Iltani Resources unlocks the silver-lead-zinc-indium riches of the Orient

Drilling has indicated that Iltani’s Orient project could host a world-class silver-lead-zinc-indium resource. Pic via Getty Images

- Iltani Resources drilling intersects extensive silver-lead-zinc-indium vein mineralisation

- Results include some of the ‘highest grade indium drill intersections’ publicly reported on the ASX

- Orient model being built to guide further drilling

Special Report: Iltani Resources has highlighted the potential of its Orient project to host a world-class silver-lead-zinc-indium resource after a further eight RC holes drilled in December last year intersected extensive vein mineralisation.

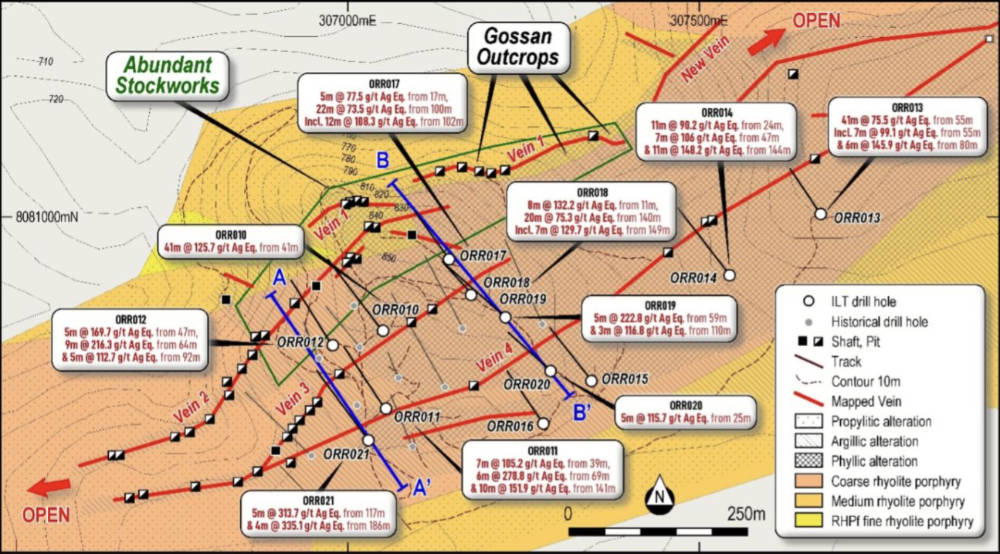

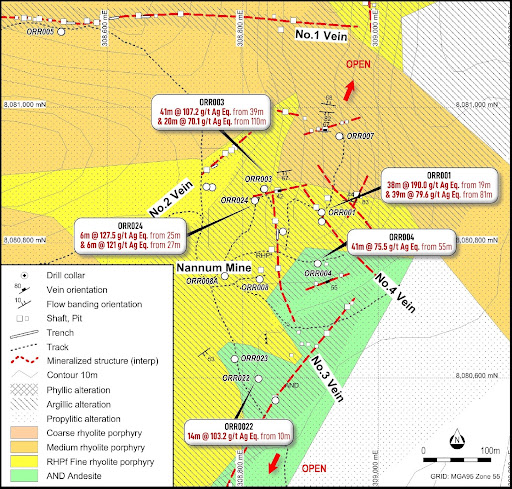

The Orient Project, about 100km inland from Cairns in the historical mining area of Herberton in northern Queensland, is a large-scale system of outcropping veins and stockwork silver-lead-zinc-indium mineralisation hosted in a rhyolite porphyry complex over an area of at least 4km2.

It was mined from 1886 to 1924, producing an estimated 6,600t of high-grade ore averaging 46oz of silver and 40% lead per tonne.

Prior to the start of the most recently completed program, drilling in August 2023 intersected multiple high-grade silver-lead-zinc-indium vein systems surrounded by halos of up to 30m to 40m of lower grade mineralisation.

Iltani Resources (ASX:ILT) noted previously that the extensive silver-rich epithermal system has strong similarities to the world-class Bolivian silver-zinc-lead-indium-tin systems.

Historical metallurgical test work has also confirmed the potential to produce high quality lead-silver and zinc-indium-silver concentrates.

Silver is expected to be in deficit, even as demand for use in photovoltaic (solar) panels increases, while indium is a critical and strategic mineral used in the defence, energy and telecommunications sectors along with smartphones and electrical semiconductors.

Drilling demonstrates Orient’s potential

Assays from the December 2023 drill program returned extensive silver-lead-zinc-indium mineralisation with Orient West hole ORR021 intersecting exceptionally high-grade mineralisation of 5m @ 43g/t silver, 0.7% lead, 5% zinc and 149g/t indium (314g/t silver equivalent – AgEq) from 117m.

This included intervals of 1m @ 141g/t silver, 1.7% lead, 18.8% zinc and 500g/t indium (1,102g/t AgEq) and 4m @ 48g/t silver, 1% lead, 4.8% zinc and 175g/t indium (335g/t AgEq) from 186m, including 1m @ 83g/t silver, 1.1% lead, 13.0% zinc and 500g/t indium (819 g/t AgEq)

The aforementioned indium assay results are believed to be the highest-grade indium drill intersections ever announced on the ASX. The intersections are at least 500g/t indium.

Having been assayed at ALS in Townsville, the samples have been sent to ALS in Vancouver (where samples can be assayed up to 10,000g/t indium) for confirmation of the indium grade.

Drilling returned further intersections of silver-lead-zinc-indium mineralisation at Orient West. Highlights include:

- ORR017: 22m @ 74g/t AgEq from 100m, including 12m @ 108g/t AgEq from 102m;

- ORR018: 20m @ 75g/t AgEq from 140m, including 7m @ 130g/t AgEq from 149m;

- ORR019: 5m @ 223g/t AgEq from 55m, including 2m @ 409g/t Ag Eq from 55m; and

- ORR020: 5m @ 116 g/t Ag Eq. from 25m.

Drilling also returned other impressive intersections of silver-lead-zinc-indium mineralisation at Orient East, including 14m @ 103g/t AgEq from 10m including 6m @ 189g/t AgEq (ORR022) and 6m @ 127g/t AgEq from 25m plus 6m @ 121 g/t AgEq from 37m (ORR024).

“Iltani’s drilling at Orient continues to deliver outstanding intersections of silver-lead-zinc-indium- mineralisation delivering both high-grade intersections and wide intersections of medium-grade mineralisation from multiple vein systems,” ILT managing director Donald Garner said.

“Of note are the high-grade indium assays from the intersections in ORR021 – Iltani believes these are the highest-grade indium drill intersections publicly reported on the ASX to date, with indium considered a critical and strategic mineral because of its use in the aerospace, defence, energy and telecommunications sectors plus in items such as smartphones and electrical semiconductors.

“Mineralisation at Orient is open along strike and depth, and Orient West and East are 2km apart, highlighting the potential for Orient to deliver a substantial resource.

“Mineralisation intersected to date is outcropping and the shallower mineralisation is amenable to potential open-pit mining, with deeper higher-grade intersections highlighting the potential for underground mining.”

The road ahead

ILT has engaged Mining One to build a model of Orient that will combine both historical and its drilling with reprocessed geophysical data plus Nick Tate’s mapping.

This model will be used to optimise the remaining drillholes for the Stage 2 drilling expected to begin in early March once the wet season abates.

ILT anticipates the Stage 2 drilling will provide better insight into Orient’s potential to host a world-class silver-lead-zinc-indium resource.

This article was developed in collaboration with Iltani Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.