Guy on Rocks: Betting against the house

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week.

Former geologist and experienced stockbroker Guy Le Page, director and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market ructions

Gold was up 1 per cent for the week to $US1,744 ($2,288) an oz and I maintain my bullish outlook based on negative 10-year US treasuries. Obviously, inflation is the elephant in the room that could wreck gold’s train. But with money printing now off the charts we are indeed in uncharted territory.

Copper was up 2 per cent over the week, closing at $US4.06 a pound, up from the dip last week that was due to short-term longs leaving the market and LME inventories doubling since March.

Shanghai copper inventories were the highest in seven months, but the outlook for copper is slightly better short term with Chile shutting its borders for the month of April as the coronavirus spirals out of control.

My longer-term view on copper is that we will experience significant supply disruptions as EV demand for copper increases, which should underpin prices well above $US5/lb.

I noticed that Citi has lowered its nickel price forecasts based on Tsingshan’s move into ‘class 2’ conversion, which significantly undermines the medium-term bull thematic, with nickel prices forecast at $US7.61/lb (-10 per cent) for 2021, $US6.58/lb (-6 per cent) for 2022 and $US6.35/lb (-15 per cent) for 2023.

I am going to do a Michael Burry here from “The Big Short” and bet that these nickel projections are on the low side due to Tsingshan’s inability to execute its ambitious expansion plans.

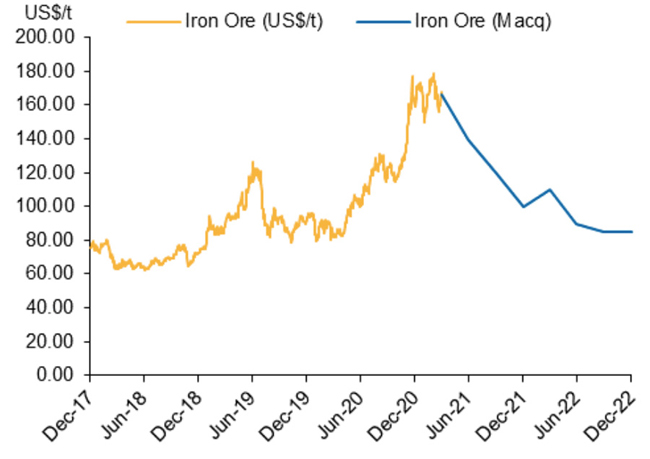

Aside from coronavirus statistics and football results it appears that everyone’s favourite pastime is predicting a fall in the iron ore price. While making negative comments on commodity prices is almost considered an act of domestic terrorism here in the West, UBS has taken the bold move in predicting iron ore prices will move closer to $US100 a tonne in the fourth quarter based on rising steel and iron ore inventories, a reduction in Chinese steel production (in an attempt to curb pollution) and on Vale ramping up its production back to pre-virus levels of 310-330 million tonnes over CY 2021.

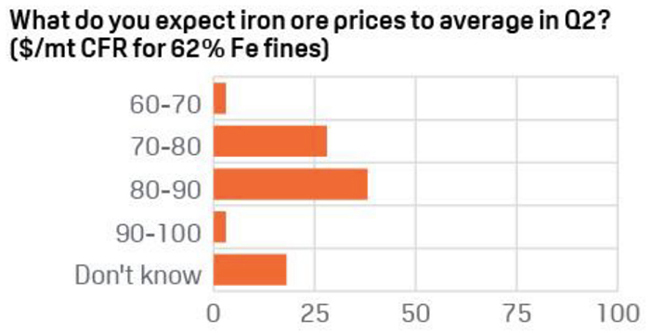

I note the results of a UBS survey (figure 2) two years ago in which the majority of survey respondents predicted iron ore at between $US80 and $US90/t (62 per cent fines) for Q2 2020, with UBS projecting an average of $US100/t over FY 2021.

Notably the survey was not bold enough to ask anyone if the price was going over $US100/t as that was unthinkable, but the price did reach $US98/t late in Q2 2020. I think I will tick the “Don’t Know” box if I am ever asked so I am not at risk of being pilloried down the track.

Mind you, UBS was correct in taking an overweight position in iron ore stocks, like Fortescue Metals Group (ASX:FMG), at the time. It seems Black Swan events are all too frequent for my liking, so I am going to bet against the house this time and say that iron ore prices will hold up over $US130/t in the fourth quarter of 2021. I am also betting against Macquarie (figure 2), but its forecast was dated April 1, 2021 so it could in fact be an April fool’s joke.

Movers and shakers

Greenland Minerals’ (ASX:GGG) journey to the promised land suffered a recent setback with the left-leaning Inuit Ataqatigitt party likely to form a coalition whose anti-uranium policy will see the giant Kvanefjeld uranium-rare earth elements (REE) project development halted.

Fortunately for the Stockhead faithful, I picked this stock up in April last year around 10c, so this did provide a good trading opportunity as the shares touched the mid 30c’s in late January this year.

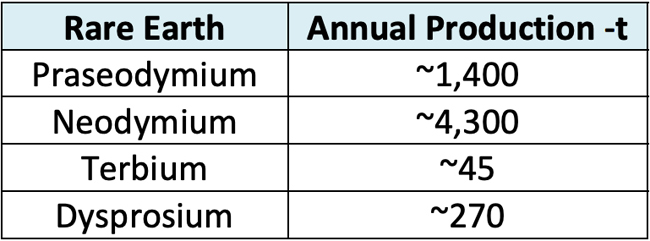

In terms of supply risk this is the granddaddy of them all and could have a significant impact on REE supply (and therefore REE prices) given its projected 37-year mine life from over 1 billion tonnes of JORC resources containing 11.1 million tonnes of rare earth oxide and 593 million pounds U3O8.

The 2019 optimised feasibility study contemplated annualised production of “magnet metals” as set out in table 1.

Looking at my financial model, uranium only accounted for around 7 per cent of revenue based on $US47/lb, so the question is could this be mined without extracting uranium?

Anyway, I think the journey is far from over here and the positive is that the deposit hasn’t disappeared, it just isn’t going anywhere in the short term. So, one of the world’s largest (and most profitable) REE deposits is currently valued at around $150m, which is pretty good value if you think things will turn around one day.

It looks like Denmark will be continuing with its €500m contribution to Greenland for the foreseeable future but at least its going to a good home.

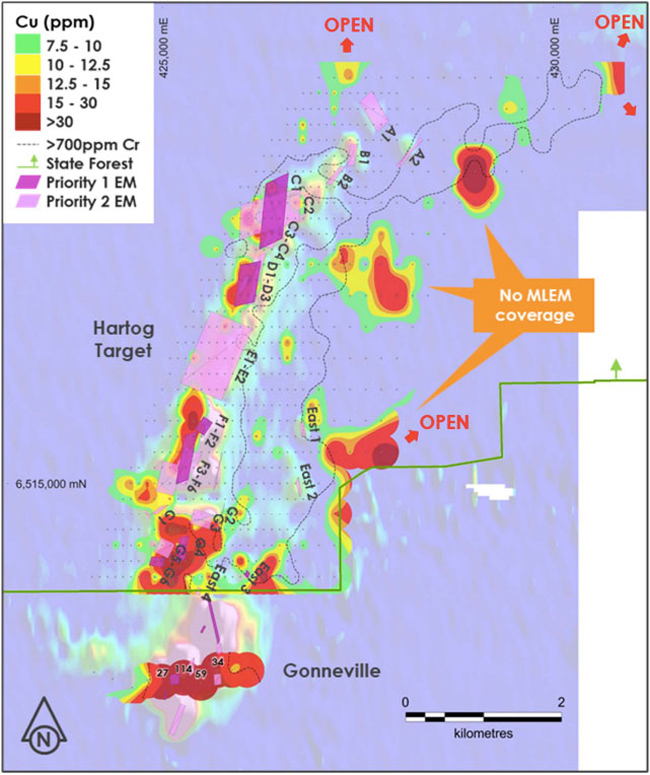

They say nothing succeeds like success (or excess if you live in WA), so another special mention goes to Chalice Mining (ASX:CHN), which has indeed arrived in Canaan by virtue of a $2.2bn market cap on the back of the potentially world class Gonneville platinum group elements-nickel-copper-cobalt-gold discovery at Julimar.

The story is far from over, with initial soil sampling and first-pass ground electromagnetics (EM) completed at the ~6.5km long Hartog Target (figure 5), where a cluster of 29 low to moderate conductance, mid to late-time bedrock EM conductors have been defined that show similarities to Gonneville. If this keeps going I am going to ask Chalice chairman Tim Goyder to change his name to Abraham.

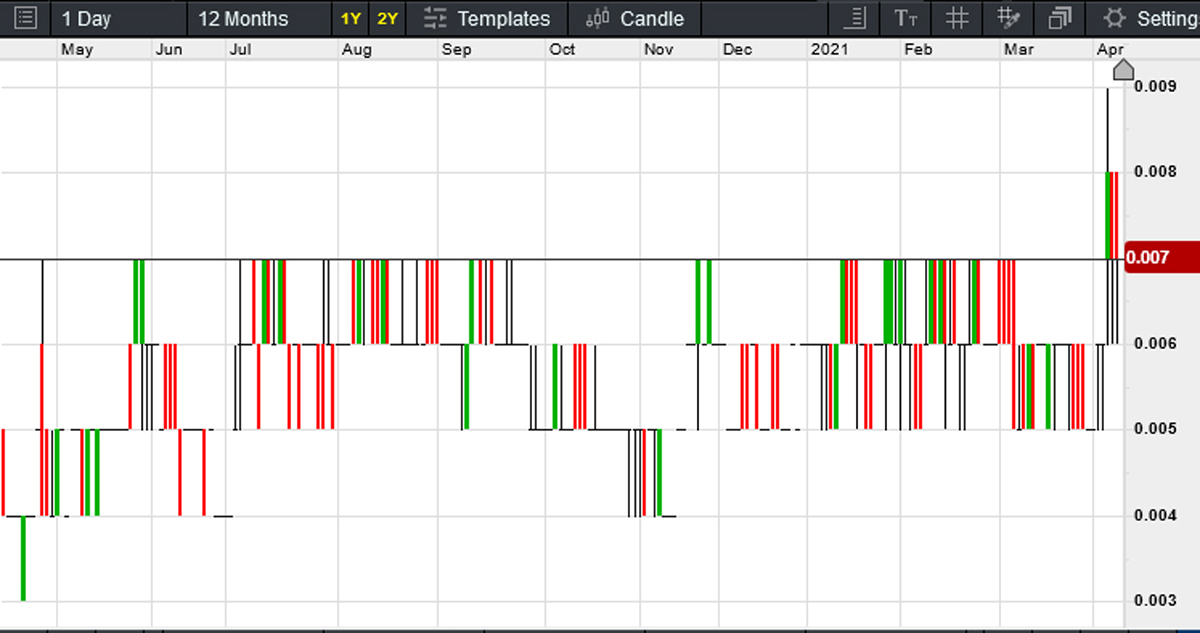

I talked about Alta Zinc (ASX:AZI) back in November last year and it has been treading water ever since. That is until a huge volume spike (figure 6) last week saw it close at 0.8c on Thursday based on $3.7m of stock changing hands on the back of some promising results.

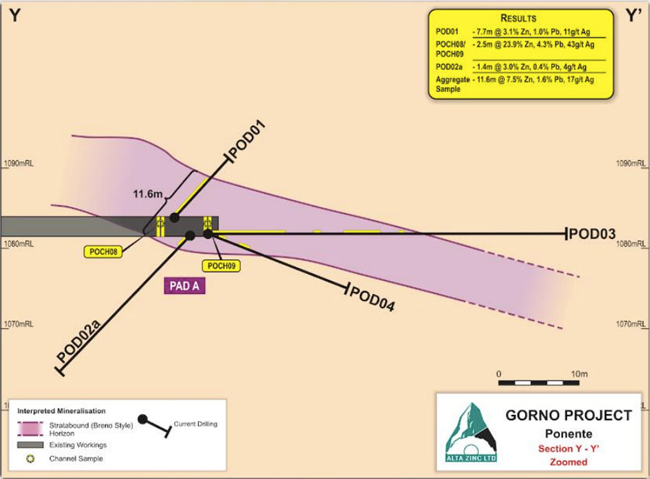

Those promising results included 11.6m at 7.5 per cent zinc and 1.6 per cent lead (9.2 per cent zinc+lead) and 17 grams per tonne (g/t) silver (drill holes POD01& 02a, channel samples POCH08&09) at Ponente (figure 7) in Italy. Further drilling results are imminent from Ponente and Pian Bracca.

Hot stocks to watch

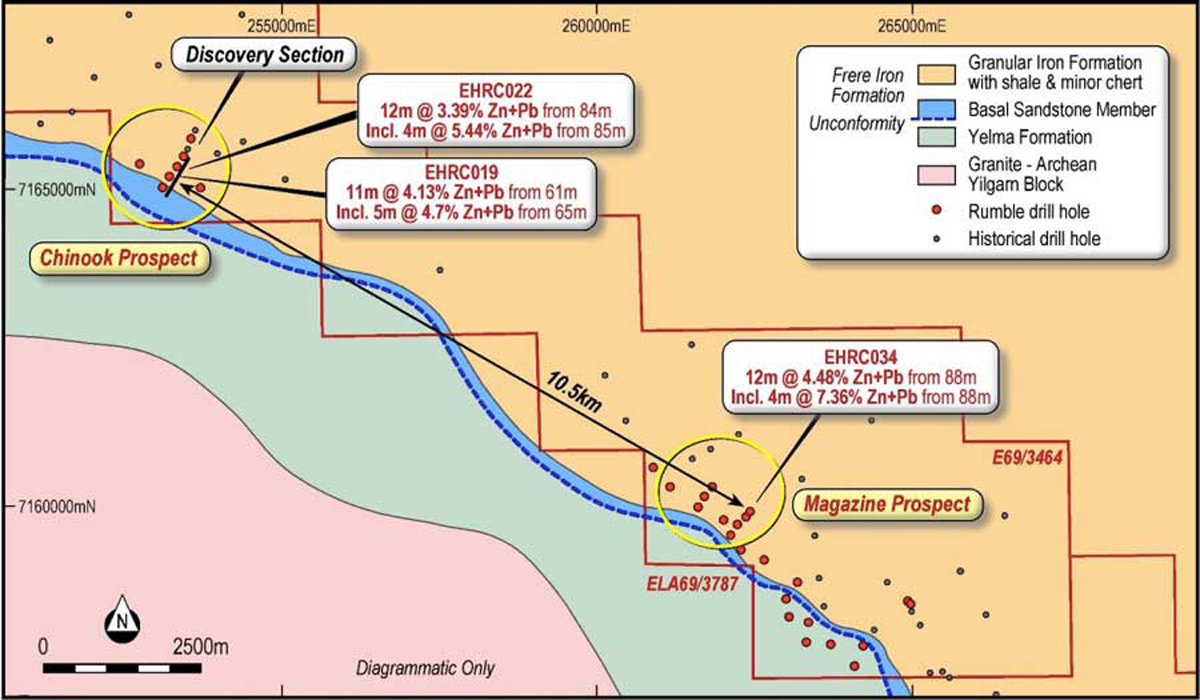

Rumble Resources (ASX:RTR) has seen a recent volume spike on the back of some promising zinc-lead intersections at its Earaheedy project (RTR: 75 per cent, Zenith Minerals 25 per cent), located about 110km north of Wiluna in Western Australia.

The company released an exploration target based around a shallow (80m deep) unconformity contact between the overlying Frere Iron Formation and underlying Yelma Formation, part of the Paleoproterozoic Earaheedy Basin. The target is 40 to 100 million tonnes at 3.5 per cent zinc-lead to 4.5 per cent zinc-lead, covering over 40km of prospective lithologies.

While no assays have been returned, the excitement appears to be centred around the upscaling of the drill program from 2,500m to 4,000m (with 3,000m already completed) based on visual inspection of the reverse circulation drill cuttings. At Chinook, 27 holes have been completed with all holes returning visual zinc-lead mineralisation.

With a market capitalisation of around $77m I will definitely be keeping an eye on this one as the assays roll in.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.