Closing Bell: ASX gains as lithium, iron ore miners dazzle; copper and gold stocks extend rally

ASX lifted by miners today. Picture Getty

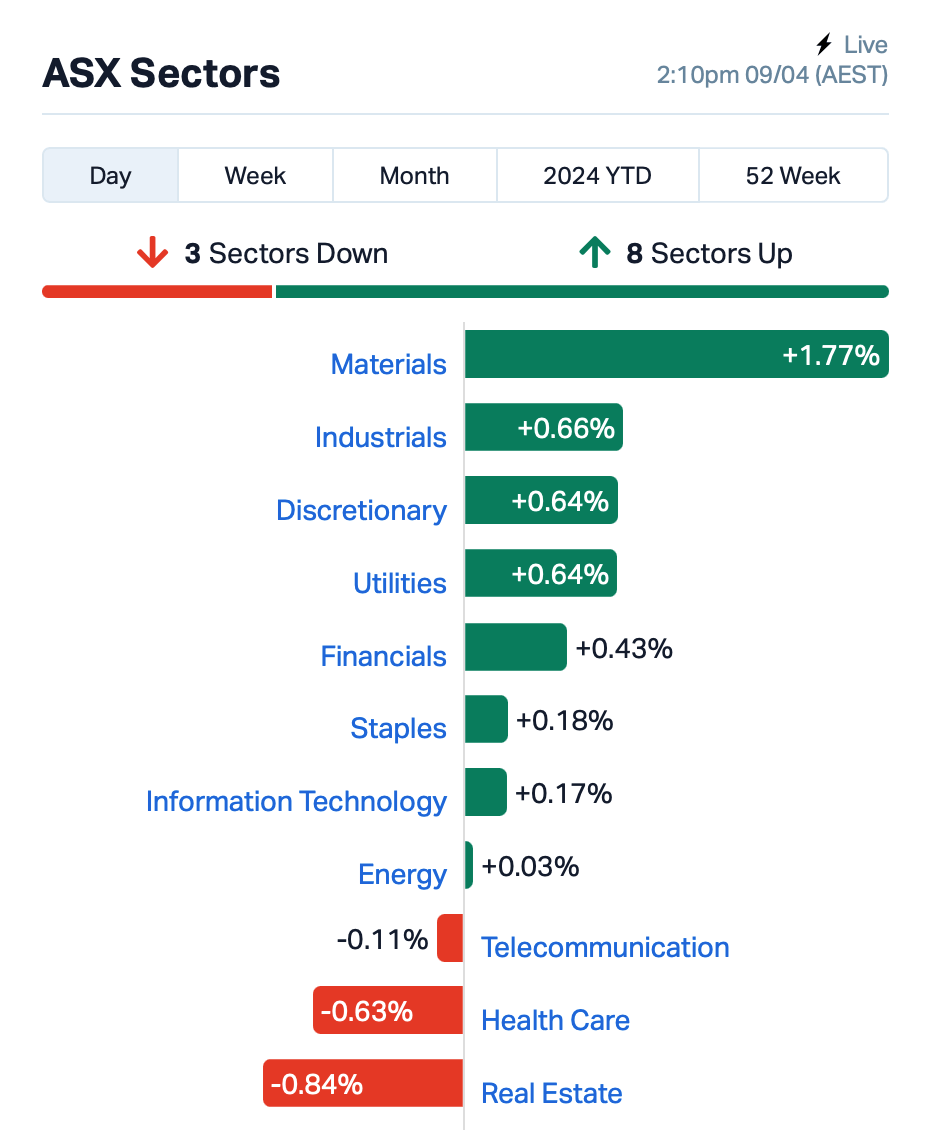

The ASX200 closed +0.5% higher on Tuesday on the back of a big lift in the Mining sector.

Lithium stocks led, with IGO (ASX:IGO) and Pilbara (ASX:PLS) gaining around 3%.

Iron ore miners rallied after the Nymex CFR China, 62% Fe price swung decisively higher overnight, closing above $US102.5/t.

Bank stocks were also up, with the ASX 200 Banks index up by +0.6%. Real Estate stocks were the worst performing sector on Tuesday.

A report from NAB’s March business survey released today indicates that business conditions in Australia fell 1 point to +9 index points in March from February, while business confidence rose 1 point.

The Westpac-Melbourne Institute’s April consumer sentiment report meanwhile shows that confidence fell 2.4% to 82.4 in April from March. Consumer interest in buying a major item also fell back to extreme lows in April.

Elsewhere …

Overnight, US equity indices closed flat as traders opted to stay on the sidelines ahead of the CPI report on Wednesday.

The market was also cautious after a US March consumer inflation expectations report revealed survey participants expected inflation growth at 3.0% in 12 months’ time, but at 2.9% in 3 years.

Across the region today, Asian stock markets nudged slightly higher as traders wait to see if the US CPI report tomorrow will change this dynamic.

Speaking in Hong Kong today, former Fed Reserve Bank of St. Louis President James Bullard said he’s expecting three interest rate cuts this year.

“At this point, you should probably take the committee and chair at face value – their best guess right now is still three cuts this year,” Bullard said an interview with Bloomberg Asia. “That’s the base case.”

ASX LARGE CAP WINNERS TODAY:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| LTR | Liontown Resources | 1.29 | 9% | 11,294,225 | $2,885,153,242 |

| ELD | Elders Limited | 7.98 | 7% | 2,965,279 | $1,169,259,308 |

| ZIM | Zimplats Holding Ltd | 18.33 | 7% | 24,088 | $1,850,291,186 |

| ANN | Ansell Limited | 25.45 | 7% | 1,364,394 | $2,981,132,069 |

| RED | Red 5 Limited | 0.41 | 6% | 17,252,847 | $1,350,882,214 |

| LYC | Lynas Rare Earths | 6.04 | 5% | 7,962,988 | $5,393,323,927 |

| LTM | Arcadium Lithium PLC | 6.65 | 4% | 2,463,651 | $2,497,087,119 |

| APM | APM Human Services | 1.20 | 4% | 3,056,562 | $1,054,759,238 |

| WHC | Whitehaven Coal | 7.31 | 4% | 5,419,626 | $5,872,937,504 |

| KAR | Karoon Energy Ltd | 2.32 | 4% | 3,362,562 | $1,786,765,278 |

| AZS | Azure Minerals | 3.44 | 4% | 1,568,875 | $1,522,816,189 |

| EMR | Emerald Res NL | 3.50 | 4% | 2,570,614 | $2,115,486,203 |

| RIO | Rio Tinto Limited | 125.71 | 3% | 1,211,969 | $45,199,286,217 |

| IGO | IGO Limited | 7.55 | 3% | 1,905,018 | $5,535,627,713 |

| SDR | Siteminder | 5.51 | 3% | 237,882 | $1,482,303,667 |

| RDX | Redox Limited | 2.94 | 3% | 150,048 | $1,496,482,070 |

| AMP | AMP Limited | 1.19 | 3% | 6,314,336 | $3,144,737,279 |

| ADT | Adriatic Metals | 4.19 | 3% | 561,948 | $1,050,988,236 |

| SIG | Sigma Health Ltd | 1.25 | 3% | 22,675,723 | $1,990,876,685 |

| TPW | Temple & Webster Ltd | 12.43 | 3% | 124,496 | $1,437,489,721 |

Gnawing on the fatty end of the steak this morning, Elders (ASX:ELD) was bouncing back from yesterday’s sell down as bargain hunters swooped on the wounded stock.

Ansell (ASX:ANN) was also climbing today, on the heels of announcing a $400 million fully underwritten institutional placement through the issue of approximately 17.8 million new fully paid ordinary shares to eligible investors at $22.45 a pop.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| SLS | Solstice Minerals | 0.150 | 50% | 6,168,496 | $10,033,681 |

| CHK | Cohiba Min Ltd | 0.003 | 50% | 2,897,365 | $7,176,488 |

| M2R | Miramar | 0.016 | 45% | 39,223,853 | $1,637,565 |

| RGS | Regeneus Ltd | 0.013 | 44% | 3,651,168 | $5,515,864 |

| CVR | Cavalierresources | 0.210 | 35% | 84,796 | $4,933,482 |

| 14D | 1414 Degrees Limited | 0.077 | 28% | 468,901 | $14,290,111 |

| ZNO | Zoono Group Ltd | 0.090 | 26% | 36,826 | $15,313,319 |

| HLX | Helix Resources | 0.005 | 25% | 905,180 | $9,292,583 |

| INP | Incentiapay Ltd | 0.005 | 25% | 308,666 | $4,975,720 |

| PKO | Peako Limited | 0.005 | 25% | 100,000 | $2,108,339 |

| PUR | Pursuit Minerals | 0.005 | 25% | 2,021,506 | $11,775,886 |

| AI1 | Adisyn Ltd | 0.022 | 22% | 81,006 | $3,174,292 |

| SPD | Southernpalladium | 0.400 | 21% | 52,317 | $14,215,848 |

| OEQ | Orion Equities | 0.205 | 21% | 10,300 | $2,660,369 |

| OAU | Ora Gold Limited | 0.006 | 20% | 1,200,027 | $29,030,004 |

| RML | Resolution Minerals | 0.003 | 20% | 200,000 | $4,024,992 |

| RR1 | Reach Resources Ltd | 0.003 | 20% | 751,253 | $8,196,808 |

| TAS | Tasman Resources Ltd | 0.006 | 20% | 807,253 | $3,563,346 |

| ARR | American Rare Earths | 0.265 | 18% | 2,576,204 | $111,020,242 |

| BOA | Boadicea Resources | 0.034 | 17% | 1,067,622 | $3,577,233 |

| NWM | Norwest Minerals | 0.034 | 17% | 1,823,463 | $10,421,716 |

| AIS | Aeris Resources Ltd | 0.205 | 17% | 6,531,072 | $169,316,970 |

| VBS | Vectus Biosystems | 0.280 | 17% | 13,612 | $12,770,247 |

| 1MC | Morella Corporation | 0.004 | 17% | 458,408 | $18,536,398 |

| CCZ | Castillo Copper Ltd | 0.007 | 17% | 191,295 | $7,797,032 |

Solstice Minerals (ASX:SLS) was leading the Small Caps at lunch time, on news that it has entered into a binding Sale and Purchase Agreement with Northern Star, to sell 100% of the Hobbes Exploration Licence for total consideration of $12.5 million. Solstice held 80% of the licence, while the remaining 20% was held by “an unrelated private company” – Solstice’s words, not mine – which has also agreed to the sale.

Explorer Miramar Resources (ASX:M2R) revealed that it is working toward a maiden drilling campaign at the Bangemall Ni-Cu-Co PGE project and has expanded its 480km2 Eastern Goldfields tenement portfolio. M2R was briefly up as much as 109% in very early trade, but that eased almost as quickly to be +55% by the closing bell.

Regeneus (ASX:RGS) was continuing its recent positive form after announcing a $3.48 million two-tranche placement, ahead of the company changing its name and ticker tomorrow to Cabrium Bio (ASX:CBM).

Patrys (ASX:PAB) jumped 12% after announcing that new data from preclinical studies using PAT-DX1 and PAT-DX3 (both called deoxymabs) in animal models were presented by Dr Kim O’Sullivan from Monash University during the plenary session at the 21st International Vasculitis Workshop in Barcelona. The presentation demonstrated positive preclinical data for deoxymabs in the autoimmune disease, anti-neutrophil cytoplasmic antibody (ANCA) vasculitis.

Next Science (ASX:NXS) announced the publication of a study which found BLASTX to be efficacious in the treatment of pressure ulcers, when used in conjunction with negative pressure wound therapy (NPWT). The study has been published in Diagnostics, an international peer-reviewed journal, by Dr Thomas E. Serena.

Helix Resources (ASX:HLX) traded higher after news regarding its Canbelego project. Geophysics has identified a “highly prospective” 1,200m zone coincident with surface copper anomalism at the NSW project, right next to the high-grade Canbelego deposit. This anomaly is in addition to the two recently identified IP anomalies west of the Canbelego Main Lode Resource. And it highlights the potential to increase the existing copper Mineral Resource.

Lincoln Minerals (ASX:LML)’s historic uranium drilling has intercepted up to 570 ppm uranium prospectivity across Lincoln’s Eyre Peninsula tenements, sending the LML price into overdrive. The Lincoln review revealed highly prospective uranium targets over four target regions across its existing tenement portfolio on Eyre Peninsula, South Australia. The SA-based, $12.78m market capper notes that its previous drilling at the Jungle Dam project intersected uranium up to 570 ppm in scout drilling.

Coolabah Metals (ASX:CBH) will acquire the Mundi Mundi project in NSW, which comes with two historical fluorite mines. Fluoride-ion batteries also have the potential to displace lithium-ion batteries as they have a potential 8-fold increase in energy density relative to lithium-ion batteries, CBH says.

Soil sampling has uncovered a bunch of gold and lithium targets at Sabre Resources’ (ASX:SBR) Cave Hill project in WA. The largest is 5km by 5km, it says.

ASX SMALL CAP LAGGARDS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| CBY | Canterbury Resources | 0.020 | -33% | 1,138,994 | $5,152,227 |

| ENT | Enterprise Metals | 0.002 | -33% | 35,000 | $2,405,913 |

| BNR | Bulletin Res Ltd | 0.047 | -28% | 8,679,499 | $19,084,866 |

| IEC | Intra Energy Corp | 0.002 | -25% | 130,000 | $3,381,563 |

| ME1 | Melodiol Glb Health | 0.006 | -25% | 9,333,000 | $3,494,685 |

| MRQ | Mrg Metals Limited | 0.002 | -25% | 1,000,000 | $5,050,237 |

| TNY | Tinybeans Group Ltd | 0.110 | -21% | 13,442 | $11,814,228 |

| GCM | Green Critical Min | 0.004 | -20% | 200,704 | $5,682,925 |

| HCD | Hydrocarbon Dynamic | 0.004 | -20% | 2,319,286 | $4,042,912 |

| DM1 | Desert Metals | 0.026 | -19% | 8,376,062 | $8,493,622 |

| WEC | White Energy | 0.039 | -19% | 4 | $5,435,296 |

| DBO | Diabloresources | 0.018 | -18% | 1,272,377 | $2,267,571 |

| KGD | Kula Gold Limited | 0.009 | -18% | 688,048 | $5,351,081 |

| TSL | Titanium Sands Ltd | 0.009 | -18% | 270,616 | $21,931,032 |

| IXU | Ixup Limited | 0.014 | -18% | 86,345 | $20,013,629 |

| PNM | Pacific Nickel Mines | 0.033 | -18% | 1,177,122 | $16,730,124 |

| ADD | Adavale Resource Ltd | 0.005 | -17% | 567,217 | $6,095,878 |

| BUY | Bounty Oil & Gas NL | 0.005 | -17% | 424,217 | $8,991,006 |

| ESR | Estrella Res Ltd | 0.005 | -17% | 7,219,949 | $10,556,231 |

| LNU | Linius Tech Limited | 0.003 | -17% | 507,851 | $15,590,222 |

| PEC | Perpetual Res Ltd | 0.010 | -17% | 4,365,963 | $7,680,353 |

| PRX | Prodigy Gold NL | 0.003 | -17% | 210,000 | $6,041,322 |

| VML | Vital Metals Limited | 0.005 | -17% | 12,856,081 | $35,370,402 |

| BUR | Burleyminerals | 0.059 | -16% | 18,103 | $7,300,773 |

| HAR | Harangaresources | 0.110 | -15% | 224,843 | $11,638,819 |

IN CASE YOU MISSED IT – PM Edition

Bioxyne’s (ASX:BXN) wholly-owned subsidiary Breathe Life Sciences (BLS) has been granted a renewed and amended wholesale licence for MDMA and Psilocybin finished products by the Therapeutic Goods Administration, allowing it to supply authorised prescribers, pharmacies, and clinical trial sponsors across Australia.

Culpeo Minerals (ASX:CPO) has found a possible new third zone of copper within the 3km-long El Quillay trend at its Fortuna project. Drilling is now being planned to the lateral and depth extensions of mineralisation within multiple structures close to the El Quillay Fault Zone – an area previously exploited by both open cut and underground mining.

Elevate Uranium (ASX:EL8) has upgraded resources at its Koppies project by 20% to 57.8Mlbs eU3O8. Infill drilling is currently underway with metallurgical testing using the company’s U-pgrade beneficiation process to start soon.

Far East Gold’s (ASX:FEG) first drill hole at the Aloe Rek prospect in its Woyla project has struck thick, high-grade gold with an intersection of 12.4m at 5.59g/t gold and 25.3g/t silver from 82.3m

Frontier Energy (ASX:FHE) expects to complete equipment selection and contract negotiations for long-lead items at its Waroona renewable energy project this quarter. The process could deliver a reduction in Capex as most items are priced below its DFS estimates.

Spartan Resources (ASX:SPR) has intersected +20m of mineralisation – including visible gold – in its deepest ever hole at its Never Never deposit. The latest intersection takes the deposit’s down-plunge extent to more than 1,000m vertical depth and extends mineralisation to more than 400m below the existing 952,000oz resource.

Trinex Metals (ASX:TX3) is gearing up for a busy summer exploring for lithium across its leading acreage position in Canada’s Northwest Territories. This includes fast-tracking on-ground exploration to determine the prospectivity of tantalising pegmatite systems at the Halo-Yuri project.

TRADING HALTS

Anteris Technologies (ASX:AVR) – pending an announcement in relation to a proposed capital raising.

Omni Bridgeway (ASX:OBL) – pending an application to the Supreme Court of Western Australia by the company seeking orders relating to the appointment of the company’s auditor.

At Stockhead, we tell it like it is. While Bioxyne, Culpeo Minerals, Elevate Uranium, Far East Gold, Frontier Energy, Spartan Resources and Trinex Metals are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.