Local markets are up this morning, and it looks like it’s a pretty cruisy day across the board so far. Goldies are leading the charge, Small Caps are rising well… I’ve gotta say, it’s not too shabby for a Thursday.

I’ll get into the nuts’n’bolts of it all shortly, but first… monkeys.

Specifically, we’re talking about monkeys that live in and around the Thai city of Lopburi, about 140km north of Bangkok, where the delightful little critters are welcomed by locals as wildlife symbols of the region.

They also get to celebrate an annual “Monkey Buffet” festival at the ancient Three Pagodas temple, which sounds horrific, but it’s the monkeys that are doing the eating. Just so we’re clear.

The issue is that the monkeys are protected under Thai law – and because of that, they have managed to do the other thing monkeys are super-good at, which is breed in fantastically massive numbers, at quite a rapid pace.

The end result is huge numbers of monkeys forming gangs, and roaming the streets of the city, emboldened by being in the company of their monkey brothers and sisters, and generally acting like total bastards.

Recently, several people have been injured as the monkeys have knocked them from their motorcycles, and the number of people being attacked and having food stolen from them is reaching plague proportions.

So, the city has hatched “a plan”. Officials have been building massive monkey gulags around town, with the intention of rounding up as many of the sly little simians as possible and putting them in monkey jail.

Once imprisoned, the monkeys will be neutered, and released back into the wild – which sounds like a great idea, but I’m not sure they’ve really thought this through.

Yes, it’ll lead to a population decline – but I’m willing to bet Baht to bananas that a city full of recently-neutered monkeys, angry about having their furry little nuts cut off, is going to very quickly turn into an interspecies hellscape.

So far, it’s not been a roaring success – just 37 monkeys have been unlucky enough to fall foul of the monkey police – but as that number grows, and those monkeys figure out what’s been happening, all hell’s gonna break loose.

TO MARKETS

The ASX is on track for modest gains today, with a mixed result on the books from Wall Street overnight providing enough forward momentum to keep Aussie investors in the game today.

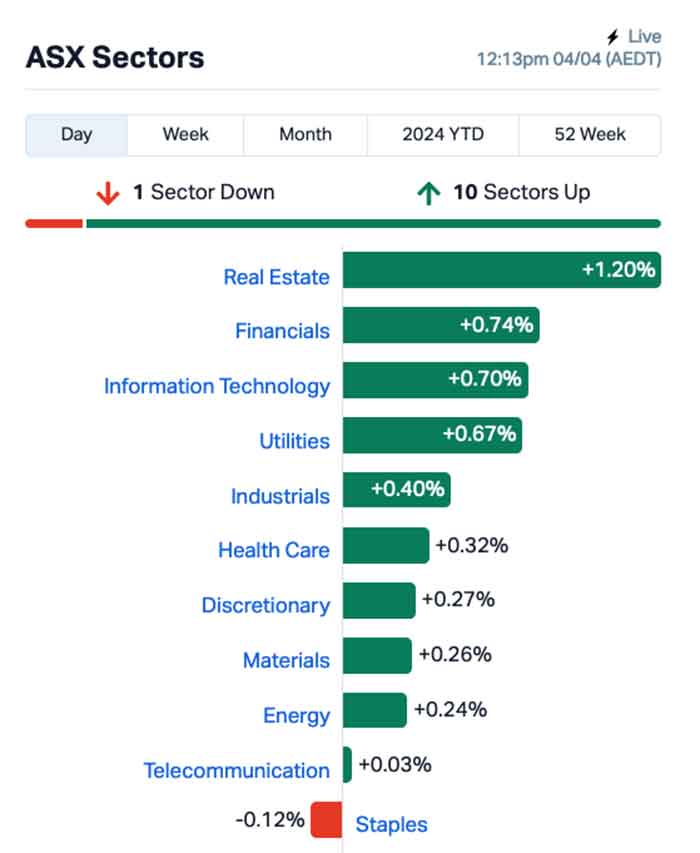

A quick look at the sectors shortly after midday, and things are looking green and delicious, like a glistening bowl of ice cold grapes in an esky, condensation slowly trickling down in fine rivulets on their plump luscious skin, stretched taut over firm but willing flesh of the fruit.

I have no idea why I just wrote that, but now I want grapes and I’m afraid to buy some because I genuinely don’t know what’s gonna happen if I do.

The one sour note on the market is Consumer Staples, which is operating below zero this morning – most likely due to some of the outsized Large Caps posting modest falls.

That includes Woolworths, down -0.25%, and the A2 Milk company, which has dropped like a -2.8% tub of expired room-temperature custard on the kitchen floor today. #Blergh

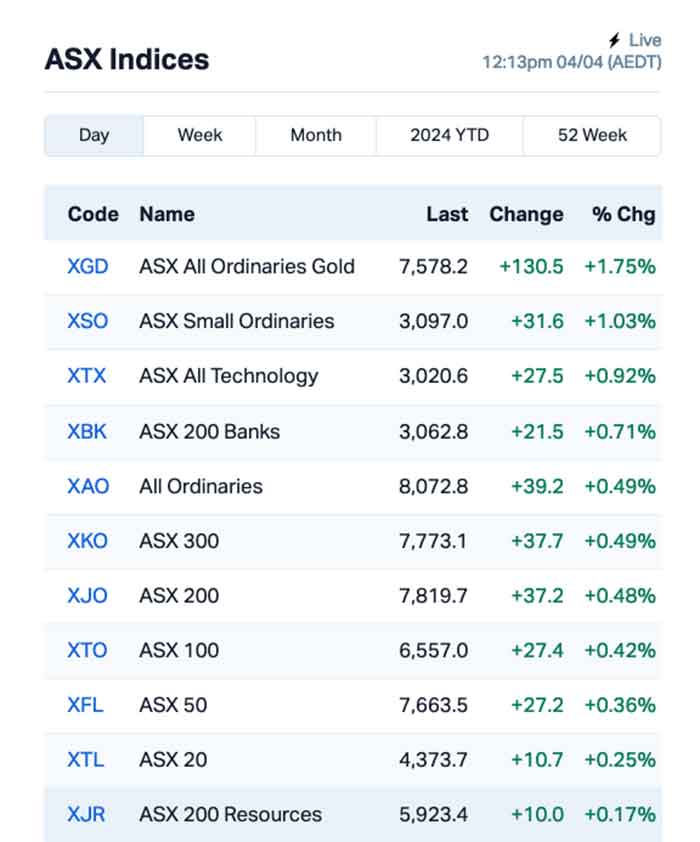

As it was yesterday, the goldies are making more hay again today, as the price of the world’s favourite precious metal continues what looks like an inexorable march to previously unheard of heights.

Earlybird Eddy Sunarto tells me that “high inflation with no interest rate hikes (or cuts) is spurring a rush to cash alternatives like gold” – and I’m inclined to believe him, because he knows a lot more about this stuff than I do.

NOT THE ASX

Speaking of Eddy, he’s also told me that Wall Street turned in a mixed bag overnight, which left the S&P 500 up by +0.11%, the blue chips Dow Jones index down by -0.11%, and the tech-heavy Nasdaq up by +0.23%.

That’s despite J-Pow strutting his stuff on the mic at Stanford University overnight, where he told an audience on the edge of their seats that nothing’s going to happen any time soon.

“On inflation, it is too soon to say whether the recent readings represent more than just a bump,” Powell rapped at 190 words per second.

“We do not expect that it will be appropriate to lower our policy rate until we have greater confidence that inflation is moving sustainably down toward 2 per cent,” he added, slowing the pace and prompting many in the crowd to scream “play Freebird” before blacking out from all the excitement.

In US stock news, Ford Motor was up almost 3% after reporting a Q1 sales jump.

Shares of Ulta Beauty, a cosmetics company, got belted by -15% after its CEO said the cosmetics sector’s slowdown was a “bit earlier” and a “bit bigger” than he thought.

Disney shares fell -3% after iconic CEO Bob Iger won a vote of confidence from shareholders who rejected dissident investor Nelson Peltz’s bid for a board seat at the company. The Mouse has remained ominously quiet throughout this entire ordeal, with many Disney observers getting nervous that it could snap at any moment.

In Asia, markets are – mostly – closed. Taiwan’s closed for Children’s Day, and also because there’s been a massive, deadly earthquake, which upset a lot of people.

But not this guy. He’s having the time of his life…

🚨#WATCH New footage captured someone swimming in a pool when the powerful 7.5 magnitude earthquake strikes

Witness new footage of a man swimming in a pool when a powerful 7.5 magnitude earthquake strikes. This took place in Taipei, Taiwan, causing violent… pic.twitter.com/FbV5s1lEmX

— R A W S A L E R T S (@rawsalerts) April 3, 2024

Chinese markets are closed for Ching Ming, which still sounds made up and racist, and in Japan the Nikkei is up +1.84% because for once, the earthquake was happening somewhere else.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 04 April [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap CYQ Cycliq Group Ltd 0.006 100% 33,830,033 $1,072,550 LSR Lodestar Minerals 0.002 33% 19,675 $3,035,096 MTL Mantle Minerals Ltd 0.002 33% 1,010,295 $9,296,169 RLG Roolife Group Ltd 0.008 33% 3,164,073 $4,694,290 SI6 SI6 Metals Limited 0.004 33% 1,000,000 $7,106,578 PEC Perpetual Res Ltd 0.013 30% 8,142,317 $6,400,294 BB1 Blinklab Limited 0.255 28% 1,702,180 $11,417,227 ME1 Melodiol Global Health 0.0075 25% 3,235,540 $2,621,014 FXG Felix Gold Limited 0.052 21% 426,373 $8,910,250 KGD Kula Gold Limited 0.009 20% 5,912,886 $3,648,464 EEL Enrg Elements Ltd 0.006 20% 2,055,564 $5,049,825 BAS Bass Oil Ltd 0.085 20% 1,298,410 $19,056,005 LDR Lode Resources 0.11 20% 430,166 $9,824,141 WSR Westar Resources 0.013 18% 5,467,870 $2,038,933 CAI Calidus Resources 0.14 17% 5,903,958 $91,314,509 NSB Neuroscientific 0.07 17% 4,074,535 $8,676,292 FGH Foresta Group 0.014 17% 1,300,313 $26,988,649 TMK TMK Energy Limited 0.0035 17% 2,376,591 $20,267,144 WA1 Wa1Resourcesltd 14.64 17% 589,677 $769,771,368 CVV Caravel Minerals Ltd 0.215 16% 1,380,895 $96,991,763 ABX ABX Group Limited 0.065 16% 16,028 $14,002,258 MMA Maronan Metals 0.325 16% 503,025 $21,002,297 DTM Dart Mining NL 0.045 15% 4,657,544 $8,875,606 CEL Challenger Gold Ltd 0.092 15% 2,164,723 $100,893,470 ADG Adelong Gold Limited 0.004 14% 1,005,500 $3,081,711

Cycliq (ASX:CYQ) was way out in front on Thursday morning, after dropping new product news that has quite a number of investors excited about the future of riding bikes.

It’s called the Fly-6 Pro, and it’s a headlight/4K Camera combo unit that has a list of features that far outstrips anything I thought would ever be needed on a bicycle headlight… but, it’s 2024, and if your gadget can connect to the internet and broadcast you riding full-tilt into a car door in the middle of the CBD, then it’s probably going to fly off the shelves.

RooLife Group (ASX:RLG) was up after the company announced a proposed placement to China-based e-commerce and supply chain business, Fujian Jushi Supply Chain Management Co., at a proposed placement price of $0.0085 per fully paid ordinary share.

Blinklab (ASX:BB1) – “a company focused on developing new smartphone-based AI-powered mental healthcare solutions” – made its market debut at midday today, climbing +30% over listing price in about an hour.

Kula Gold (ASX:KGD) has reported results of a recent rock chipping and mapping programme in the vicinity of the historical Camilleri/Donnybrook Mine with an assay result of up to 11.19g/t gold, which is pretty juicy.

Meanwhile, Westar Resources (ASX:WSR) announced it has commenced a detailed review of historic gold exploration activities as a first step in unlocking the gold potential at the Mindoolah Mining Centre, which is part of the Company’s Mindoolah project in Western Australia’s Murchison Region.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 04 April [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap AXP AXP Energy Ltd 0.001 -50% 30,612 $11,649,361 EDE Eden Inv Ltd 0.001 -50% 228,125 $7,356,542 M2R Miramar 0.012 -33% 509,012 $2,679,652 MHC Manhattan Corp Ltd 0.002 -33% 2,200,000 $8,810,939 1MC Morella Corporation 0.003 -25% 205,222 $24,715,198 MRQ MRG Metals Limited 0.0015 -25% 6,650,000 $5,050,237 NNG Nexion Group 0.012 -20% 1,672,703 $3,034,618 MCL Mighty Craft Ltd 0.02 -20% 586,030 $9,128,304 ECT Env Clean Tech Ltd 0.004 -20% 212,693 $14,321,552 GMN Gold Mountain Ltd 0.004 -20% 7,385,650 $14,877,528 ROG Red Sky Energy 0.004 -20% 70,002,418 $27,111,136 PIL Peppermint Inv Ltd 0.013 -19% 18,856,262 $33,861,733 EXT Excite Technology 0.01 -17% 9,397,088 $15,950,901 PRX Prodigy Gold NL 0.0025 -17% 942,455 $5,822,823 CMX Chemx Materials 0.042 -16% 99,628 $4,667,159 EG1 Evergreen Lithium 0.094 -15% 1,830 $6,185,300 AN1 Anagenics Limited 0.012 -14% 118,622 $5,867,860 AUK Aumake Limited 0.003 -14% 1,500,000 $6,700,424 BLZ Blaze Minerals Ltd 0.006 -14% 300,000 $4,399,908 CMG Critical Mineral Group 0.12 -14% 4,069 $5,396,240 WTM Waratah Minerals Ltd 0.077 -13% 4,074 $13,293,440 C7A Clara Resources 0.013 -13% 42,325 $2,835,586 BNL Blue Star Helium Ltd 0.007 -13% 1,003,883 $15,538,122 CTN Catalina Resources 0.0035 -13% 937,500 $4,953,948 HOR Horseshoe Metals Ltd 0.007 -13% 1,812,720 $5,171,829

ICYMI – AM EDITION

Battery Age Minerals (ASX:BM8) has appointed highly experienced geologist Nick Mitchell as its exploration manager for Canada with immediate effect.

Mitchell has over 20 years’ experience in mineral exploration and had joined the company as a senior exploration geologist in August last year and was responsible for the supervision and execution of the Phase II drilling at Falcon East extension.

He has worked for several highly successful junior miners and contracting companies, including Fronteer Gold where he developed a structural target model that added significant ounces to the Northumberland Mine in Nye County, Nevada.

Mitchell also worked at Cantex Mine Development Corp where he oversaw 55,000 meters of drilling and delineation of 2.6 km of mineralisation.

The Calmer Co International (ASX:CCO) has reported a 25% increase in monthly online sales for March compared to February, with exponential growth in the sector since April last year.

The health and wellness company is riding a burgeoning trend of people under 30 not drinking alcohol, which is boosting demand for its range of Fiji-produced kava beverages.

At Stockhead, we tell it like it is. While Battery Age Minerals and The Calmer Co are Stockhead advertisers, they did not sponsor this article.