Closing Bell: The ASX has come a long way and gone nowhere on Monday

News

Australian sharemarkets lacked all the vim, vigour and vinegar one associates with victory on Monday.

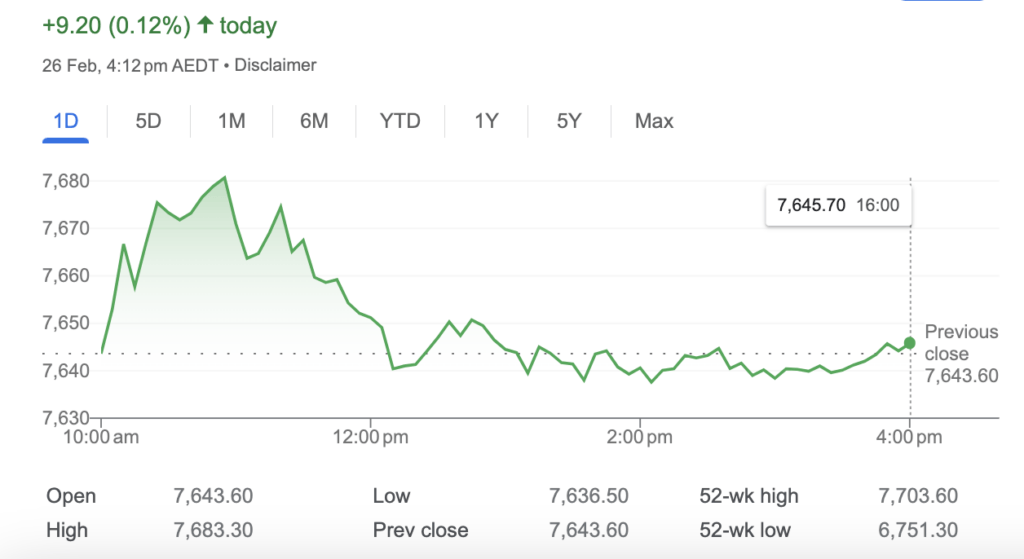

At 4.15pm on February 26, the S&P/ASX200 was up by 9 points or 0.12% to 7,652.80…

Directionless. Purposeless. Without conviction. And alone. But enough about the degenerate senior editorial committee here at Stockhead!

What can I say that’s constructive for traders of the ASX?

Local markets were a disgrace on Monday.

Weak corporate data soured already fragile sentiment as the day wore on.

Shares were flattening out across the morning, dragged lower by the lack of love for local energy stocks, which were themselves abandoned by lower LNG, and crude oil prices.

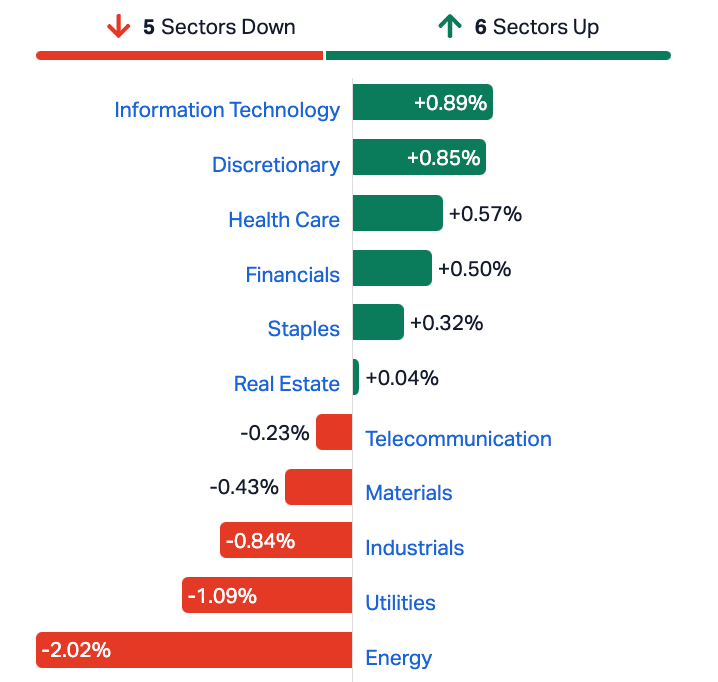

The Energy sector was the worst performer.

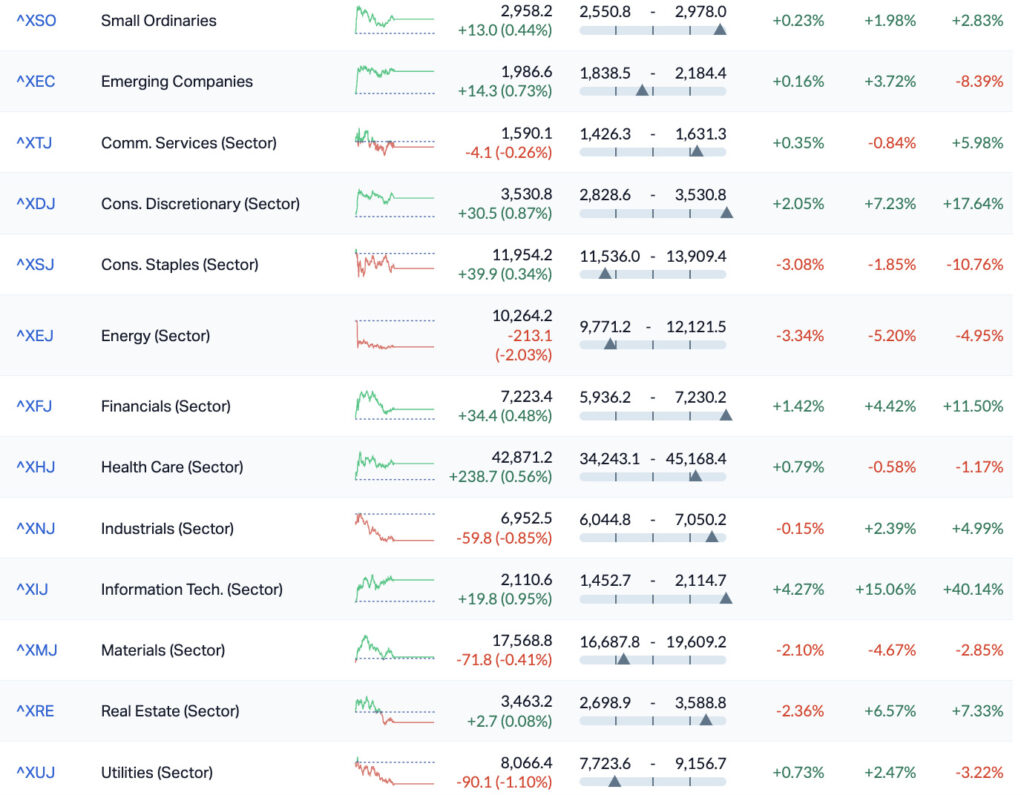

Gains for the IT index, Healthcare and Consumer Discretionary were offset by big losses among the resources and industrial names.

Santos stock collapsed about 5% and Woodside was underdone all day.

It was a little depressing on the earnings front, aside from Kogan, which was up 22% at lunchtime…

Kogan.com copped a hard run coming out of the pandemic which had looked so damn promising. They fluffed it with logistics, but now appear to be back. I think EBITDA was up some 500% so, keep rustlin’ cowbuy.

In the ASX cupboard of shame: The local medtech Nanosonics, which was down double digits after disappointing first half results for the infection technology maker.

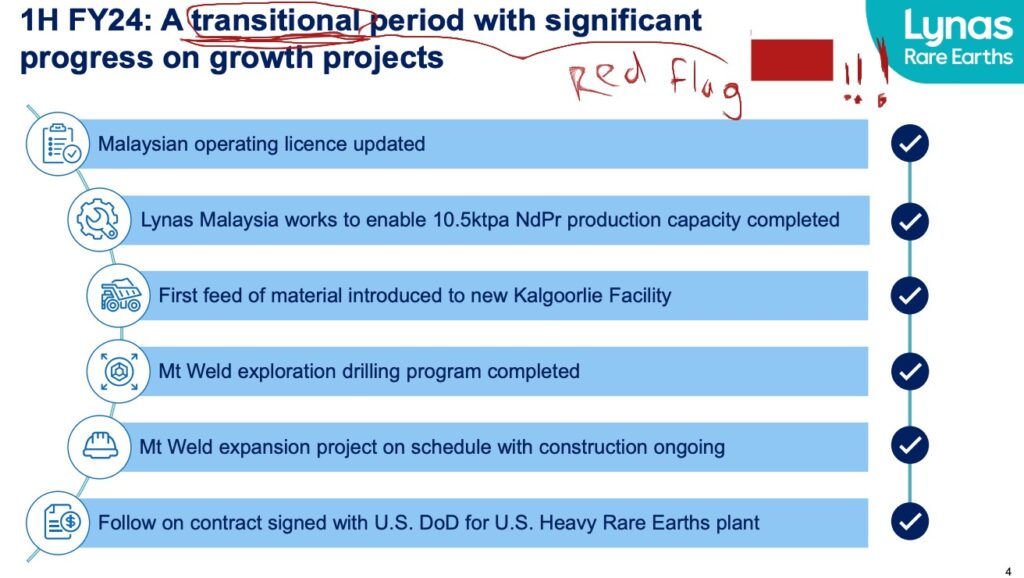

Not in the ASX doghouse (largely because the share price has actually edged higher) but far from covered in glory is Lynas (ASX:LYC), where net profit came tumbling down by three-quarters on the the first half of last year – that’ll be circa $150mn down to circa $40mn.

Despite falling rare earths prices last year, Chinese authorities lifted quotas for rare earth mining and smelting again in early February by 12.5% and 10.4% respectively for the first half of the year to 135,000t and 127,000t. That’s also impacting Lynas, which remains bullish on the outlook, regardless of challenges like the 7 weeks of production pause during bad weather in Malaysia.

Lynas has been looking to rejig it’s Malaysia-based REE efforts, but this kind of description (below) never looks good on the first page of an earnings presso.

Best avoid ‘transition period’ even if it is.

Closer to the mark are the words of chief exec Amanda Lacaze who said the rare earths producer is among the variety of ASX miners revealing a slide in profits as part of the knock on impact of the meltdown in nickel prices.

Lacaze on Monday thought it was bad enough to send a general warning out that governments should be “alert at all times” for what else the crash in prices could do.

Lynas: 1H24 a time of transition…

Via ASX… the majority of Monday’s reporters were slaughters.

But not all was lost.

There’s the inadvertent thwack on the noggin for TPG Telecom (ASX:TPM), delivered annual net profit of an appalling $49mn (compared to the half a billion of a year earlier.

A lot of debt on the books and higher costs for everything have come knocking.

So has competition.

TPG won’t be cheering news Aussie Broadband (itself up 5%) just snapped up a clean 20% stake in rival broadband providing minnow Superloop (ASX:SLC) as part of a near half a billion takeover play to literally scale up and take down the major Aussie telcos.

Both the small ords and emerging markets XAO and XEC indices were trading higfher on Monday. Looking ahead for this fun-filled week of indicators and vindicators – Coles Group (ASX:COL) drops its next obscenely robust profit report on Tuesday, which will nicely lead into January Aussie retail sales data on Thursday.

Woodside will also report its annual result on Tuesday and CoreLogic drops house price data for February on Friday, projecting a likely rise in capital city homes, everywhere.

![]()

We’re watching oil…

We have to. It’s being silly.

WTI crude futures fell to around $76 per barrel on Monday, extending losses from the previous session as demand-side uncertainties outweighed supply concerns. Futures dropped below their 200-day moving average in the week’s final trading session, triggering some scary algorithmic selling.

Traders endured dramatic swings lower – the biggest in three weeks as per Bloomberg – after futures breached the key moving average.

Crude has been trading in a narrow band for the past two weeks. On the supply side, investors closely monitored geopolitical developments in the Middle East as Iran-aligned Houthis continued their attacks on Red Sea shipping. Still, analysts noted that the Israel-Hamas war has not significantly affected supply.

OPEC+ supply curbs are offsetting the impact of higher production from outside the group, including the US, where production continues to shake OPEC+ plans.

The cartel is widely expected to extend its current cutbacks into the next quarter when it meets early next month.

Probably the silent killer in all this is uncertainty around the outlook in top crude importer.

On the supply side, investors closely monitored geopolitical developments in the Middle East as Iran-aligned Houthis continued their attacks on Red Sea shipping. Still, analysts noted that the Israel-Hamas war has not significantly affected supply.

For now, Brent looks happy below $US82 a barrel after falling almost 2.7% on Friday in the States.

US Markets…

Where to next for US stocks drunk with the power potential of AI?

We’ll find out in a few hours when investors return to the scene of the Nasdaq’s Nvidia (NVDA) inspired run late last week.

There’s some quality inflation data out later this week, but do US investors really mind now that it seems AI can crash through any wall or scale any mountain?

On Wednesday the US Fed retreated into insignificance when the newly minted US$2trn chip giant delivered yet another blockbuster earnings which laid waste to all doubters and even the highest of Wall Street expectations.

In response, not only did Nvidia become the first semiconductor company to reach a market cap of $2 trillion on Friday, the company’s guidance sent technology and artificial intelligence-related stocks soaring.

Nvidia’s gains sent the Nasdaq Composite up 3% on Thursday, for its best session in more than 52 weeks of trying.

On Friday, US markets looked a bit hungover-stunned, ending mixed, but definitely looking for the next catalyst.

For the week, all three major averages ended in positive territory. The S&P 500 was the biggest weekly winner, gaining 1.66%, while the Nasdaq gained 1.4%. The Dow added 1.3% for the period.

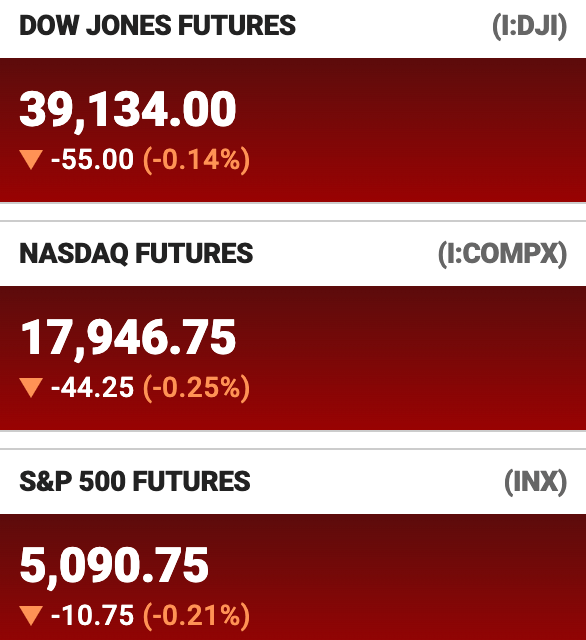

US Futures (4pm Monday in Sydney – 12pm Sunday NY) ahead of the Monday open in New York:

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| W2V | Way2Vatltd | 0.032 | 60% | 132,081,482 | $13,032,169 |

| EXL | Elixinol Wellness | 0.009 | 50% | 2,377,022 | $3,797,230 |

| AVW | Avira Resources Ltd | 0.0015 | 50% | 150,285 | $2,133,790 |

| RKT | Rocketdna Ltd | 0.01 | 43% | 47,769,028 | $4,592,804 |

| BP8 | BPH Global Ltd | 0.002 | 33% | 167,999 | $2,931,174 |

| AHK | Ark Mines Limited | 0.2 | 33% | 105,902 | $8,316,962 |

| PL3 | Patagonia Lithium | 0.17 | 31% | 235,497 | $6,386,705 |

| LSA | Lachlan Star Ltd | 0.052 | 30% | 981,979 | $8,302,928 |

| BVS | Bravura Solution Ltd | 1.245 | 30% | 7,928,441 | $430,419,842 |

| OSL | Oncosil Medical | 0.009 | 29% | 1,212,315 | $13,821,788 |

| SKN | Skin Elements Ltd | 0.005 | 25% | 311,471 | $2,357,944 |

| ZEO | Zeotech Limited | 0.031 | 24% | 824,895 | $43,335,577 |

| INV | Investsmart Group | 0.155 | 24% | 5,000 | $17,835,061 |

| COY | Coppermoly Limited | 0.011 | 22% | 90,394 | $6,265,219 |

| WCN | White Cliff Min Ltd | 0.017 | 21% | 8,775,065 | $18,702,031 |

| TTM | Titan Minerals | 0.023 | 21% | 3,390,284 | $32,221,079 |

| MOZ | Mosaic Brands Ltd | 0.205 | 21% | 194,260 | $30,346,095 |

| AYT | Austin Metals Ltd | 0.006 | 20% | 655 | $6,425,957 |

| CHK | Cohiba Min Ltd | 0.003 | 20% | 11,322,357 | $6,325,575 |

| HIQ | Hitiq Limited | 0.025 | 19% | 27,743 | $7,388,744 |

| PKD | Parkd Ltd | 0.025 | 19% | 507,094 | $2,184,292 |

| STP | Step One Limited | 1.45 | 19% | 1,388,326 | $226,115,155 |

| XF1 | Xref Limited | 0.13 | 18% | 106,430 | $20,479,392 |

| PXX | Polarx Limited | 0.013 | 18% | 6,947,947 | $18,035,785 |

| MTM | MTM Critical Metals | 0.092 | 18% | 7,011,913 | $9,695,116 |

Critical minerals hunter Enova Mining (ASX:ENV) has entered into a binding option agreement with a private individual – one Rodrigo de Brito Mello – to acquire 100% of the huge, 153.3km2 CODA prospect.

Located in the mining heavy state of Minas Gerais in Brazil, CODA is viewed by Enova as a potential world class “district sized” ionic clay rare earths project.

So far, 11 shallow auger holes have been drilled within the CODA prospect, with the most significant results revealing the following:

• 10.5m at 2,567 ppm TREO including 4.5m at 4,157 ppm TREO

• 10m at 3,218 ppm TREO including 6m at 3,608 ppm TREO

• 10m at 2,414 ppm TREO including 4m at 4,401 ppm TREO

The highest assaying drill intercepts were recorded at end of hole: 0.5m at 5,697 ppm TREO and 1m at 5,078 ppm TREO.

Enova reports that mineralisation remains open in all directions at CODA with grades significantly increasing at depth.

Still kicking on is the Aussie AI prospect, cybersecurity minnow WhiteHawk (ASX:WHK).

This is what WHK says about WHK:

WhiteHawk is a cloud-based cyber security exchange platform that delivers Artificial Intelligence based Cyber Risk Profile’s, interactive online maturity models, tailored Cyber Risk Scorecard reports, matching to innovative products, solutions and best practices, all via an intuitive virtual consult.

The platform enables customers to leverage their tailored Security Story to find affordable and impactful cyber tools, non-technical context, and relevant services through our algorithms, online customer journey and accessible expertise.

The stock’s up HEAPS since Nvidia’s knock out earnings drop on Thursday.

The Aussie tech-debt collection provider Credit Clear (ASX:CCR) upgraded guidance for FY24 following a strong 1H’24 result, which included better margins, revenue, mre customers and a decent balance sheet.

CCR is now tracking ahead of FY24 guidance, and consequently here’s the newly upgraded forecast:

FY24 revenue guidance up from $39m – $41m to $40m – $42m, and FY24 Underlying EBITDA1 guidance up from $1m – $2m to in excess of $3m.

CCR revenue jumped up 15% pcp to over $20mn; Underlying EBITDA improved some $1.8m on the pcp and Statutory EBITDA improved $5.4m on pcp; Gross margin expanded to 54%, up from 50% in 1H’23 .

CCR says it signed on 225 new clients, a 24% increase on pcp, including tier-1 clients in banking, insurance, and essential services (utilities).

And we all like a strong balance sheet: CCR now has $13m cash at the bank, an improvement of $3.7m on pcp.

Investors like a lot of that. The stock is killing it on Monday.

Also doing quite well, Cygnus Metals (ASX:CY5). The diversified minerals hunter says first drilling has taken place at the Pegasus prospect within its high-priority Auclair lithium project in James Bay, Quebec in Canada.

And it’s reporting some “strong visual results”, revealing, it says, numerous thick and shallow spodumene-bearing pegmatite intersections up to 77m wide, with an average width of 38m.

The best mineralised section of the drill core appears to be 43.7m of pegmatite with average 10-12% estimated spodumene mineralisation from 46.4m. That includes 3.3m with 60-70% estimated spodumene mineralisation from 83.5m.

Assays are pending, of course, and those are expected in Q2.

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| RBR | RBR Group Ltd | 0.002 | -33% | 110 | $4,855,214 |

| STX | Strike Energy Ltd | 0.215 | -26% | 69,221,034 | $830,045,499 |

| TKL | Traka Resources | 0.0015 | -25% | 250,000 | $3,501,317 |

| ADR | Adherium Ltd | 0.043 | -22% | 85,887 | $18,339,199 |

| AXN | Alliance Nickel Ltd | 0.036 | -20% | 587,539 | $32,662,783 |

| ATH | Alterity Therapeutics | 0.004 | -20% | 400,196 | $21,913,774 |

| CAV | Carnavale Resources | 0.004 | -20% | 12,537,500 | $17,117,759 |

| CNJ | Conico Ltd | 0.002 | -20% | 400,000 | $3,925,237 |

| IEC | Intra Energy Corp | 0.002 | -20% | 100,000 | $4,226,954 |

| PRX | Prodigy Gold NL | 0.004 | -20% | 3,326,102 | $8,755,539 |

| PUR | Pursuit Minerals | 0.004 | -20% | 150,323 | $14,719,857 |

| RDS | Redstone Resources | 0.004 | -20% | 200,000 | $4,626,892 |

| RMX | Red Mount Min Ltd | 0.002 | -20% | 2,611,228 | $6,683,940 |

| VML | Vital Metals Limited | 0.004 | -20% | 6,660 | $29,475,335 |

| SGR | The Star Entertainment Group | 0.45 | -20% | 133,580,546 | $1,606,461,291 |

| HUM | Humm Group Limited | 0.56 | -19% | 5,008,926 | $353,184,666 |

| HAL | Halo Technologies | 0.11 | -19% | 61,536 | $17,481,854 |

| ASV | Asset Vision Company | 0.015 | -17% | 1,937,297 | $13,065,058 |

| FTC | Fintech Chain Ltd | 0.015 | -17% | 48,964 | $11,713,853 |

| BMO | Bastion Minerals | 0.01 | -17% | 6,397,167 | $3,737,329 |

| ECT | Env Clean Tech Ltd. | 0.005 | -17% | 253,915 | $17,185,862 |

| LRL | Labyrinth Resources | 0.005 | -17% | 238,200 | $7,125,262 |

| MSI | Multistack International | 0.005 | -17% | 2,929 | $817,824 |

| NSM | Northstaw | 0.04 | -17% | 4,000 | $6,714,038 |

EP&T Global (ASX:EPX) has reported being cash flow positive for a financial half for the time. Cash flow from operations was $600k for H1 FY24, being a $3.2 million improvement on pcp.

EPX says statutory revenue rose 29% to $6.5 million on pcp, while recurring revenue was up 37% to $5.9 million, representing over 90% of total revenue.

Underlying EBITDA loss reduced by 76% to $500k compared to pcp with contracted buildings up 8% to 531. Total cash on hand of $0.7m at 31 December 2023.

EPX uses AI and Machine Learning to enhance energy efficiency, decrease GHG emissions, and reduce operational costs for commercial properties worldwide with their flagship offering called EDGE, a platform that identifies real-time energy inefficiencies in buildings.

Hot Chili’s (ASX:HCH) Costa Fuego copper-gold project in Chile has seen a 6% increase in copper equivalent contained metal and a 9% increase for the higher-grade component of the indicated resource.

ADX Energy (ASX:ADX) has spudded the potentially transformational Welchau-1 gas well in Upper Austria to test a giant prospect which could host up to 807 billion cubic feet equivalent of gas.

Critical minerals explorer Western Yilgarn (ASX:WYX) has rattled the tin for $1.15 million to advance exploration work across its flagship Ida Holmes Junction and Julimar West projects in WA.

Aura Energy (ASX:AEE) has come out in support of the Swedish Government’s inquiry into potentially overturning the existing ban on uranium mining in the country, as the historically anti-nuclear country looks to increase nuclear investment and make way for greater energy capacity.

New drilling results at Ark Mines’ (ASX:AHK) Sandy Mitchell project confirmed rare earth elements (REE) and heavy mineral intersections in every metre sampled, consistent with previous hits at a slightly higher grade.

White Cliff Minerals (ASX:WCN) has appointed Expert Geophysics to carry out an airborne geophysical survey over high priority targets at its 805km2 Coppermine project in Nunavut, Canada, during Q2 2024.

Pan Asia Metals (ASX:PAM) has increased the area covered by granted exploration concessions at its Tama Atacama lithium project in Chile to ~996km2 after it was granted a fourth series of concessions.

Vertex Minerals’ (ASX:VTX) updated pre-feasibility study for the Reward gold mine development in New South Wales has revealed significantly improved economics thanks to its recent acquisition of the Gekko processing plant.

Artificial intelligence-guided exploration has delivered on its promise, aiding Legacy Minerals’ (ASX:LGM) discovery of the first-known magmatic PGE-nickel-copper mineralisation within the Lachlan Fold Belt of New South Wales.

Newly reinstated copper producer Hillgrove Resources (ASX:HGO) has raised $10 million to accelerate mine expansion and exploration drilling at its Kanmantoo underground operation in South Australia.

CardieX (ASX:CDX) has ruled off on a $14 million funding round, providing the company with a strong financial foundation to execute against its vision and go-to-market strategy as it prepares to launch the world’s first customisable vascular biometric monitor.

An initial 1,500m drill program is about to get under way at Fin Resources’ (ASX:FIN) White Bear lithium discovery at Cancet West after high-grade lithium assays returned up to 6.85% Li2O late last year.

Pointerra (ASX:3DP) – to facilitate an orderly market in the company’s securities pending an announcement regarding a material contract award.

CSR (ASX:CSR) – in relation to a potential material transaction involving CSR.

Global Oil and Gas (ASX:GLV) – pending the release of an announcement regarding a capital raising

Calima Energy (ASX:CE1) – requested for the purposes of a sale.

PharmAust (ASX:PAA) – pending an announcement of Phase 1 MND Study Top-Line Results.

Way2VAT (ASX:W2V) – pending an announcement in relation to a proposed capital raising

Kula Gold (ASX:KGD) – pending an announcement by the company regarding a capital raise

EV Resources (ASX:EVR) – pending an announcement regarding a capital raise.