You might be interested in

News

Closing Bell: ASX clipped -1.3pc on broad selloff; BHP makes a $60bn play for Anglo American

Health & Biotech

ASX Health Stocks: Recce can now dose R327 at higher level, testing its high concentration potential

News

The benchmark was shot through the heart by CSL this morning leaving everything else in vain.

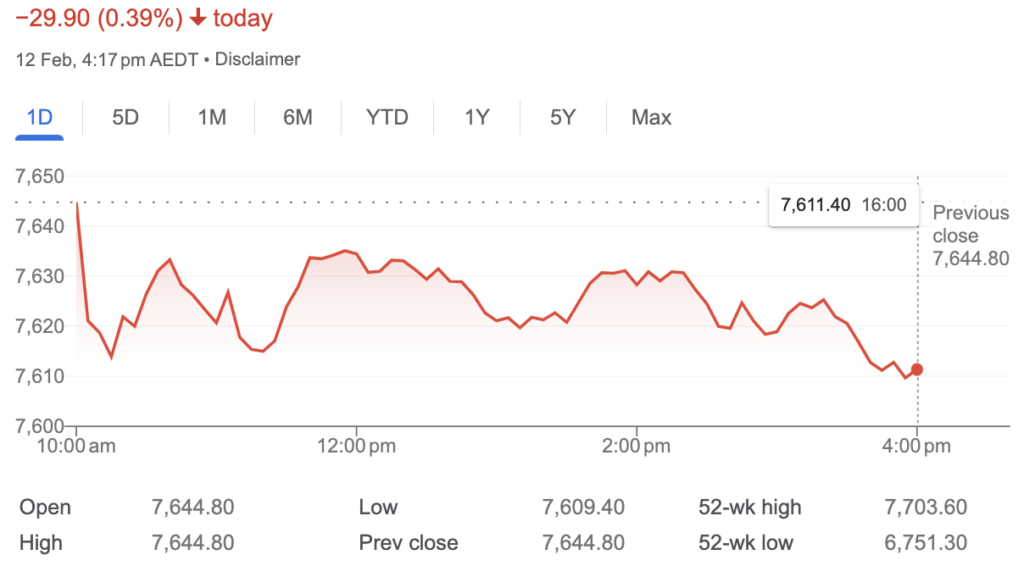

At 4.15pm on February 12, the S&P/ASX200 was down 30 points or 0.39% to 7,615:

The ASX 200 ended three sessions of wins on Monday after index giant CSL collapsed over 6% after an ignominious phase III drug trial failure.

The benchmark fell as much as 0.54% after the blood plasma giant revealed its CSL112 drug for heart attack patients failed to meet its efficacy endpoint.

Lot’s else happening – trader timidity seems rife ahead of this week’s US inflation data – but when CSL crashes like this everything else seems a little pointless.

The sheer gravitational pull of a stock like CSL is hard to deny.

CSL stock began to deteriorate right off the bat after tossing hopes of regulatory approval in the bin for a proposed drug following weak results in a phase-three trial.

The falling star dragged the other healthcare majors with it – ResMed (ASX:RMD), Ramsay Health Care (ASX:RHC) and Cochlear (ASX:COH) all suffering by proxy.

Some curious stocks kicking against the tide on Monday, however – JB Hi-Fi (ASX:JBH) coming to mind after the retail giant surged up the bourse after lifting both 1H sales and revenue to the top end of guidance.

Elsewhere, mining and energy stocks dropped on softer commodity prices, while trading is expected to remain subdued throughout while the other major Asia Pacific indices are closed for the lunar new year holidays.

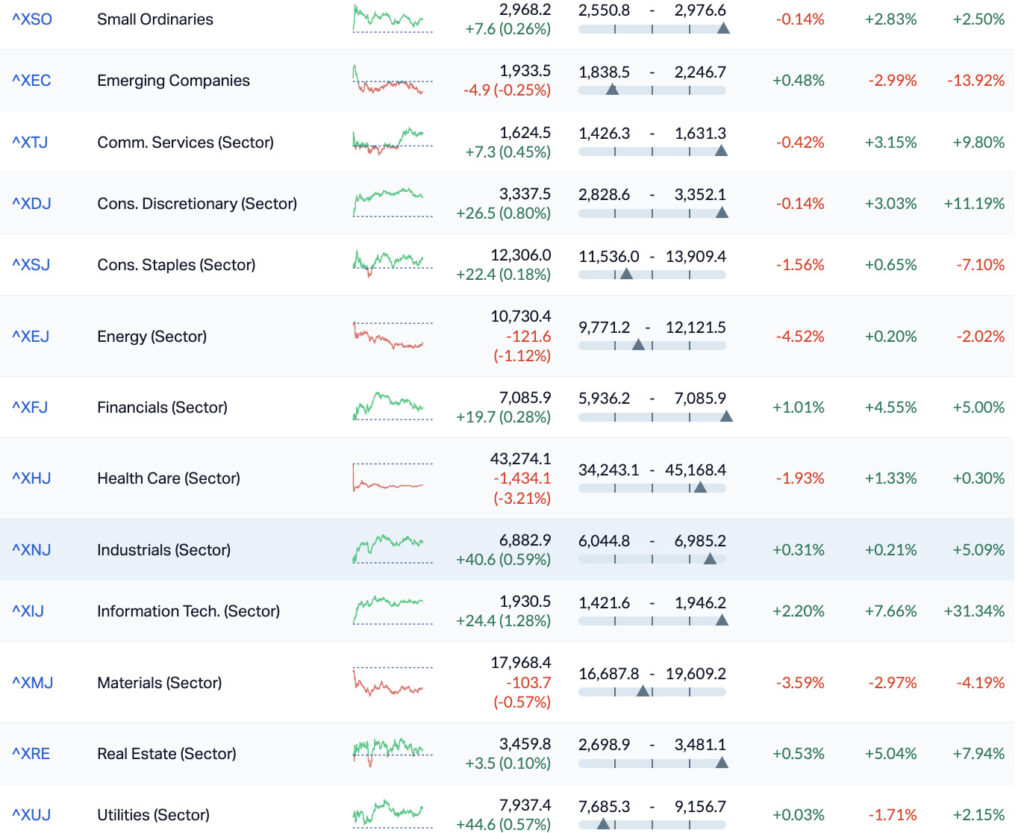

At the sector level, Materials and Energy weighed while Information Technology led.

Healthcare is down about 3.2%

The ASX small ordinaries (XSO) rose and the (XEC) emerging companies index fell.

![]()

We’re watching oil…

Brent crude futures fell below $82 per barrel on Monday, paring gains from last week on a likely technical correction, while the latest development in the Middle East somewhat eased supply concerns. WTI crude futures fell to around $76.5 per barrel.

There’s a few contrary forces at work this week, the count for US producers’ gas and oil rigs is at 10 week highs , while demand this week is likely to be thin with China, Hong Kong, Japan, South Korea and Taiwan all closed for lunar new year holidays

Last week, oil prices jumped more than 6% as Israeli Prime Minister Benjamin Netanyahu rejected a ceasefire proposal and the US continued to lob missiles at Iran-linked militant groups near the Red Sea.

Meanwhile, in the States…

Last week the S&P added 1.4% and the Nasdaq Composite jumped 2.3%, while the Dow Jones finished just about flat.

December’s revised inflation reading came in lower than first reported just adding further smoke signals out of the US of inflation in remission.

The resilient US economy and some more solid corporate earnings are behind 2024’s Wall Street rally, which last week led the majors to add a fifth straight weekly gain.

The surge in megacap tech stocks helped lift the S&P 500 and Nasdaq on Friday, with the S&P holding above the 5,000 level and just pushing its record high ever higher.

The last session in New York saw more of the Magnificent Majors drive gains.

This time Nvidia (NVDA) surged 3.65% to a new intraday record high, while nearby Messrs Microsoft (MSFT), Amazon (AMZN) and Alphabet (GOOG) all added strength.

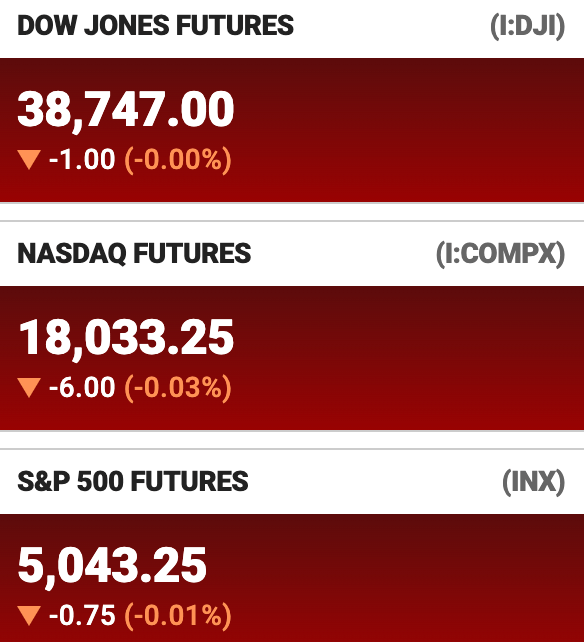

And US Futures are mixed in Sydney (at 3pm on Monday).

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | MARKET CAP |

|---|---|---|---|---|---|

| GCR | Golden Cross | 0.003 | 50% | 6,232 | $2,194,512 |

| LSR | Lodestar Minerals | 0.003 | 50% | 330,000 | $4,046,795 |

| INV | Investsmart Group | 0.155 | 48% | 5,000 | $14,981,451 |

| ARR | American Rare Earths | 0.235 | 47% | 12,360,008 | $71,427,728 |

| FTC | Fintech Chain Ltd | 0.014 | 27% | 5,000 | $7,158,465 |

| EVR | Ev Resources Ltd | 0.0145 | 26% | 11,751,185 | $12,645,266 |

| NC6 | Nanollose Limited | 0.03 | 25% | 871,854 | $4,128,153 |

| CHK | Cohiba Min Ltd | 0.0025 | 25% | 851,571 | $5,060,460 |

| DOU | Douugh Limited | 0.005 | 25% | 2,658,864 | $4,328,276 |

| IEC | Intra Energy Corp | 0.0025 | 25% | 10,000,000 | $3,381,563 |

| REE | Rarex Limited | 0.02 | 25% | 3,634,248 | $10,934,185 |

| SI6 | SI6 Metals Limited | 0.005 | 25% | 9,095,107 | $7,975,438 |

| SCL | Schrole Group Ltd | 0.185 | 23% | 12,294 | $5,393,257 |

| IPB | IPB Petroleum Ltd | 0.011 | 22% | 2,619,233 | $5,086,102 |

| KGD | Kula Gold Limited | 0.011 | 22% | 485,383 | $3,808,907 |

| MEM | Memphasys Ltd | 0.011 | 22% | 1,091,660 | $12,094,729 |

| AD8 | Audinate Group Ltd | 19.3 | 20% | 720,273 | $1,332,234,641 |

| BRN | Brainchip Ltd | 0.27 | 20% | 21,346,959 | $406,308,304 |

| AMD | Arrow Minerals | 0.006 | 20% | 21,039,366 | $17,368,825 |

| AUZ | Australian Mines Ltd | 0.012 | 20% | 43,879,697 | $10,657,537 |

| M4M | Macro Metals Limited | 0.003 | 20% | 468,000 | $6,167,694 |

| TMR | Tempus Resources Ltd | 0.006 | 20% | 10,164 | $3,654,994 |

| WRK | Wrkr Ltd | 0.033 | 20% | 1,467,473 | $34,968,698 |

| AZL | Arizona Lithium Ltd | 0.025 | 19% | 29,147,445 | $79,515,346 |

| TKM | Trek Metals Ltd | 0.04 | 18% | 1,657,226 | $17,444,613 |

American Rare Earths (ASX:ARR) was way out in front of the game on Monday morning, despite not having any news for the ASX today – possibly on the heels of Friday’s investor presentation, and late news that chairman Ken Traub has been replaced by non-executive director Richard Hudson. Traub is set to remain on the board as a non-executive director.

But that seems kinda unlikely, given that 99.9% of the time, shuffling of the board is roundly ignored by investors, especially in the absence of any really juicy gossip – but the company did respond to a Please Explain from the ASX with a cheerful “We don’t know either” about the sudden surge in price.

Appen (ASX:APX) was climbing this morning, on news that the company has finalised details of additional measures to mitigate the impact of the loss of a material customer contract.

On 22 January, Appen was dealt a major blow when Google told the company that it would no longer require its services, bringing work between the two companies to a halt on or before 19 March 2024 – a huge blow for Appen, as Google’s contract was worth $82.8 million at a gross margin of 26% in In FY23.

Battery metals explorer Australian Mines (ASX:AUZ) went soaring late in the day without any news to explain why, as did RareX (ASX:REE) – but with Tin and Silver the only metals and / or industrials showing any signs of positive movement in commodities, it could have been something obscure getting very valuable today, or it could just have been the wind…

And Nanollose (ASX:NC6) lifted through the afternoon, on news that it has received the first purchase order for 340kg of the Company’s Nullarbor-20 fibre, with the order coming from Orta Anadolu Ticaret Ve Sanayi İşletmesi, which is apparently “a leader in clothing sustainability”.

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | MARKET CAP |

|---|---|---|---|---|---|

| HCL | Highcom Ltd | 0.17 | -47% | 2,677,555 | $32,858,455 |

| GRE | Greentechmetals | 0.205 | -40% | 4,301,374 | $28,587,192 |

| GCR | Golden Cross | 0.002 | -33% | 50,000 | $3,291,768 |

| ICL | Iceni Gold | 0.033 | -27% | 376,031 | $11,095,247 |

| ADS | Adslot Ltd. | 0.0015 | -25% | 400,000 | $6,448,991 |

| ABE | Ausbondexchange | 0.03 | -25% | 308,911 | $4,506,725 |

| NYM | Narryermetalslimited | 0.034 | -24% | 801,305 | $2,159,711 |

| STX | Strike Energy Ltd | 0.325 | -23% | 74,799,827 | $1,202,134,861 |

| ERW | Errawarra Resources | 0.059 | -20% | 1,150,223 | $7,098,130 |

| 88E | 88 Energy Ltd | 0.004 | -20% | 28,588,575 | $123,627,103 |

| EM2R | Eagle Mountain - Rights 23-Feb-24 | 0.004 | -20% | 100,000 | $381,209 |

| LNU | Linius Tech Limited | 0.002 | -20% | 1,636 | $12,348,102 |

| MCT | Metalicity Limited | 0.002 | -20% | 882,616 | $11,212,634 |

| SI6 | SI6 Metals Limited | 0.004 | -20% | 2,704,000 | $9,969,297 |

| EG1 | Evergreenlithium | 0.093 | -19% | 21,335 | $6,466,450 |

| ICR | Intelicare Holdings | 0.013 | -19% | 2,061 | $3,757,192 |

| KGL | KGL Resources Ltd | 0.115 | -18% | 292,947 | $79,420,861 |

| AQX | Alice Queen Ltd | 0.005 | -17% | 96,292 | $4,145,905 |

| CT1 | Constellation Tech | 0.0025 | -17% | 1,051,983 | $4,424,201 |

| FAU | First Au Ltd | 0.0025 | -17% | 65,000 | $4,985,980 |

| NRZ | Neurizer Ltd | 0.005 | -17% | 1,130,752 | $8,483,465 |

| OAR | OAR Resources Ltd | 0.0025 | -17% | 348,861 | $7,931,183 |

| TEG | Triangle Energy Ltd | 0.02 | -17% | 16,875,366 | $33,637,099 |

| TMR | Tempus Resources Ltd | 0.005 | -17% | 999,753 | $4,385,992 |

| NSX | NSX Limited | 0.021 | -16% | 88,951 | $10,035,507 |

Tambourah Metals (ASX:TMB) has completed rock chip sampling, shallow auger sampling of alluvial dumps and localised RC drilling below historical alluvial workings Shaw River project near Port Hedland, WA, with rock chip sampling returning up to 3,660ppm Li.

Victory Metals (ASX:VTM) has reported that assays from a 13,718 aircore infill resource definition drilling program at the North Stanmore project have confirmed ‘exceptional’ dysprosium and terbium ratios with a combined value 900% higher than most valuable light rare earth elements.

ADX Energy (ASX:ADX) is days away from spudding the Welchau-1 well to test a giant gas prospect in Upper Austria that will have little difficulty finding customers should it prove successful, as the site has a best technical prospective resource of 807 billion cubic feet equivalent (Bcfe) of gas.

Burley Minerals’ (ASX:BUR) hunt for channel iron deposits at its Broad Well Flat project in WA’s Pilbara region is off to a fantastic start with rock chip sampling returning an average grade of 56.3% iron.

The countdown is on to the results of AdAlta’s (ASX:1AD) ’s AD-214 Phase I extension study on track later this month with the clinical stage biotech gearing up for partnering opportunities to advance next phase studies.

Anson Resources (ASX:ASN) has advised the market that arthworks for an upcoming drill program at the Green River lithium project in Utah’s Paradox Basin have started, including the excavation and installation of the ‘drill cellar’ as well the delivery of drill casing and brine storage.

Ongoing field mapping and surface sampling has identified a 2km shear zone within the southern half of the Gnaweeda greenstone belt at Meeka Metals’ (ASX:MEK) Murchison gold project in Western Australia as it continues to advance potential funding arrangements.

Arizona Lithium’s (ASX:AZL) direct lithium extraction pilot plant at its Prairie project in Saskatchewan, Canada, has operated exceedingly well over the past three months, and produced very high quality and consistent results as the company determines the final design and engineering of the commercial plant.

The full set of results from a 28-hole, 6,000m RC drill program at Brightstar Resources’ (ASX:BTR) Link Zone and Aspacia deposit, part of the company’s Menzies project, include high-grade hits of up to 18.88g/t gold and confirm more than 600m of strike extent at the tenure.

In a milestone achievement for Hillgrove Resources (ASX:HGO), the company has been reinstated as an Australian copper producer after producing first concentrate from its Kanmantoo underground operation in South Australia.

Exploration south of the planned wellfield for the Kachi lithium brine project in Argentina has returned an average brine grade of 257mg/L over 407m and down to a depth of +600m, further supporting the modelling of last year’s definitive feasibility study from Lake Resources (ASX:LKE) .

Copper Search (ASX:CUS) has outlined another chargeability target at Paradise Dam, within the wider Peake project in South Australia’s Gawler Craton, following a recent IP geophysical Survey that found all the right ingredients for hosting a large copper deposit.

Melodiol Global Health (ASX:ME1) has announced that wholly-owned Canadian subsidiary Mernova Medicinal has achieved further operational milestones during Q1 FY24, with cost optimisation initiatives that have identified opportunities which are expected to remove ~$400k in annual expenses from the business.

Comet Resources (ASX:CRL) – pending an announcement to the ASX in relation to a proposed capital raising.

Greenstone Resources (ASX:GSR) – pending an announcement to the market in relation to a proposed material transaction.

Norwest Minerals (ASX:NWM) – pending the release of an announcement concerning an acquisition of tenements and capital raising.

Elixinol Global (ASX:EXL) – pending an announcement to the ASX in connection with a capital raising.

Singular Health Group (ASX:SHG) – pending an announcement in respect of a capital raising.

Nova Eye Medical (ASX:EYE) – pending an announcement in relation to a proposed capital raising.

PainChek (ASX:PCK) – pending an announcement regarding a capital raise.

Horizon Minerals (ASX:HRZ) – pending an announcement regarding in relation to a proposed material transaction.

Fletcher Building (ASX:FBU) – pending the release of the company’s half-year results on Wednesday 14 February.