Closing Bell: ASX clipped -1.3pc on broad selloff; BHP makes a $60bn play for Anglo American

ASX clipped as all 11 sectors sold off. Picture Getty

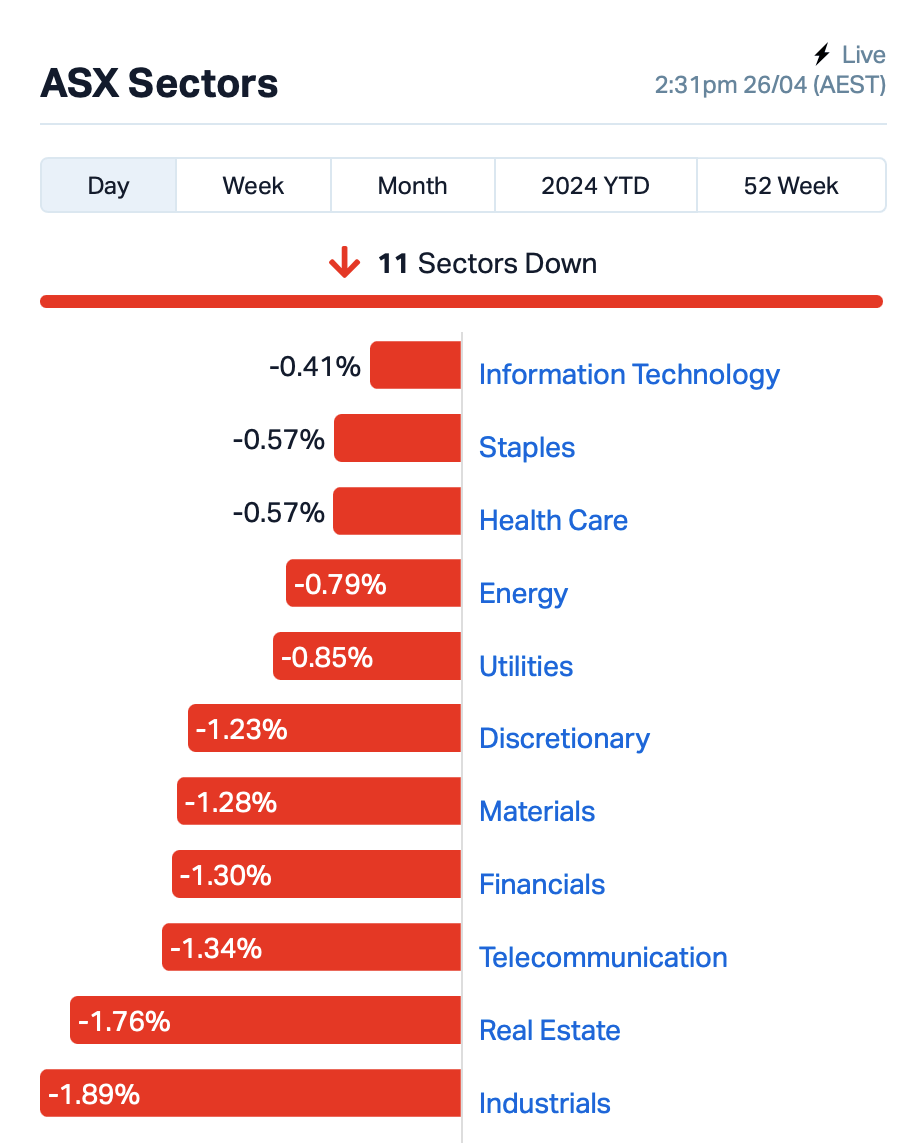

- The ASX slumped by over -1pc, as jitters about delayed rate cuts rattled markets

- Miner BHP confirmed $60 billion bid for competitor Anglo American

- Gold stocks climbed, but all 11 sectors closed in the red

The ASX 200 declined sharply by -1.3% on Friday on diminishing bets the US Fed could cut rates significantly this year. For the week, the benchmark index was down -0.8%.

Local stocks reacted to news of a soft US GDP print of just 1.6%, and inflation rate which has increased by 3.4% in Jan-Mar, compared to an increase of 1.8% in the final three months of 2023.

“If growth continues to slowly decelerate, but inflation strongly takes off again in the wrong direction, the expectation of a Fed interest rate cut in 2024 is starting to look increasingly more out of reach,” said Olu Sonola at Fitch.

The local bourse was a sea of red today, with Industrials, Real Estate and Telcos leading the selloff.

The Mining sector was dragged down by BHP (ASX:BHP), which tumbled -4% after confirming a possible $60 billion acquisition of Anglo American. The proposal included an all-in offer of shares, necessitating Anglo to divest its holdings in Anglo American Platinum and Kumba Iron Ore to its shareholders.

“The combined entity would have a leading portfolio of large, low-cost, long-life Tier 1 assets focused on iron ore and metallurgical coal and future facing commodities, including potash and copper,” said the statement from BHP.

Gold-related stocks were mostly up, with ASX All Ordinaries Gold (XGD) surging by over +4%.

Hani Abuagla, senior market analyst at XTB MENA says that while it can be argued that gold is overvalued after reaching historical highs earlier this month, the price is still looking relatively low.

“Looking at the metal in relation to the prices of other assets such as copper, oil, the S&P 500, or in relation to the still huge central bank balance sheets, it seems that gold still may have more upside ahead,” Abuagla said.

Meanwhile, Aussie bond yields surged today (bond prices lower) after Judo Bank’s chief economic adviser Warren Hogan told the AFR that the RBA could increase rates this year to 5.1%.

“Everything points to the fact that 4.35 per cent isn’t the right level for the cash rate,” he told The Australian Financial Review, referring to the current cash rate of 4.35%.

Elsewhere…

Asian tech stocks mostly rose on Friday as Google and Microsoft posted solid updates after the Nasdaq’s closing bell last night.

Alphabet crushed sales estimates of top and bottom lines and announced a dividend. The Alphabet stock price popped +11% after the bell.

Fellow megacap Microsoft also beat forecasts, lifted by demand for its cloud and AI offerings. Its share price rose by +4% after the bell.

According to a note from State One Stockbroking, US companies listed to report earnings later today or tonight include: AbbVie, Air China, Cameco, Chevron, Colgate-Palmolive, Electrolux, Exxon Mobil, Hitachi, Imperial Oil, JVC Kenwood, Kia, Kikkoman, Komatsu, Mitsubishi Electric, NEC, Nomura, Phillips 66, SAAB, Shaanxi Coal Industry, Stanley Electric, Sumitomo Heavy Industries, TDK, Tokyo Steel Manufacturing and TotalEnergies.

Also on the docket tonight are the closely-watched US March personal income and spending, plus the March personal consumption expenditure (PCE).

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| IS3 | I Synergy Group Ltd | 0.005 | 150% | 6,511,072 | $608,161 |

| RCR | Rincon | 0.062 | 51% | 48,927,418 | $9,067,206 |

| ASE | Astute Metals NL | 0.060 | 46% | 1,075,843 | $16,831,299 |

| VNL | Vinyl Group Ltd | 0.130 | 35% | 3,089,650 | $58,056,505 |

| EXL | Elixinol Wellness | 0.006 | 33% | 8,277,152 | $5,854,833 |

| MKL | Mighty Kingdom Ltd | 0.005 | 25% | 9,579,867 | $9,323,732 |

| ORN | Orion Minerals Ltd | 0.022 | 22% | 3,525,958 | $105,233,124 |

| TTT | Titomic Limited | 0.064 | 21% | 1,529,248 | $48,793,700 |

| IMI | Infinitymining | 0.070 | 21% | 32,396 | $6,887,697 |

| TMR | Tempus Resources Ltd | 0.006 | 20% | 200,083 | $3,654,994 |

| CMG | Criticalmineralgrp | 0.125 | 19% | 21,385 | $4,047,180 |

| MAP | Microbalifesciences | 0.190 | 19% | 309,856 | $71,656,316 |

| ENV | Enova Mining Limited | 0.019 | 19% | 3,946,133 | $15,326,870 |

| TRU | Truscreen | 0.019 | 19% | 138,540 | $8,841,458 |

| ARR | American Rare Earths | 0.325 | 18% | 2,964,585 | $135,691,407 |

| GLL | Galilee Energy Ltd | 0.047 | 18% | 234,795 | $13,589,786 |

| VN8 | Vonex Limited. | 0.014 | 17% | 402,001 | $4,341,943 |

| OSX | Osteopore Limited | 0.395 | 16% | 721,568 | $3,511,754 |

| GBE | Globe Metals &Mining | 0.037 | 16% | 221,852 | $21,627,763 |

| SRJ | SRJ Technologies | 0.075 | 15% | 96,817 | $10,354,138 |

| CLA | Celsius Resource Ltd | 0.012 | 15% | 3,693,397 | $24,083,600 |

| ZEO | Zeotech Limited | 0.039 | 15% | 6,119,488 | $59,616,384 |

| BCT | Bluechiip Limited | 0.008 | 14% | 955,000 | $7,705,368 |

| BXN | Bioxyne Ltd | 0.008 | 14% | 312,746 | $14,326,518 |

Infinity Mining (ASX:IMI) reported a 2,700oz maiden resource at Great Northern, part of the 63,000oz Central Goldfields project. IMI is aiming for a resource of 500,000oz across the project area, which comprises 10 mining and prospecting licences in the Eastern Goldfields region of WA. The small explorer reckons the 63,000oz uncovered so far has “good mining potential” because the gold starts at surface, is wide enough and of sufficient grade for open pit mining.

American Rare Earths (ASX:ARR) has received an indicative, conditional and non-binding proposal from a NASDAQ-listed Special Purpose Acquisition Company (SPAC) to acquire the company’s 100% owned subsidiary Wyoming Rare (USA) Inc, which holds the company’s 2.34 billion tonne Halleck Creek Rare Earth Project. The proposal would have resulted in Wyoming Rare (USA) Inc. being listed (via a combination) with the SPAC as a separate entity on the NASDAQ. ARR’s board says it will look into the proposal to ensure optimal returns to shareholders.

Earths Energy (ASX:EE1) posted a solid rise in the wake of the company’s statement on Wednesday that “recent significant government initiatives and policy updates that align with the company’s strategic vision for growth of the renewable energy sector.

Similarly, Belararox’s (ASX:BRX) quarterly report on Wednesday has carried momentum through to this morning’s session, after the company assured investors that its three projects, one each in Agentina, New South Wales and Western Australia, are all tracking well.

Osteopore (ASX:OSX) is moving rapidly again today (up +29.4% this morning) after getting another speeding ticket from the ASX about a sudden rise earlier in the week, which the company countered with some nonchalant whistling and a “nowt to see ‘ere, guvnor”.

Australia’s only ASX-listed music company, Vinyl Group (ASX:VNL), announced that RealWise Group Holdings (RGH) has elected to convert its convertible note into VNL ordinary shares. Following this week’s EGM where shareholders approved the option to convert the convertible note in full or in part by RGH, the full principal balance of $6,955,413 will be converted into stock at a conversion price of $0.04482 per share. The resulting conversion will see RealWise Group Holdings become the largest shareholder of Vinyl with an approximate 34% holding.

Loyal Lithium (ASX:LLI) says the Trieste Lithium Project is taking shape with Dyke #04 returning more thick near-surface high grade drill assay results. The now completed winter drilling program has recorded many notable near-surface sub-perpendicular results including: 32.8m of 1.2% Li2O from 27.6m, and 31.8m of 2.2% Li2O from 2.9m.

WA1 Resources (ASX:WA1) announced that assays from broad-spaced RC and diamond drilling have extended the shallow high-grade blanket of niobium mineralisation to the east at Luni. Best new intersections from 200m spaced drill holes in the east include: 3m at 4.0% Nb2O5 and 73m at 0.8% Nb2O5.

And in the large cap space, dual-listed gold major Newmont (NYSE:NEM ASX:NEM, TSX:NGT) produced 2.2Moz in the first quarter of 2024, generating over US$1.4 billion in cash. The US$50bn capped behemoth declared a dividend of US25c/sh for the quarter. Full year guidance is unchanged at 6.93Moz at US$1400/oz all in sustaining costs.

ASX SMALL CAP LAGGARDS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AXP | AXP Energy Ltd | 0.001 | -50% | 2,040 | $11,649,361 |

| TD1 | Tali Digital Limited | 0.001 | -50% | 5,834,652 | $6,590,311 |

| NTM | Nt Minerals Limited | 0.004 | -27% | 1,790,000 | $4,729,466 |

| FAU | First Au Ltd | 0.002 | -25% | 29,031 | $3,323,987 |

| IEC | Intra Energy Corp | 0.002 | -25% | 32,000 | $3,381,563 |

| ME1 | Melodiol Glb Health | 0.003 | -25% | 1,373,382 | $2,693,949 |

| OAR | OAR Resources Ltd | 0.002 | -25% | 21,739,346 | $6,306,622 |

| ADR | Adherium Ltd | 0.022 | -24% | 3,849,960 | $9,861,159 |

| AJX | Alexium Int Group | 0.012 | -20% | 1,511,962 | $9,918,161 |

| MBK | Metal Bank Ltd | 0.016 | -20% | 540,000 | $7,809,186 |

| NVQ | Noviqtech Limited | 0.004 | -20% | 20,454 | $7,436,536 |

| TMX | Terrain Minerals | 0.004 | -20% | 3,070,107 | $7,158,353 |

| WWG | Wisewaygroupltd | 0.110 | -19% | 53,541 | $22,584,673 |

| ID8 | Identitii Limited | 0.009 | -18% | 2,637,088 | $4,732,618 |

| RFT | Rectifier Technolog | 0.009 | -18% | 2,840,005 | $15,201,823 |

| RXL | Rox Resources | 0.185 | -18% | 1,192,931 | $83,104,709 |

| AGD | Austral Gold | 0.030 | -17% | 300,000 | $22,043,209 |

| PVT | Pivotal Metals Ltd | 0.015 | -17% | 727,000 | $12,674,129 |

| AZI | Altamin Limited | 0.040 | -17% | 3,480,287 | $21,064,754 |

| GTR | Gti Energy Ltd | 0.005 | -17% | 14,719,600 | $12,299,683 |

| LRL | Labyrinth Resources | 0.005 | -17% | 1,800,185 | $7,125,262 |

| OAU | Ora Gold Limited | 0.005 | -17% | 1,006,543 | $34,836,005 |

| PNX | PNX Metals Limited | 0.005 | -17% | 2,253,000 | $32,973,748 |

| WSR | Westar Resources | 0.010 | -17% | 1,897,406 | $2,224,290 |

| FNR | Far Northern Res | 0.160 | -16% | 66,500 | $6,791,707 |

IN CASE YOU MISSED IT

Bioxyne (ASX:BXN) has acquired UK-based Phyto Nourishment Ltd in a $4.65m all- stock deal as it moves to also diversify its revenue channels and enter the $500bn coffee market.

Summit Minerals’ (ASX:SUM) reconnaissance work has identified a large-scale surface saprolite clay system at its newly acquired T1-T2 rare earths project in Brazil’s prolific Minas Gerais mining district.

Toubani Resources (ASX:TRE) has raised $3.85m through a placement of shares to existing and new investors to drive technical work streams required to deliver a definitive feasibility study for its 2.4Moz Kobada gold project in southern Mali. Another $150,000 will be raised through the issue of shares to non-executive director Tim Kestell subject to shareholder approval.

Trinex Minerals’ (ASX:TX3) diamond drilling program at the Gibbons Creek project in Canada’s prolific Athabasca Basin has intersected uranium mineralisation with values over 8,660 counts per minute.

Corazon Mining (ASX:CZN) has wrapped up the latest phase of drilling at its Lynn Lake nickel-copper-cobalt project in Manitoba, Canada, with samples from the two diamond holes submitted for laboratory analysis. Preliminary assessment of the results indicate the presence of Lynn Lake-style magmatic sulphide mineralisation, confirming that the target Fraser Lake Complex (FLC) hosts a large mineralised body. It has also improved the understanding of the 3D induced polarisation and MT geophysical anomalies, which will assist with ongoing target generation at the FLC.

Peregrine Gold (ASX:PGD) has started field exploration over newly acquired tenements at its flagship Newman gold project in Western Australia where its previous exploration had defined the Tin Can bedrock-hosted gold discovery. Planned exploration activities include vehicle and helicopter-based stream sediment sampling across the newly acquired tenure, close-spaced reverse circulation drilling along strike and down plunge from Tin Can, and RC drilling to test gold in soil anomalism along strike from Tin Can. The company also intends to carry out prospect-scale geological mapping at the Epithermal prospect along with heritage surveys and drilling at the Perry Creek gold in soil anomaly.

Raiden Resources (ASX:RDN) preliminary heritage reports have indicated that all key target areas at Andover South where drilling is planned are clear of any culturally sensitive areas.

Likewise, the preliminary report for Andover North has been received and planning is underway for exploration programs over that area.

The surveys were carried out over priority lithium-bearing pegmatite targets at both project areas.

TRADING HALTS

Iron Road (ASX:IRD) – Pending the release of an announcement in relation to a significant transaction related to its Cape Hardy Industrial Port Precinct development.

Nexion Group (ASX:NNG) – Pending an announcement regarding a material acquisition.

At Stockhead, we tell it like it is. While Bioxyne, Summit Minerals, Corazon Mining, Toubani Resources , Peregrine Gold, Raiden Resources, and Trinex Minerals are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.