Why did mining legends Tim Goyder and Stuart Tonkin buy into this $5m capped gold explorer?

Pic: Via Getty

On 8 December Battery Minerals (BAT) – soon-to-be renamed Waratah Minerals (ASX:WM1) — completed a private $560,000 placement at a premium to two strategic investors, Tim Goyder and Stuart Tonkin.

Legendary small cap investor Goyder needs little introduction. His companies Liontown Resources (ASX:LTR) and Chalice Mining (ASX:CHN) have become two of the largest explorers on the ASX over the past three years.

He now owns 7.26% of BAT.

Tonkin, who leads ~1.7Mozpa gold major Northern Star Resources (ASX:NST), was already on the BAT register but bumped his stake from 5.83% to 9.89%.

The news was enough to light a rocket under the tiny stock, which has soared almost 150% to a market capitalisation of $12.5m on outsized volumes.

The 8.5% premium paid by Goyder and Tonkin (3.8c per share) already looks like a bargain.

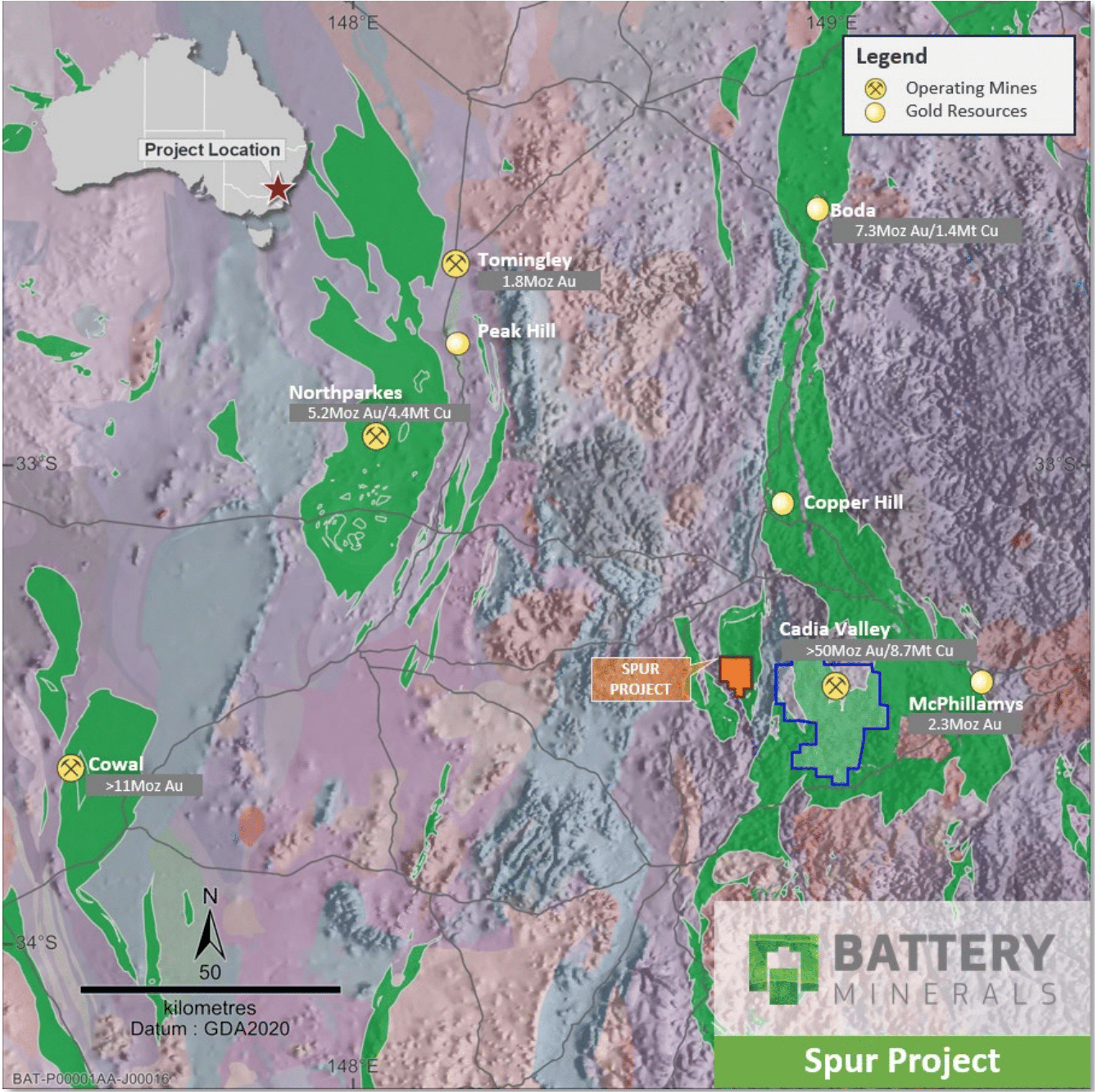

Their interest probably lies in BAT’s recently acquired Spur project in NSW’s East Lachlan Fold belt, home to some of Australia biggest gold and copper operations.

Just 14km from Spur is Newcrest Mining’s 32.1Moz gold, 7.2Mt copper Cadia Valley operations. But this isn’t just a nearology play.

Tied up in private hands for the last decade or so, Spur comes with a cluster of thick historic drill hits, like 86m @ 1.56g/t gold from 85m.

Historical explorers were mostly in it for the copper and this drilling doesn’t go very deep, despite old IP geophysics defining a strong southerly plunging anomaly beneath existing mineralisation.

Promising signs. An initial 2000m drill campaign to test this target at depth is due to kick off in January.

Battery Minerals managing director Peter Duerden has become a bit of a specialist in East Lachlan mineral systems, having spent many years kicking rocks for big companies like Newcrest and Alkane Resources (ASX:ALK).

The veteran geologist says Goyder and Tonkin see “a good gold discovery opportunity” at Spur, a project he himself has had an eye on for some time.

“We like it. We have gone hard to secure the project because it represents a drill ready discovery opportunity near Cadia Valley,” he told Stockhead.

“That area has been looked at for copper in the past, and the gold hits went under the radar a bit, despite their significance.

“It’s got some flavours of porphyry and epithermal mineralisation.

“There could be a major system there, and we are just methodically working up the targets which we will start testing in January.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.