Predator/Prey: Three ASX lithium stocks SQM could be gunning for next

Pic: Getty Images

In January, Sociedad Quimica y Minera de Chile (SQM), one of the world’s largest lithium producers, announced a $20m investment in Azure.

The 19.99% stake in Azure Minerals (ASX:AZS) provided SQM with exposure to Andover, a 60-40 JV with legendary Aussie prospector and billionaire, Mark Creasy.

It was SQM’s first major investment in a junior explorer in Australia, and a highly successful one.

The stock has since surged +1000% on its lithium exploration success at Andover, which culminated in a 100Mt and 240Mt @ 1-1.5% Li20 exploration target and a rebuffed $900m takeover offer ($2.31 per share) from SQM itself.

The exploration target places the project “within the top 10 lithium deposits in the world”, AZS managing director Tony Rovira told Stockhead.

“If you take the upper part of the exploration target, that puts us in the top five lithium deposits in the world,” he says.

SQM’s successful investment – it picked up those initial Azure shares at just 25.6c each – could have it and other cashed up miners running the ruler over juniors with similarly prospective tenure.

Who’s looking good?

With SQM – one of the biggest lithium miners in the world – clearly having an appetite for acquisitions in the space, and a key focus on Australia specifically, we asked MST Financial’s Michael Bentley for three ASX small cap lithium plays that he finds interesting and why.

Bentley says greenfield lithium projects are becoming more attractive to downstream producers who see vertical integration as a strategy to reduce supply risk.

From his point of view, there are a number of emerging lithium hubs around Australia featuring currently producing assets alongside explorers who’ve had strong success with early-stage exploration.

“Using Azure Minerals as an example, the company has seen large early stage exploration success and may in time turn into a mine, allowing other projects in the region with potential resources to feed into the hub.

“Other companies with good landholdings right next door to major deposits or discoveries include Raiden Resources (ASX:RDN), Zenith Minerals (ASX:ZNC), and Delta Lithium (ASX:DLI).”

If any of these three lithium companies have any near-term exploration success, they could be very attractive to their big brother next door.

Exciting lithium plays

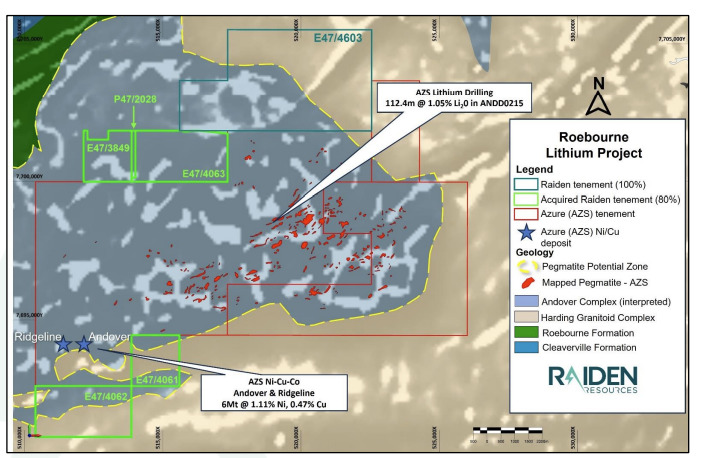

Raiden Resources (ASX:RDN)

Raiden has fast become a lithium darling with its Andover south project in the Pilbara, which sandwiches Azure’s Andover project to the north and south, where drilling activities have been focused on delivering a maiden resource in Q1, 2024.

Investors have clearly caught on to the company’s potential, with its share price up 192% for the year, as it continues to find swarms of outcropping and interpreted pegmatites of up to 30m width at surface.

The $51.38m market cap company says early indications show that the lithium system at Andover South may be “significant in scope and nature” with pegmatites, so far, defined across a 3.5km long, 600m wide pegmatite field.

Raiden’s team is now mapping and sampling the remaining tenements at Andover South and conducting reconnaissance work at the Mt Sholl and Arrow projects.

Zenith Minerals (ASX:ZNC)

Zenith Minerals’ Split Rocks lithium project is in WA’s Forrestania greenstone belt, an emerging lithium district host to SQM-Wesfarmer’s Mt Holland/Early Grey lithium deposit containing 189Mt at 1.5% Li20.,

The company recently defined 30 new lithium targets in addition to the >3km long by 2km wide Cielo lithium target reported earlier this year.

These new targets lie outside the Rio prospect, where drilling returned 26m at 1.2% Li20.

ZNC MD Michael Clifford says the explorer is “very keen” to see these targets being tested to unlock the full potential of this exciting project area.

Delta Lithium (ASX:DLI)

Delta recently attracted a major new investor in mining behemoth Mineral Resources (ASX:MIN) which now holds a 14.24% stake in DLI.

The company’s Mt Ida project in WA’s Goldfields region boasts a resource estimate of 12.7Mt at 1.2% Li20 and according to executive chairman David Flanagan, it is the only lithium project in the current Western Australian mines department currently under consideration.

Mt Ida is in the same region as Zenith Minerals’ Mt Ida North project and MinRes’ Mt Marion mine.

Newly reported drilling results include 27m at 1.3% Li20 from 848m, 21.2m at 0.5% Li20 from 56.1m and 20.9m at 1.4% Li20 from 675.4m in a program designed to upgrade the resource from inferred to indicated classification.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.