Trading with Focus – Still waiting for a silver squeeze? What about a milk squeeze instead?

Experts

Experts

So, silver is going nowhere fast. It probably isn’t going to have a short squeeze, because the market is too big and the ‘shorting’ (aka ‘manipulation’) that everyone references has been known and talked about for years.

Mostly, I would suggest that there are lots of paper contracts within the silver market because that’s how you hedge production, but what would I know… It will probably go up when gold does, like, y’know, it always does?

So what’s the tenuous link to A2 Milk? Honestly, there is none. But it was hard to find a more disappointing performance in a company that was previously a ‘market darling’. And as you should know by now, I’m always on the hunt for an underperformer, so let’s have a look at Milky Joe and see if there’s a trade. While we’re waiting for silver?

(The only thing I have found more disturbing than Homelander’s Oedipal milk issues in the past year was googling ‘A2M’ images for this article. Whoever allowed that ASX code should be brought up on charges.)

Note: I’m not an analyst. I don’t own, nor foresee myself buying A2 Milk products, or even A2 Milk shares. I don’t know anything about the milk markets, or the demand/supply of milk products or Daigous. This article is to show you how you can go about doing some due diligence on a stock, beyond the usual ‘my mate was telling me to buy some cos they’re good’ that I hear every day…and ignore.

The first thing I do when looking for a cheap stock (to try and scalp a bounce trade out of) is look at the chart. If the first thing I think is “Woof! That’s got to hurt”, then it garners further interest. In my opinion the harder a stock has fallen, the more it is hated, the better the bounce can be. And in a generally over-valued market, these are becoming harder to come by.

So, onto the next bit…because a 62% fall from recent highs for a company that is still holding onto a $6 BILLION DOLLAR market cap is noteworthy! In a bullmarket! Where Webjet is still 2.5x higher than its COVID lows! To put that into perspective, that means the company has lost more than the value of the Lendlease in 12 months.

Next step – does the thing make money, or is it ‘going to make money at some indeterminant date in the future that is not too far off’?

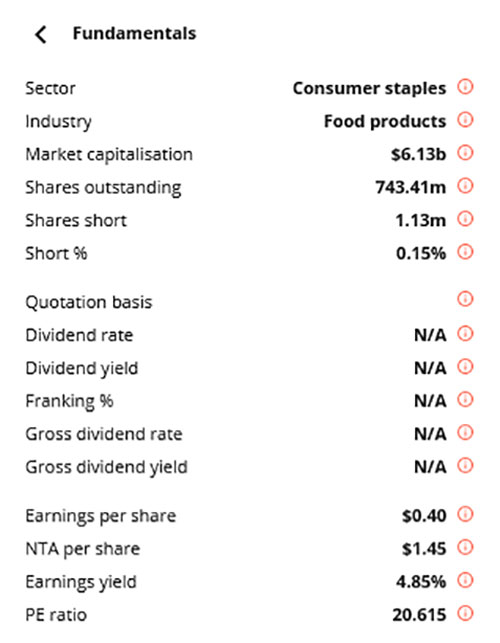

The first and laziest step here is to go to the ‘fundamentals’ section of the platform, where our good friends IRESS supply some basic background information.

Now, the interesting thing here is that this company actually does make money! Profits! If they were to pay out the profits as dividends, they would be able to pay almost 5%, but they are obviously re-investing that money into their quote unquote “growth” instead. Don’t forget though that all profit data is looking backwards, and you want to look forwards.

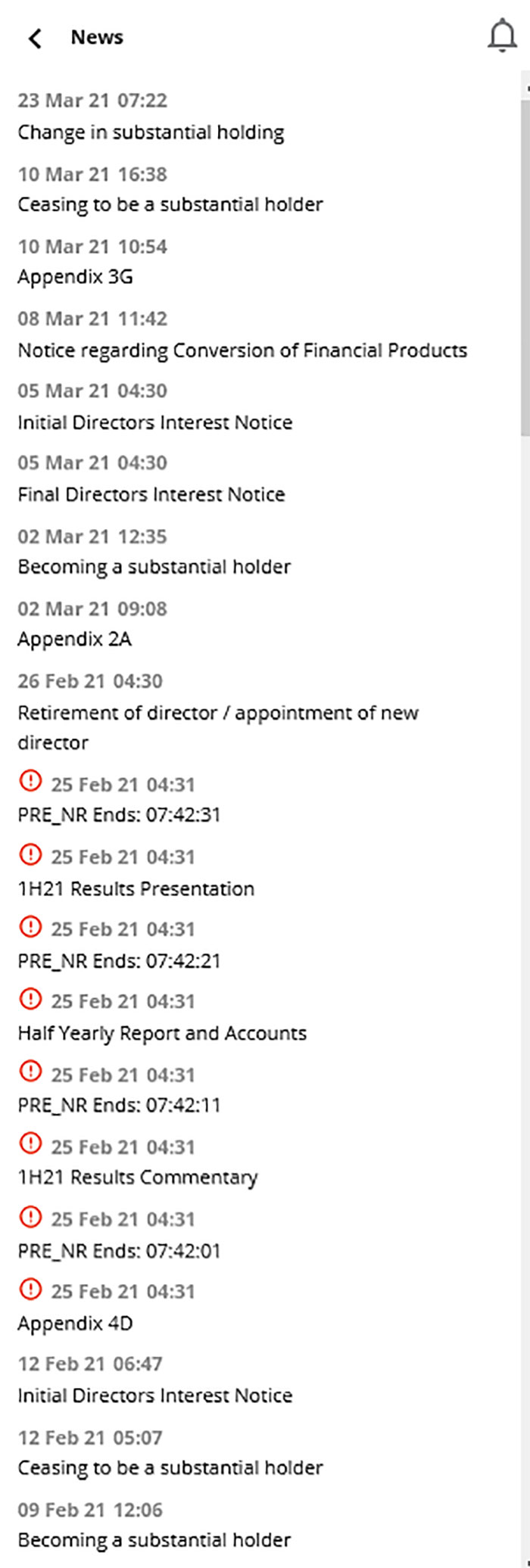

So, that requires a bit more digging. I always try to get the latest company presentation, which luckily in this case, was only in February. Once you decide to start following a company, whack an ‘alert’ on the news to save you having to try and keep track of too many different companies. Let us do it for you!

If you have a look at the presentation, you’ll notice a few niceties, pretty pictures and the like, then the guts of it. Revenue was down heavily, and mostly, the company blames COVID for disrupting their “Daigou/reseller” channels, but still maintain a very tidy profit margin of ~27%.

So this tells me a few things. Firstly, there is a lot of positivity around the future recovery of general profits in pretty much every single other company in the world. And they still have a great business in Australia and New Zealand, its just that they are seeing less people in Aust/NZ buying their products here and shipping them home to China. That’s a tough demand segment to crack, or even understand… (Note to self: learn Mandarin and Cantonese)

The Chinese daigou angle was probably the cream, and probably put the froth into the share price to start with (wucka wucka…no more puns, I promise). Their profits have dropped 32%, but their share price has dropped >60%, so this might be an anomaly where the market price has overshot, or excess negativity – that we can take advantage of. The banks did this in the GFC, and recovered very well indeed. As has pretty much every other COVID affected stock.

As is usual in these company reports, there’s a lot of justification and a lot of positivity about the future. But, the fact remains that a large amount of negativity surrounds the stock now, and when there is a lot of negativity it often means there’s a good chance for a bounce trade! So it goes on the watchlist!

Why? Well, share prices are just determined by people. You, me, some hedge fund guy, the guy deciding whether to buy it for a super fund or a multi-billion dollar industry fund. There are also short-sellers. All people. With emotions and a desire to make money, and protect what they got.

And when these ‘people’ start feeling sick in the stomach because they are losing so much money, it usually means they are prepared to sell out just to stop looking at it, at any price. So stocks get over-sold and sometimes, when they bounce, they can bounce hard because lots of sellers have already sold, or they have stopped looking at the stock. Less sellers, more buyers…equals..?

Or there can easily be more weakness, because sometimes the sellers are right. So if you’re a trader, whack in a stop-loss price every time. Or average into a position using smaller parcels rather than chomping in. Things you can do if your brokerage is only $5 or 0.02%…

So this is how I see the playbook when a stock goes from market darling to seriously hated. There is a point at which it gets sold off further because people are just sick of being burnt. Then there is a point at which it becomes good value, so even if you don’t pick the absolute bottom you can start nibbling away.

This is my final stop. If I like the business, think there’s a recovery in the future and also know its underpinned by at least some sort of fundamental value – then I look to the charts for timing.

That last leg looked like a grind down, not a sell-off. That February profit result was not the catalyst that many were hoping for and you saw one more downleg – but since then it looks more like a buyers strike. Each day just slowly dipping a bit more at a time, no green days for at least a month or two. Then, all of a sudden, a bit of a lift, with bigger volatility and a few decent green days. Less sellers, more buyers.

Looking back at the chart above, you’ll see the RSI at the bottom. Google it. Basically it says that a stock is theoretically ‘oversold’ when it dips below the purple(?) line. Each time its been oversold there has been a bounce, so its been somewhat validated on this stock. So you might jag a sneaky short-term trade, but over the last year its always been a suckers rally and therefore all about timing.

The Donchian Channels don’t show a stock that is breaking out. The MACD has turned slightly, showing that there might be an improvement in strength, direction or momentum, but that has been a total loss as an indicator over the last 12 months. The trusty Kagi would have had you selling out above $19, and certainly no re-entry signal just yet. In fact, given the stock has been in a severe downtrend now for 12 months, this is starting to look more like a stab in the dark, or an ‘are you feeling lucky?’ trade.

So, all in all, thanks for reading. Sorry if it was a bit long for a non-result. A2 Milk might be a good company down on its luck and maybe its suitable for a long-term turnaround, and getting back into the fundamentally cheap range, but there is absolutely nothing beyond that to wet the whistle for this short term degenerate trader who is bored waiting for his silver exposures to go up. Which means there’ll probably be a takeover offer tomorrow if my luck is anything to go by!

Luckily there are a lot of other stocks in the market, and considering I neither consume nor understand the product that they are selling I have no business even looking any further! Good luck to all, but to all a goodnight!

Right-i-o, what dog stocks start with a B?

At Marketech our platform is about technology, providing you the tools and technology to trade. We encourage our high-function trading platform to get you live pricing, live charts, live market depth to ensure you have the tools and trading capability at your fingertips, and on your mobile phone or PC.

You trade your own stock on your individual HIN. It is your cash in your own Macquarie account where you keep the competitive interest you earn.

Our subscribers get access to brokerage starting at $5, and then 0.02 per cent for trades over $25k. If you want to trade the market you need immediate access wherever you are and the seamless Marketech mobile app means you are live anywhere anytime.

For more information, visit www.marketech.com.au. Any queries regarding Marketech should be directed to Marketech and not to Stockhead.

This article was developed in collaboration with Marketech Stockbroking Pty Ltd (AFSL 486148), a Stockhead advertiser at the time of publishing. This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.