In Case You Missed It: Tim Goyder’s new speccy gets drilling, BHP doles out the $$

Pic: Via Getty

Stockhead’s In-Case-You-Missed-It highlights today’s most interesting small cap stories that might have slipped beneath your radar.

Below is a wrap of the top 20 performing stocks, by percentage, that made announcements today.

ICYMI Leader Board

| CODE | COMPANY | PRICE | % | MARKET CAP |

|---|---|---|---|---|

| CBE | Cobre | 0.077 | 88% | $11,763,351 |

| TNC | True North Copper | 0.105 | 54% | $26,169,219 |

| WTM | Waratah Minerals Ltd | 0.095 | 19% | $11,949,160 |

| JDO | Judo Cap Holdings | 1.1 | 18% | $1,037,196,279 |

| CCO | The Calmer Co International | 0.007 | 17% | $5,144,971 |

| TAR | Taruga Minerals | 0.009 | 13% | $5,648,214 |

| HMG | Hamelin Gold | 0.084 | 12% | $11,812,500 |

| COE | Cooper Energy Ltd | 0.1225 | 11% | $290,404,205 |

| RCL | ReadCloud | 0.05 | 11% | $6,579,203 |

| TMG | Trigg Minerals Ltd | 0.01 | 11% | $3,372,806 |

| QIP | Qantm Intellectual | 1.045 | 10% | $133,048,312 |

| AMD | Arrow Minerals | 0.0055 | 10% | $17,368,825 |

| LCL | LCL Resources Ltd | 0.014 | 8% | $12,364,905 |

| MRL | Mayur Resources Ltd | 0.215 | 8% | $67,220,239 |

| ORN | Orion Minerals Ltd | 0.015 | 7% | $81,830,486 |

| ARX | Aroa Biosurgery | 0.735 | 7% | $236,974,567 |

| GDG | Generation Dev Group | 1.83 | 6% | $328,802,683 |

| AGH | Althea Group | 0.041 | 5% | $15,445,714 |

| IVZ | Invictus Energy Ltd | 0.11 | 5% | $147,677,247 |

| GTE | Great Western Exploration | 0.026 | 4% | $7,098,703 |

BHP will give African explorer Cobre (ASX:CBE) US$500,000 as part of its 2024 Xplor program.

CBE intends to use the cash to assess and progress targets which have the potential to host tier-one copper-silver deposits. Fellow recipient Hamelin Gold (ASX:HMG) also made strong gains today.

Tim Goyder and Stuart Tonkin-backed Waratah Minerals (ASX:WTM) is drilling at the Spur project in NSW’s Lachlan Fold, down dip from big hits like 86m @ 1.56g/t Au, 536ppm Cu.

First assay results are expected March 2024.

True North Copper (ASX:TNC) signed binding offtake and toll-milling agreements with one of the world’s largest miners, Glencore, for its Cloncurry copper project in Queensland.

A presentation was given this morning by new Arrow Minerals’ (ASX:AMD) managing director Dave Flanagan, formerly of Atlas Iron and Delta Lithium.

Arrow has an iron ore project along strike and adjoining the giant Simandou iron ore project under development by a consortium of companies, including Rio Tinto (ASX:RIO).

Copper-gold porphyry hopeful Hot Chili (ASX:HCH) has launched into the next phase of its 30,000m resource expansion drilling blitz at Costa Fuego in Chile.

A resource upgrade for Costa Fuego is being finalised and expected to be announced in Q1 2024. Updates on the PFS and water concept studies are also due this quarter.

Mark Creasy-backed Peregrine Gold (ASX:PGD) has acquired three more exploration licenses around its Newman project in the Pilbara for $175k in shares, plus another $1.2m cash if PGD hits certain development milestones.

Argentina brines developer Galan (ASX:GLN) says filling of Pond 1 has commenced at Hombre Muerto West (HMW) ahead of lithium chloride production in H1 2025.

And serial cap raiser Invictus Energy (ASX:IVZ) is trying to wrangle another $15m from shareholder pockets at a premium to the last closing price.

In December, IVZ raised $15m via placement at 13c per share, a 21% discount to the 5-day VWAP at the time. The company also raised a collective $35.4m between April-June, and another $15m in September.

Who’s making cash?

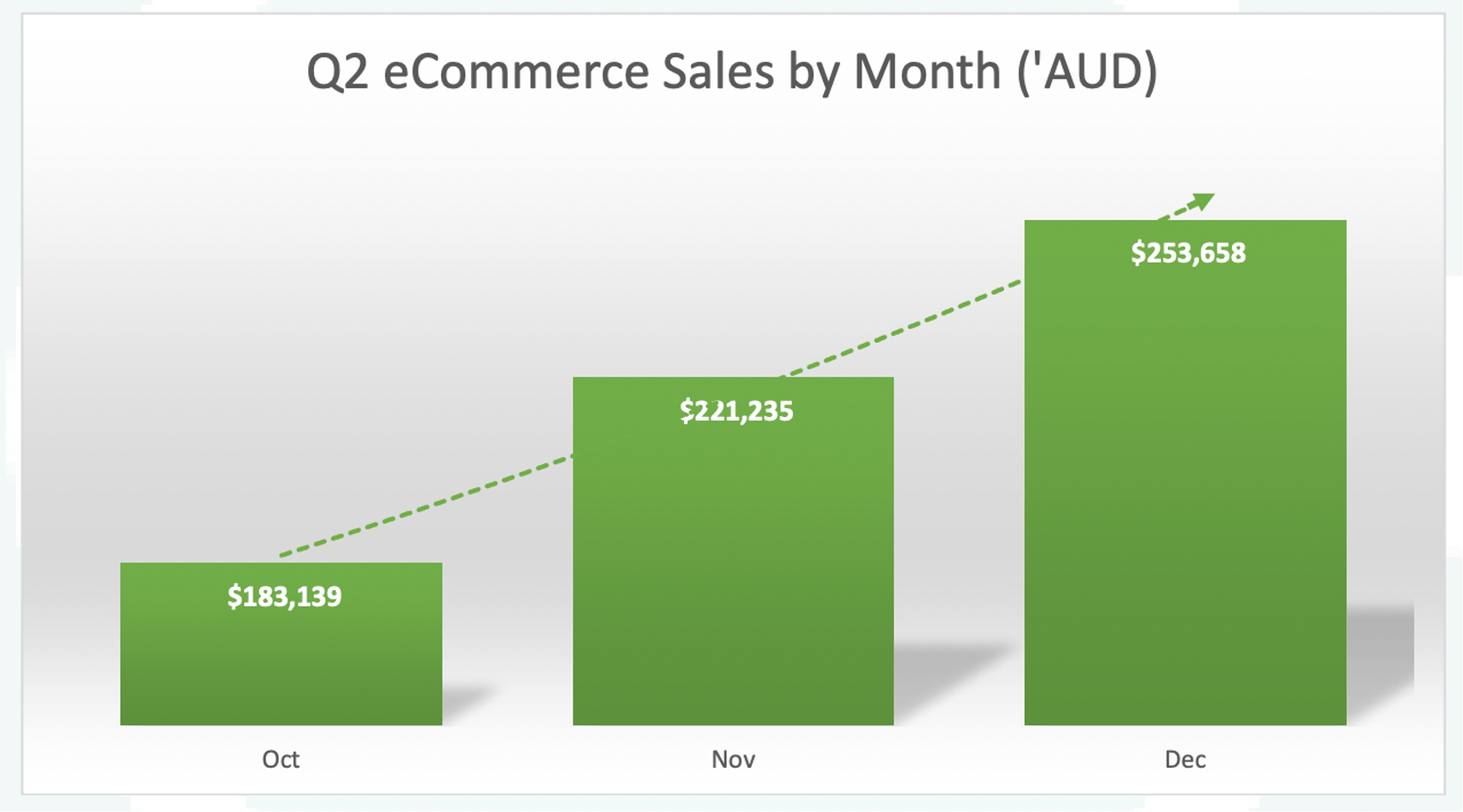

Health and wellness stock The Calmer Co (ASX:CCO) says December ecommerce sales have again materially increased and now have surpassed $250,000:

Neobank Judo Capital (ASX:JDO) says December half profit before tax (PBT) was $67m, up 24%, and “ahead of company compiled consensus”. Judo expects second half PBT of $40m – $45m, resulting in FY24 PBT of $107m – $112m.

Q2 FY24 production (61.7 TJe/d) and revenue ($55m) were up 3% and 8% respectively for Cooper Energy (ASX:COE).

And intellectual property stock QANTM (ASX:QIP) upgraded earnings per share by 20%-25% for FY24. QANTM also expects underlying EBITDA to be between 8% and 10% higher than the analyst estimates of $31m.

More Top Small Cap Stories: Tuesday

One of the best performing stocks of 2023, Spartan Resources (ASX:SPR), has begun the new year strongly with multiple high grade hits at the 952,000oz ‘Never Never’ deposit.

Four rigs are currently spinning across the wider Dalgaranga gold project in WA, with more on the way.

Fellow 2023 standout Strickland Metals (ASX:STK) says more drilling is now underway at the Earaheedy and Yandal projects in WA.

The rig will initially be focused on the large-scale base metal prospect, Rabbit Well, while final gold assays are awaited from diamond, RC and aircore drilling in 2023.

Botala Energy (ASX:BTE) received environmental approval to proceed with commercial development of its Serowe Coal Bed Methane (CBM) project.

Patriot Lithium (ASX:PAT) finalised the all-share acquisition of the Beyond claims near its Gorman project, along strike from one of Canada’s largest and highest grade hard-rock lithium deposits called PAK.

Anson Resources (ASX:ASN) received a Conditional Use Permit (CUP) for exploration drilling and operation of its sample demonstration plant at the Green River lithium project in Utah.

A DFS update on Toubani’s (ASX:TRE) 2.4Moz Kobada gold project will look at processing of more ore through a bigger plant compared to previous studies.

And soil sampling defined new lithium trends at Franks Far Southeast and Spargos East, part of Dynamic Metals’ (ASX:DYM) Widgiemooltha project in the Goldfields of WA.

At Stockhead we tell it like it is. While HCH,PGD,GLN, SPR,STK, BTE, PAT and ASN are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.