There’s currently one ASX company that owns Bitcoin — are there more to come?

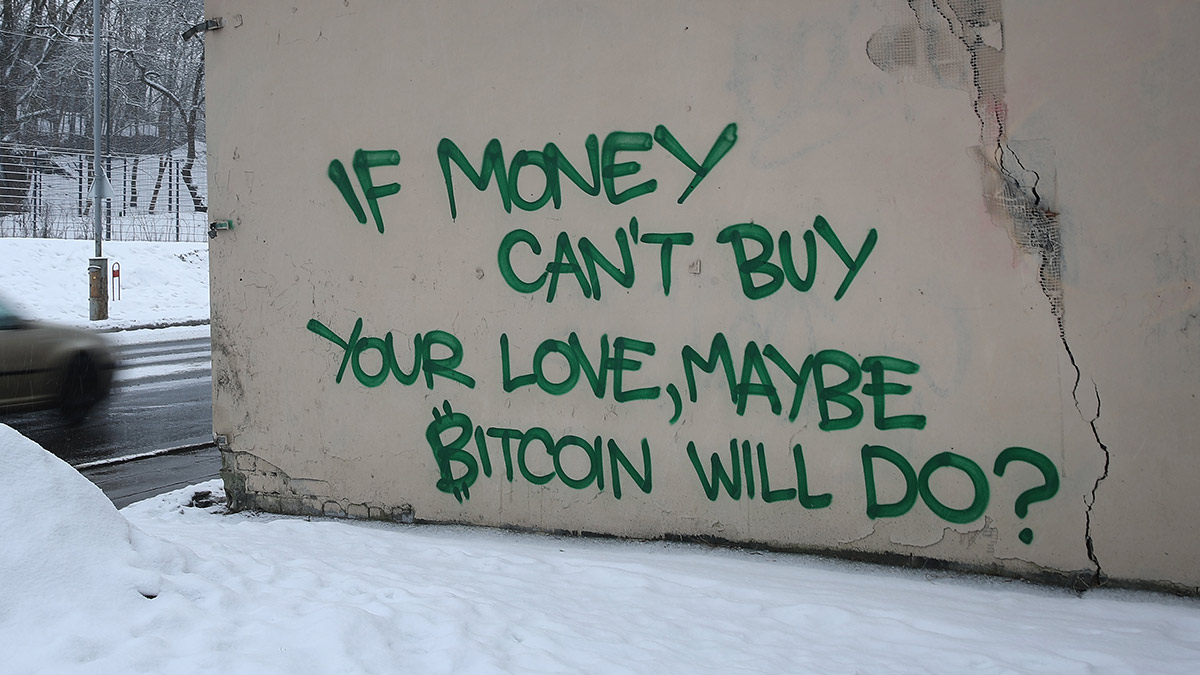

(Pic: Getty)

Major players such as Tesla and Square Inc have created a “corporate playbook” for listed companies to invest in Bitcoin, Leigh Travers says.

Stockhead caught up this week with Travers, CEO of crypto-adjacent DigitalX (ASX:DCC), amid another big rally for BTC and crypto markets more broadly.

DCC currently holds a unique place in Australian public markets as the only ASX-listed company that owns physical Bitcoin on its balance sheet.

The company owns a stash of Bitcoin which at the end of March was worth just over $35m, and it’s one of around 30 listed companies globally that hold BTC as a direct asset.

Speaking with Stockhead, Travers discussed DCC’s standing as a proxy for Bitcoin investment and the markets outlook as cryptocurrency becomes more intertwined with the traditional financial system.

Bitcoin on the ASX

Along with its direct BTC holdings, DCC also runs investment funds based around crypto asset management, targeted at sophisticated investors.

Back in February the company said funds under management (FUM) were approaching $20m, and as at March 31 it reported FUM of $31.9m.

Travers says very few DCC shareholders have moved through and bought units in the funds, a reflection of its “predominantly retail investor base”.

“So that’s been interesting for us. We got circa 9,000 shareholders and the shares did have strong correlation — around 90 per cent — with the BTC price until early this year”.

That correlation diverged a bit following an $8.8m capital raise announced in early March, largely from US investors.

Although following Bitcoin’s latest breach of new all-time highs yesterday, shares in DCC jumped by almost 40 per cent to close above 9c for the first time since March 4.

Commenting on DCC’s recent cap raise, Travers said it marked an interesting experience with the dynamic crossover between US capital markets and crypto assets.

The investors involved had also participated in a number of other crypto capital raisings which were managed by US investment bank H.C. Wainwright & Co.

All up, Wainwright & Co raised capital for “a dozen-plus North American companies that were involved in the BTC space”, Travers said.

US investors “sort of saw us as an Australian version of Greyscale, which is a Bitcoin fund over there that’s been very successful in the passive investment space”.

“It was a very short conversation. Done overnight, no trading halt needed. It was the fastest cap raising that I’ve ever been a part of, and my background is raising capital for public companies,” Travers said.

Almost just as quickly, some US investors such as the Armistice Capital Master Fund began selling DCC shares on-market which Travers said had been “surprising and a bit frustrating”.

“I do think that as soon as that selling finished, it looks like that correlation returned a bit,” he said.

“And being the only listed company with digital asset holdings, we should start to benefit from that upside coming from BTC.”

Next steps

Crypto markets continue to storm ahead, with Bitcoin trading at new all-time highs of $US64,000 ahead of the marquee NASDAQ listing of crypto trading exchange Coinbase.

That makes DCC’s Bitcoin investment — made at the outset of the first bull market in May and June 2017 — increasingly profitable.

“What we saw back then was the market was going to move, but we also saw Australian investors weren’t yet ready to invest in the space, at least through DigitalX,” Travers said.

“So we bought in industry investors that were already heavily involved in Bitcoin. They came into a (DCC) cap raising with Bitcoin, and we chose to keep that rather than sell it down.”

Will other ASX players include Bitcoin as part of their corporate treasury strategy?

Travers said the process around storing Bitcoin for corporate treasury purposes is also much better understood than it was in 2017.

“Companies like Tesla, Square Inc and MicroStrategy have established a corporate playbook for what you need to go through,” he said.

“We’ve got independent custodian storing that Bitcoin asset, which is backed by insurance registered with the SEC (US Securities & Exchange Commission).”

“They’ve got a multiple of billions of dollars worth of BTC in their custody, and that’s the element we brought in to advance the business and help investors understand that DCC is an established platform to get exposure to the (crypto) space.”

He added that public companies are somewhat limited in their investment strategies.

So activity from a name like Tesla is “really a signal to other companies that this is a good strategy to have as part of your capital base”, he said.

“BTC is the first asset where supply is truly fixed, so you only have to model demand to see where prices are going.”

“For commodity-style assets, rather than being based off cash flows the way you value it is through demand, and based on that trend it seems quite clear to me that BTC is going up over the next few years.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.