‘Carefully scripted propaganda’: Why China’s nickel supply story is full of holes

Pic: Getty.

In March, Chinese nickel giant Tsingshan announced plans to supply 100,000 tonnes of nickel ‘matte’ converted from lower quality nickel pig iron (NPI) to battery midstream majors CNGR and Huayou Cobalt.

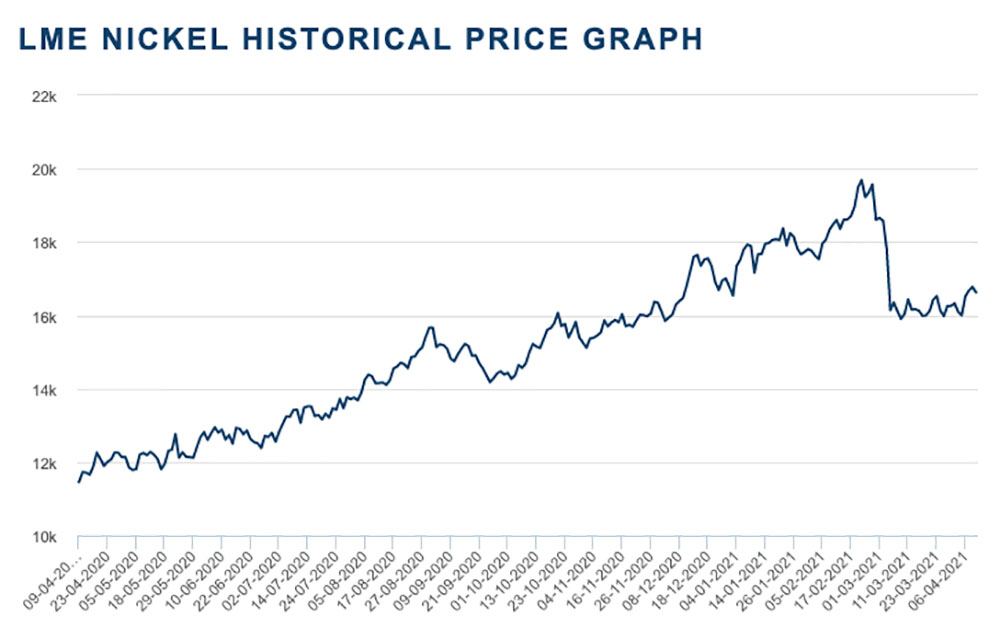

News that Tsingshan was about to supply a big chunk of the current and predicted battery nickel shortfall with converted ‘class 2’ nickel — largely avoided due to higher conversion costs and an elevated carbon footprint – was enough to send shockwaves through the red-hot nickel market.

The LME price promptly fell ~14 per cent and has yet to recover.

Should nickel investors be worried? No, according to a range of experts on Benchmark Mineral Intelligence’s recent Nickel Day.

BENCHMARK MINERAL INTELLIGENCE

Greg Miller, analyst

“Although this announcement sent massive shockwaves around the nickel market there are still a lot of question marks around this process,” Miller says.

“The key strength of the ‘NPI-to-nickel matte’ route is its scalability. NPI to matte capacity from NPI can be built really in two years compared to 3-5 year for HPAL.

“However, there are significant downsides to using this processing route. Particularly the higher CO2 emissions. It is up to five times more carbon intensive than the HPAL route. There is no obvious mitigation to this.

“In our view, this route will function as swing supply in times of market tightness, helping to bridge supply gaps for the battery industry.

It does ease a lot of the longer term supply concerns, Miller says, but without significant cleaning up of the process it may not be viable for EU cell makers and auto makers.

“And although the nickel price took a beating from this announcement, for the battery industry it doesn’t really alleviate the near term supply shortages,” he says.

QUEENSLAND PACIFIC METALS (ASX:QPM)

Stephen Grocott, CEO

“I’ll be blunt: I think it’s a complete beat up,” Grocott says.

“NPI to matte: yes, you can do that in two years, but the matte through to sulphate [used in batteries] process is very slow, very complex.

“I estimate you need at least $US10/lb as an incentive price [currently ~$US7.20/lb]. That will put a cap on it, and stop some of the boom and bust.

“Also, on the sustainability credentials — it has a massive greenhouse gas footprint.

“It’s not economically attractive, it’s not environmentally attractive [and] it’s not something non-Chinese manufacturers will want in their cars.”

Sam Riggall, Managing Director and CEO

“China has taken the view that it will invest significantly, and I don’t think it cares too much about the return on capital,” Riggall says.

“This is an enabler to control what is a relatively strategic downstream sector in automotive technology production.

“Western Governments are waking up to the reality that they need to be quite interventionist now if they actually want to develop alternative supply chains.

“I think that’s where it’s heading.

“I think you’ll see a lot of support, in a lot of different ways for projects [like ours].”

Chris Reed, managing director and CEO

“I think it was carefully scripted propaganda from our Chinese friends to stop the rise of the nickel price,” Reed says.

“I can’t really see why it should’ve upset the applecart. Yes, there is volume, but has it been committed to?

“It was a newspaper article, basically, but it had the desired effect.

“[The Chinese] wouldn’t be that happy about [lithium] spodumene prices creeping up either. No doubt there will be moves to knock the sting out of the spodumene price as well.

“I don’t think they will succeed, but [like Benchmark says] this is a global arms race for battery materials.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.