Kick Back: The biggest stories you might have missed on Stockhead this week

News

News

Welcome to what’s lately become your weekly roundup of outrageous valuations.

This week we have The Pixel ($1.7 million):

The Doge ($42 billion):

#dogecoin #doge Doge will move above 50cents within 5 days. Momentum is solid… pic.twitter.com/C35U7qccKX

— Doge Realtor (@DogeCoi48931538) April 16, 2021

We also acknowledge the work of the Great Creator, who showed us they too have a palpable sense of humour, by giving us Coinbase on the same day they took away Bernie Madoff.

So yeah, money and things. There are a lot of outraged people saying “circus” and “what a s..tshow” lately.

But ask any famous trader’s parents about their childhood and you won’t be at all surprised to hear something along the lines of “was always looking for ways to make money” and “made their first hundred dollars swapping baseball cards”.

Insert line about how the proud parents used to “drive to a different town every month for swap meets” here.

Hey, guess what? Baseball cards don’t have fundamentals. But, like Dogecoin, they do have value, because the people that collect baseball cards and Doge say they have value.

Iron ore isn’t “worth” $178 a tonne. It’s the same lump of metal this week as it was last week. It’s “worth” what the world’s largest consumer of it say it’s worth. If you don’t believe that, see the note about China and nickel below.

Why is your house worth more this week than it was last week? It’s the same house.

Answer: For the same reason those ’86 MJ rookie Fleers just keep mooning, year after year. Scarcity, and desire.

And obviously, BTC isn’t “worth” $100K. Except it is, right now, until we all say it isn’t.

Does that put the crypto market in a calamitous state? Hardly. It’s worth less than half the entire Australian property market. About as much as the US Covid bailout.

And that’s ALL the cryptocurrencies. Bitcoin, in its entirety, is worth roughly less than half the Sydney real estate market.

Maybe people suddenly DGAF about money because they’ve finally come to the conclusion that money DGAF about them. Because they’re reading more stories about Bill Hwang getting to spend billions of dollars that didn’t exist. Stories written by respected financial journalists writing about respected financial institutions such as Goldman Sachs.

Goldman Sachs, which couldn’t resist giving Bill Hwang a shot at spending money he didn’t have, even though they knew he was a terrible bet, just because everyone else was making money – that, like Bitcoin, didn’t exist – off him.

It doesn’t matter how “fundamentally” wrong any of the above assumptions are; it’s all just perception. And right now – perhaps forever going forward – perception is reality. It’s the only reason anti-vaxxers exist.

So maybe let’s just spend the money. Spend it all. And if we don’t have it all to spend, then create some more and spend all that.

Oh wait, we’re already doing it:

It doesn't make sense that Coinbase is worth more than ICE (NYSE) and CBOE combined.

That would be like if Tesla was worth more than the combined market caps of GM, Ford, Daimler, BMW, Ferrari, and Volkswagen.

— Michael Batnick (@michaelbatnick) April 14, 2021

Here’s some fairly regular stuff you might have missed this week, like what we used to have in the past.

So, here we are.

A whole new demographic of Aussie retail investors learning about this day trading thing over the past 12 months and now wondering how they can lose as much money as Bill Hwang and Sanjeev Gupta too.

Actually, they’re not stupid. They now know all about IPOs and have seen the opening day moons.

Asked finance Twitter what the next big pop will be.

And spent an hour cursing, trying to get in on Airtasker as it debuts, only to finally win a bid at the traditional opening day top then watch their money disintegrate in the traditional opening day fall an hour later as all of finance Twitter which told them it would be huge takes the profit they helped build and run.

And cap raises! Gah!

Who are these mysterious “oversubscribed” investors who get to buy shares at 12 per cent premiums while your stuck in the 48 trading halt waiting for them cash out at the open and torpedo your holding by said 12 per cent?

It doesn’t have to be this way. You don’t need to be a “sophi” with $2.5 million to get a slice of the exclusive client action.

Here are a couple of platforms you can get a peek behind the cap raise curtain and maybe be a part of some of that oversubscribed action. One of them even gives you – yes, you! – access to pre-IPOs.

So whose IPO was making millionaires on the ASX this week?

These shiny new stocks:

Next week – look out for games developer Mighty Kingdom (ASX:MKL) and AI-based recuitment tech company Hiremii (ASX:HMI).

Remember milk?

The market is back to pre-Covid levels – officially. On Wednesday it hit the last pre-Covid high.

Milk stocks, however, are lagging. Or at least, the former darlings are, such as A2M.

A2M actually kept rising right through to the end of June, when it hit a high of $19.83, but has plummetted to around $8 as Australia waits for the daigou trade to return.

Now, the new breed of white gold wielders has taken up residence at the top of the table:

| Code | Company | Price | %Mth | YTD% | MktCap |

|---|---|---|---|---|---|

| CLV | Clover Corporation | 1.93 | 62 | 18 | $321.8M |

| BFC | Beston Global Ltd | 0.076 | 12 | 12 | $54.8M |

| JAT | Jatcorp Limited | 0.031 | 11 | 30 | $40.1M |

| BXN | Bioxyne Ltd | 0.017 | 42 | 42 | $10.9M |

| WHA | Wattle Health Au Ltd | 0.53 | 0 | 0 | $122.2M |

| AHF | Aust Dairy Group | 0.054 | 6 | -10 | $27.1M |

| AUK | Aumake Limited | 0.041 | -2 | -39 | $22.1M |

| HRL | Hrlholding | 0.11 | -8 | -23 | $54.3M |

| HVM | Happy Valley | 0.13 | -16 | -24 | $24.0M |

| KTD | Keytone Dairy | 0.185 | -10 | -24 | $49.2M |

| BUB | Bubs Aust Ltd | 0.51 | -2 | -15 | $318.6M |

| MBH | Maggie Beer Holdings | 0.36 | -9 | -24 | $74.8M |

| NUC | Nuchev Limited | 0.75 | -18 | -20 | $29.0M |

| SM1 | Synlait Milk Ltd | 3.27 | -2 | -33 | $721.3M |

| A2M | The A2 Milk Company | 7.94 | -14 | -30 | $6.1B |

One makes infant formula supplements, one has a foothold in the strict European market, one also does cosmetics and one specialises in lactoferrin with purity over 95 per cent.

And yes, maybe it’s time to talk about A2M.

Our man at Marketech Focus doesn’t own, nor foresee himself buying A2 Milk shares, or even A2M products. He knows nothing about milk markets.

But he’s getting a little tetchy waiting for the much ballyhooed “silver squeeze”. And what he does know is charts. In his words, “the harder a stock has fallen, the more it is hated, the better the bounce can be.”

And falls in generally over-valued markets like this one don’t come much more calamitous than this:

Next comes the lesson in trading tools. Here you’ll find A2M is still holding onto about $6 billion and still makes profits (in fact, enough to pay out a 5% divvie).

Still here?

Stick around and you’ll get the full RSI, Donchian Channel, MACD and Kagi treatment. And find out why A2M is actually still looking a bit too much like an “are you feeling lucky trade” for comfort.

It’s a pretty simple equation for DigitalX CEO Leigh Travers, but we’ll put it in special writing so you don’t miss it:

DigitalX is the only ASX-listed company modelling BTC demand right now. In fact, they’ve modelled it all the way from a $27m holding two weeks ago to a current $35m holding.

The other 29 listed companies holding BTC as a direct asset are not in Australia, and they’re all on this fairly interesting list of who they are, when they bought, and how much they’ve made. (Hat tip, Coin Citadel, for turning $184K into $32 mill.)

Here are Travers’ thoughts on why such an investment makes much more sense now than it did in 2017, whether any other ASX players will make the leap, and why “it seems quite clear” that BTC is going up over the next few years.

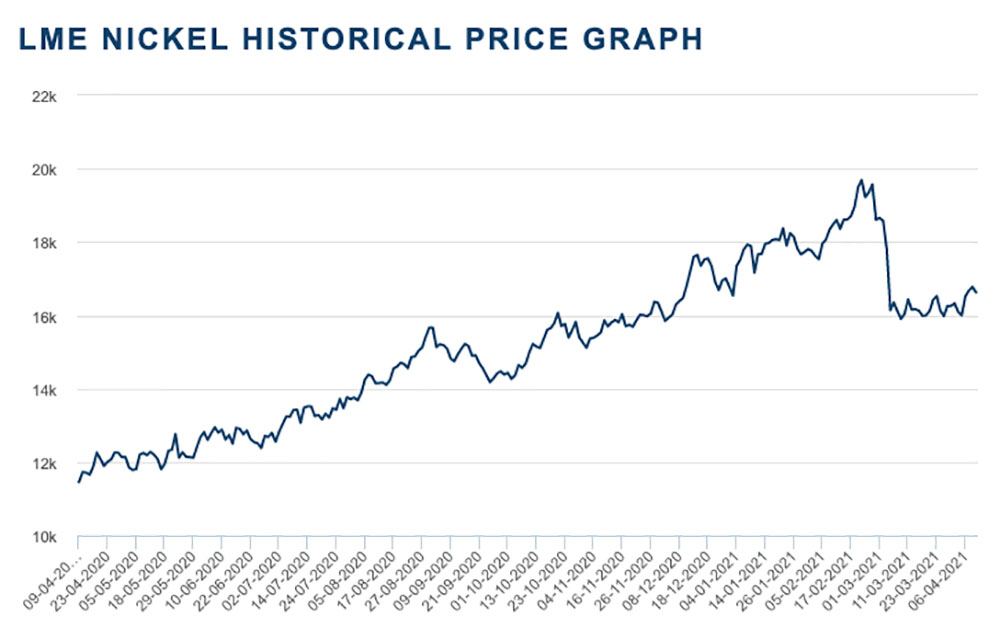

No, this is how you manipulate global markets:

Nickel is still trying to recover from the swiftie Chinese nickel giant Tsingshan pulled last month by announcing it would ignore all good sense and pump out 100,000 tonnes of nickel ‘matte’ converted from lower quality nickel pig iron.

That’s a bid to address a pending shortfall in the battery nickel market. But the process and materials used means it can be up to five times more carbon intensive than the established standard HPAL route. And maybe actually not even quicker at all.

So, next question – will it happen? Here’s what the ASX nickel players we asked had to say:

Here’s why a fairly obvious attempt to stop the rise of a commodity price is probably not going to work.

If you’re 59 and have have been plagued by a chronic infection for half of your life, maybe it’s time to get experimental.

Recce Pharmaceutical dropped an intriguing announcement last week about the very positive result from a treatment on “Patient X” with its R327 compound.

R327 is a synthetic antibiotic developed by retired former head of research at Johnson & Johnson and Recce founder Dr Graham Melrose.

“Patient X” is known as “Patient X” because he lobbied to try R327 on himself via Australia’s Special Access Scheme, a pathway for unapproved medicine used to treat potentially deadly conditions.

We called him “Fletcher”.

And Fletcher has spent most of his life feeling “dead and exhausted” because no on-market antibiotic has been able to wipe sort out his problem with recurring sinusitis.

It was a “rigorous” getting approval to use R327. But within 90 minutes of using the nasal spray, Fletcher’s sinuses cleared up. There was less discharge and inflammation.

And within a few days, blood samples returned no sign of infection. Fletcher could even sleep again.

His official diagnosis of R327? “It’s a bloody miracle.”

The Secret Broker: Farewell, our non-PC Duke; ‘allo Vera!

TSB and Mrs Broker were enjoying an ep of Vera on ABC the other night and guess what happened? Only the bloody Duke of Edinburgh went and died, didn’t he?

Cue two hours of breaking news interruptions and updates, which was just plain annoying because surely one can only die once.

Anyway, he did his bit for Queen and country. Literally, did his bit. And eventually, once TSB had the end of Vera explained to him, it was time to reminisce on the old geezer’s wont for the odd non-PC gaffe.

Speaking of remembering fun, here’s TSB rambling about Jimmy “Shoe’ Shine (and the paper bag football trick), and Jonesy skolling a pint in 10 seconds while standing on his head.

Ah. They don’t call them the good old days for nothing.

This week in bonkers crypto moves started with all the chartist triangles prepping for another BTC surge:

#Bitcoin is currently {Backtesting} the (triangle} breakout around $60k. This is textbook clean & should be included in the 2021 updated Edwards & Magee TA textbook. Can it be this easy? Feels a little too easy. Stay very alert. $GBTC $MARA $MSTR $RIOT $QBTC.TO $GLXY.TO $BITF.V pic.twitter.com/uttql3i3he

— Edward Gofsky (@EdwardGofsky) April 12, 2021

Here’s how that played out.

Monday: Bitcoin breaks free of triangle pattern, but is setup too easy?

Tuesday: ‘Caged bull’ of Bitcoin rests a little more as rally stalls

Wednesday: THE BULL BREAKS FREE: Bitcoin, Ethereum, Cardano and Dogecoin smash all-time highs

Thursday: Ethereum nears $US2,500 on Berlin upgrade; Dogecoin now a top 10 coin

Friday: Who’s a good Dogecoin now? Meme coin continues parabolic rise with 110pc one-day gain

See the pattern there?

Doge Reaper has been doing the rounds, but this one got the ultimate reply:

Knock knock… can I come in? 🐕 #dogecoin #dogetothemoon pic.twitter.com/tsd50SN9AI

— Sadia 🚀 (@sadiaslayy) April 14, 2021

How do you pick a gold stock? If we knew, we wouldn’t be sat here writing about how to pick gold stocks.

On one hand, it’s complicated, just like like picking any stock well. But on the other hand, picking gold stocks is simple. All you need to know is how to find gold.

Better – find people who know how find gold.

“The best thing to do is find companies with good geologists,” Bridge Street Capital Partners analyst Dr Chris Baker, who’s peppered with requests for how to pick these growth companies.

That makes sense. Dr Baker is himself a geologist with 27 years’ analyst experience. So we’re happy to take his advice on which small cap gold hunters have the right people on board for success.

Or, there’s the other way. We have our own geologist.

Tune in to Stockhead every Tuesday morning for Guy le Page’s “significant happenings of the resources market”.

That’ll do. Have a great weekend.