Resources Top 6: Rare earths hunter Alvo goes ionic at Bluebush; Many Peaks also hits REE heights

Pic via Getty Images

- REE hunting is in the spotlight today, with Alvo proving successful in Brazil…

- … and Many Peaks making a lunchtime burst up the ASX re(e) it’s Odyssey project in Canada

- Meanwhile, TYX, FAU and ZNC are all making gains on a decent day on the bourse so far

Here are the biggest resources winners in early trade, Thursday November 2.

Alvo Minerals (ASX:ALV)

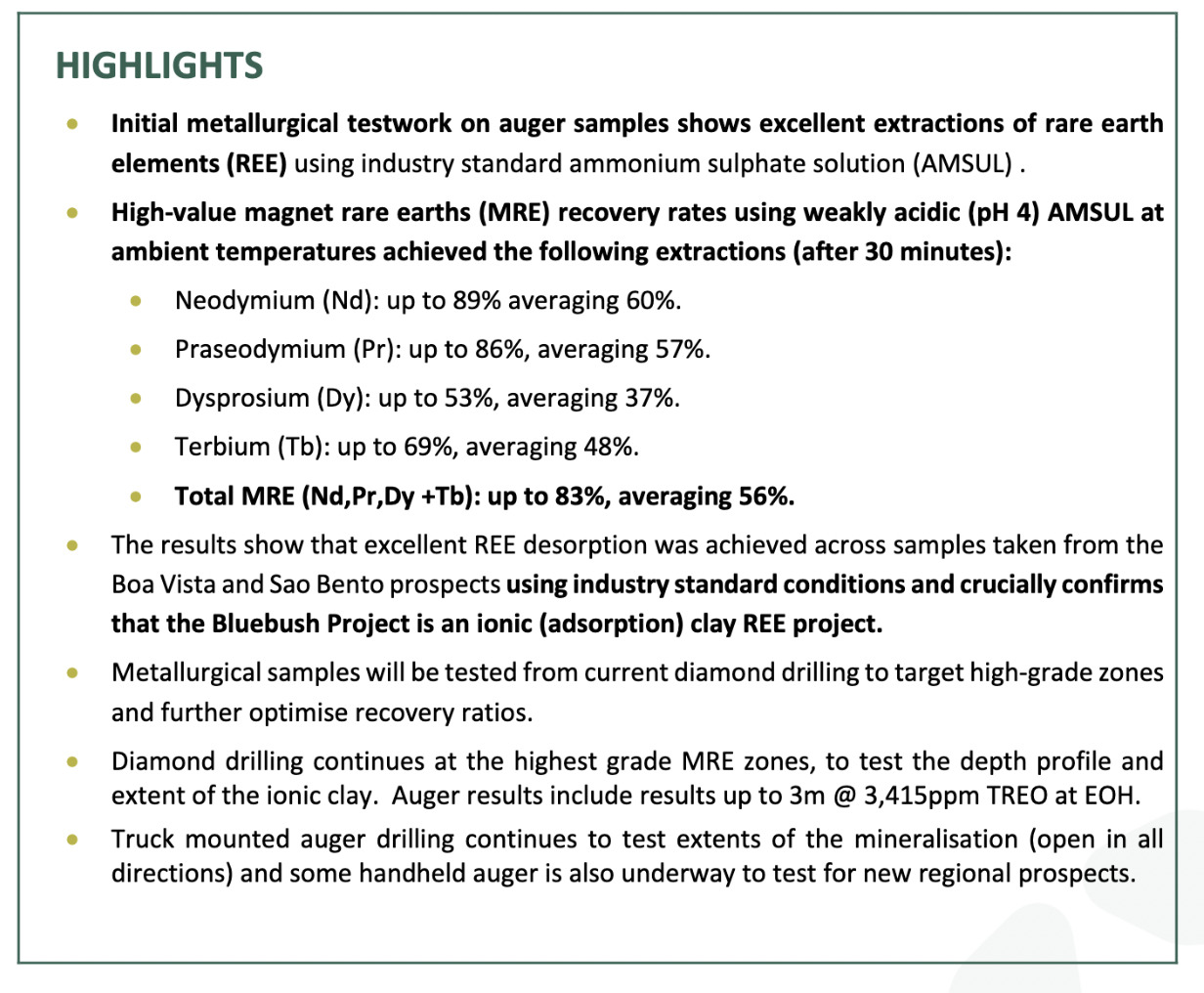

Rare earths hunter Alvo has big news this morning about its big Brazilian hunt – namely its Bluebush project, which it can now confirm is a bona fide ionic adsorption clay REE project.

This is the news it’s been itching to deliver to the ASX and now that itch can be considered scratched.

As Stockhead’s Cam Drummond reported mid October:

With tenements adjacent to the only known Tier 1, ionic clay-hosted REE deposit under construction outside China – the monster 911Mt @ 1,200ppm TREO Serra Verde deposit – Alvo Minerals has just started drilling its highly prospective 120km2 Bluebush REE project in central Brazil.

And what it’s now found from its initial metallurgical testwork is “exceptional magnet rare earth extractions up to 83%, using ammonium sulphate solution”.

Initial metallurgical testwork on auger samples from $ALV.AX Bluebush Project shows excellent extractions of #REE using industry standard ammonium sulphate solution.

The results returned individual samples of MRE’s recovering up to 83%.https://t.co/uSMoIdrupH pic.twitter.com/0a8X2pdEYT

— Alvo Minerals Ltd (@AlvoMinerals) November 1, 2023

Bluebush is located on the northern half of the Serra Dourada granite, the same host rock of the Serra Verde ionic clay REE deposit, which is said to be the only ionic clay project currently being commissioned outside of China.

The company notes that the results confirm the status of Bluebush as an ionic clay (adsorption) REE project, and the reason that’s important is because of “simpler potential mining and processing costs with associated lower capital and operating costs” compared with hard rock or simple clay hosted REE prospects.

In other words, it represents a more cost-effective operation at scale.

Alvo MD Rob Smakman said:

“This is a significant step forward for Bluebush… The results are outstanding for initial metallurgical testwork… We have said from when we acquired this exciting project, there were three things we wanted to clearly demonstrate during the due diligence period: Scale, Grade, and Ionic Clay (Adsorption) Mineralisation.

“Our results released to date have demonstrated high grades of TREO and MREO near surface and over broad areas at both Boa Vista and Sao Bento prospects, covering the potential size and grade questions. The final, and possibly the most important factor, was establishing the presence of ionic clay adsorption hosted mineralisation. The testwork released today shows this.”

ALV share price

Tyranna Resources (ASX:TYX)

Missing the gains down in Africa? Battery minerals hunter Tyranna isn’t. Not today at least.

TYX is well up today on news that it recently got the drills spinning at the Muvero prospect within the Namibe lithium project in Angola, and it has indeed already intersected lithium mineralisation.

TYX notes it’s completed three drill holes, with multiple mineralised pegmatites in each of them.

Drilling will cover the entire area of the prospect and to a depth of 200m or more, while access to other prospects and site preparation is ongoing with drilling to continue through to at least June 2024.

Tyranna’s technical director, Peter Spitalny, said something about being excited and expressed optimism for “many more mineralised intersections as drilling progresses throughout this campaign”.

TYX share price

First Au (ASX:FAU)

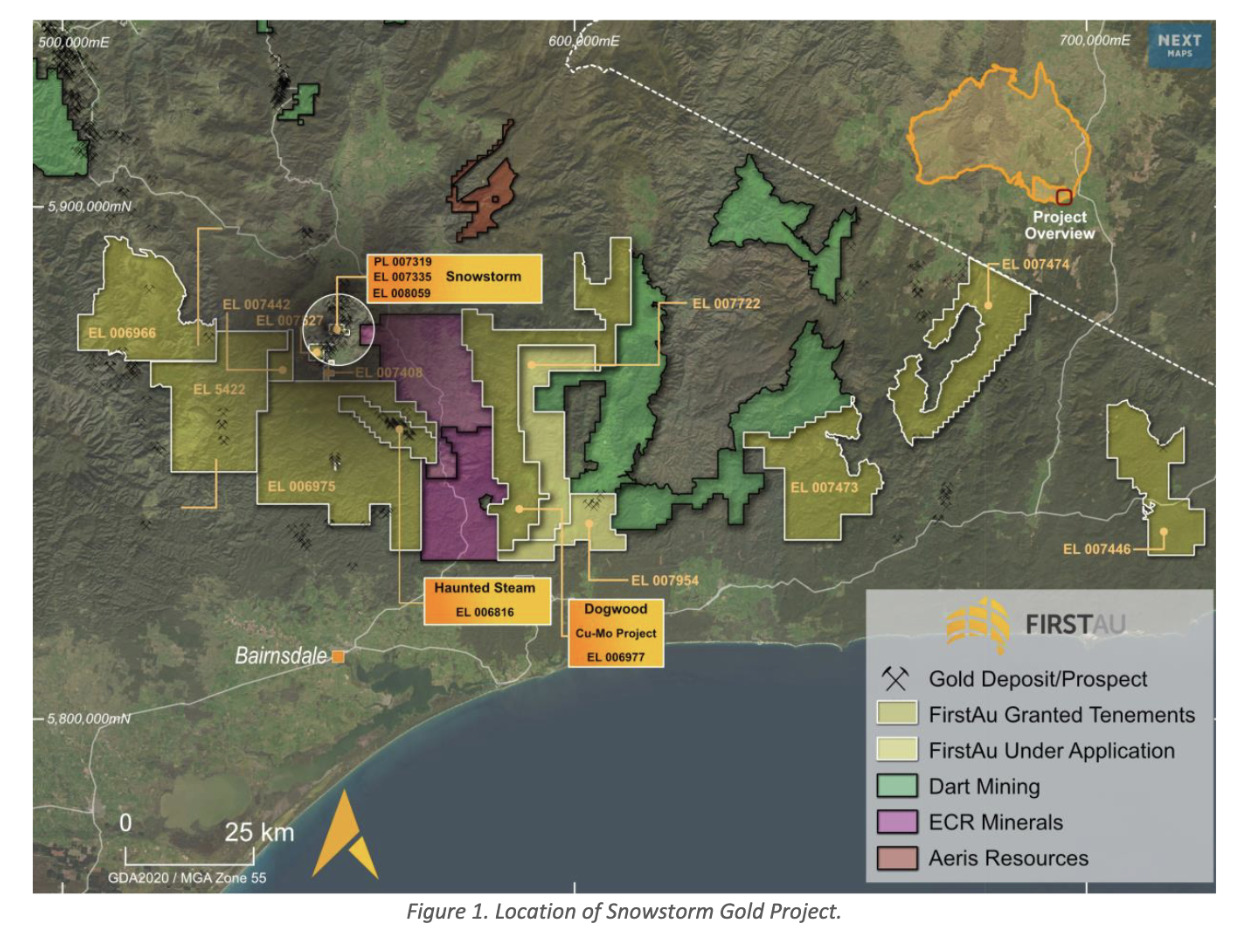

Tiny goldie First AU is glinting brightly on the bourse today after receiving statutory endorsement from Earth Resources and Regulation (ERR) for its work plan in relation to the proposed bulk sampling at the Snowstorm Gold Project in East Gippsland, Victoria.

First AU also has gold and base metal projects going on in WA and SA, but Vic’s Snowstorm is the focus today, and the ERR’s endorsement is one that rings nicely for the company, not to mention shareholders enjoying a 25% increase on FAU at the time of writing.

“Receiving statutory approval for the work plan is a major milestone in receiving final authorisation and FAU being able to undertake the work plan,” wrote the company in its ASX release this morning.

It means FAU can now move on to meeting the final permitting requirements at Snowstorm, which it anticipates will happen before the year’s out.

With all of this in place, it will allow more detailed mapping of the Snowstorm gold system to better understand the grade and geological continuity of mineralisation.

Getting on with the program there will also see the company be able to establish greater underground access for potential future exploration drilling if warranted.

The Snowstorm project is located just outside the township of Swifts Creek in East Gippsland. The area has a rich history of gold mining and has historically produced over 110,000oz Au.

Read more on other recent First AU activities here.

FAU share price

Zenith Minerals (ASX:ZNC)

Diverse metals (base, industrial, precious, critical/lithium) hunter Zenith Minerals is pumping +28% so far today, courtesy of… hmm, boardroom shuffling?

That can’t be the reason can it? Maybe it actually is. In any case, here’s the news:

Andrew Bruton has decided to step down as non-executive director of the company at the end of today, for the reason of “other commitments”. Fair enough, we’ve got some of those going on here and there, too. Which reminds me, youngest kid has basketball reps try-outs later tonight.

David Ledger is also resigning from his position as executive chairman of the company – also at the end of a momentous day for Zenith. “Other interests” are what he’ll now be pursuing.

They leave the company in pretty good shape by the sounds, though, as it gears towards taking full control of a 100% interest in the Split Rocks and Waratah Well lithium projects in early January 2024.

The Split Rocks lithium project is in WA’s Forrestania greenstone belt, an emerging lithium district host to SQM-Wesfarmer’s Mt Holland/Early Grey lithium deposit (189Mt at 1.5% Li20).

The company recently defined 30 new lithium targets in addition to the >3km long by 2km wide Cielo lithium target reported earlier this year.

These new targets lie outside the Rio prospect, where drilling returned 26m at 1.2% Li20.

$ZNC is pleased to announce a maiden Inferred Mineral Resource for the Rio Deposit, the initial lithium discovery within the very large Split Rocks project area.

Read more: https://t.co/CN4yWtlsep#lithium pic.twitter.com/1gkZSCgnqe

— Zenith Minerals (@ZenithMinerals) September 28, 2023

Could Chilean lithium giant SQM be interesting in sniffing around Zenith for a potential buy? It’s a question our Jess Cummins posed in August, which you can read more about here.

ZNC share price

Lithium Universe (ASX:LU7)

Explorer Lithium Universe is double digits in the right direction today, which perhaps has something to do with a strong Quarterly Activities/Cashflow Report released earlier this week.

There’s been no standing around (well apart from the board of directors photo shoot, see below) for LU7 since its big arrival on the ASX a few months ago.

Its been a busy Quarter since commencing on the ASX

$LU7 #Quarterly #Report pic.twitter.com/JUAt2no7pl

— Lithium Universe (ASX:LU7) (@LithiumUniverse) October 30, 2023

LU7 burst onto the local bourse in August after a $4.5m IPO and has tenure in both Australia and Canada – regions where the team has vast experience in developing lithium projects.

Chaired by Aussie lithium industry trailblazer Iggy Tan, LU7 has a board, technical team and contractors that all worked on Galaxy’s successful Mt Cattlin lithium mine (which, now run by Allkem (ASX:AKE), produces 137,000tpa of spodumene concentrate).

One of the most recent choice highlights from LU7’s universe so far included this news:

Global engineering behemoth Hatch has been signed on to undertake the vital engineering study for the design of Lithium Universe’s multi-purpose battery-grade lithium carbonate (Li2O3) refinery – part of its proposed Québec Lithium Processing Hub (QLPH). Hatch’s inclusion to LU7’s vision brings further expertise on board. (More on that here.)

Full LU7 report here.

LU7 share price

Late breaker: Many Peaks Gold (ASX:MPG)

Just as we were searching for a pic of a blue bush to go with the headlining Alvo story above, we noticed this grab the ball at pace and burst through a weak tackle up the middle of the ASX.

We have full deets on MPG’s beaut week (now up 32%) in our special report, but just quickly, a fact-bombing snippet or two from that well-written piece, to keep you up to speed:

Exploration at the Mann 2 prospect at Many Peaks’ Odyssey REE project have shown up to 6.3% TREO in recent sampling, and combined with previous work hosts multiple >5% TREO results over a >800m strike length within a 2.2km long mineralised (>1% TREO) corridor.

Odyssey is in the Red Wine rare earth element (REE) district in Canada’s Labrador province and is host to more than a dozen REE, zircon and niobium occurrences.

20km east of Odyssey, the Two Tom project is along the same horizon and has an inferred resource of 40.6Mt @ 1.18% TREO, with 0.244% NdPr and 0.26% niobium (Nb2O5).

Neodymium and praseodymium (NdPr) are high value REEs and critical inputs into the clean energy sector, required for generating low-weight permanent magnets for use in numerous applications, like EVs and wind turbines.

EXPLORATION DEFINES MORE THAN 800m STRIKE >5% TREO AT ODYSSEY REE PROJECT in Labrador, Canada 🇨🇦🔗 https://t.co/OphpEeQMrU

Sampling indicates up to 140m widths across the western Mann 2 mineralized corridor #rareearths #REE #criticalminerals #Canada… pic.twitter.com/5burKm9CBS

— Many Peaks Minerals (ASX:MPK) (@ManyPeaksASX) October 30, 2023

MPG share price

At Stockhead we tell it like it is. While MPG, FAU and LU7 are Stockhead advertisers at the time of writing, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.