Council report points to thriving gold production and long-term demand

- Meanwhile, gold prices are still healthy but fractionally down from this time last week

- The week’s top ASX goldie gainers led by: STK and TIE

Right then, gold. You. Are. Gold. Always believe.

Let’s start with the price action at the precise time of a quarter past typing this sentence:

In relatively strong US dollars, we’re talking $1,989 (a truly golden year for the Canberra Raiders) per ounce.

In relatively pissweak Aussie dollars, we’re talking: $3,093 an oz.

This is still pretty strong performance, although down just a tad from this time last week – so, no fresh ATH for Aussie gold to report this time around.

We’ve seen the odd analyst here and there late this week calling it a “softening” of the recent momentum of the soft heavy metal. A bit like Linkin Park, perhaps. (Actually, not sure about that reference as I’ve never listened to a full Linkin Park song and probably never will.)

That said, you’ve got to keep on top of these momentum narratives, because here’s a more up-to-minute one from gold-focused media outlet Kitco, whose Neils Christensen noted overnight:

“The gold market is seeing healthy momentum as the US labor market appears to be losing some momentum as the number of American workers applying for first-time unemployment benefits rises more than expected.

“The gold market continues to hold below $2,000 an ounce; however, it has seen a small jump in initial reaction to the latest labor market data. December gold futures last traded at $1,996.70 an ounce, up 0.46% on the day.”

And as Stockhead’s very own ressie expert Josh Chiat noted in his October review of commodities:

“War is in fact good for gold prices, but how long will October’s safe haven bump last?”

Safe haven rallies like these don’t always last, reckons Josh, as we saw with the run beyond US$2000/oz after last year’s invasion of Ukraine by Russia.

And the US rate-hike cycle is still something for investors to consider he warns, “which could yet persist longer than expected with inflation remaining a concern for key state banks”.

Agreed.

Jerome Powell of the Federal Reserve said today that progress on taming inflation will be lumpy.

Yes,

He said lumpy.

Help us all.

— Gold Telegraph ⚡ (@GoldTelegraph_) November 1, 2023

Gold mining record in reach: World Gold Council

But what does the World Gold Council reckon? It has a whole bunch of fresh takes released this week via its latest Gold Demand Trends report, which it’s based on Q3 action.

Among the key takeaways, this one stood out:

A potential global gold production all-time-high this year points to strong demand for the precious metal, you would think, wouldn’t you?

Speaking of which, some other WGC report highlights:

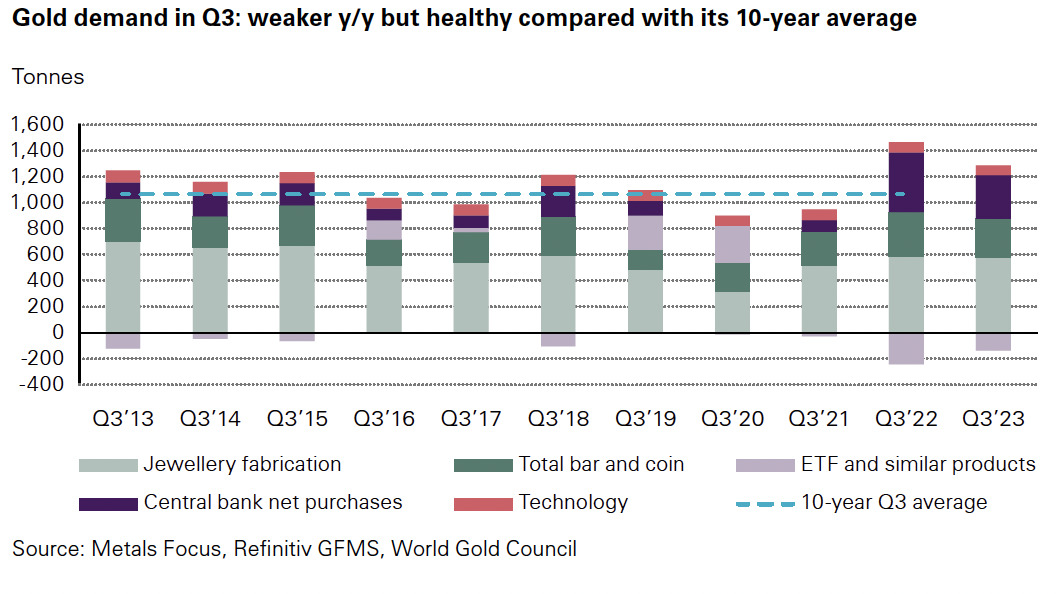

• Q3 gold demand proved to be “firmly above the longer term average”.

The LBMA gold price benchmark averaged US$1,928.5/oz during Q3. That’s 2% below the record high seen in Q2, but 12% higher y/y.

Several countries saw higher local gold prices due to currency weakness against the US dollar, notes the WGC, including Japan, China and Turkey.

Several countries saw higher local gold prices due to currency weakness against the US dollar, notes the WGC, including Japan, China and Turkey.

• Central banks are still frothing for the yellow metal, maintaining a “historic pace” in Q3, but falling short of the Q3’22 record. “Central banks have bought a net 800t of gold so far this year, the highest on record for that nine-month period.”

• Jewellery demand meanwhile softened slightly in the face of high gold prices, while the investment picture was mixed.

Winners & Losers

Here’s how ASX-listed precious metals stocks are performing:

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop.

Stocks missing from this list? Email [email protected] and/or [email protected]

| Code | Company | Price | % Week | % Month | % Year | Market Cap |

|---|---|---|---|---|---|---|

| MRR | Minrex Resources Ltd | 0.014 | -7% | 0% | -67% | $15,188,145 |

| NPM | Newpeak Metals | 0.001 | 0% | 0% | 0% | $9,995,579 |

| ASO | Aston Minerals Ltd | 0.033 | 0% | 22% | -50% | $43,384,653 |

| MTC | Metalstech Ltd | 0.13 | -10% | -42% | -66% | $30,176,734 |

| FFX | Firefinch Ltd | 0.2 | 0% | 0% | 0% | $236,569,315 |

| GED | Golden Deeps | 0.05 | 0% | -11% | -57% | $5,776,117 |

| G88 | Golden Mile Res Ltd | 0.021 | -5% | -28% | -1% | $6,258,401 |

| DCX | Discovex Res Ltd | 0.002 | 0% | 0% | -20% | $6,605,136 |

| NMR | Native Mineral Res | 0.033 | -13% | -20% | -80% | $6,650,676 |

| AQX | Alice Queen Ltd | 0.014 | 0% | 0% | -65% | $1,771,208 |

| SLZ | Sultan Resources Ltd | 0.015 | -17% | -25% | -84% | $2,222,851 |

| MKG | Mako Gold | 0.013 | -19% | -13% | -68% | $7,488,106 |

| KSN | Kingston Resources | 0.086 | -1% | 8% | 0% | $42,824,718 |

| AMI | Aurelia Metals Ltd | 0.095 | 3% | 3% | -9% | $158,412,861 |

| PNX | PNX Metals Limited | 0.003 | -25% | 20% | -20% | $16,141,874 |

| GIB | Gibb River Diamonds | 0.037 | -3% | 37% | -31% | $7,825,849 |

| KCN | Kingsgate Consolid. | 1.135 | 5% | -2% | -33% | $293,836,929 |

| TMX | Terrain Minerals | 0.005 | 25% | 0% | -29% | $6,767,139 |

| BNR | Bulletin Res Ltd | 0.155 | 24% | 96% | 15% | $44,038,665 |

| NXM | Nexus Minerals Ltd | 0.04 | 3% | -18% | -76% | $15,562,405 |

| SKY | SKY Metals Ltd | 0.039 | -3% | -9% | -9% | $17,994,526 |

| LM8 | Lunnonmetalslimited | 0.69 | -5% | -14% | -15% | $162,992,140 |

| CST | Castile Resources | 0.06 | 5% | 18% | -50% | $14,272,243 |

| YRL | Yandal Resources | 0.058 | 4% | 23% | -55% | $9,468,185 |

| FAU | First Au Ltd | 0.0025 | 0% | -17% | -44% | $3,629,983 |

| ARL | Ardea Resources Ltd | 0.52 | 8% | -12% | -40% | $102,197,505 |

| GWR | GWR Group Ltd | 0.076 | 9% | -10% | 27% | $24,091,249 |

| IVR | Investigator Res Ltd | 0.043 | 10% | 8% | -10% | $61,798,311 |

| GTR | Gti Energy Ltd | 0.0075 | -6% | -32% | -49% | $15,374,603 |

| IPT | Impact Minerals | 0.011 | 10% | -12% | 83% | $28,647,039 |

| BNZ | Benzmining | 0.35 | 3% | -15% | -30% | $44,141,832 |

| MOH | Moho Resources | 0.006 | -25% | -14% | -75% | $2,380,311 |

| BBX | BBX Minerals Ltd | 0.027 | -7% | 4% | -58% | $15,756,296 |

| PUA | Peak Minerals Ltd | 0.003 | -14% | 0% | -50% | $3,124,130 |

| MRZ | Mont Royal Resources | 0.18 | 9% | 0% | -5% | $14,813,088 |

| SMS | Starmineralslimited | 0.039 | -9% | -3% | -54% | $2,912,239 |

| MVL | Marvel Gold Limited | 0.011 | 0% | -8% | -56% | $9,501,698 |

| PRX | Prodigy Gold NL | 0.008 | 0% | 14% | -27% | $12,257,755 |

| AAU | Antilles Gold Ltd | 0.023 | 5% | -8% | -48% | $18,236,862 |

| CWX | Carawine Resources | 0.12 | 2% | -19% | 42% | $23,618,096 |

| RND | Rand Mining Ltd | 1.15 | -12% | -12% | -21% | $65,407,355 |

| CAZ | Cazaly Resources | 0.036 | 16% | 3% | 20% | $13,825,105 |

| BMR | Ballymore Resources | 0.125 | 14% | 25% | -26% | $18,274,658 |

| DRE | Dreadnought Resources Ltd | 0.034 | 6% | -29% | -70% | $110,622,250 |

| ZNC | Zenith Minerals Ltd | 0.11 | 21% | -4% | -61% | $42,285,706 |

| REZ | Resourc & En Grp Ltd | 0.015 | 0% | -3% | -25% | $7,497,087 |

| LEX | Lefroy Exploration | 0.165 | -6% | -6% | -42% | $33,371,298 |

| ERM | Emmerson Resources | 0.059 | -2% | -2% | -27% | $31,593,168 |

| AM7 | Arcadia Minerals | 0.085 | -6% | -15% | -70% | $9,269,259 |

| ADT | Adriatic Metals | 3.42 | 1% | -7% | 36% | $829,497,733 |

| GMR | Golden Rim Resources | 0.02 | -5% | -5% | -47% | $11,831,767 |

| CYL | Catalyst Metals | 0.755 | 26% | 14% | -35% | $159,563,469 |

| CHN | Chalice Mining Ltd | 1.925 | 8% | -16% | -55% | $719,582,112 |

| KAL | Kalgoorliegoldmining | 0.025 | -14% | -14% | -76% | $3,710,851 |

| MLS | Metals Australia | 0.038 | 15% | 9% | 0% | $22,465,303 |

| ADN | Andromeda Metals Ltd | 0.019 | -10% | -5% | -55% | $62,200,169 |

| MEI | Meteoric Resources | 0.25 | 6% | 16% | 1983% | $466,117,710 |

| SRN | Surefire Rescs NL | 0.012 | -14% | -14% | 0% | $26,478,958 |

| SIH | Sihayo Gold Limited | 0.002 | 0% | 33% | -20% | $24,408,512 |

| WA8 | Warriedarresourltd | 0.059 | 2% | -9% | -61% | $30,194,990 |

| HMX | Hammer Metals Ltd | 0.047 | 9% | 0% | -32% | $44,320,367 |

| WCN | White Cliff Min Ltd | 0.01 | -17% | -17% | -44% | $12,570,186 |

| AVM | Advance Metals Ltd | 0.003 | 0% | -40% | -75% | $1,765,676 |

| WRM | White Rock Min Ltd | 0.063 | 0% | 0% | -15% | $17,508,200 |

| ASR | Asra Minerals Ltd | 0.007 | 0% | -18% | -70% | $10,126,460 |

| MCT | Metalicity Limited | 0.002 | 0% | -20% | -43% | $8,502,172 |

| AME | Alto Metals Limited | 0.045 | -2% | -2% | -40% | $32,139,004 |

| CTO | Citigold Corp Ltd | 0.0045 | 13% | -10% | -25% | $14,368,295 |

| TIE | Tietto Minerals | 0.5975 | 44% | 73% | -17% | $637,145,105 |

| SMI | Santana Minerals Ltd | 0.66 | 15% | 26% | 4% | $112,033,850 |

| M2R | Miramar | 0.019 | -30% | -49% | -78% | $3,200,695 |

| MHC | Manhattan Corp Ltd | 0.005 | 0% | -29% | -29% | $14,684,899 |

| GRL | Godolphin Resources | 0.036 | -5% | -12% | -56% | $6,431,197 |

| SVG | Savannah Goldfields | 0.051 | -12% | -22% | -77% | $11,024,212 |

| EMC | Everest Metals Corp | 0.095 | -1% | -14% | -5% | $12,661,895 |

| GUL | Gullewa Limited | 0.055 | 0% | 0% | -15% | $10,767,521 |

| CY5 | Cygnus Metals Ltd | 0.17 | 17% | 0% | -66% | $49,307,249 |

| G50 | Gold50Limited | 0.125 | 0% | -11% | 4% | $13,464,375 |

| ADV | Ardiden Ltd | 0.0055 | -8% | 10% | -21% | $14,785,844 |

| AAR | Astral Resources NL | 0.08 | 1% | -4% | 45% | $65,766,595 |

| VMC | Venus Metals Cor Ltd | 0.11 | 10% | -12% | 5% | $20,870,155 |

| NAE | New Age Exploration | 0.0055 | 0% | -8% | -31% | $9,866,444 |

| VKA | Viking Mines Ltd | 0.01 | 25% | 11% | 25% | $10,252,584 |

| LCL | LCL Resources Ltd | 0.025 | -14% | -11% | 15% | $19,857,612 |

| MTH | Mithril Resources | 0.0015 | 0% | -25% | -67% | $5,053,207 |

| ADG | Adelong Gold Limited | 0.0065 | -7% | -7% | -19% | $4,174,256 |

| RMX | Red Mount Min Ltd | 0.004 | -11% | 14% | -20% | $10,694,304 |

| PRS | Prospech Limited | 0.02 | 0% | -29% | -30% | $4,175,440 |

| XTC | Xantippe Res Ltd | 0.001 | 0% | 0% | -76% | $17,528,005 |

| TTM | Titan Minerals | 0.035 | 0% | 0% | -56% | $50,323,457 |

| NML | Navarre Minerals Ltd | 0.019 | 0% | 0% | -58% | $28,555,654 |

| MZZ | Matador Mining Ltd | 0.045 | -4% | -2% | -49% | $14,947,638 |

| KZR | Kalamazoo Resources | 0.098 | 3% | -7% | -47% | $14,566,405 |

| BCN | Beacon Minerals | 0.027 | 4% | 13% | 13% | $101,432,741 |

| MAU | Magnetic Resources | 1.06 | 6% | 27% | 33% | $266,065,609 |

| BC8 | Black Cat Syndicate | 0.225 | 5% | 7% | -22% | $66,163,487 |

| EM2 | Eagle Mountain | 0.068 | -4% | -15% | -62% | $20,432,780 |

| EMR | Emerald Res NL | 2.675 | 2% | 1% | 142% | $1,672,335,501 |

| BYH | Bryah Resources Ltd | 0.013 | -7% | -13% | -40% | $4,661,869 |

| HCH | Hot Chili Ltd | 1.08 | 4% | -9% | 10% | $126,014,692 |

| WAF | West African Res Ltd | 0.795 | 11% | 3% | -26% | $795,237,635 |

| MEU | Marmota Limited | 0.042 | 14% | 27% | -14% | $43,410,824 |

| NVA | Nova Minerals Ltd | 0.25 | -9% | 14% | -69% | $53,776,940 |

| DCN | Dacian Gold Ltd | 0.28 | 0% | 189% | 70% | $328,536,253 |

| SVL | Silver Mines Limited | 0.1675 | 2% | -1% | -4% | $238,736,464 |

| PGD | Peregrine Gold | 0.29 | 0% | 4% | -35% | $16,601,895 |

| ICL | Iceni Gold | 0.057 | -3% | -27% | -14% | $14,631,286 |

| FG1 | Flynngold | 0.067 | 3% | 16% | -33% | $9,274,016 |

| WWI | West Wits Mining Ltd | 0.014 | -7% | -7% | -22% | $30,176,910 |

| RML | Resolution Minerals | 0.005 | 0% | -29% | -50% | $6,286,459 |

| AAJ | Aruma Resources Ltd | 0.032 | 0% | -11% | -54% | $6,103,637 |

| AL8 | Alderan Resource Ltd | 0.011 | 0% | -8% | 57% | $6,783,641 |

| GMN | Gold Mountain Ltd | 0.0055 | -8% | -8% | -21% | $13,614,472 |

| MEG | Megado Minerals Ltd | 0.035 | 0% | -15% | -49% | $8,905,945 |

| HMG | Hamelingoldlimited | 0.087 | 5% | 4% | -52% | $13,702,500 |

| TBA | Tombola Gold Ltd | 0.026 | 0% | 0% | -13% | $33,129,243 |

| BM8 | Battery Age Minerals | 0.215 | -9% | -23% | -57% | $18,718,746 |

| TBR | Tribune Res Ltd | 3.1 | -3% | -3% | 12% | $157,404,231 |

| FML | Focus Minerals Ltd | 0.18 | 20% | 6% | 24% | $51,580,556 |

| GSR | Greenstone Resources | 0.0075 | -6% | -17% | -71% | $10,923,331 |

| VRC | Volt Resources Ltd | 0.007 | -13% | -13% | -68% | $28,507,967 |

| ARV | Artemis Resources | 0.027 | 23% | 0% | -7% | $34,703,204 |

| HRN | Horizon Gold Ltd | 0.3 | -2% | -8% | -8% | $37,554,492 |

| CLA | Celsius Resource Ltd | 0.011 | 10% | 0% | -8% | $24,706,568 |

| QML | Qmines Limited | 0.077 | -13% | -23% | -61% | $16,362,844 |

| RDN | Raiden Resources Ltd | 0.0385 | 17% | 28% | 350% | $81,755,281 |

| TCG | Turaco Gold Limited | 0.055 | 10% | 15% | 38% | $27,146,700 |

| KCC | Kincora Copper | 0.031 | 0% | -14% | -52% | $4,967,039 |

| GBZ | GBM Rsources Ltd | 0.021 | 17% | 40% | -61% | $13,026,758 |

| DTM | Dart Mining NL | 0.018 | 0% | -9% | -73% | $3,683,066 |

| MKR | Manuka Resources. | 0.04 | -9% | -7% | -69% | $22,500,802 |

| AUC | Ausgold Limited | 0.029 | 4% | -3% | -31% | $66,588,095 |

| ANX | Anax Metals Ltd | 0.031 | -14% | -9% | -46% | $13,327,021 |

| EMU | EMU NL | 0.0015 | 50% | -25% | -64% | $1,667,521 |

| SFM | Santa Fe Minerals | 0.043 | 0% | -2% | -51% | $3,131,208 |

| SSR | SSR Mining Inc. | 17.82 | -20% | -14% | -18% | $405,324,305 |

| PNR | Pantoro Limited | 0.04 | 0% | 5% | -70% | $166,528,976 |

| CMM | Capricorn Metals | 4.595 | 0% | 12% | 29% | $1,744,445,932 |

| X64 | Ten Sixty Four Ltd | 0.57 | 0% | 0% | 0% | $130,184,182 |

| SI6 | SI6 Metals Limited | 0.006 | 9% | -14% | 0% | $9,969,297 |

| HAW | Hawthorn Resources | 0.093 | -2% | 1% | 11% | $33,166,546 |

| BGD | Bartongoldholdings | 0.245 | 4% | 17% | 75% | $47,900,880 |

| SVY | Stavely Minerals Ltd | 0.067 | -8% | -11% | -54% | $25,667,471 |

| AGC | AGC Ltd | 0.065 | 0% | 7% | -6% | $6,300,000 |

| RGL | Riversgold | 0.009 | -10% | -31% | -80% | $8,561,353 |

| TSO | Tesoro Gold Ltd | 0.021 | 11% | 5% | -34% | $21,072,251 |

| OKR | Okapi Resources | 0.13 | 0% | -16% | -38% | $28,361,612 |

| CPM | Coopermetalslimited | 0.12 | 0% | 0% | -65% | $6,386,118 |

| MM8 | Medallion Metals. | 0.055 | -5% | -18% | -66% | $16,613,189 |

| AUT | Auteco Minerals | 0.032 | 7% | 0% | -29% | $167,443,108 |

| CBY | Canterbury Resources | 0.023 | -15% | -15% | -48% | $3,324,041 |

| LYN | Lycaonresources | 0.17 | -15% | -35% | -37% | $8,013,750 |

| SFR | Sandfire Resources | 6.35 | 7% | 2% | 70% | $2,737,384,500 |

| NCM | Newcrest Mining | 23.35 | 0% | 2% | 40% | $20,880,287,592 |

| TMZ | Thomson Res Ltd | 0.005 | 0% | 0% | -72% | $4,881,018 |

| TAM | Tanami Gold NL | 0.038 | 9% | 3% | -5% | $39,953,300 |

| WMC | Wiluna Mining Corp | 0.205 | 0% | 0% | 0% | $74,238,031 |

| NWM | Norwest Minerals | 0.0305 | -15% | 2% | -40% | $8,770,870 |

| ALK | Alkane Resources Ltd | 0.605 | 3% | -1% | -5% | $355,785,642 |

| BMO | Bastion Minerals | 0.019 | 12% | -5% | -68% | $3,973,950 |

| IDA | Indiana Resources | 0.052 | 2% | -16% | -4% | $30,621,853 |

| GSM | Golden State Mining | 0.0195 | 3% | -50% | -50% | $3,630,677 |

| NSM | Northstaw | 0.049 | 36% | 44% | -57% | $5,285,588 |

| GSN | Great Southern | 0.023 | 0% | -4% | -54% | $15,847,339 |

| RED | Red 5 Limited | 0.3 | -5% | 11% | 82% | $1,055,967,721 |

| DEG | De Grey Mining | 1.145 | -1% | 2% | 2% | $2,086,950,633 |

| THR | Thor Energy PLC | 0.027 | 0% | -29% | -66% | $4,761,086 |

| CDR | Codrus Minerals Ltd | 0.064 | 5% | -9% | 7% | $5,584,000 |

| MDI | Middle Island Res | 0.016999 | -14% | -10% | -68% | $2,391,077 |

| BAT | Battery Minerals Ltd | 0.047 | -6% | 57% | -65% | $5,621,411 |

| POL | Polymetals Resources | 0.3 | 0% | -12% | 50% | $45,300,367 |

| RDS | Redstone Resources | 0.007 | 17% | -13% | 0% | $6,099,649 |

| NAG | Nagambie Resources | 0.029 | 32% | 38% | -63% | $11,634,526 |

| BGL | Bellevue Gold Ltd | 1.3525 | -4% | -3% | 76% | $1,602,862,765 |

| GBR | Greatbould Resources | 0.063 | -5% | 17% | -30% | $30,462,704 |

| KAI | Kairos Minerals Ltd | 0.016 | -20% | -24% | -41% | $41,934,595 |

| KAU | Kaiser Reef | 0.17 | 0% | -3% | 3% | $25,139,129 |

| HRZ | Horizon | 0.035 | -5% | -3% | -41% | $25,936,396 |

| CAI | Calidus Resources | 0.19 | 19% | 23% | -50% | $118,996,216 |

| CDT | Castle Minerals | 0.011 | 0% | 10% | -52% | $12,345,301 |

| RSG | Resolute Mining | 0.365 | 6% | 6% | 109% | $777,103,255 |

| MXR | Maximus Resources | 0.038 | -3% | 31% | -10% | $12,183,019 |

| EVN | Evolution Mining Ltd | 3.495 | -2% | 7% | 67% | $6,466,887,215 |

| CXU | Cauldron Energy Ltd | 0.01 | 11% | -15% | -5% | $8,762,118 |

| DLI | Delta Lithium | 0.595 | 3% | -23% | 16% | $312,252,304 |

| ALY | Alchemy Resource Ltd | 0.012 | 20% | 9% | -65% | $11,780,763 |

| HXG | Hexagon Energy | 0.009 | 13% | 0% | -36% | $4,103,327 |

| OBM | Ora Banda Mining Ltd | 0.155 | 19% | 55% | 96% | $264,343,955 |

| SLR | Silver Lake Resource | 1.06 | 9% | 24% | -10% | $995,502,715 |

| AVW | Avira Resources Ltd | 0.002 | 33% | 0% | -33% | $4,267,580 |

| LCY | Legacy Iron Ore | 0.017 | 0% | 6% | 0% | $108,916,045 |

| PDI | Predictive Disc Ltd | 0.23 | 7% | 18% | 48% | $475,696,140 |

| MAT | Matsa Resources | 0.032 | -6% | 10% | -18% | $15,697,243 |

| ZAG | Zuleika Gold Ltd | 0.016 | 14% | 45% | -27% | $7,845,759 |

| GML | Gateway Mining | 0.022 | -8% | -24% | -65% | $5,859,338 |

| SBM | St Barbara Limited | 0.185 | -14% | -3% | -17% | $147,234,668 |

| SBR | Sabre Resources | 0.04 | -17% | 5% | 0% | $11,367,961 |

| STK | Strickland Metals | 0.155 | 57% | 121% | 223% | $176,126,071 |

| SAU | Southern Gold | 0.015 | 15% | 25% | -46% | $7,294,279 |

| CEL | Challenger Gold Ltd | 0.085 | 6% | 9% | -47% | $100,508,684 |

| LRL | Labyrinth Resources | 0.006 | 20% | 0% | -65% | $7,125,262 |

| NST | Northern Star | 11.58 | -4% | 10% | 29% | $13,307,980,523 |

| OZM | Ozaurum Resources | 0.098 | 10% | 2% | 31% | $13,652,500 |

| TG1 | Techgen Metals Ltd | 0.023 | -23% | -21% | -81% | $1,774,870 |

| XAM | Xanadu Mines Ltd | 0.066 | 0% | -12% | 136% | $103,182,924 |

| AQI | Alicanto Min Ltd | 0.048 | -2% | 7% | 45% | $28,803,330 |

| KTA | Krakatoa Resources | 0.027 | 23% | 13% | -56% | $11,307,346 |

| ARN | Aldoro Resources | 0.094 | -5% | 8% | -68% | $12,654,632 |

| WGX | Westgold Resources. | 2.01 | 2% | 17% | 164% | $1,004,080,188 |

| MBK | Metal Bank Ltd | 0.03 | -6% | -23% | 1% | $11,138,415 |

| A8G | Australasian Metals | 0.17 | -6% | -11% | -26% | $8,860,484 |

| TAR | Taruga Minerals | 0.0105 | 17% | -5% | -64% | $7,413,281 |

| DTR | Dateline Resources | 0.011 | 10% | -21% | -84% | $10,625,314 |

| GOR | Gold Road Res Ltd | 1.81 | -1% | 10% | 31% | $2,002,700,142 |

| S2R | S2 Resources | 0.185 | -3% | 6% | 37% | $75,866,932 |

| NES | Nelson Resources. | 0.004 | 0% | -33% | -43% | $2,454,377 |

| TLM | Talisman Mining | 0.14 | -3% | 4% | 8% | $28,248,052 |

| BEZ | Besragoldinc | 0.1225 | -23% | -21% | 196% | $50,172,109 |

| PRU | Perseus Mining Ltd | 1.685 | -2% | 2% | -10% | $2,328,190,905 |

| SPQ | Superior Resources | 0.025 | 9% | 4% | -58% | $47,698,398 |

| PUR | Pursuit Minerals | 0.011 | 22% | 22% | 10% | $26,495,743 |

| RMS | Ramelius Resources | 1.61 | -5% | 12% | 98% | $1,857,573,333 |

| PKO | Peako Limited | 0.005 | 0% | -17% | -69% | $2,635,424 |

| ICG | Inca Minerals Ltd | 0.018 | -10% | 6% | -38% | $8,370,796 |

| A1G | African Gold Ltd. | 0.038 | -5% | -7% | -64% | $6,772,448 |

| OAU | Ora Gold Limited | 0.0075 | 7% | -6% | 50% | $33,521,249 |

| GNM | Great Northern | 0.021 | 5% | -13% | -65% | $3,092,582 |

| KRM | Kingsrose Mining Ltd | 0.049 | -2% | 2% | -11% | $37,626,326 |

| BTR | Brightstar Resources | 0.011 | 5% | 0% | -45% | $21,074,167 |

| RRL | Regis Resources | 1.7475 | 2% | 16% | 10% | $1,310,512,832 |

| M24 | Mamba Exploration | 0.029 | -17% | -45% | -78% | $1,768,517 |

| TRM | Truscott Mining Corp | 0.063 | 0% | 9% | 85% | $10,402,024 |

| TNC | True North Copper | 0.145 | 0% | -22% | 174% | $37,677,010 |

| MOM | Moab Minerals Ltd | 0.007 | 0% | -13% | -36% | $4,983,744 |

| KNB | Koonenberrygold | 0.036 | -16% | -20% | -54% | $4,550,465 |

| AWJ | Auric Mining | 0.064 | 33% | 52% | -4% | $7,851,575 |

| AZS | Azure Minerals | 4.03 | 15% | 42% | 1480% | $1,649,328,217 |

| ENR | Encounter Resources | 0.375 | 39% | 23% | 134% | $138,434,023 |

| SNG | Siren Gold | 0.061 | -10% | -9% | -62% | $9,696,060 |

| STN | Saturn Metals | 0.135 | 4% | -10% | -46% | $26,609,892 |

| USL | Unico Silver Limited | 0.1 | 1% | 11% | -23% | $29,605,159 |

| PNM | Pacific Nickel Mines | 0.099 | 10% | 2% | 38% | $41,825,311 |

| AYM | Australia United Min | 0.003 | 50% | 0% | -25% | $5,527,732 |

| ANL | Amani Gold Ltd | 0.001 | 0% | 0% | 0% | $25,143,441 |

| HAV | Havilah Resources | 0.24 | 4% | -3% | -23% | $72,827,018 |

| SPR | Spartan Resources | 0.41 | 3% | -4% | 117% | $351,153,334 |

| PNT | Panthermetalsltd | 0.073 | -3% | -9% | -60% | $4,463,950 |

| MEK | Meeka Metals Limited | 0.038 | -10% | 0% | -32% | $41,508,563 |

| GMD | Genesis Minerals | 1.445 | -1% | 4% | 26% | $1,506,044,755 |

| PGO | Pacgold | 0.215 | -9% | 13% | -45% | $18,006,402 |

| FEG | Far East Gold | 0.15 | -6% | -6% | -75% | $27,090,932 |

| MI6 | Minerals260Limited | 0.33 | -11% | -28% | 3% | $78,390,000 |

| IGO | IGO Limited | 9.765 | -9% | -23% | -35% | $7,080,454,052 |

| GAL | Galileo Mining Ltd | 0.305 | -5% | -26% | -73% | $60,275,603 |

| RXL | Rox Resources | 0.23 | 2% | 2% | 10% | $88,207,855 |

| KIN | KIN Min NL | 0.059 | 13% | 51% | -26% | $65,976,431 |

| CLZ | Classic Min Ltd | 0.001 | 0% | 0% | -92% | $12,357,082 |

| TGM | Theta Gold Mines Ltd | 0.135 | 8% | 8% | 69% | $95,185,126 |

| FAL | Falconmetalsltd | 0.145 | 7% | -3% | -22% | $26,550,000 |

| SXG | Southern Cross Gold | 0.865 | -5% | 7% | 114% | $69,342,830 |

| SPD | Southernpalladium | 0.39 | 1% | -10% | -58% | $16,800,548 |

| ORN | Orion Minerals Ltd | 0.016 | -6% | -16% | -16% | $96,673,923 |

| TMB | Tambourahmetals | 0.16 | 33% | -11% | 19% | $13,685,158 |

| TMS | Tennant Minerals Ltd | 0.025 | -4% | -14% | -19% | $18,985,835 |

| AZY | Antipa Minerals Ltd | 0.013 | 18% | 0% | -46% | $57,887,311 |

| PXX | Polarx Limited | 0.008 | 0% | -16% | 14% | $12,476,934 |

| TRE | Toubaniresourcesinc | 0.115 | -4% | 15% | 0% | $16,063,880 |

| AUN | Aurumin | 0.025 | -17% | 4% | -70% | $7,961,077 |

| GPR | Geopacific Resources | 0.015 | -12% | 0% | -71% | $13,960,249 |

| FXG | Felix Gold Limited | 0.05 | -12% | -32% | -57% | $5,579,201 |

Best-performing goldies over the past week

The week’s biggest gains

Strickland Metals (ASX:STK): +57%

Tietto Minerals (ASX:TIE): +44%

Encounter Resources (ASX:ENR) : +39%

North Stawell Minerals (ASX:NSM) : +36%

Nagambie Resources (ASX:NAG): +32%

This week’s gilt-edged head turners

Which ASX goldies have beaut stories to share this week? Plenty. In no particular preferential order, let’s start with…

Tietto Minerals (ASX:TIE) After ramp-up blues, will Chinese premium be enough to satisfy the board and shareholders of Tietto Minerals? Read more > here And… late-breaking news from Josh on this > here

Strickland Metals (ASX:STK) has now commenced diamond drilling to test what it believes could be a concealed gold deposit – dubbed Marwari. Hole MWDD001 was completed yesterday, extending a further 111m from initial planned depth, Strickland has revealed. Read more > here

Nagambie Resources (ASX:NAG) came off a trading halt today after delivering its annual report to the ASX. Earlier this month, NAG noted that the average stope grade at its 100%-owned namesake antimony-gold mine in Victoria is now 5.6% Sb, making the discovery “the highest-grade antimony mineralisation in Australia”. Read more > here.

Magnetic Resources (ASX:MAU): Explorer Magnetic Resources has backed up its recent drilling success at Lady Julie with confirmation the best zones are still open at depth. Read more > here

Titan Minerals (ASX:TTM): A maiden JORC-compliant resource of 3.12Moz gold and 21.98Moz silver for the Dynasty project in southern Ecuador headlined a pivotal quarter for the company. Read more > here

Tempus Resources (ASX:TMR) has released the resource estimate for its Elizabeth gold project in Canada of 317,200t at 5.97g/t gold for 60,900oz. Read more > here

Diablo Resources (ASX:DBO) has flagged some solid gold and copper hits from the maiden RC drilling program at its Devils Canyon project in Nevada, USA. Read more > here

Desoto Resources’ (ASX:DES) hunt for a tier 1 discovery at its Fenton project in the NT is off to a strong start, with maiden drilling showing the potential for a 2km-long gold zone. Read more >here

Ora Banda (ASX:OBM) says high grade intercepts have unveiled the potential for the Sand King deposit to become the second underground gold mine at its Davyhurst gold project in WA. Read more > here

First Au (ASX:FAU) received statutory endorsement from Earth Resources and Regulation (ERR) this week, for its work plan in relation to the proposed bulk sampling at the Snowstorm Gold Project in East Gippsland, Victoria. Read more > here

West Wits Mining (ASX:WWI): Investors have demonstrated their support for West Wits’ push to develop its Qala Shallows gold project by backing a $1.2m placement. Read more > here

Native Mineral Resources (ASX:NMR): A pivotal agreement with Ashby Mining could launch Native Mineral Resources from junior explorer to near-term gold producer at the Far Fanning and Black Jack deposits near Charters Towers, QLD. Read more >here

CGN Resources (ASX:CGR): This newly listed iron-oxide-copper-gold (IOCG) and carbonatite explorer is looking to replicate the success of its northern neighbour WA1 Resources (ASX:WA1). Read more > here.

Antilles Gold (ASX:AAU): During the quarter AR1 continued to focus on extending copper mine life at its Mt Isa copper cathode operations in QLD as the flagship Anthill campaign is set to conclude in March 2025. Read more > here

Emerald Resources (ASX:EMR): On a 120% gain this year to date, $1.6 billion Cambodian gold miner Emerald Resources walks into ASX 200. Read more >here

Maximus Resources (ASX:MXR): RC drilling at Maximus’ Kandui prospect and Hilditch gold project has intersected lithium, nickel and gold. Read more >here

Warriedar Resources (ASX:WA8): Independent Investment Research note flags discovery potential at WA8’s historic projects in WA. More > here and here

Spartan Resources (ASX:SPR): Drilling at Spartan’s non-core Glenburgh and Egerton gold projects return high-grade hits. Read more > here

Golden Mile Resources (ASX:G88): Metallurgical testing at the flagship 26.3Mt Quicksilver nickel-cobalt project in WA is indicating opportunities for producing a range of high-value concentrates. Read more > here

Indiana Resources (ASX:IDA) has resumed its gold, rare earths and base metals hunt in South Australia’s Gawler Craton following a $3.8m cap raise. Read more > here

Note: Several of the stocks listed in this article are Stockhead advertisers at the time of writing, however, none of them sponsored this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.