Gold Digger: AI tech boom will supercharge precious metals demand, claims new report

"Hmm, which Stockhead journo job will I take first?" Pic via Getty Images

- New report from Metals Focus predicts AI adoption could play a big role in tech sector’s need for gold and other precious metals

- Gold price momentum slows but still looks technically strong, says analyst

- The week’s top ASX goldie gainers: Bulletin, Calidus, Besra

Last week’s flight-to-safety momentum for gold amid world chaos may have slowed just a tad, but prices are still moving in the right direction for the precious metal as we round out the week.

At the time of writing, spot gold is changing hands for roughly US$1,990 (good year, that – especially for the Canberra Raiders) and about $3,143 of our Aussie dollars. This is higher than this time last week and still very close to the all-time high for bullion Down Under, which is about $3,163, posted yesterday.

We made a big deal about the Aussie gold ATH last week amid raging global conflicts and still-uncertain macroeconomic times.

It was, and still is, a big deal, but we have a feeling we haven’t seen the last of fresh weekly highs on spot gold in the short term. We’ll see how that statement holds up this time next week.

“Technically, December gold futures bulls have the overall near-term technical advantage,” wrote Kitco’s analytical gold charts watcher Jim Wyckoff, adding:

“Prices are in an uptrend on the daily bar chart. Bulls’ next upside price objective is to produce a close above solid resistance at the October high of US$2,009.20.”

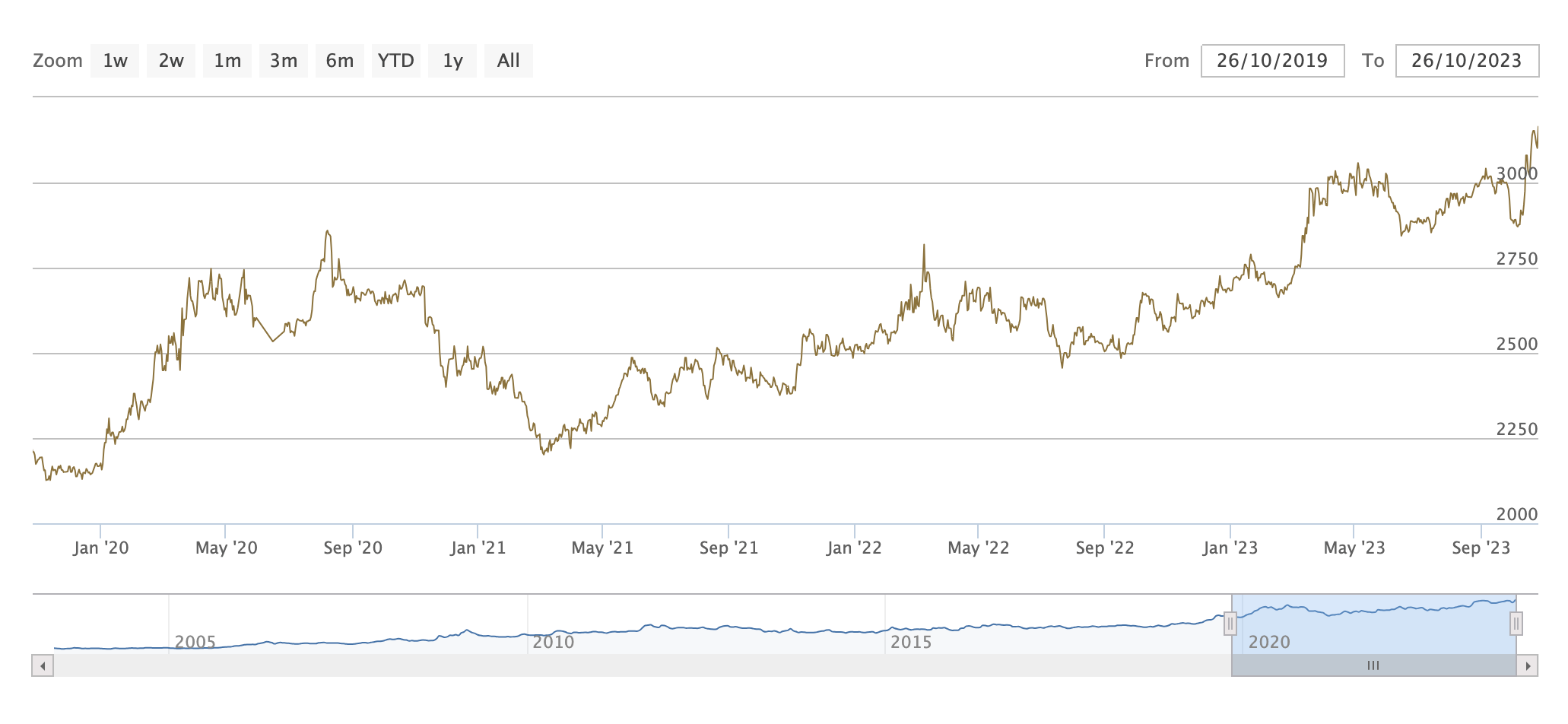

Zooming out a tad, though, here’s how gold’s travelled over the past few years. You probably don’t need a reminder of how and why the stock markets crashed in early 2020, and how gold performed correspondingly. It’s a cruel mistress that rides high on crisis, but gotta respect the consistency, and the hedge.

Gold up, futures reach $2,000. Dollar up too. Interesting times ahead… pic.twitter.com/0bMCbVeQL4

— Jan Nieuwenhuijs (@JanGold_) October 26, 2023

AI will drive demand for gold: Metals Focus report

Wars, pandemic, inflation, chaos in general and the strength/weakness of the US dollar – yep these things are all factors in the flight to the safety (and steady increase over time) of gold.

And obviously factors of supply and demand greatly affect the precious metal’s price, too. Supply, that is, from mining companies. And demand, certainly lately, significantly coming from global central bank hoarders and other investors.

But what else can drive the demand for the precious commodity? The jewellery trade and industrial usage.

Interestingly, according to a new report from independent global precious metals research group Metals Focus, the tech boom surrounding artificial intelligence (AI) “should” help support industrial demand for gold and other precious metals in 2024.

⛏️ Read this week's Precious Metals Weekly which focuses on how supportive AI will be of higher industrial demand. If you would like to subscribe to our weekly newsletter and learn more about the industry, subscribe here: https://t.co/6sBAHAh3Tk

— Metals Focus (@MetalsFocus) October 25, 2023

Meanwhile the World Gold Council’s website notes that jewellery still represents the largest source of annual demand for gold per sector – near 50% of total gold demand, with China and India by far the biggest markets (albeit waning somewhat this year). Rappers such as Kanye and Jay Z make a fair crack as a competing market, too. Joking, sort of…

And industry/tech only represents about 7% of global gold demand at the moment according to Statista research, with investments and central banks making up the rest.

But the tech demand looks like it’s set to increase in coming years with the increase of generative AI and conversational AI applications, such as Chat GPT, for instance. How so?

AI boom takes precious metals along for the ride

“Expected upside from several applications that are gradually maturing should help support the recovery in industrial offtake [of precious metals] next year,”Metals Focus notes.

The thesis there is that a boom in demand for AI applications creates a boom in demand for the chips and components that help power the tech – a boon for manufacturers such as Nvidia, but also for precious metals producers.

“At present, among the various emerging applications there is little that is capturing more spotlight than artificial intelligence (AI)… Generative AI is expected to make inroads in a growing number of fields, particularly in 2024, wrote the precious metals consultancy.

Since most components used in conjunction with AI devices are high-specification, “we expect to see widespread support for a range of precious metals bearing components”.

Also:

“To cope with the evolution of AI algorithms, shipping growth for AI servers and switches will rise by double digits over the next few years and stimulate precious metals demand.

“Demand will rise for platinum alloys used in chip manufacturing, silver-palladium Ag-Pd multi-layer ceramic capacitors (MLCCs) in high power components, gold bonding wire in chip and memory packages, gold plating in printed circuit boards and palladium plating on lead frames.”

And here’s an example of the incredible power of AI technology…

Peter Schiff finally admits he’s seen the light and he’s selling all his gold for #Bitcoin pic.twitter.com/18rNfXCp4D

— The ₿itcoin Therapist (@TheBTCTherapist) October 24, 2023

Next stop, AI is definitely plotting in the background, secretly planning to take over our jobs at Stockhead when we’re down the pub on a Friday and not looking…

(It bangs on a bit here, so we’d best not go into it any further.)

Winners & Losers

Here’s how ASX-listed precious metals stocks are performing:

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop.

Stocks missing from this list? Email [email protected] and/or [email protected]

| Code | Company | Price | % Week | % Month | % Year | Market Cap |

|---|---|---|---|---|---|---|

| MRR | Minrex Resources Ltd | 0.014 | -10% | -3% | -67% | $16,273,013 |

| NPM | Newpeak Metals | 0.001 | 0% | 0% | 0% | $9,995,579 |

| ASO | Aston Minerals Ltd | 0.032 | -11% | -6% | -58% | $42,737,121 |

| MTC | Metalstech Ltd | 0.145 | -15% | -3% | -64% | $27,347,666 |

| FFX | Firefinch Ltd | 0.2 | 0% | 0% | 0% | $236,569,315 |

| GED | Golden Deeps | 0.05 | -2% | -9% | -62% | $5,776,117 |

| G88 | Golden Mile Res Ltd | 0.022 | 0% | -27% | -13% | $7,246,569 |

| DCX | Discovex Res Ltd | 0.002 | 0% | 0% | -43% | $6,605,136 |

| NMR | Native Mineral Res | 0.038 | -32% | -10% | -73% | $7,658,354 |

| AQX | Alice Queen Ltd | 0.014 | 0% | 8% | -72% | $1,771,208 |

| SLZ | Sultan Resources Ltd | 0.018 | 0% | -14% | -81% | $2,667,421 |

| MKG | Mako Gold | 0.016 | -16% | 23% | -62% | $9,216,131 |

| KSN | Kingston Resources | 0.084 | -2% | 4% | 4% | $43,322,680 |

| AMI | Aurelia Metals Ltd | 0.091 | -2% | 0% | -5% | $155,042,375 |

| PNX | PNX Metals Limited | 0.004 | 0% | 60% | 7% | $21,522,499 |

| GIB | Gibb River Diamonds | 0.038 | 0% | 41% | -31% | $8,037,359 |

| KCN | Kingsgate Consolid. | 1.065 | -7% | -10% | -35% | $278,371,827 |

| TMX | Terrain Minerals | 0.005 | 25% | 0% | -17% | $5,030,575 |

| BNR | Bulletin Res Ltd | 0.16 | 63% | 122% | 14% | $36,698,888 |

| NXM | Nexus Minerals Ltd | 0.039 | -5% | -24% | -75% | $14,784,285 |

| SKY | SKY Metals Ltd | 0.04 | -5% | -13% | -20% | $18,455,924 |

| LM8 | Lunnonmetalslimited | 0.735 | 4% | -5% | -5% | $156,515,631 |

| CST | Castile Resources | 0.059 | 23% | 18% | -49% | $13,788,438 |

| YRL | Yandal Resources | 0.055 | 4% | 8% | -50% | $8,836,972 |

| FAU | First Au Ltd | 0.0025 | 0% | 0% | -50% | $3,629,983 |

| ARL | Ardea Resources Ltd | 0.505 | 3% | -17% | -42% | $93,437,719 |

| GWR | GWR Group Ltd | 0.07 | -1% | -17% | 9% | $22,485,166 |

| IVR | Investigator Res Ltd | 0.042 | 14% | 2% | -11% | $56,049,631 |

| GTR | Gti Energy Ltd | 0.007 | -18% | -30% | -56% | $16,359,577 |

| IPT | Impact Minerals | 0.0095 | -5% | -21% | 36% | $28,647,039 |

| BNZ | Benzmining | 0.36 | -5% | -18% | -22% | $37,995,501 |

| MOH | Moho Resources | 0.007 | 0% | -22% | -73% | $2,720,355 |

| BBX | BBX Minerals Ltd | 0.028 | 8% | 4% | -56% | $18,277,303 |

| PUA | Peak Minerals Ltd | 0.004 | 33% | 33% | -33% | $3,644,818 |

| MRZ | Mont Royal Resources | 0.155 | -9% | -21% | -16% | $13,578,664 |

| SMS | Starmineralslimited | 0.035 | -22% | -13% | -60% | $1,558,870 |

| MVL | Marvel Gold Limited | 0.012 | 9% | 20% | -50% | $9,501,698 |

| PRX | Prodigy Gold NL | 0.008 | 0% | 0% | -27% | $14,008,863 |

| AAU | Antilles Gold Ltd | 0.021 | -5% | -16% | -56% | $17,047,501 |

| CWX | Carawine Resources | 0.118176 | 9% | -14% | 40% | $23,259,101 |

| RND | Rand Mining Ltd | 1.3 | 2% | 0% | -13% | $74,223,129 |

| CAZ | Cazaly Resources | 0.031 | -11% | -16% | -6% | $12,245,093 |

| BMR | Ballymore Resources | 0.13 | 0% | 30% | -32% | $19,005,644 |

| DRE | Dreadnought Resources Ltd | 0.03 | -32% | -42% | -74% | $110,194,673 |

| ZNC | Zenith Minerals Ltd | 0.09 | -3% | -1% | -68% | $32,066,660 |

| REZ | Resourc & En Grp Ltd | 0.015 | 0% | -6% | -29% | $7,497,087 |

| LEX | Lefroy Exploration | 0.175 | 3% | -3% | -40% | $34,352,807 |

| ERM | Emmerson Resources | 0.06 | -2% | -6% | -24% | $32,682,587 |

| AM7 | Arcadia Minerals | 0.09 | -5% | -14% | -71% | $9,814,509 |

| ADT | Adriatic Metals | 3.48 | -1% | -1% | 44% | $812,764,349 |

| GMR | Golden Rim Resources | 0.021 | 5% | -5% | -46% | $12,423,356 |

| CYL | Catalyst Metals | 0.6 | -6% | 22% | -48% | $132,052,526 |

| CHN | Chalice Mining Ltd | 1.88 | 0% | -18% | -56% | $696,244,314 |

| KAL | Kalgoorliegoldmining | 0.028 | -7% | -7% | -73% | $4,304,587 |

| MLS | Metals Australia | 0.034 | 3% | 3% | -13% | $21,217,230 |

| ADN | Andromeda Metals Ltd | 0.021 | 5% | 0% | -48% | $65,310,177 |

| MEI | Meteoric Resources | 0.24 | 14% | 2% | 1746% | $456,054,425 |

| SRN | Surefire Rescs NL | 0.014 | 0% | -7% | 8% | $23,169,089 |

| SIH | Sihayo Gold Limited | 0.002 | 0% | 0% | -20% | $24,408,512 |

| WA8 | Warriedarresourltd | 0.058 | -3% | -21% | -59% | $28,246,926 |

| HMX | Hammer Metals Ltd | 0.042 | 2% | -7% | -34% | $38,115,516 |

| WCN | White Cliff Min Ltd | 0.012 | 4% | -8% | -37% | $15,084,223 |

| AVM | Advance Metals Ltd | 0.003 | 0% | -45% | -75% | $1,765,676 |

| WRM | White Rock Min Ltd | 0.063 | 0% | 0% | -19% | $17,508,200 |

| ASR | Asra Minerals Ltd | 0.007 | -13% | -18% | -71% | $10,126,460 |

| MCT | Metalicity Limited | 0.002 | -20% | 33% | -50% | $7,472,172 |

| AME | Alto Metals Limited | 0.045 | 0% | -2% | -41% | $32,853,204 |

| CTO | Citigold Corp Ltd | 0.005 | 25% | 11% | -17% | $11,494,636 |

| TIE | Tietto Minerals | 0.4125 | -1% | 18% | -43% | $467,991,537 |

| SMI | Santana Minerals Ltd | 0.595 | 13% | 8% | -14% | $102,253,117 |

| M2R | Miramar | 0.027 | -33% | -48% | -69% | $4,019,478 |

| MHC | Manhattan Corp Ltd | 0.005 | -17% | -29% | -17% | $14,684,899 |

| GRL | Godolphin Resources | 0.038 | 6% | 6% | -55% | $6,431,197 |

| TRY | Troy Resources Ltd | 0 | -100% | -100% | -100% | $62,920,961 |

| SVG | Savannah Goldfields | 0.058 | -8% | -11% | -72% | $11,625,533 |

| EMC | Everest Metals Corp | 0.1 | -9% | -9% | 0% | $12,795,178 |

| GUL | Gullewa Limited | 0.055 | 0% | 0% | -11% | $10,767,521 |

| CY5 | Cygnus Metals Ltd | 0.17 | 13% | -6% | -69% | $42,056,183 |

| G50 | Gold50Limited | 0.125 | -14% | 0% | 4% | $13,464,375 |

| ADV | Ardiden Ltd | 0.0055 | -8% | 10% | -21% | $16,130,012 |

| AAR | Astral Resources NL | 0.08 | -4% | -1% | 27% | $62,402,946 |

| MGV | Musgrave Minerals | 0 | -100% | -100% | -100% | $230,571,100 |

| VMC | Venus Metals Cor Ltd | 0.1 | 0% | -20% | 15% | $18,972,868 |

| NAE | New Age Exploration | 0.0055 | 0% | -21% | -27% | $9,866,444 |

| VKA | Viking Mines Ltd | 0.009 | -10% | -10% | 13% | $8,202,067 |

| LCL | LCL Resources Ltd | 0.026 | -7% | -4% | 10% | $23,034,829 |

| MTH | Mithril Resources | 0.001 | -33% | -50% | -80% | $3,368,804 |

| ADG | Adelong Gold Limited | 0.0065 | -7% | -7% | -19% | $4,174,256 |

| RMX | Red Mount Min Ltd | 0.004 | 0% | 0% | 0% | $10,694,304 |

| PRS | Prospech Limited | 0.02 | -13% | -26% | -36% | $4,395,200 |

| XTC | Xantippe Res Ltd | 0.001 | 0% | 0% | -76% | $17,528,005 |

| TTM | Titan Minerals | 0.035 | -3% | 0% | -54% | $53,373,364 |

| NML | Navarre Minerals Ltd | 0.019 | 0% | 0% | -59% | $28,555,654 |

| MZZ | Matador Mining Ltd | 0.046 | -4% | -15% | -58% | $14,828,220 |

| KZR | Kalamazoo Resources | 0.095 | -2% | -5% | -47% | $16,110,457 |

| BCN | Beacon Minerals | 0.026 | -4% | 8% | 8% | $97,675,972 |

| MAU | Magnetic Resources | 1.02 | 4% | 21% | 19% | $244,096,889 |

| BC8 | Black Cat Syndicate | 0.21 | 14% | -11% | -28% | $64,659,771 |

| EM2 | Eagle Mountain | 0.071 | -7% | -10% | -62% | $21,652,647 |

| EMR | Emerald Res NL | 2.595 | -8% | 1% | 131% | $1,628,162,477 |

| BYH | Bryah Resources Ltd | 0.014 | 0% | -7% | -41% | $5,020,474 |

| HCH | Hot Chili Ltd | 1.11 | 6% | -6% | 14% | $124,223,014 |

| WAF | West African Res Ltd | 0.73 | -4% | -7% | -30% | $733,670,850 |

| MEU | Marmota Limited | 0.036 | 13% | 3% | -23% | $39,175,621 |

| NVA | Nova Minerals Ltd | 0.255 | -9% | 6% | -64% | $57,994,739 |

| DCN | Dacian Gold Ltd | 0.28 | -5% | 133% | 100% | $340,704,263 |

| SVL | Silver Mines Limited | 0.165 | -6% | -6% | -8% | $231,714,804 |

| PGD | Peregrine Gold | 0.29 | 18% | -2% | -51% | $16,291,507 |

| ICL | Iceni Gold | 0.059 | -13% | -28% | -16% | $14,151,571 |

| FG1 | Flynngold | 0.065 | 7% | 25% | -41% | $8,864,868 |

| WWI | West Wits Mining Ltd | 0.014 | 0% | 0% | -26% | $34,819,511 |

| RML | Resolution Minerals | 0.006 | 20% | 0% | -45% | $6,286,459 |

| AAJ | Aruma Resources Ltd | 0.032 | -3% | 3% | -54% | $6,300,528 |

| AL8 | Alderan Resource Ltd | 0.012 | 0% | 9% | 33% | $6,783,641 |

| GMN | Gold Mountain Ltd | 0.006 | 20% | 0% | 0% | $13,614,472 |

| MEG | Megado Minerals Ltd | 0.035 | 6% | -13% | -51% | $8,905,945 |

| HMG | Hamelingoldlimited | 0.083 | -1% | -1% | -45% | $13,072,500 |

| TBA | Tombola Gold Ltd | 0.026 | 0% | 0% | -19% | $33,129,243 |

| BM8 | Battery Age Minerals | 0.235 | 9% | -10% | -53% | $20,947,169 |

| TBR | Tribune Res Ltd | 3.04 | 0% | -5% | -15% | $165,799,123 |

| FML | Focus Minerals Ltd | 0.155 | 7% | -16% | 3% | $47,282,176 |

| GSR | Greenstone Resources | 0.008 | -6% | -11% | -68% | $10,923,331 |

| VRC | Volt Resources Ltd | 0.0075 | -6% | -17% | -72% | $29,545,679 |

| ARV | Artemis Resources | 0.022 | 16% | -24% | -31% | $34,648,204 |

| HRN | Horizon Gold Ltd | 0.305 | 2% | -7% | -7% | $38,180,401 |

| CLA | Celsius Resource Ltd | 0.011 | 0% | 0% | -15% | $22,460,517 |

| QML | Qmines Limited | 0.081 | -10% | -15% | -56% | $18,226,965 |

| RDN | Raiden Resources Ltd | 0.037 | 54% | 16% | 333% | $77,083,551 |

| TCG | Turaco Gold Limited | 0.05 | 0% | -2% | 19% | $25,135,833 |

| KCC | Kincora Copper | 0.029 | -6% | -26% | -52% | $4,967,039 |

| GBZ | GBM Rsources Ltd | 0.018 | 13% | 20% | -64% | $11,165,793 |

| DTM | Dart Mining NL | 0.019 | -12% | -20% | -74% | $3,489,220 |

| MKR | Manuka Resources. | 0.044 | 5% | -4% | -66% | $24,750,883 |

| AUC | Ausgold Limited | 0.031 | 3% | -6% | -30% | $64,291,954 |

| ANX | Anax Metals Ltd | 0.035 | -3% | -13% | -42% | $15,046,637 |

| EMU | EMU NL | 0.0015 | -25% | -50% | -64% | $2,501,282 |

| SFM | Santa Fe Minerals | 0.043 | 0% | 0% | -51% | $3,131,208 |

| SSR | SSR Mining Inc. | 21.97 | 0% | -1% | 0% | $494,341,033 |

| PNR | Pantoro Limited | 0.041 | 0% | 8% | -71% | $208,161,221 |

| CMM | Capricorn Metals | 4.68 | -2% | 13% | 43% | $1,725,648,023 |

| X64 | Ten Sixty Four Ltd | 0.57 | 0% | 0% | -7% | $130,184,182 |

| SI6 | SI6 Metals Limited | 0.005 | -9% | -29% | -9% | $9,969,297 |

| HAW | Hawthorn Resources | 0.095 | 4% | -5% | 13% | $31,826,483 |

| BGD | Bartongoldholdings | 0.235 | 0% | 21% | 68% | $45,945,742 |

| SVY | Stavely Minerals Ltd | 0.074 | 7% | 1% | -41% | $27,554,786 |

| AGC | AGC Ltd | 0.0645 | 3% | -1% | -5% | $6,500,000 |

| RVR | Red River Resources | 0 | -100% | -100% | -100% | $37,847,908 |

| RGL | Riversgold | 0.01 | -17% | -17% | -77% | $9,512,615 |

| TSO | Tesoro Gold Ltd | 0.02 | 18% | -5% | -39% | $20,018,639 |

| OKR | Okapi Resources | 0.125 | 9% | -31% | -46% | $28,361,612 |

| CPM | Coopermetalslimited | 0.12 | 4% | -8% | -62% | $6,386,118 |

| MM8 | Medallion Metals. | 0.06 | -17% | -8% | -66% | $17,836,639 |

| AUT | Auteco Minerals | 0.03 | 0% | 0% | -35% | $162,041,718 |

| CBY | Canterbury Resources | 0.027 | 0% | 0% | -39% | $3,902,135 |

| LYN | Lycaonresources | 0.205 | -5% | -31% | -15% | $8,013,750 |

| SFR | Sandfire Resources | 6.115 | 3% | 1% | 80% | $2,719,104,804 |

| NCM | Newcrest Mining | 23.35 | -7% | -5% | 44% | $20,880,287,592 |

| TMZ | Thomson Res Ltd | 0.005 | 0% | 0% | -74% | $4,881,018 |

| TAM | Tanami Gold NL | 0.035 | -10% | -5% | -13% | $41,128,397 |

| WMC | Wiluna Mining Corp | 0.205 | 0% | 0% | 0% | $74,238,031 |

| NWM | Norwest Minerals | 0.036 | 9% | 24% | 9% | $10,352,502 |

| ALK | Alkane Resources Ltd | 0.5725 | -9% | 0% | -18% | $352,770,510 |

| BMO | Bastion Minerals | 0.017 | 6% | -15% | -74% | $3,555,640 |

| IDA | Indiana Resources | 0.05 | -9% | -11% | -17% | $29,396,979 |

| GSM | Golden State Mining | 0.02 | -44% | -41% | -43% | $3,630,677 |

| NSM | Northstaw | 0.035 | 0% | 3% | -71% | $4,324,572 |

| GSN | Great Southern | 0.021 | -19% | -9% | -56% | $17,356,609 |

| RED | Red 5 Limited | 0.32 | -2% | 14% | 106% | $1,090,589,614 |

| DEG | De Grey Mining | 1.1575 | -11% | -1% | 6% | $2,086,950,633 |

| THR | Thor Energy PLC | 0.027 | 0% | -36% | -66% | $4,761,086 |

| CDR | Codrus Minerals Ltd | 0.061 | 2% | -22% | -6% | $5,322,250 |

| MDI | Middle Island Res | 0.021 | -5% | -5% | -66% | $2,953,823 |

| BAT | Battery Minerals Ltd | 0.047 | 34% | 42% | -65% | $5,980,225 |

| POL | Polymetals Resources | 0.3 | 5% | -9% | 50% | $44,944,867 |

| RDS | Redstone Resources | 0.007 | 0% | 0% | 0% | $6,099,649 |

| NAG | Nagambie Resources | 0.023 | 21% | 10% | -69% | $12,797,979 |

| BGL | Bellevue Gold Ltd | 1.445 | -3% | 2% | 93% | $1,613,952,204 |

| GBR | Greatbould Resources | 0.066 | 2% | 16% | -24% | $33,508,974 |

| KAI | Kairos Minerals Ltd | 0.019 | -5% | -10% | -25% | $52,418,244 |

| KAU | Kaiser Reef | 0.17 | -13% | -3% | -8% | $25,139,129 |

| HRZ | Horizon | 0.035 | 25% | -8% | -39% | $24,534,429 |

| CAI | Calidus Resources | 0.19 | 46% | 19% | -44% | $97,260,778 |

| CDT | Castle Minerals | 0.011 | 16% | 16% | -54% | $12,933,173 |

| RSG | Resolute Mining | 0.355 | -3% | 4% | 103% | $734,522,254 |

| MXR | Maximus Resources | 0.04 | 14% | 25% | -2% | $12,503,625 |

| EVN | Evolution Mining Ltd | 3.54 | -2% | 3% | 77% | $6,558,746,409 |

| CXU | Cauldron Energy Ltd | 0.009 | 0% | -17% | -6% | $8,762,118 |

| DLI | Delta Lithium | 0.6075 | -9% | -21% | 11% | $309,583,481 |

| ALY | Alchemy Resource Ltd | 0.01 | -9% | -23% | -71% | $11,780,763 |

| HXG | Hexagon Energy | 0.008 | 0% | -11% | -47% | $4,103,327 |

| OBM | Ora Banda Mining Ltd | 0.125 | 14% | 19% | 56% | $221,383,794 |

| SLR | Silver Lake Resource | 1.03 | 4% | 16% | -12% | $911,375,725 |

| AVW | Avira Resources Ltd | 0.002 | 33% | 0% | -33% | $3,200,685 |

| LCY | Legacy Iron Ore | 0.016 | -11% | 7% | -11% | $108,916,045 |

| PDI | Predictive Disc Ltd | 0.23 | 0% | 15% | 39% | $444,672,479 |

| MAT | Matsa Resources | 0.036 | 33% | 33% | -5% | $16,172,917 |

| ZAG | Zuleika Gold Ltd | 0.015 | -6% | 25% | -21% | $7,322,709 |

| GML | Gateway Mining | 0.024 | -4% | -17% | -67% | $6,392,005 |

| SBM | St Barbara Limited | 0.2225 | 11% | 20% | 4% | $175,863,632 |

| SBR | Sabre Resources | 0.048 | 45% | 20% | -4% | $13,991,337 |

| STK | Strickland Metals | 0.1 | 12% | 89% | 75% | $158,513,464 |

| SAU | Southern Gold | 0.013 | 0% | -13% | -61% | $6,321,709 |

| CEL | Challenger Gold Ltd | 0.08 | 3% | -5% | -47% | $95,722,556 |

| LRL | Labyrinth Resources | 0.005 | -29% | -29% | -73% | $5,937,719 |

| NST | Northern Star | 11.895 | -1% | 11% | 39% | $13,790,653,392 |

| OZM | Ozaurum Resources | 0.089 | 3% | -1% | 11% | $14,128,750 |

| TG1 | Techgen Metals Ltd | 0.03 | 3% | 3% | -76% | $2,315,048 |

| XAM | Xanadu Mines Ltd | 0.065 | -10% | -20% | 132% | $108,096,397 |

| CHZ | Chesser Resources | 0 | -100% | -100% | -100% | $65,818,414 |

| AQI | Alicanto Min Ltd | 0.048 | 12% | 14% | 50% | $30,029,003 |

| KTA | Krakatoa Resources | 0.022 | 22% | 5% | -65% | $9,567,754 |

| ARN | Aldoro Resources | 0.099 | 10% | 11% | -65% | $13,327,751 |

| WGX | Westgold Resources. | 1.9725 | 1% | 12% | 144% | $930,668,664 |

| MBK | Metal Bank Ltd | 0.032 | -16% | -20% | -7% | $11,497,718 |

| A8G | Australasian Metals | 0.18 | -8% | 20% | -25% | $9,381,689 |

| TAR | Taruga Minerals | 0.01 | 11% | 11% | -69% | $6,354,241 |

| DTR | Dateline Resources | 0.01 | 0% | -33% | -85% | $8,854,428 |

| GOR | Gold Road Res Ltd | 1.915 | 2% | 15% | 41% | $1,981,107,688 |

| S2R | S2 Resources | 0.185 | -5% | 3% | 37% | $77,917,389 |

| NES | Nelson Resources. | 0.004 | 0% | -33% | -50% | $2,454,377 |

| TLM | Talisman Mining | 0.135 | -4% | -4% | -4% | $27,306,451 |

| BEZ | Besragoldinc | 0.165 | 38% | 6% | 280% | $66,896,145 |

| PRU | Perseus Mining Ltd | 1.735 | 5% | 5% | -3% | $2,354,739,386 |

| SPQ | Superior Resources | 0.023 | 15% | -4% | -50% | $42,194,736 |

| PUR | Pursuit Minerals | 0.01 | 11% | 0% | -9% | $26,495,743 |

| RMS | Ramelius Resources | 1.71 | -1% | 16% | 161% | $1,898,682,060 |

| PKO | Peako Limited | 0.005 | -29% | -17% | -64% | $2,635,424 |

| ICG | Inca Minerals Ltd | 0.02 | 11% | 18% | -29% | $9,847,995 |

| A1G | African Gold Ltd. | 0.04 | 0% | -2% | -49% | $6,772,448 |

| OAU | Ora Gold Limited | 0.0075 | 0% | -17% | 71% | $33,519,665 |

| GNM | Great Northern | 0.02 | 0% | -26% | -67% | $3,092,582 |

| KRM | Kingsrose Mining Ltd | 0.05 | 4% | -2% | -6% | $37,626,326 |

| BTR | Brightstar Resources | 0.011 | 0% | 0% | -39% | $20,116,251 |

| RRL | Regis Resources | 1.695 | 3% | 13% | 16% | $1,287,852,668 |

| M24 | Mamba Exploration | 0.03 | -14% | -47% | -76% | $2,134,417 |

| TRM | Truscott Mining Corp | 0.063 | 0% | 24% | 85% | $10,922,125 |

| TNC | True North Copper | 0.145 | -3% | -19% | 174% | $37,677,010 |

| MOM | Moab Minerals Ltd | 0.007 | 8% | -42% | -36% | $4,983,744 |

| KNB | Koonenberrygold | 0.044 | 7% | -2% | -44% | $5,149,211 |

| AWJ | Auric Mining | 0.048 | -4% | 14% | -33% | $6,150,401 |

| AZS | Azure Minerals | 3.505 | 45% | 33% | 1130% | $1,555,717,697 |

| ENR | Encounter Resources | 0.27 | 13% | -5% | 93% | $106,791,961 |

| SNG | Siren Gold | 0.068 | 10% | -4% | -66% | $10,808,723 |

| STN | Saturn Metals | 0.13 | 0% | -10% | -49% | $24,709,185 |

| USL | Unico Silver Limited | 0.1 | 16% | 6% | -33% | $29,309,108 |

| PNM | Pacific Nickel Mines | 0.095 | 14% | 8% | 32% | $37,642,779 |

| AYM | Australia United Min | 0.003 | 0% | 0% | -25% | $5,527,732 |

| ANL | Amani Gold Ltd | 0.001 | 0% | 0% | -33% | $25,143,441 |

| HAV | Havilah Resources | 0.23 | -4% | -4% | -27% | $72,827,018 |

| SPR | Spartan Resources | 0.4025 | -7% | 7% | 104% | $351,153,334 |

| PNT | Panthermetalsltd | 0.075 | 6% | 1% | -58% | $4,586,250 |

| MEK | Meeka Metals Limited | 0.042 | 11% | -14% | -32% | $49,810,275 |

| GMD | Genesis Minerals | 1.445 | -4% | 2% | 26% | $1,551,182,509 |

| PGO | Pacgold | 0.24 | 7% | 26% | -42% | $19,681,416 |

| FEG | Far East Gold | 0.17 | 3% | 3% | -74% | $28,896,994 |

| MI6 | Minerals260Limited | 0.36 | -11% | -24% | 13% | $86,580,000 |

| IGO | IGO Limited | 10.88 | -5% | -9% | -34% | $8,140,628,990 |

| GAL | Galileo Mining Ltd | 0.31 | -2% | 2% | -74% | $63,239,977 |

| RXL | Rox Resources | 0.225 | 2% | -12% | 29% | $81,007,214 |

| KIN | KIN Min NL | 0.054 | 15% | 35% | -33% | $61,263,828 |

| CLZ | Classic Min Ltd | 0.001 | 0% | 0% | -94% | $12,357,082 |

| TGM | Theta Gold Mines Ltd | 0.125 | -11% | -11% | 58% | $88,134,376 |

| FAL | Falconmetalsltd | 0.14 | -3% | 8% | -32% | $23,895,000 |

| SXG | Southern Cross Gold | 0.985 | 26% | 23% | 170% | $81,950,617 |

| SPD | Southernpalladium | 0.385 | -8% | -13% | -62% | $16,585,156 |

| ORN | Orion Minerals Ltd | 0.017 | -6% | -11% | 13% | $96,673,923 |

| TMB | Tambourahmetals | 0.13 | 13% | -32% | 0% | $9,952,842 |

| TMS | Tennant Minerals Ltd | 0.028 | 0% | 0% | -10% | $19,745,269 |

| AZY | Antipa Minerals Ltd | 0.012 | -14% | -8% | -53% | $44,367,391 |

| PXX | Polarx Limited | 0.009 | 0% | 0% | 13% | $14,036,551 |

| TRE | Toubaniresourcesinc | 0.12 | 9% | 9% | 0% | $14,103,462 |

| AUN | Aurumin | 0.03 | 0% | 3% | -63% | $9,553,292 |

| GPR | Geopacific Resources | 0.015 | 0% | 7% | -76% | $13,960,249 |

| FXG | Felix Gold Limited | 0.058 | -11% | -24% | -59% | $6,706,911 |

Best-performing goldies over the past week

The week’s biggest gains

Bulletin Resources (ASX:BNR) : +63%

Calidus Resources (ASX:CAI) : +46%

Besra Gold (ASX:BEZ): +38%

The Japanese yen has dropped to its lowest level against the dollar in a year.

Gold is right around record highs measured against the yen.

Here we go.

— Gold Telegraph ⚡ (@GoldTelegraph_) October 26, 2023

Who else is turning heads?

Plenty. In no particular preferential order, let’s start with…

Strickland Metals is days away from commencing diamond drilling to test what could be a concealed gold deposit – called Marwari – at its Yandal project in WA.

The company discovered Marwari last month as part of an extensive aircore drilling blitz designed to systematically explore for gold in new areas – including the poorly understood Horse Well project – that it had acquired in July 2021 to consolidate the entire NE flank of the prolific Yandal Greenstone belt.

Further to this…

- Aircore drilling at Marwari previously returned 31m at 5.6g/t

- Diamond rig will now test the prospect, with an RC rig to follow

Our special report has more.

West Wits is pursuing gold opportunities in South Africa’s Witwatersrand Basin, where development on its eponymous 4.28Moz gold camp continues apace.

Most recently, the ASX-lister attracted a $15.7m investment from a cornerstone US backer — capital that will help the company fine-tune its 924,000oz Qala Shallows gold hub.

The news comes soon after WWI released a DFS update, highlighting a 105% jump in free cashflow and forecasting an increase in gold production from 43,000ozpa to 51,000ozpa over 17.7 years, with steady-state production holding strong at 70,000ozpa for 9 years.

Tune into the Explorers Podcast for more on this, in which Stockhead’s ‘Garimpeiro’ columnist Barry FitzGerald chats with Michael Quinert, chairman of WWI.

Barry also recently chatted with Simon Lawson, managing director and CEO at Spartan Resources.

Spartan is pursuing high-grade gold opportunities in the heart of the Murchison Region, where it’s leveraging nearby infrastructure to build a sustainable operations plan.

Right now, all eyes are on visible gold intersected 130 metres below the deepest assays at the company’s Never Never discovery, part of its flagship Dalgaranga gold camp in WA.

But these fresh results are just a small part of a much bigger drilling picture; an ongoing 32,000-metre campaign is looking to add ounces to Never Never’s left, right and centre, building to an upgrade for its 721,200oz gold resource.

Listen in, here.

Ora Banda’s strategy to focus on higher-grade underground ore is just beginning with an increase in reserve grade by 50% at the Davyhurst gold project, 100km NW of Kalgoorlie, WA.

The 1,200km2 Davyhurst tenements boast a current resource base of 1.8Moz at an average grade of 2.6 g/t gold.

The tenement package is centred on five key, highly prospective project hubs (Mulline, Riverina, Davyhurst, Callion, and Siberia) where historical production is estimated at 1.4Moz gold since 1897.

Underground drilling has commenced at Riverina to focus on extensions to the higher-grade resource.

More, here.

More gilt-edged news

Explore Stockhead’s gold coverage further, and read about the latest happenings with:

Bellevue Gold (ASX:BGL) , Gold Road Resources (ASX:GOR) and Regis Resources (ASX:RRL) > here

Antilles Gold (ASX:AAU) > here

Peregrine Gold (ASX:PGD) > here

Golden State Mining (ASX:GSM) > here

Southern Cross Gold (ASX:SXG) > here

And…

Bishop Resources > here

BREAKING NEWS

THE CEO OF HSBC IS WARNING THAT THE WORLD IS AT A TIPPING POINT ON DEBT THAT THREATENS TO SPARK A GLOBAL RECKONING AFTER YEARS OF GOVERNMENT BORROWING BINGES

This is a massive bank.

People are officially waking up.

— Gold Telegraph ⚡ (@GoldTelegraph_) October 25, 2023

At Stockhead we tell it like it is. While Strickland Metals, Ora Banda, Antilles Gold, Peregrine Gold, Southern Cross Gold and Golden State Mining are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.