Guy on Rocks: Missed WA1? Don’t tear your hair out – here’s a cheap new neighbour

No cigar for you. Picture: Getty Images

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions

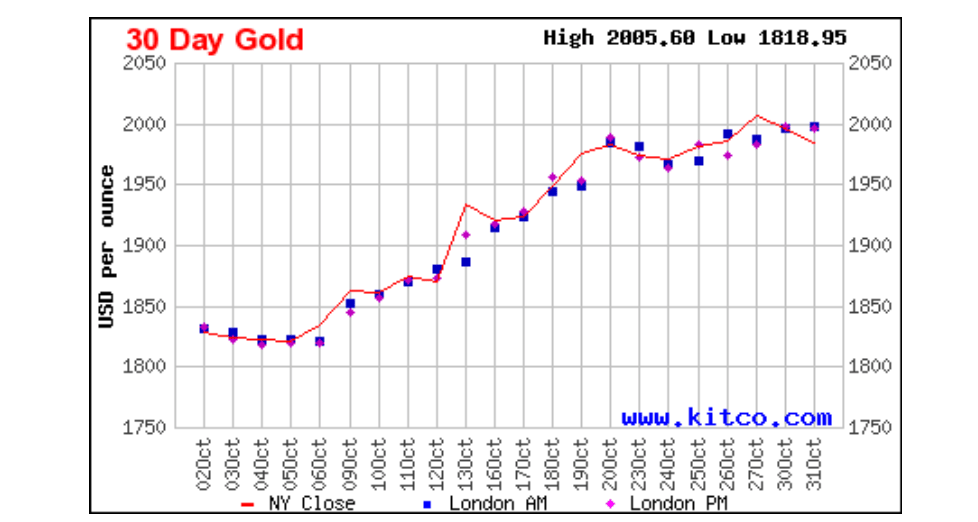

A strong US dollar put the brakes on gold and silver prices earlier this week after gold surged past US$2,000/ounce as the Middle East conflict escalated. The DXY is sitting at 106.77, up 20 basis points and US 10-year Treasuries are off 6 basis points to 4.90% over the last week with the market no doubt waiting for the outcome of the FOMC meeting which is now underway.

Gold is currently trading at US$1,978/ounce (figure 1). December silver was last at $23.00, down 39 cents over the week. Platinum is sitting at US$925/oz, up US$35 last week with palladium bouncing off 4.5-year lows to close up 2% to US$1,106/oz.

Volatility remains high with the VIX index at 18 after hitting 22 on Friday last week.

The World Gold Council recently reported that gold-buying surged to 800 tons over the first nine months of 2023 and could hit a record in 2023 (figure 2).

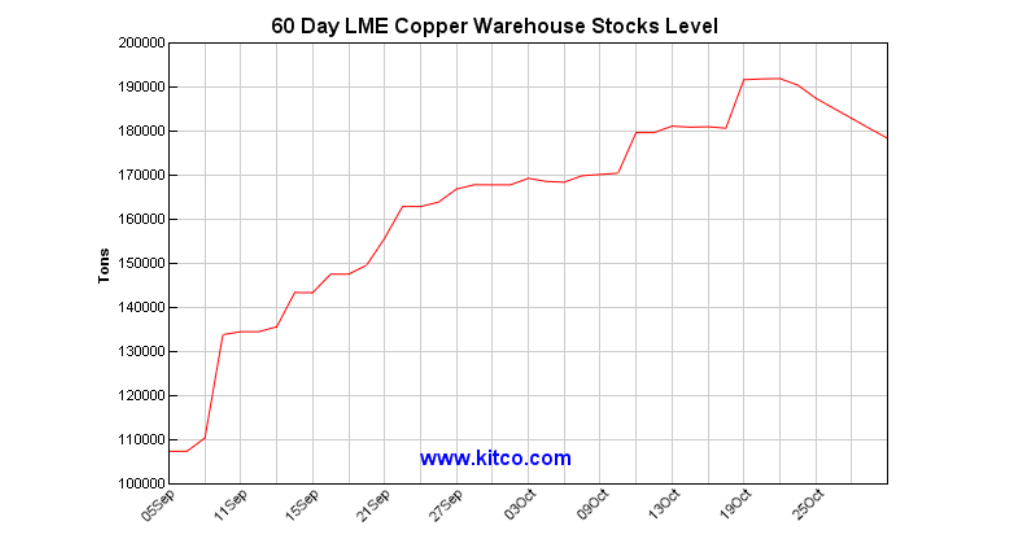

Copper closed up 4% for the week closing around US$3.63/lb and remains in a one cent contango as stockpiles came off from recent highs (figure 3).

Market commentators are expecting the FOMC to pause interest rates. The Bank of Japan paused rates earlier this week and restated its longer-term goal of 2% inflation.

In other economic news last week US personal consumer expenditure moved up sharply to 3.7%, reinforcing the underlying strength of the US economy.

After Exxon’s tilt at Pioneer a few weeks ago Conico Philips have come out and stated that they see more consolidation in the Permian basin. At the same time, Biden is now going after avgas which comprises less than 1% of the US fuel market but is essential for light planes.

Uranium continued its strong year to finish the week at US$74.38, up another 2.5% despite equities failing to respond. Interest in uranium projects worldwide, particularly in the favoured jurisdictions of the US, Canada and Australia, is escalating sharply as companies position themselves for some yellow fever just around the corner…

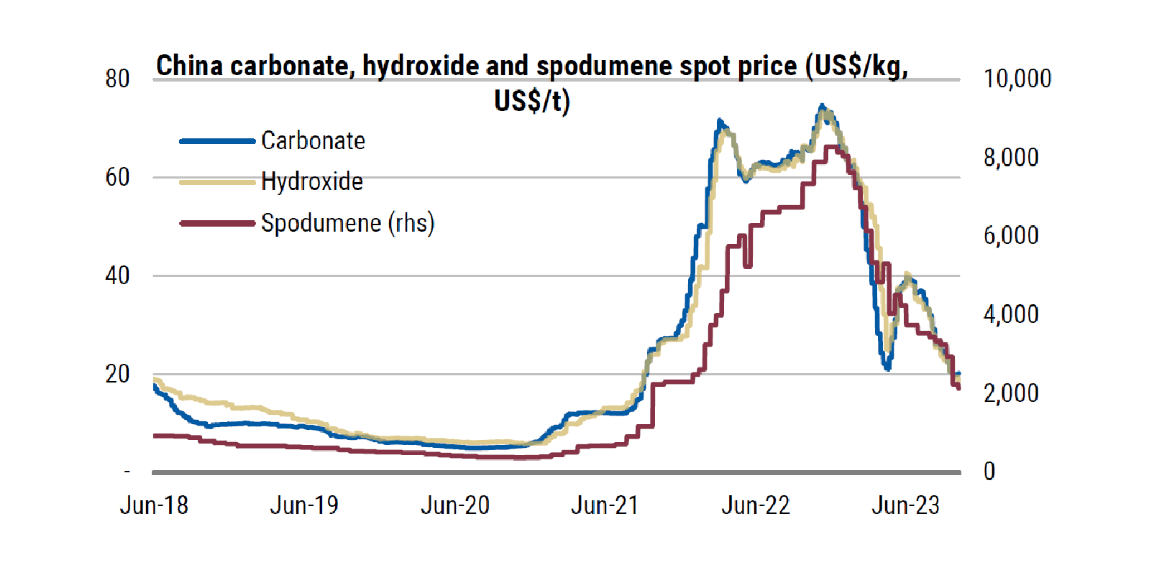

Despite lithium prices being under pressure over the last 12 months (figure 4), the white-hot lithium sector marches on here in Western Australia with Gina Rhinehart (via Hancock Prospecting) and Chris Ellison (Mineral Resources) coming in like low-flying bombers in the last few weeks to snap up 18% of Azure Minerals (ASX: AZS) (60% owner of Andover lithium) and 19.85% of Pilbara explorer Wildcat Resources (ASX: WC8) respectively.

Wildcat has an eye-watering market capitalisation of just under $1 billion on the back of string of impressive lithium hits; not bad for a company that is yet to publish a resource!

Hancock is now in a position to block last week’s $3.50/share takeover offer by Sociedad Quimica y Minr de Chile SA (NYSE: SQM). A few weeks ago Gina saw Albemarle Corp (NYSE: ALB) off the property after buying a blocking stake in Liontown Resources (ASX: LTR).

New Ideas

Newly listed iron-oxide-copper-gold (IOCG) and carbonatite explorer CGN Resources (ASX: CGR) is looking to replicate the success of its northern neighbor WA1 Resources (ASX: WA1) which has been on a tear over the last 12 months on the back of what looks like to be a very high-grade niobium resource.

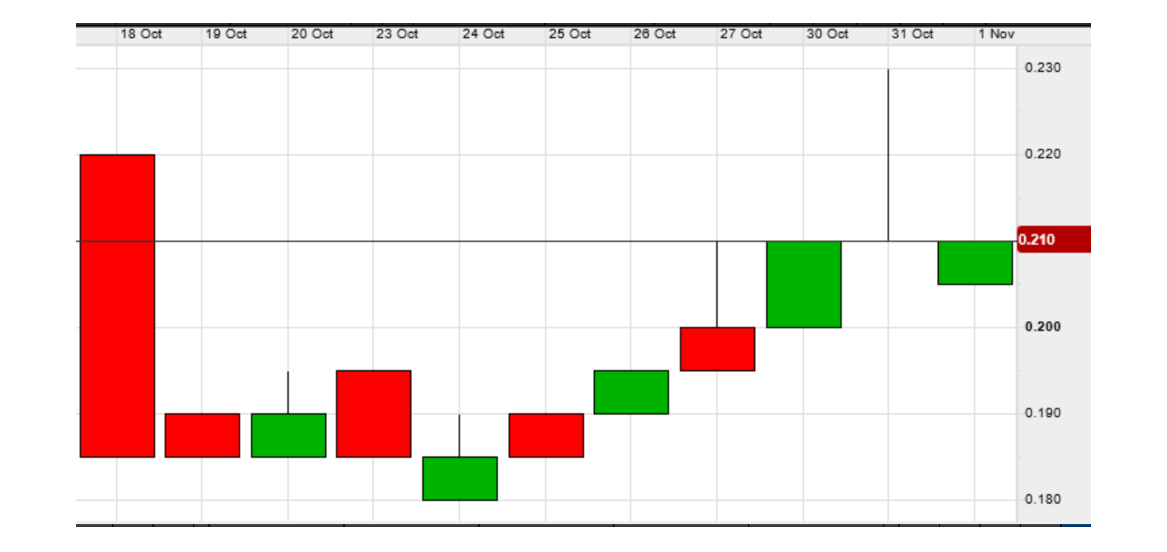

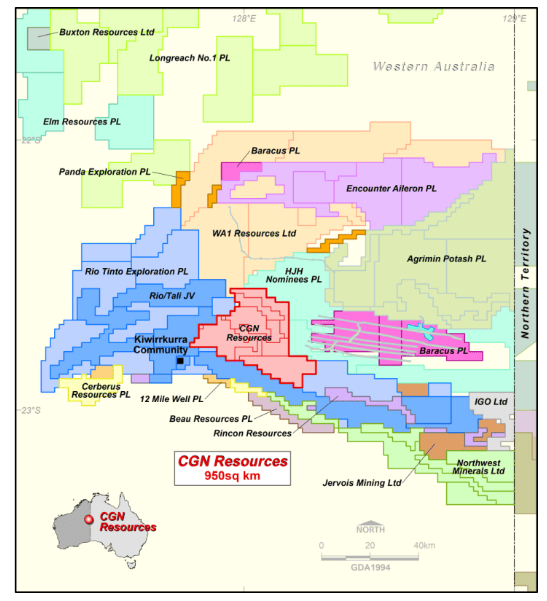

CGR has a 948km2 land position in the West Arunta (figure 7) and came onto the market with a $12.2m enterprise value at the 20 cents/share IPO price. Its ground is situated due south of WA1 Resources (ASX: WA1), which boasts a market capitalisation of $526m following some recent stonking hits at their Luni prospect.

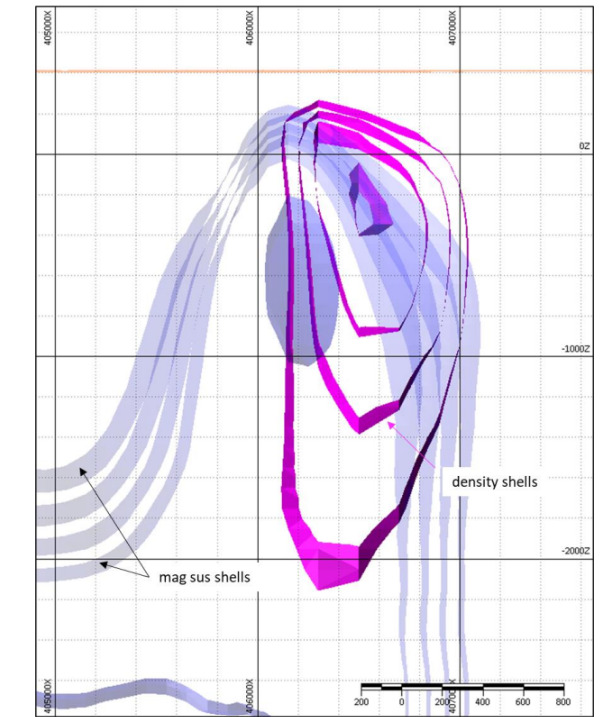

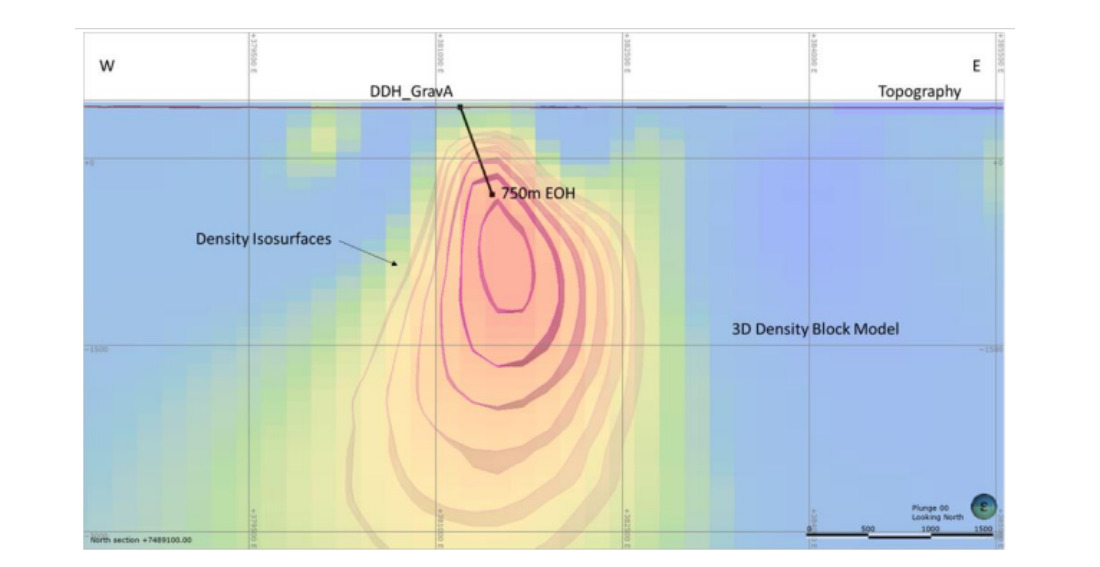

The key prospects are Tantor and Surus, which are defined by coincident geophysics and geochemistry.

Tantor (figure 8) is a 2km x 1km coincident gravity and magnetic anomaly within a regional copper-cobalt surface geochemistry anomaly. It is similar in scale and style to Prominent Hill in South Australia.

Surus (figure 9) is a 3km x 2km gravity anomaly within a regional copper surface geochemistry anomaly.

First prize would be to land a carbonatite along the lines of WA1 Resources’ Luni Carbonatite which has a similar geophysical signature to both Tantor and Surus. With Rio Tinto spending $58m to the west on its adjoining tenements as part of the Rio Tinto-Tali JV, and WA1 Resources becoming a millionaires’ club, there is excellent leverage to any discovery for CGR.

Unfortunately, not all the CGN shareholders were able to celebrate the successful IPO at Cigar Social given the Cigar Social Climate Change Sceptic Committee’s strict entry requirements. One was once kicked out for no crime other than having no hair atop his head.

With a market capitalisation of around $20 million at 20 cents per share let’s hope they can go some way to replicating the $500m of WA1. The drills are reaching target depth on the first diamond hole which will no doubt be watched closely by the CSCCSC given a number of them are still holding WA1 at the right price…

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.