The ionic reason Alvo Minerals is in the right place, at the right time, to prove up rare earths in Brazil

The world is bending over backwards to find ex-China supplies of rare earths and Brazil is shaping up to be a #1 destination. Pic via Getty Images.

In the exploration game, and especially when it comes to rare earths, you could dig up 10,000 spoons when all you need is that one knife to get a project off the ground. Brazil, and its geology, is potentially playing host to the next large-scale ionic REE projects to get into production.

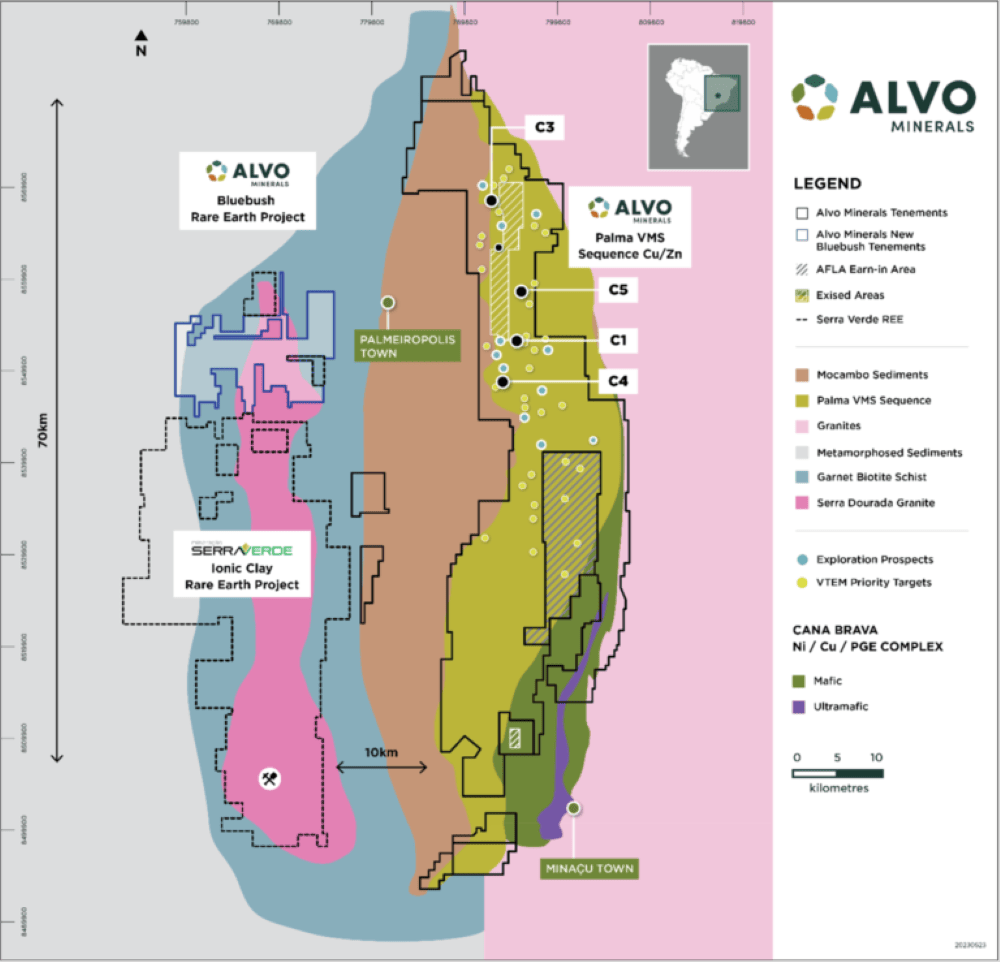

With tenements adjacent to the only known Tier 1, ionic clay-hosted REE deposit under construction outside China – the monster 911Mt @ 1,200ppm TREO Serra Verde deposit – Alvo Minerals (ASX:ALV) has just started drilling its highly prospective 120km2 Bluebush REE project in central Brazil.

Rare earth hunter Alvo is at early doors with its Bluebush project and is looking to prove up what it thinks might be an ion-adsorption (ionic) clay-hosted rare earth deposit – as is the neighbouring Serra Verde REE project along strike. We’ll get to that, but first, let’s take a look at why rare earths are so hot right now.

‘Rare’ earth elements: Why is that?

Well, for starters, they’re hard to find – unless you find an economical way to drill deep into the Earth’s mantle.

Volcanic machinations over millions of years have spurt up rare earth elements (REE) through fault lines in the Earth’s crust to sporadic, near-surface locations across the world that we can economically drill into.

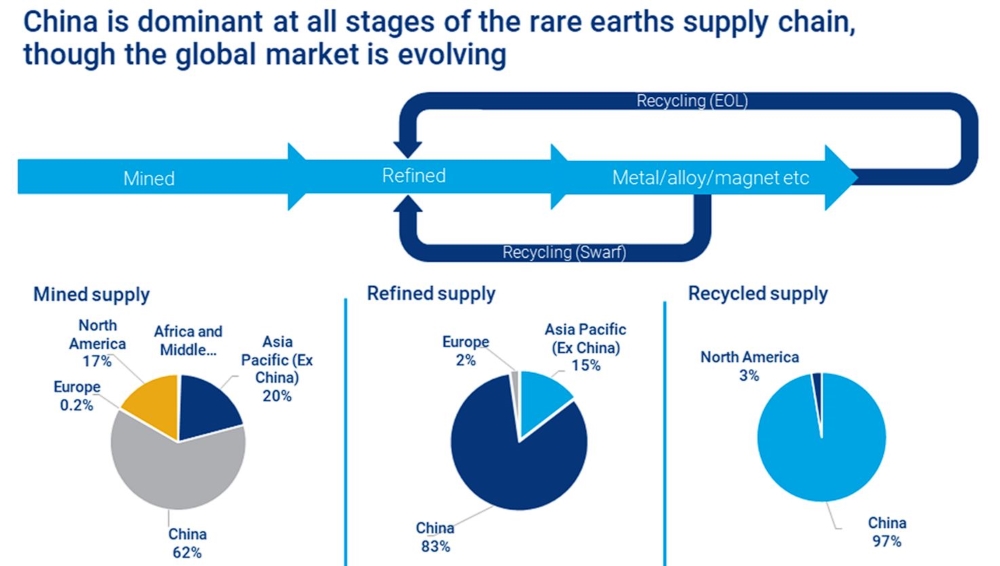

In recent decades, the West has been sleeping on them. China, however, taking advantage of its prolific economic boom in the 80s, has become a powerhouse of production, processing, refining and manufacturing of REEs into essential products used the world over.

China’s hegemony over these rare elements has been known for quite some time – especially the pricier and extremely vital magnetic rare earth oxides (MREO), used in a range of high techs, from everyday smartphones to military technologies.

Still, there has been little investment by nations outside China due to the Middle Kingdom’s monopolisation tactics which have kept global rare earth prices depressed for more than a decade, flattening incentives to explore and develop new deposits.

“Chinese companies routinely adjust their domestic production quotas and subsidise REE prices to strategically flood the market to drive out competitors and deter new market entrants,” the Australian Strategic Policy Institute (ASPI) says.

This graph shows just how much need there is to shore up REE supply chains outside China:

A quick guide to rare earth acronyms

The whole ‘rare earths’ bundle can be confusing, so here’s a quick breakdown:

REE/REO – REE stands for rare earth elements and encompasses all types of rare earths, of which there are 15+2.

They’re part of the lanthanide series of elements, including: lanthanum (La), cerium (Ce), praseodymium (Pr), neodymium (Nd), promethium (Pm), samarium (Sm), europium (Eu), gadolinium (Gd), terbium (Tb), dysprosium (Dy), holmium (Ho), erbium (Er), thulium (Tm), ytterbium (Yb) and lutetium (Lu) – the +2 refers to yttrium (Y) and scandium (Sc), as they are commonly found in HREE deposits.

HREE/HREO – heavy rare earths/oxides

LREO – light rare earths/oxides

MREO – valuable magnetic rare earth oxides – Nd, Pr, Dy, Tb, Eu and Y

TREO – total rare earth oxides

Proof it can be done

Lynas (ASX:LYC) boss Amanda Lacaze said that it was in 1999 that she first heard of the necessity to create an outside of China ‘mine to magnet’ downstream supply chain for rare earths.

LYC, having gained >300% in share price in the past five years, has weathered the imposed price depression storm, and come out on top as one of the only major producers outside China.

It now boasts ongoing developments of downstream MREO projects in both WA’s Kalgoorlie region and Malaysia.

Kudos to LYC’s perseverance though, because they’re currently the West’s only major producer of REEs to counteract China’s quota-based production system – and, talking to Stockhead, Lacaze says the success of developing an outside-China industry is important for all of us.

“Sometimes I think that the desire is to set up outside China operators as if they’re sort of competing with each other when in fact, the main game is China, right? That is our competition.

“For the rest of us, our success is going to be about building this outside-China industry. Otherwise, we simply produce material that ends up going into China for finishing and further value-adding.

Demand is expected to grow considerably, however, from 260-280,000tpa REO in 2022 to 340-370,000tpa by 2027 – and that means more production needs to come online.

And isn’t it ionic, don’t you think?

Apologies to Alannis Morissette fans. C’mon, it was there.

Boasting an exceptionally high purity compared to hard rock REE deposits, ionic, clay-hosted rare earth deposits are predominantly near-surface (usually to depths of just 10m) and can be extracted quite simply using pH levels of ~4 (that’s table salt levels) using leach methods – meaning lower capex and higher returns – IF it’s ionic.

The salt solution breaks the bonds between the clay itself and the REEs, allowing the elements to become soluble – with a kicker that it’s a cheaper and more environmentally friendlier way of extraction.

Speaking to Stockhead, Alvo MD Rob Smakman says proving up a resource is complicated, but with the right geological setting, the right approach and the right people in place, there’s plenty of opportunity to do it well.

“You can have clay-hosted REE projects but often they’re not easy to extract. That’s where the ionic process comes in – a simpler extraction technique that is pivotal for capital expenditure metrics to get these types of projects off the ground,” Smakman says.

“While they definitely help, it’s often not all about the grades themselves, it’s about the size of the deposit and its extractability. You’d rather have a large, low-grade deposit that’s easy to extract than vice versa.”

Besides Bluebush and Serra Verde, another Brazilian project plays host to an additional intrepid Australian explorer in Meteoric Resources (ASX:MEI).

A penny stock last year, Meteoric now has skyrocketed to a market cap of near on $400m at 20c/sh now due to its ionic 409Mt @ an eye-whopping 2,626ppm TREO Caldeira project.

Could Bluebush prove to be the world’s next ionic rare earth deposit?

The timing couldn’t be better to explore for tangible rare earths projects and Alvo, while still bijou with Bluebush, is at a juncture that will provide increased certainty of exactly what’s inside its fenceline.

With tenements adjacent to the only known Tier 1, ionic clay-hosted REE deposit under construction outside China – Serra Verde – Alvo Minerals has just started drilling at its highly prospective 120km2 Bluebush REE project in central Brazil.

Bluebush’s eight exploration tenements are along strike from and on the same biotite-rich granite intrusion, Serra Dourada, that hosts Serra Verde’s monster 911Mt @ 1,200ppm TREO and MREO heavy resource.

Alvo is looking to prove that the hosted surficial saprolites are the highly-valued ionic clay type that reap high percentages of REEs – particularly HREEs that include pricey magnetic rare earths such as dysprosium, terbium, neodymium and praseodymium.

Smakman says Brazil is “becoming one of the premier destinations for critical minerals mining and we’re fortunate enough to be on the same geological structure as the only in-construction ionic clay-hosted rare earth play in the world”.

So, it’s along strike from Serra Verde’s monster: What’s Alvo up to now?

Since signing a binding six-month purchase option for the Bluebush tenements in June this year, Alvo’s early works have included augur drilling based on interpreted historical data.

In September, Alvo reported up to 3,779ppm TREO (26% MREO), including 96ppm dysprosium and 16ppm terbium from auger drilling at the Boa Vista prospect.

A diamond drill rig has been mobilised to site and has already started spinning to test the depth profile of the saprolite clay across both the Boa Vista and Sao Bento prospects for an initial ~1,000m program.

“The work that we’re doing on the ground is to test our theory that there’s a decent-sized clay deposit at Bluebush,” Smakman says.

“And really, we’re looking to confirm three things – has it got the size potential to be another Serra Verde type deposit, has it got the grades, and is it ionic?

“We’ve come a long way to answering those first two questions. The results we’ve put out so far are that it has good grades, it’s open at depth and extensive in all directions.

“October will not only see diamond drilling, but the start of a concerted push on exploration – with ongoing extensional auger drilling and commencement of the Loupe geophysical survey to better define the clay and regolith profile which will assist in preparing a clear exploration target.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.