Two mine-ready gold projects? New joint venture could make Native Mineral Resources a producer within two years

Pic via Getty Images.

- NMR has agreed to purchase interests in two near-term gold projects in QLD

- A JV will be created with Ashby Mining

- The company is committing to spend $2m in exploration

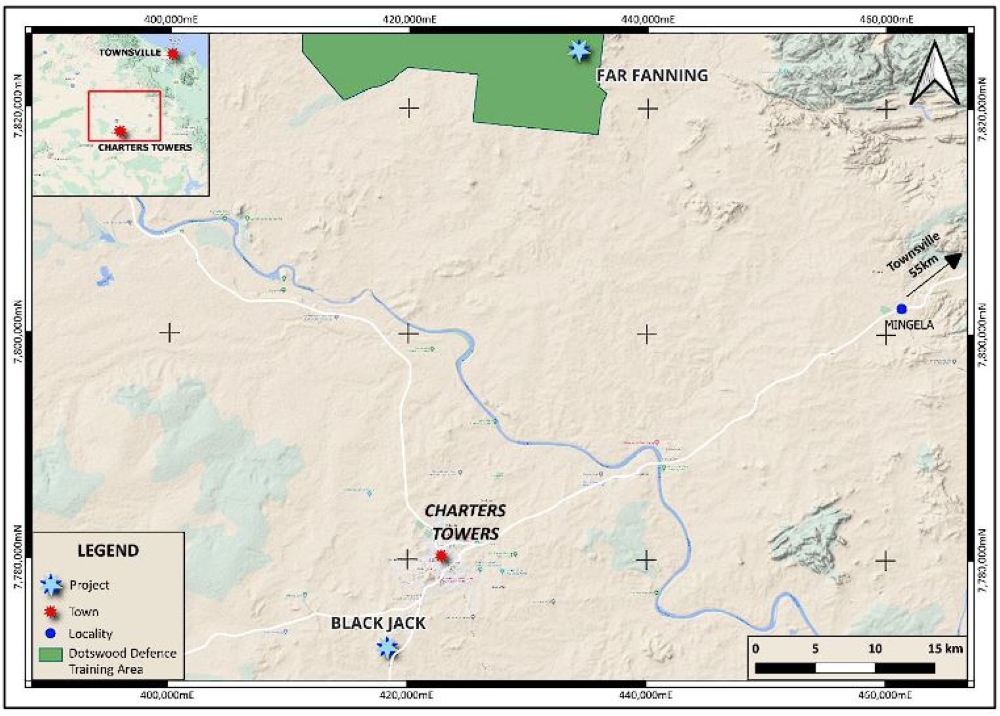

A pivotal agreement with Ashby Mining could launch Native Mineral Resources from junior explorer to near-term gold producer at the Far Fanning and Black Jack deposits near Charters Towers, QLD.

Far Fanning is a historic mine with a resource of 2.3Mt @ 1.84g/t Au for 138,000oz gold and consists of five mining leases across a 2.6km2 area.

Black Jack contains 12 mining leases, five of which will make up part of Native Mineral Resources’ (ASX:NMR) share of the proposed JV. They cover three shallow oxide pits that sit above the historic Black Jack underground mine which produced 20,796oz until 1889.

Terms of the JV

Ashby has granted NMR exclusive rights to undertake due diligence into the Far Fanning and Black Jack projects.

Once completed, NMR will commit to a $2m spend in the first two years to obtain a 60% interest in the JV with a right to increase to 85% once 70,000t of gold has been stockpiled.

Ashby will own the Black Jack CIL processing plant and be responsible for repairs and upgrades to the mill.

NMR says the JV with Ashby would propel it from junior explorer to gold producer in less than two years.

“NMR is extremely excited to be able to take advantage of this unique opportunity further investigate its participation in two near-mine projects with no upfront cash payment,” NMR MD Blake Cannavo says.

“Far Fanning and Black Jack are both advanced projects and would give NMR a substantial head start on becoming a miner and gold producer.

“We are looking forward to working closely with Ashby over the coming weeks to finalise our due diligence work and agree to a binding legal documentation.”

Upcoming zinc and lithium drilling

Meanwhile, NMR will drill its next diamond hole at its Maneater Hill project in November to test a chargeability high anomaly that is associated with a resistive low and a magnetic low within the eastern anomaly.

Previous exploration at the project uncovered a “potentially large mineralised system” with drilling indicating that zinc mineralisation increases with depth at the project.

The company also has a pipeline of activity planned at its McLaughlin Lake lithium project in Canada with initial planning for a maiden drilling in 1Q 2024 now well advanced.

This article was developed in collaboration with Native Mineral Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.