It’s Cardinal 2.0: Bishop Resources has +1Moz projects in West Africa, the world’s most underexplored gold destination

Pic via Getty Images.

- Bishop is led by 17Moz Au of exploration and development experience

- All directors helped lead Cardinal Resources in proving up the +7.5Moz Namdidi gold deposit

- Drilling is underway in Senegal and exploration in Ghana is pegged for Q1 next year

- Thor Exploration’s 1.79Moz @1.5g/t Makasa deposit just 400m from Bishop tenements

You’ll be hearing a lot more of Bishop Resources in the coming months – a gold developer that has set up shop in West Africa’s highly-regarded mining jurisdictions of Ghana and Senegal – run by experts who have done it all before with previous ASX market darling Cardinal Resources.

It owns two project areas that have a bright future for further exploration and development in two Tier 1 gold districts of West Africa.

The projects come with a plant each already – one ready for refurbishment and the other ready for construction. We’ll get to them, but first – let’s talk about the team that’s driving these projects.

A wealth of experience with strong West African connections

Bishop is led by a team of minted African gold project developers from Cardinal fame, who have had massive success in Ghana, including the discovery of the 7.5Moz Namdini gold mine.

Between them, they have been driving forces behind ~17Moz of discovered and developed gold over the past decade.

Bishop chair Kevin Tomlinson has a wealth of experience mining in Africa, and has had roles as director of Cardinal, ex-director of Centamin, Orbis Gold and Medusa Mining, and is current non-exec chair of Bellevue Gold.

A founding director of Cardinal Resources, Malik Easah, a prominent Ghanaian, is the current director of Asante Gold and brings his expertise as executive director of Bishop.

So does David Michael, also from Cardinal, who has founded numerous ASX-listed companies such as Beacon Minerals, St George Mining, Argent Minerals and Western Yilgarn.

Other directors include Michele Muscillo, who hails from Aeris Resources and was on the board with Cardinal, as well as Alec Pismiris who also founded Cardinal and is a current director of Agrimin, Aguia Resources, Mount Magnet South and Pelican Resources.

With an IPO on the cards this year, these mining experts are putting their money where their mouth is for gold projects as they currently make up ~46% of the share registry.

Let’s take look at the projects:

Ghana: A burgeoning mining district

Ghana, where major gold miners such as Gold Fields and AngloGold Ashanti have operated for years, ranks creditably on the stability index – above South American countries like Peru and Chile on the Fraser Institute’s Mining Investment Attractive Index – and fifth overall in Africa.

Encouragingly, the country’s sovereign wealth mechanism the Minerals Income Investment Fund (MIIF), recently invested US$32.9m for a stake in Atlantic Lithium (ASX:A11) for the development of its Ewoyaa project.

And, while yes it’s not gold, it’s a good sign for investors that Ghana is looking to reinforce its mining sector.

“Our investment highlights Ghana as arguably the best mining investment destination in Africa in view of the options MIIF provides to investors,” the sovereign wealth fund said in a statement.

Let’s take a closer look at Bishop’s projects:

North Ghana

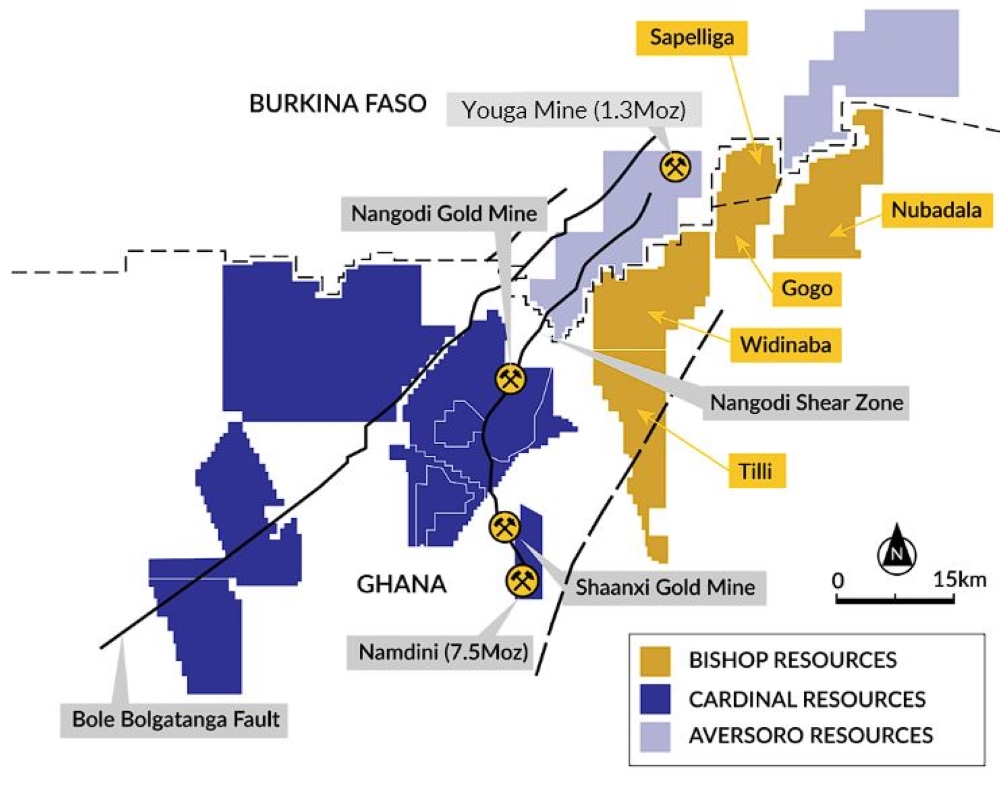

In northern Ghana, the team has five large-scale prospecting permits covering 478km2 of the Nangodi greenstone belt: Sapelliga, Widinaba, Gogo, Tilli and Nubadala – adjacent to ex-Cardinal’s Namdini, Shaanxi, Nangodi and Youga gold mines.

Bishop is first targeting Sapelliga and Widinaba, the most advanced prospects to date, where Castle Minerals (22 holes) and Bishop (28 holes) confirmed “excellent gold mineralisation” from RC drilling campaigns.

At the 53km2 Sapelliga – along trend of Avesoro Resources’ >1Moz Youga gold project – significant past intercepts include 22m @ 2.04 g/t Au from 25 and 10m @ 5.23g/t Au from 62m and a 2,000m RC program is pegged to start in Q1 next year.

For the 162km2 Widinaba project, Bishop is targeting the Teshie prospect where three shallow open pits extend along strike of the Nangodi gold mine for ~500m.

Starting next year at the prospects, assessment and development work will be followed by identifying targets, conducting airborne surveys and commencing drilling.

Makabingui

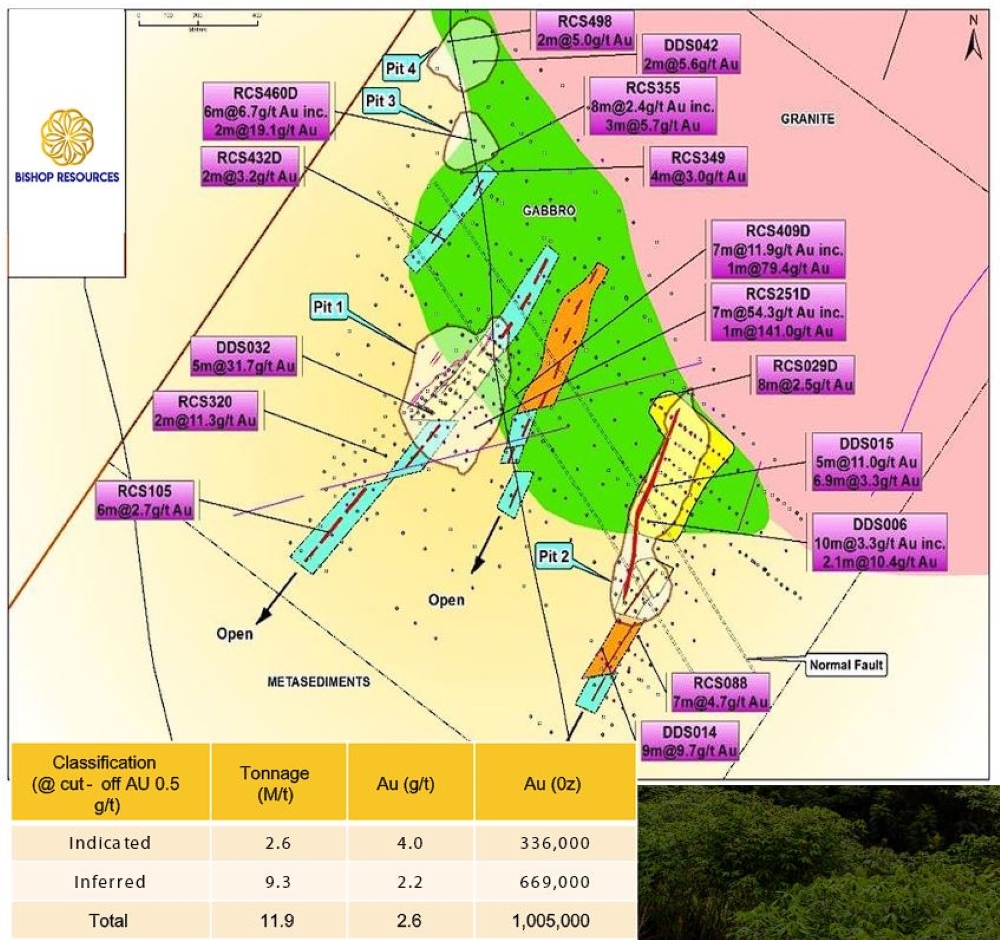

Acquired this year in eastern Senegal, Bishop’s flagship asset is the proven 1.05Moz Makabingui gold deposit, surrounded by a whopping +60Moz of proven Tier 1 gold deposits in its prolific Birmian belt geology.

The area includes major mines such as Endeavour’s Sabodala-Massawa open pit mine which is soon to be a >400,000ozpa at a low AISC of just US$576/oz, AngloGold Ashanti’s 13Moz Sadiola and Barrick’s ~18Moz Loulo and Goukoto deposits.

It’s also just 400m from where mineralisation commences at Thor Exploration’s giant 1.785Moz @ 1.5g/t Makasa deposit.

Early work at Makabingui expanded the resource to 1.05Moz based on 898 holes for 54km worth of RAB, RC and diamond drilling completed in December last year with a confirmed 12km strike of mineralisation.

With near-surface intercepts of 2m @ 12.2g/t Au from 28m, 8m @ 12g/t Au from 14m and 10m @ 2.4g/t Au from 2m, it’s no wonder they say these areas are underexplored.

The project already includes a fully operational 80-person camp, walk-up drill targets, and Peter Gleeson from SRK Consulting fame has identified exploration targets that will lead to a 5,000m diamond drill campaign at Makabingui East, with plans for an additional 24km of RAB drilling this year.

Michael says he’s very pleased to have this very detailed mapping and target generated by SRK and is confident that further exploration will add to the existing 1.05Moz resource.

“We’ve also had institutional interest recently visiting site with a view to provide additional funding and look forward to future developments at the project over the coming months,” Michael said.

At Stockhead we tell it like it is. While Bishop Resources is a Stockhead advertiser, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.