Should nickel bulls be worried about ‘dirty’ Tsingshan battery metals?

Pic: John W Banagan / Stone via Getty Images

Last week, Chinese nickel giant Tsingshan agreed to supply 100,000 tonnes of nickel ‘matte’ converted from lower quality nickel pig iron (NPI) to battery midstream majors CNGR and Huayou Cobalt.

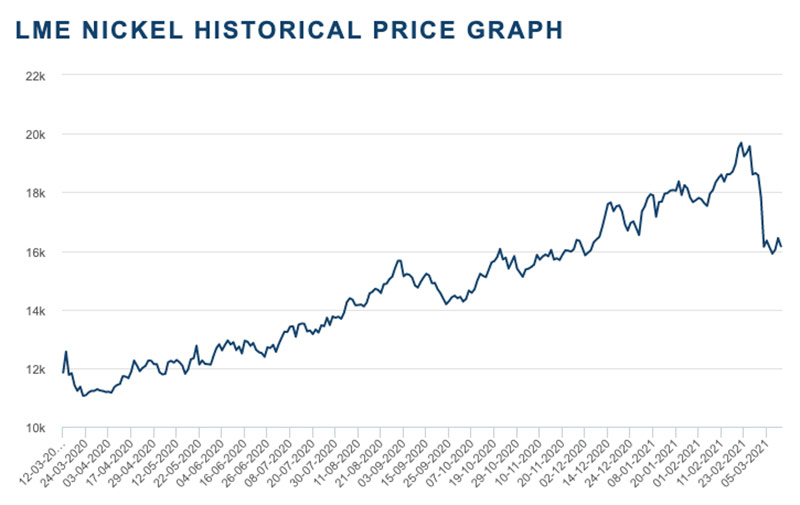

This sent shockwaves through the nickel market. The LME price promptly fell ~14 per cent and has yet to recover.

Why though?

First, some definitions.

Nickel is usually found in two main ore types – sulphide or laterite.

Laterites (class 2) are good for NPI, which is used as a cheaper alternative to pure nickel for the production of stainless steel.

Sulphides (class 1) are turned into battery grade nickel sulphate much more cheaply and easier than nickel laterites and fetch a higher price.

Many of the explorers you read about – like Auroch Minerals (ASX:AOU), Azure Minerals (ASX:AZS), and Corazon Mining (ASX:CZN) — are sulphide explorers.

Auroch, Azure and Corazon share price charts

But supply of nickel sulphides is declining because of a lack of new discoveries, at the same time demand is climbing.

Hence the bullish sentiment, which had driven prices to near 10-year highs.

News that Tsingshan was about to supply a big chunk of this battery nickel shortfall with converted ‘class 2’ nickel — largely avoided until now to due to higher conversion costs, loss of cobalt as a by-product, and an elevated carbon footprint – was enough to put a dent in this sentiment.

“The announcement comes amidst tightness in the availability of both nickel sulphate, and ‘class 1’ raw material supply suitable for chemical conversion which has forced Chinese buyers to seek alternative sources to meet supply gaps,” Benchmark Mineral Intelligence says.

“With battery demand expected to continue accelerating this year, and a raft of new Indonesian NPI supply coming to market across 2020 and 2021, the utilisation of ‘class 2’ units to bridge emerging supply gaps has come closer to a reality.”

The key downside of conversion of NPI to matte is that it is an expensive (although Tsingshan appears to have appeared to done it economically) carbon intensive process, and with the ESG spotlight firmly fixed on the battery supply chain, “it remains to be seen whether Western automakers will utilise nickel from such sources in their supply chains”, Benchmark says.

Smelting of laterite ores to produce NPIs is associated with some of the highest CO2 emissions in the industry, Roskill says.

“This could provide Western OEMs, the likes of Tesla, with a difficult decision in terms of nickel procurement from these sources,” it says.

Tesla alone needs ~26% of projected nickel supply by 2030.

“These companies have placed ESG high up their list of raw material procurement criteria,” Roskill says.

Having said that, this development could offer nickel sulphate producers a new feedstock option, Roskill says — diversifying the raw material choices and thus easing feedstock tightness for the battery industry, at least in the short-term.

“The deal could represent a short-term supply solution while the high pressure acid leach (HPAL) projects being constructed in Indonesia [nickel sulphate projects which use laterite ore], reach completion and become fully ramped up,” Roskill says.

“This is especially pertinent given HPAL technology’s history for complexity and these projects facing additional challenges following plans to drop marine tailings disposal.”

Still, the jury is out on the impacts of Tsingshan’s announcement to the nickel market longer term.

“Uncertainty remains as to whether regular supply from successful trial production from Tsingshan will guarantee a path to large-scale matte production in an economical and sustainable way leading to wide adoption of matte among battery consumers,” Roskill says.

“Indonesian NPI supply has surged over recent years, climbing from 7,000t of contained nickel in 2014 to an estimated 610,000t of contained nickel in 2020 thanks to an influx of NPI investment into the country,” it says.

“That represents a sizeable amount of capacity that could choose to add a matte conversion circuit should Tsingshan’s initiative prove successful.”

The growth in Indonesian production in recent years also highlights the speed with which additional capacity could be added in the country, it says.

“Roskill continues to monitor developments of the nickel industry as supply chains adjust to compensate for growing demand from Li-ion batteries amid ongoing growth of China’s stainless steel industry.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.