Closing Bell: Local markets ride commodities higher after a blow to US confidence on Friday

News

News

Before the market opened this morning, the ASX 200 index futures contract was pointing up by +0.09%, flying the contrarian flag in the face of a bit of a shocker on Wall Street for Friday. Pleasingly, the benchmark has managed to stick to that script, despite a solid effort from Real Estate giant Lendlease Group (ASX:LLC) to derail things today.

I’ll explain in a moment, but here’s your afternoon snapshot.

At 4.15pm on February 19, the S&P/ASX200 was up 6.8 points or 0.09% to 7,665.10

I’ll keep this brief because time is of the essence this afternoon. Local markets managed to buck a predicted downswing in the wake of bad inflationary news from the US on Friday, where the the Producer Price Index jumped 0.3% in January from the prior month.

This was much higher than the 0.1% rise expected by economists, and is very much not the news that anyone hoping for US rate relief would have been wanting to hear.

That’s the bad news.

The good news is that drop in confidence of a rate cut in the US pushed the US dollar down, which in turn pushed commodity prices up, which is great news for the resources-reliant companies on the ASX.

And it was largely those guys who helped keep local markets from following Wall Street lower for this session.

There’s also the small matter of the weekend’s tweaking of the Critical Minerals list by the federal government, which has now included nickel – a huge shot in the arm for the ailing industry, aimed at heading off a range of mooted project shutdowns in the sector.

The end result was a buoyancy in the resources market sufficient to move the ASX 200 benchmark forward by +0.09% – when, by rights, it would probably have registered well into the negatives thanks to Wall Streets Friday shenanigans.

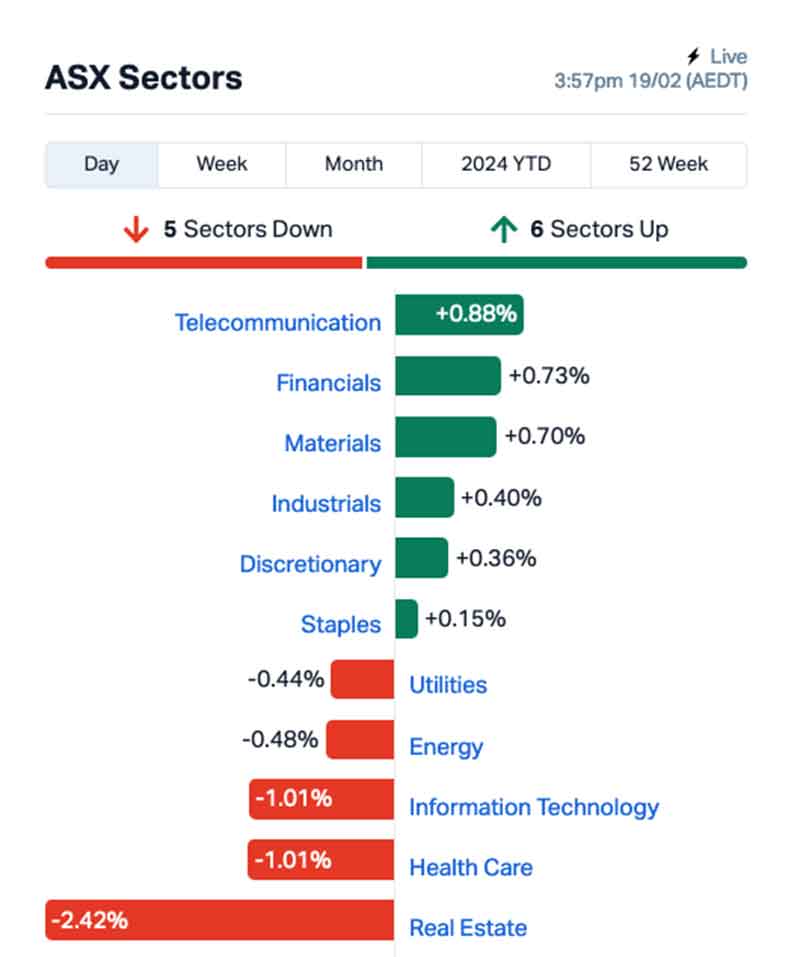

You can see on the chart below how it all played out.

The biggest drop on the market came via the Real Estate sector, which was dealt something of a body blow this morning when LendLease delivered some shocking news: the company has slashed its outlook and warned of tough times ahead, after posting a $136 million loss for the prior six-month period.

Our dear friends and neighbours at The Australian put it perfectly this morning: “Investors savaged the company’s shares on the disappointing result, and they were down 13.5 per cent in early trading after riding the broader recovery in property stocks over the last several months.”

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| TKL | Traka Resources | 0.002 | 100% | 70,024 | $1,750,659 |

| BP8 | Bph Global Ltd | 0.0015 | 50% | 319,046 | $1,954,116 |

| W2V | Way2Vatltd | 0.022 | 47% | 58,796,461 | $9,774,126 |

| APM | APM Human Services | 1.21 | 46% | 11,909,642 | $761,261,015 |

| 29M | 29Metalslimited | 0.26 | 41% | 22,946,825 | $129,743,336 |

| 1MC | Morella Corporation | 0.004 | 33% | 2,481,041 | $18,536,398 |

| HOR | Horseshoe Metals Ltd | 0.008 | 33% | 1,812,071 | $3,878,872 |

| IPT | Impact Minerals | 0.013 | 30% | 5,819,877 | $28,647,039 |

| RDM | Red Metal Limited | 0.22 | 26% | 6,844,732 | $52,281,834 |

| AL8 | Alderan Resource Ltd | 0.005 | 25% | 200,000 | $4,427,445 |

| PUR | Pursuit Minerals | 0.005 | 25% | 478,241 | $11,775,886 |

| RR1 | Reach Resources Ltd | 0.0025 | 25% | 2,277,575 | $6,420,594 |

| WML | Woomera Mining Ltd | 0.005 | 25% | 10,851,108 | $4,872,556 |

| C7A | Clara Resources | 0.016 | 23% | 82,951 | $2,457,507 |

| NC6 | Nanollose Limited | 0.03 | 20% | 763,659 | $4,300,159 |

| CCO | The Calmer Co Int | 0.006 | 20% | 11,191,875 | $5,377,928 |

| JCS | Jcurve Solutions | 0.031 | 19% | 243,612 | $8,536,929 |

| COD | Coda Minerals Ltd | 0.125 | 19% | 31,510 | $14,948,994 |

| ASO | Aston Minerals Ltd | 0.019 | 19% | 802,475 | $20,721,028 |

| ELT | Elementos Limited | 0.13 | 18% | 770,772 | $21,421,409 |

| SYA | Sayona Mining Ltd | 0.065 | 18% | 130,776,590 | $566,131,281 |

| SHO | Sportshero Ltd | 0.013 | 18% | 100,000 | $6,796,161 |

| PFE | Panteraminerals | 0.062 | 17% | 480,988 | $7,028,995 |

| IMD | Imdex Limited | 1.875 | 17% | 2,873,879 | $819,427,023 |

| AU1 | The Agency Group Aus | 0.035 | 17% | 203,429 | $12,857,298 |

Among the Small Caps on Monday morning, most of the upward swings could be attributed to the increase in investor confidence in commodities, as the bulk of the big percentage movers this morning are making headway without the benefit of their own announcements to pin it on.

Impact Minerals (ASX:IPT) did drop some news, announcing that the company has managed to hit a crucial milestone, by achieving better than 99.99% (4N+) High Purity Alumina (Al2O3) from the company’s Lake Hope mud via its proprietary and patented Playa One Sulphate Process.

This is big news for Impact, as the company’s recent Scoping Study demonstrated an NPV of $1.3 billion for the project and an estimated operating cost to produce 4N HPA up to 50% lower than anyone else globally at less than US$4,000 per tonne.

Elsewhere, it’s mid-cap and large caps with news that made the Monday morning winners list, including APM Human Services (ASX:APM) after it confirmed that it’s received a conditional and non-binding indicative proposal pursuant to which funds or investment vehicles advised by CVC would acquire all of the shares in APM by way of a scheme of arrangement, following ongoing discussions between the pair.

Indeed, it was APM that ended up taking the winner’s spot on the overall podium today, finishing the day 48.8% higher on the news.

And A2 Milk (ASX:A2M) was higher on Monday morning on news of a positive interim result with 3.7% revenue growth and 5.0% EBITDA growth for 1HFY24, off the back of the company managing to grow its infant milk formula revenue despite a large, double-digit decline in the Chinese market overall.

Way2VAT’s (ASX:W2V) upward rush has continued from the previous week, again without anything in the way of news since the company announced the launch of its AI-driven automated accounts payable auditing product, AI-AP Compliance, on 15 February.

A letter to shareholders from the boss at 29Metals (ASX:29M) seems to have done the trick, with the stock up close to 38% on Monday afternoon after the company’s recent form slump prompted the CEO to put pen to paper and reassure shareholders that 2024 is “a recovery year to set us up for long term success”.

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| AVW | Avira Resources Ltd | 0.001 | -50% | 109,850 | $4,267,580 |

| LSR | Lodestar Minerals | 0.002 | -33% | 18,533,807 | $6,070,192 |

| CT1 | Constellation Tech | 0.002 | -20% | 9,869,918 | $3,686,834 |

| HCD | Hydrocarbon Dynamic | 0.004 | -20% | 2,250 | $4,042,912 |

| KNM | Kneomedia Limited | 0.002 | -20% | 4,000,000 | $3,833,178 |

| MSG | Mcs Services Limited | 0.008 | -20% | 1,167,800 | $1,980,997 |

| TMK | TMK Energy Limited | 0.004 | -20% | 4,613,449 | $30,612,897 |

| TTI | Traffic Technologies | 0.008 | -20% | 47,948 | $7,576,702 |

| XPN | Xpon Technologies | 0.025 | -17% | 142,222 | $9,108,245 |

| AMD | Arrow Minerals | 0.005 | -17% | 50,182,050 | $20,842,591 |

| AYT | Austin Metals Ltd | 0.005 | -17% | 679,724 | $7,711,148 |

| SPQ | Superior Resources | 0.01 | -17% | 488,874 | $24,014,645 |

| TMR | Tempus Resources Ltd | 0.005 | -17% | 620,000 | $4,385,992 |

| VRC | Volt Resources Ltd | 0.005 | -17% | 1,620,304 | $24,780,640 |

| A8G | Australasian Metals | 0.088 | -16% | 80,392 | $5,472,652 |

| LLC | Lendlease Group | 6.36 | -15% | 8,004,693 | $5,179,138,175 |

| PNM | Pacific Nickel Mines | 0.04 | -15% | 288,095 | $19,657,896 |

| ACW | Actinogen Medical | 0.041 | -15% | 14,342,775 | $111,614,884 |

| ADA | Adacel Technologies | 0.75 | -14% | 187,554 | $66,696,865 |

| G88 | Golden Mile Res Ltd | 0.012 | -14% | 298,210 | $5,757,120 |

| KPO | Kalina Power Limited | 0.006 | -14% | 247,086 | $15,470,896 |

| MRC | Mineral Commodities | 0.024 | -14% | 512,114 | $27,565,233 |

| RIE | Riedel Resources Ltd | 0.003 | -14% | 1,645,003 | $7,783,425 |

| AGD | Austral Gold | 0.025 | -14% | 2,060 | $17,757,029 |

| BMR | Ballymore Resources | 0.1 | -13% | 511,849 | $20,278,017 |

Dateline Resources (ASX:DTR) – to allow the company the time necessary to plan and secure commitments from sophisticated and professional investors in relation to a proposed capital raising.

3D Energi Limited (ASX: TDO) – pending an announcement by the company to the market regarding a capital raising.

De.mem (ASX:DEM) – pending an announcement by the company to the market in relation to a capital raising.

Melodiol Global Health (ASX:ME1) – pending an announcement regarding a capital raising.

Cooper Metals (ASX:CPM) – pending an announcement regarding exploration results and a material capital raising.

American West Metals (ASX:AW1) – an announcement to the market regarding a proposed capital raising.

Gold Hydrogen (ASX:GHY) – pending the release of a prospective resource statement in relation to its flagship Ramsay Project.

Cosmo Metals (ASX:CMO) – pending an announcement regarding an accelerated non-renounceable entitlement offer and capital raising.

Simble Solutions (ASX:SIS) – pending an announcement in respect of a placement to be conducted via sophisticated investors.

Summit Minerals (ASX:SUM) – pending an announcement by Summit in relation to a strategic acquisition.

Star Entertainment Group (ASX:SGR) – pending an announcement to ASX regarding correspondence received from the NSW Independent Casino Commission (NICC) on 19 February 2024 regarding the commencement of an inquiry under the Casino Control Act 1992 (NSW).

Anson Resources (ASX:ASN) has announced that drill results underscore its belief that Ajana is a significant exploration opportunity within a proven and established mining province for lead, silver, and zinc, after hitting significant intercepts for those metals.

Impact Minerals (ASX:IPT) has announced that the company has used its proprietary and patented Playa One Sulphate Process to produce better than 99.99% (4N) high purity alumina (HPA) using mud sourced from its Lake Hope project in WA.

Drilling of ADX Energy’s (ASX:ADX) potentially transformational Welchau-1 gas well in Austria is imminent with the replacement RED Drilling & Services E200 drill rig now mobilising to the Vienna Basin.

Marmota’s (ASX:MEU) four-part review into the uranium potential of its highly prospective Junction Dam project in South Australia has resulted in the identification of an extensive and intriguing palaeochannel at the Yolanda prospect.

Sunshine Metals (ASX:SHN) is looking to geophysical surveys for another layer of supporting evidence in determining future drill targets for the Liontown, Truncheon, and Highway East prospects near Charters Towers in North Queensland.

Gold explorer Strickland Metals (ASX:STK) has a bunch of prospects at its Yandal gold project – and recently expanded a drill program west of the Horse Well and Dusk til Dawn which uncovered a consistent 750m-long primary mineralised structure.

LTR Pharma (ASX:LTP) has begun patient recruitment for its clinical study into SPONTAN, designed to be a world-first, fast acting, on-demand Nasal Spray treatment for erectile dysfunction, as the company progresses towards commercialisation.

Variscan Mines (ASX:VAR) has a bundle of new drill targets to test following a geological assessment and structural targeting study with world-renowned expert Dr Brett Davis at the San Jose mine in northern Spain.

RareX (ASX:REE) says it is on the hunt for new projects to develop and feed into rising global demand, while continuing to develop its 44Mt @ 1% total rare earth oxide (TREO) Cummins Range project in the NT.

Drilling has underscored the potential scale of Southern Hemisphere Mining’s (ASX:SUH) 145Mt at 0.7% copper equivalent (CuEq) Llahuin copper-gold project in Chile, following the receipt of more thick intersections of mineralisation from surface.

Iltani Resources (ASX:ILT) has highlighted the potential of its Orient project to host a world-class silver-lead-zinc-indium resource after a further eight RC holes drilled in December last year intersected extensive vein mineralisation.

The search is underway at three exploration licences MTM Critical Metals (ASX:MTM) holds in the prolific West Arunta region, which hosts a plethora of carbonatite mineralisation known for containing high-value magnetic rare earths such as niobium.