In the Shadow of the Headframe: Warriedar is sitting on a literal goldmine

The company’s historic WA projects could have resource expansion potential. Pic: via Getty Images.

- Independent Investment Research note flags discovery potential at WA8’s historic projects in WA

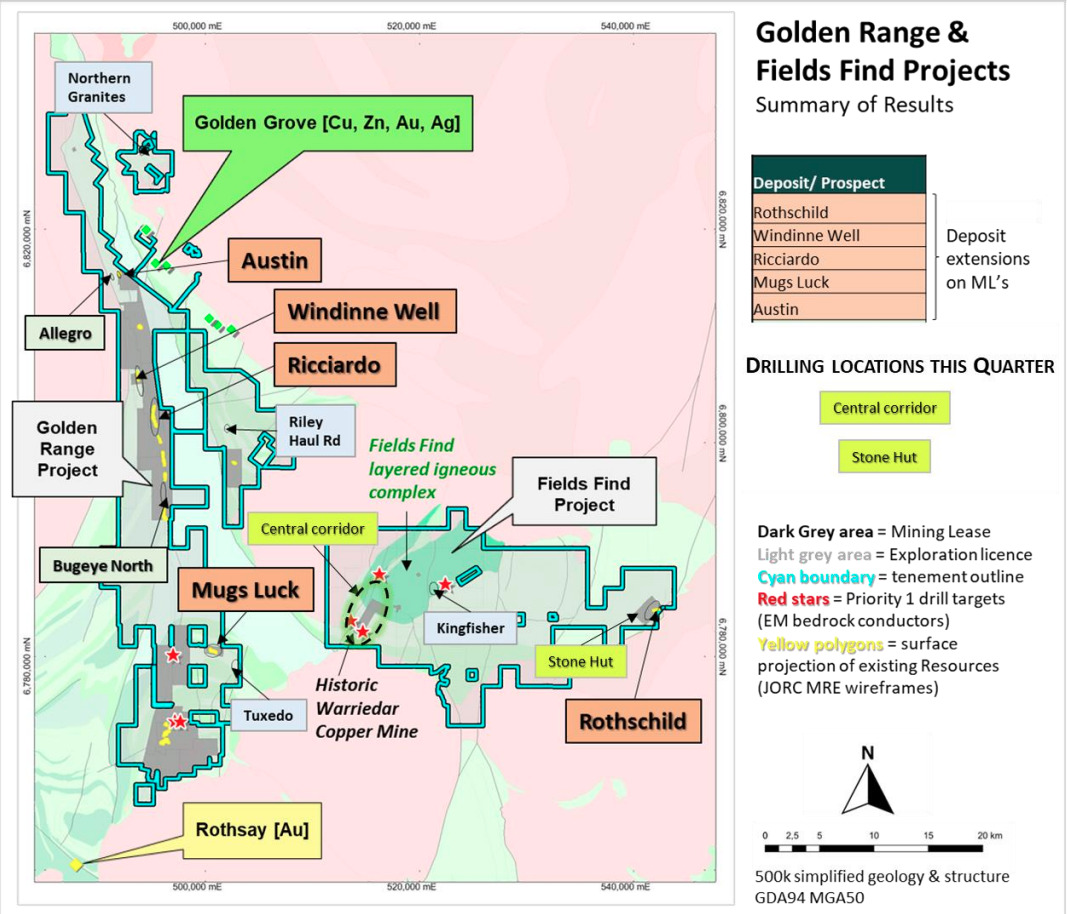

- Company picked up Warriedar, Fields Find and Golden Range projects earlier this year

- Research points to potential to expand current gold and gold/copper resources

- IRR says WA8 currently trading at a relatively low valuation compared to peers

Spectrum Metals and Bellevue Gold are just two former small cap explorers which hit ten bagger status after finding world class deposits near historical workings. Independent Investment Research (IRR) says Warriedar Resources could be next.

In February, ASX explorer Warriedar picked up the historic Fields Find and Golden Dragon (now Golden Range) projects, which instantly doubled its resources to ~2Moz.

There aren’t many ~$30m capped gold stocks with a 2Moz inventory. More importantly, Golden Range and Fields Find contain additional untapped gold resources in a highly active mining and exploration province, within a truly Tier 1 jurisdiction.

Golden Range is smack bang on top of the previously mined Golden Dragon, which produced some 310,500oz of gold from shallow oxide pits between 2001 and 2019.

Mine infrastructure, including an 800ktpa plant, 156-man camp, ancillary facilities and grid connection came as part of the deal.

Notably, this was an oxide only operation, and there was very little work done in assessing the fresh rock potential.

This is a situation in several of the WA goldfields and provides a major value creation opportunity for the company, according to IRR.

“Many discoveries are made ‘in the shadow of the headframe’, and by revisiting areas that were previously mined for different mineralisation types – that is pertinent with the primary mineralisation opportunity in areas that were mined for oxide gold,” the research company said in a note.

Those discoveries near historic mines include Spectrum’s Penny West – now owned by Ramelius (ASX:RMS) — and Bellevue, which saw eponymous (ASX:BGL) soar from 3c/sh explorer to the $1.48/sh mine developer it is today.

Brownfields exploration upside

One of the main benefits of brownfields exploration – apart from all the convenient established infrastructure – is the opportunity to extend the existing life of a historic high grade mine by finding new, previously untouched deposits.

Currently, Warriedar’s WA projects include a well-defined resource of 19.2Mt at 1.5 g/t gold for 945,000oz contained gold.

But IRR notes there is considerable potential to expand current resources.

One key opportunity is the primary gold potential at Golden Range (and the nearby Fields Find, which includes Warriedar) which was unmined in previous operations due to mill limitations.

“There is also strong potential for new discoveries, with previous drilling barely scratching the surface (with an average hole depth in the order of 50m), and with geophysical anomalies typical of sulphide gold systems not being historically tested,” IRR said.

Orogenic gold is not the only target.

Warriedar was a high-grade copper operation until 1969, producing at a life of mine grade of 9.83% copper. It also sits less than 40km south of the largest operating base metal mine in WA, Golden Grove – which has a current resource of 61.4Mt at 1.7% copper, 4.0% zinc, 0.7g/t gold, 28g/t silver.

A takeover target in the making?

It’s worth noting that the projects are located near current gold, gold/copper and polymetallic operations –like Mt Magnet, Deflector, Golden Grove — which have plants that could potentially treat mineralisation from the company’s ground.

“The lights of 29 Metals’ Golden Grove can be seen from our camp,” says non-exec chair Mark Connelly in the company’s Annual Report.

“Silver Lake’s Deflector and Rothsay are our western neighbours, whilst Ramelius’ Mt. Magnet mine is to the north-east.

“Finally, Capricorn Metals’ Mt. Gibson project is a stone’s throw from the southern tip of our tenement package.”

IRR said that while it’s still early days for the explorer, there is the possibility should a viable resource be defined for a corporate end game with Warriedar.

“Recent times have seen significant acquisitions and takeovers/mergers, particularly by the current producers, who are looking to expand operations, through either developing new hubs, or finding ‘stranded’ assets withing trucking distance of existing plants,” they said.

“With Mark Connelly, the company has a chair with significant success in such scenarios.”

This would largely depend on the results of ongoing exploration and assessment (and what opportunities may come up), and could involve development including a mill, development using toll treatment or concentrate sales, or an asset or corporate deal amongst others.

Year-round exploration planned

Since acquiring the project the company has punched in 26,990 m of reverse circulation (RC) drilling in 142 holes, at target areas including the historic Warriedar copper mine and the Falcon prospect.

Backed by a recent $5.5m cap raise, the next phase of exploration and drilling at Fields Find West will kick off early November and continue into CY2024 testing a further 4-7 prospective areas, covering both base metal and gold targets.

The rig will also return to Rothschild, where drilling at the start of the year returned high-grade gold intercepts at depth and along strike from the existing 31,000oz resource.

It is now moving into extensional drilling at its highly prospective Rothschild prior to an update of the resource.

WA8 will also focus on metallurgical drilling and test work along the Ricciardo corridor, where the Silverstone deposit cluster contains a combined resource of 476,000oz gold.

A Phase 3 exploration program will follow in 2024 after further groundwork, and testing of the remaining target areas.

IRR says that along with its Big Springs project in the US, the company’s active exploration program allows for year-round operations and hence news flow – and provides a hedge against the risks inherent in a single project company.

“The company has an active exploration/evaluation program underway in Western Australia, including further resource expansion drilling, and testing new targets,” IRR says.

“As such we expect positive results and steady news flow, which should drive value in Warriedar, which is currently trading at a relatively low valuation compared to peers.”

This article was developed in collaboration with Warriedar Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.