Resources Top 5: Stop… hammer time for MC Mining after off market cash offer; Goldie Strickland spins the drills

- South African-based coking coal producer is sitting on a takeover offer

- Strickland has the drills spinning hard at Yandal, WA, stepping up exploration efforts

- NAG, PNR and LRV are also well up at the time of writing

Here are the biggest resources winners in early trade, Friday November 3.

MC Mining (ASX:MCM)

This small-ish South African coking coal producer is up big time today, on the back of a takeover offer from two of the company’s largest shareholders – Senosi Group Investment Holdings and Dendocept.

The two are acting together in a consortium effort on behalf of a group of shareholders and associates. It’s an off-market cash takeover offer for all MCM shares not currently held by the consortium, which represents about 64.5% of MCM shares it’s aiming to reel in.

Following receipt of the bid via letter, MCM has set up an Independent Board Committee to consider the offer on behalf of shareholders not associated with the consortium “and to seek to evaluate and improve the indicative offer price”.

The board has also urged shareholders to “take no action” at this time.

MC Mining’s flagship asset is the Makhado metallurgical and thermal coal project, in South Africa’s Limpopo province.

The company had a rough FY22, posting a $20.8m loss after tax thanks to civil unrest, lower production, and increased input costs. YTD in 2023, it’s not faring fantastically, either, currently down 34%.

Perhaps this takeover bid can prove to be some sort of king-making deal if terms can be agreed.

MCM share price

Strickland Metals (ASX:STK)

About a week ago this prominent goldie told us it could well be on the tail of a large, concealed gold deposit at its high-grade Yandal gold project in WA.

Well, today’s it’s delivered a related update, specifically regarding the Horse Well prospect within Yandal, which the company notes represents a significant, deeper step in its exploration efforts.

The company has now commenced diamond drilling to test what it believed could be a concealed gold deposit – dubbed Marwari.

Hole MWDD001 was completed yesterday, extending a further 111m from initial planned depth, Strickland revealed.

The company’s RC and diamond rigs will now focus solely on Marwari for the immediate future and a further four diamond holes are on the drilling schedule.

The company discovered Marwari last month as part of an extensive aircore drilling blitz designed to systematically explore for gold in new areas – including the Horse Well project – that it had acquired in July 2021 to consolidate the entire NE flank of the prolific Yandal Greenstone belt.

Marwari first turned up in aircore hole HWAC1472, which returned a spectacular 31m intersection grading 5.6 grams per tonne (g/t) gold from a down-hole depth of 72m.

STK share price

Nagambie Resources (ASX:NAG)

You know that sinking feeling when you’ve lost your wallet or phone or keys, but then you find them shortly after and life suddenly seems wonderful?

Well, we’re reaching for an analogy here that probably doesn’t work, but we do know that Nagambie shareholders will be in a decent mood this morning after NAG came off a trading halt to post a 30% gain at the time of writing.

What gives? It was slapped on the wrist by the ASX the other day for failing to lodge its annual report on time. Perhaps the dog ate the original.

Said report has now been submitted and everything’s hunky dory again with the good folks at the bourse.

Earlier this month, NAG noted that the average stope grade at its 100%-owned namesake antimony-gold mine in Victoria is now 5.6% Sb, making the discovery “the highest-grade antimony mineralisation in Australia”.

Nagambie Resources is in the thick of a renewed Vic gold hunt and its Nagambie mine is some 40km from the Costerfield antimony-gold mine owned by Canada’s Mandalay Resources (CAD $183.8m).

NAG share price

Pantoro (ASX:PNR)

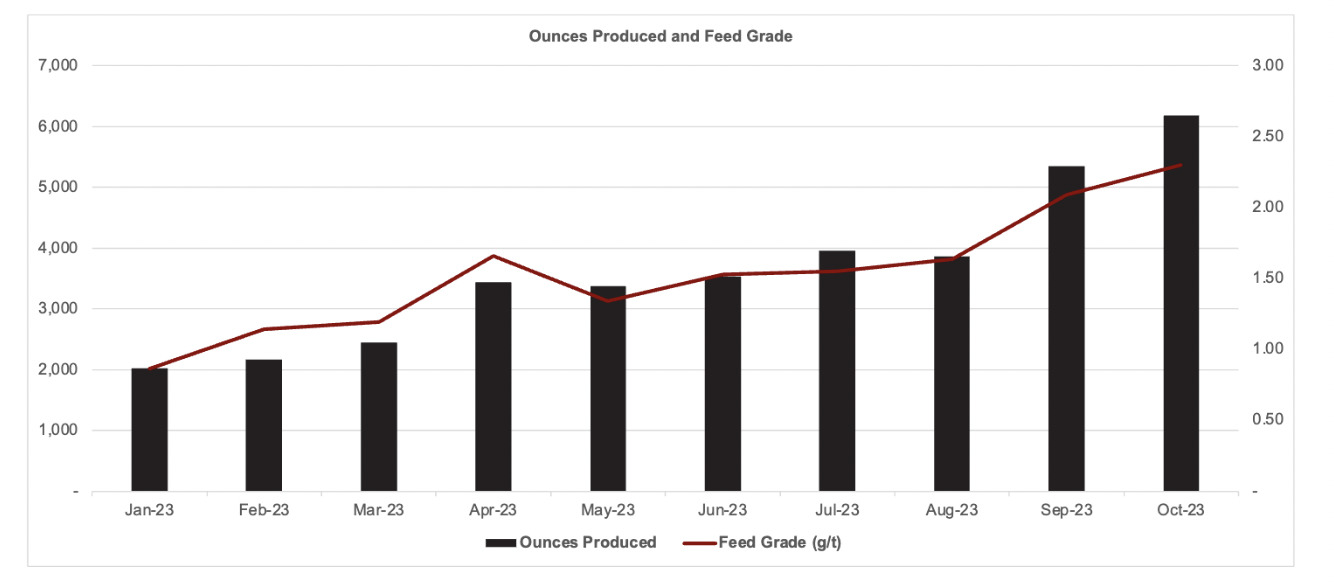

Australian gold producer Pantoro, like so many goldies of late, is up after announcing month-on-month production figures at its 100% owned Norseman gold project continued to move in the right direction in October.

Earlier this month, Josh wrote that the gold miner enjoyed a share price bump as it announced a 27% increase in production at Norseman (in WA’s Eastern Goldfields) to 13,168oz, up from 10,345oz in the June quarter.

Now the company notes October’s 2023 estimated gold production has increased by a further 16% to 6,186 ounces recovered, compared with 5,325 ounces produced during September 2023.

Across October about 90,200 tonnes was milled at a grade of 2.30 g/t of gold, despite a planned mill shut, with the mill operating at rates of up to 150 wet tonnes per hour.

Pantoro also says open pit ore availability has improved substantially since the high grade Scotia pit advanced past the historical pit floor.

High grade and medium grade ore stocks of roughly 50,000 tonnes over 1.9 g/t gold are available for haulage to the processing plant at the end of this month.

Ad, in addition to open pit stocks, there are about 16,000 tonnes of current mill ROM (run of mine) stocks available for processing.

MD Paul Cmrlec said: “Mining operations at both the OK mine and the Scotia open pit continue to improve as the operation matures.

“It is pleasing to see ore volumes and grades increasing at Scotia as expected with depth, and the OK mine continues to impress with very high grade zones often exceeding expectation.”

PNR share price

Larvotto Resources (ASX:LRV)

This junior gold, copper and base metals hunter Larvotto has been turning a few heads lately and is up a good 20% so far today thanks to “encouraging results from drilling at Eyre’s Ni Li project”.

LRV says the drills have been spinning for lithium, nickel and PGEs on the Mt Norcott and Merivale prospects within the broader Eyre project – which, by the way, is only about 30km to the east of the Norseman gold project (see PNR, above).

That’s some 2,383m worth of RC drilling, with the following highlight: hole MNRC003: 100m at 675ppm Ni including 4m at 0.178% Ni and 913ppm Cu.

Results from a 24-hole RC drill program for 2,383m have been received for at our Eyre Project in Western Australia.

Highlights include:

– Ni/Cu anomalism at Mt Norcott

– Thick pegmatites & nickel anomalism intersected at Merivale ProspectRead: https://t.co/T88NdBECHe$LRV pic.twitter.com/mGguKxpRcT

— Larvotto Resources (@LarvottoR) November 2, 2023

The company also says thick pegmatites have been intersected at the Merivale prospect with not unexpected results for lithium. And it’s talking multiple swarms of pegmatites, too, while “ultramafic nickel anomalism” has been hit on the western side.

MD Ron Heeks said: “We are encouraged by the results from the recent RC drilling at our Eyre Project. Several commodities were targeted, and all showed anomalous results from our first pass RC drilling that will require follow up.”

LRV share price

Note: Strickland Metals is a Stockhead advertiser at the time of writing, although it did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.