ASX Small Caps Lunch Wrap: Who’s been baffled by the sun disappearing this week?

"I'm telling you, Wilma... the f#@!ing thing just disappeared... WHAT DID YOU DO TO IT?" Pic via Getty Images.

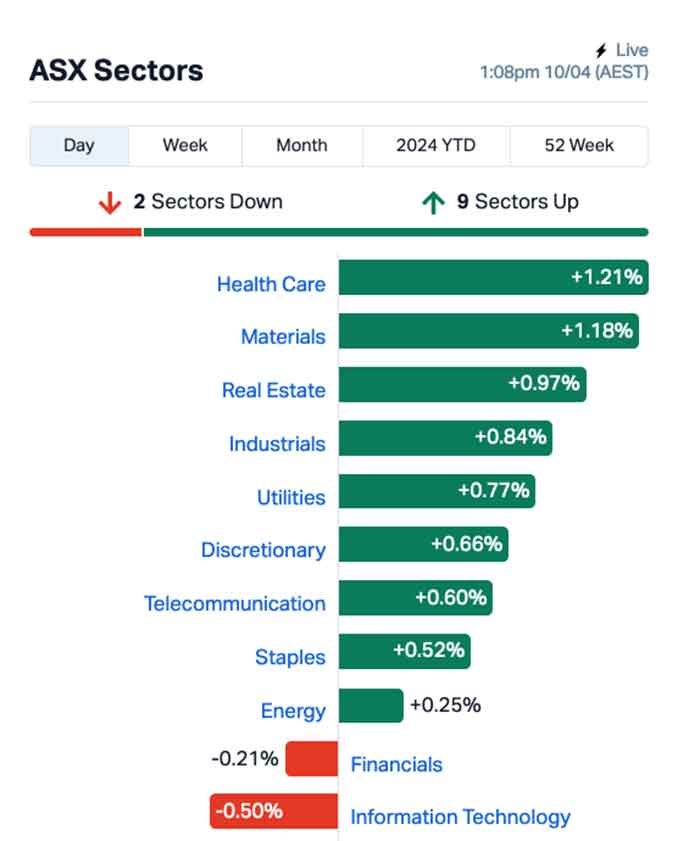

Local markets were up this morning, climbing around +0.45% early in the session and hanging in at that level as Wednesday dragged on – mostly thanks to another reasonable day among the Materials crowd and a number of solid bumps at the pricey end of the Health Care sector as well.

I’ll get into that shortly, but first we need to talk about the recent solar eclipse in the United States, which was both one of Mother Nature’s most glorious spectacles and also, it seems, an excuse for the foolhardy and the mentally unstable to really let themselves go.

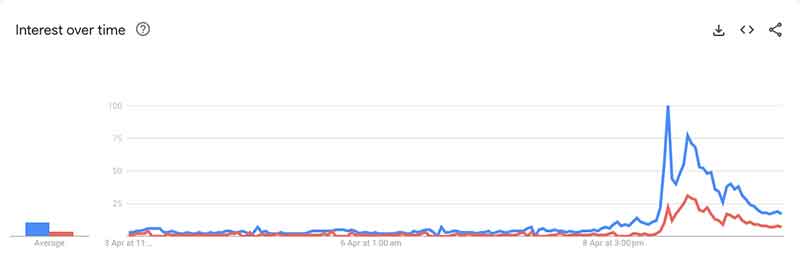

For starters, there’s some hard data from Google Trends suggesting that despite numerous warnings to people in the US not to look at the eclipse without suitable eye protection, a solid chunk of the population seems to have done just that.

Searches for “my eyes hurt” and “why do my eyes hurt” spiked rather dramatically in the short period immediately after the eclipse rolled across a broad swathe of North America, raising concerns that people are learning the hard way that staring at the sun for even a short period of time is going to boil your peepers.

Things got a little weirder than that, though – including one woman in Florida who became convinced that God had spoken to her, and told her that the eclipse was his sign that she should head out of the house to shoot a bunch of people.

The Florida Highway Patrol arrested 22-year-old Taylon Nichelle Celestine after she allegedly drove onto the intersate highway, and opened fire on two cars, hitting one driver in the neck and another in the arm.

She was pulled over after doing a U-Turn to get back onto the highway, with officers claiming she was preparing to start shooting again.

Eclipse fever infected the US political stage as well, with internationally-renowned bozo Marjorie Taylor Greene taking time off from her role as the self-appointed soccer mom of Congress to spout theories that the eclipse, among other things, were signs from an angry and vengeful Lord.

“God is sending America strong signs to tell us to repent. Earthquakes and eclipses and many more things to come. I pray that our country listens,” she wrote on social media, to outright howls of derision from around the world.

But perhaps the weirdest of them all was a campaign ad (I think … it’s kinda hard to tell) from frustrated Florida Bible salesman Donald Trump, who posted this image on his Truth Social platform.

Whether he’s trying to convey the message that he’s some kind of deity, or if he’s simply foreshadowing that if he were to come to power, he would plunge the whole of America into darkness, is still open to debate.

TO MARKETS

Local markets are trending higher this morning, with the ASX 200 benchmark climbing rapidly to 7,868 points (+0.56%) before easing slowly as the session wore on.

It’s since started to bounce again on the way into lunchtime, sitting around +0.43%, with the bulk of the forward impetus coming from the Health Care and Materials sectors.

Health Care is out in front because there’s a stack of Large Caps in that sector enjoying decent gains this morning, including Resmed, Neuren Pharmaceuticals and Sigma Healthcare, which are all up more than 3.0%.

Elsewhere around the traps, the goldies are having another lazy day, dropping 0.5% since the doors of the ASX opened for business this morning, despite spot gold prices rising for the eighth consecutive session overnight to briefly reach a new all time high above US$2,380.

NOT THE ASX

Wall Street was sending mixed messages overnight, which saw the S&P 500 rise by +0.14%, the blue chips Dow Jones index down by -0.02%, and the tech-heavy Nasdaq climbing by +0.32%.

In US stock news, the start of the US Q1 earnings season gets underway in earnest on Friday, which will provide the next catalyst for the market.

Nvidia’s shares fell nearly -2% after Intel revealed a new version of its AI chip at its Vision event. Intel’s shares rose +1%.

Moderna jumped by +6% to a three-month high after the company revealed positive responses in its early-stage cancer vaccine developed with Merck.

Alphabet lifted 1.3% to a one-year high after announcing a new video-creation app, Google Vids, which also utilises AI.

On the meme stock front, Trump Media & Technology Group is continuing to bumble along, down around 44% since it peaked late last month – but it’s more the actions of the man whose shingle is out the front than the stock price itself that’s raising eyebrows at the moment.

Trump recently took to the platform to talk up how great the company is, boasting – without providing proof – that the company has US$200 million in the bank and “zero debt”, which is a very different picture to the one painted by the company’s financial disclosure to the NYSE last week.

It’s worth noting that major shareholders making false statements about the performance of a company they’re invested in is really illegal… and the rumour mill is working overtime that this could turn out to be yet another legal impediment to Trump bullshitting his way into the US presidency again later this year.

In Asian market news, the Nikkei has dropped -0.38%, Shanghai markets are down -0.28% and Hong Kong’s Hang Seng is up 1.13%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 10 April [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

CODE COMPANY PRICE % TODAY VOLUME MARKET CAP FRS Forrestaniaresources 0.029 107% 33,959,718 $2,265,000 CNJ Conico Ltd 0.0015 50% 1,510,495 $1,805,095 MKL Mighty Kingdom Ltd 0.003 50% 25,933,626 $1,322,533 TD1 Tali Digital Limited 0.0015 50% 8,882,837 $3,295,156 TMR Tempus Resources Ltd 0.006 50% 1,855,682 $2,923,995 PSC Prospect Res Ltd 0.125 44% 4,730,735 $40,309,881 WTM Waratah Minerals Ltd 0.105 40% 1,287,231 $11,202,337 IEC Intra Energy Corp 0.002 33% 500,000 $2,536,172 NES Nelson Resources. 0.004 33% 500,000 $1,840,783 M4M Macro Metals Limited 0.014 27% 50,591,648 $35,552,734 KGD Kula Gold Limited 0.011 22% 6,476,565 $4,378,157 PR1 Pureresourceslimited 0.12 21% 256,903 $2,539,351 CYM Cyprium Metals Ltd 0.023 21% 8,833,125 $28,969,534 CPN Caspin Resources 0.088 21% 725,717 $6,881,394 14D 1414 Degrees Limited 0.095 20% 598,241 $18,815,313 CAV Carnavale Resources 0.006 20% 200,000 $17,117,759 CHK Cohiba Min Ltd 0.003 20% 2,429,253 $8,970,610 OSL Oncosil Medical 0.006 20% 85,000 $11,277,706 VRC Volt Resources Ltd 0.006 20% 347,698 $20,650,533 GTG Genetic Technologies 0.16 19% 174,084 $15,581,328 YRL Yandal Resources 0.14 17% 291,115 $32,136,914 BFC Beston Global Ltd 0.007 17% 993,806 $11,982,281 GGE Grand Gulf Energy 0.007 17% 8,312,213 $12,571,482 LRL Labyrinth Resources 0.007 17% 819,000 $7,125,262 TMK TMK Energy Limited 0.0035 17% 20,464 $20,267,144

Out in front for the Small Caps on Wednesday morning was Forrestania Resources (ASX:FRS), after the company revealed that it’s been poring over old exploration and digging date, and had boots on the ground on-site, in its search for gold at the Ada Ann and Bonnie Vale North prospects, just north of Coolgardie, WA.

The highlight of the announcement was a rock chip grab sample that contained 49g/t Au, found in previously unrecorded, historic drill spoils at Ada Ann, to go with other grab samples of 15.7g/t and 13.5g/t.

That caught the eye of investors this morning, sending FRS briefly above +100%, but that eased on the way to lunch to just over +85%.

Other gold finds pushing gains this morning included Waratah Minerals (ASX:WTM) high grade gold and porphyry discovery at the Spur project, in the Lachlan Fold Belt, of NSW.

Prospect Resources (ASX:PSC) has executed an agreement that will see Orpheus Minerals (ASX:ORP) exiting from its exploration projects in Zambia, and pay $1.0 million in fully paid PSC shares as partial reimbursement of prior exploration expenditure, along with three options to acquire ordinary PSC shares for every four shares issued, at 15 cents per share, expiring three years after issue.

Kula Gold (ASX:KGD) was back in the news on Wednesday, reporting UFF soil sampling has defined a gold anomaly at the Boomerang Gold Prospect at the Marvel Loch project, near Southern Cross WA.

Kula said the project is handily located close to existing gold resources, north of the Nevoria Gold Mine (+600,000oz gold), and east of the circa 2.4Moz Marvel Loch Gold Mine and west of the Mt Palmer Gold Mine (+150,000 oz gold).

ASX SMALL CAP LAGGARDS

Here are the least best performing ASX small cap stocks for 10 April [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap AXP AXP Energy Ltd 0.001 -50% 9,297,454 $11,649,361 SOM SomnoMed Limited 0.205 -31% 435,207 $32,354,969 NVU Nanoveu Limited 0.017 -26% 125,892 $10,250,999 RIE Riedel Resources Ltd 0.003 -25% 30,000 $8,895,343 RMX Red Mount Min Ltd 0.0015 -25% 10,063,525 $5,347,152 DTM Dart Mining NL 0.03 -21% 2,556,868 $8,648,026 FZR Fitzroy River Corp 0.115 -21% 1,440 $15,653,366 EMP Emperor Energy Ltd 0.012 -20% 3,739,028 $5,111,062 NMR Native Mineral Res 0.024 -20% 100 $6,295,515 ECT Env Clean Tech Ltd. 0.004 -20% 223,185 $15,859,052 HLX Helix Resources 0.004 -20% 2,374,354 $11,615,729 LNU Linius Tech Limited 0.002 -20% 8,760,361 $12,991,852 VRX VRX Silica Ltd 0.073 -19% 1,133,376 $52,504,069 SRR Saramaresourcesltd 0.025 -17% 575,382 $2,412,573 MHC Manhattan Corp Ltd 0.0025 -17% 112,532 $8,810,939 MOM Moab Minerals Ltd 0.005 -17% 1,425,800 $4,271,781 TAS Tasman Resources Ltd 0.005 -17% 101,000 $4,276,016 VML Vital Metals Limited 0.005 -17% 1,809,070 $35,370,402 YAR Yari Minerals Ltd 0.005 -17% 25,000 $2,894,147 NYR Nyrada Inc. 0.11 -15% 3,857,055 $23,323,131 HASR Hastings Tech Met - Rights 17-Apr-24 0.023 -15% 207,493 $1,660,986 CRR Critical Resources 0.012 -14% 286,825 $24,889,904 HXL Hexima 0.012 -14% 481,801 $2,338,555 TSI Top Shelf 0.155 -14% 98,478 $37,561,655 GSN Great Southern 0.02 -13% 479,897 $17,356,609

ICYMI – AM EDITION

Bailador Technology Investments (ASX:BTI) says the merger of its investee company Rezdy with independent global tours and activities booking software providers Checkfront and Regiondo has provided significant value for shareholders. The combined company – RC TopCo, is poised to become a booking software leader in the $300bn+ tours and activity market.

First Lithium (ASX:FL1) has appointed experienced geological services group Pivot Mining Consultants to manage and conduct the maiden mineral resource estimate for its Mali lithium project.

Pivot has extensive consulting experience, undertaking due diligence studies, resource and reserve estimate studies and feasibility studies across many resource projects worldwide and has appointed Rob Barnett, who has 40 years’ experience as the competent person for the resource estimate work.

The company has reported multiple thick, high-grade hits at the Blakala prospect within the project. This is hugely encouraging as Blakala is one of only two Tier 1 priority lithium targets in Mali, the other being Leo Lithium (ASX:LLL) and Ganfeng’s giant 211Mt at 1.37% Li2O Goulamina project.

Felix Gold (ASX:FXG) has completed metallurgical testwork at its NW Array prospect that achieved strong gold recoveries of over 90%. The testing, which comes ahead of a maiden resource estimate, also found that the gold is free milling and recoverable using cyanide.

At Stockhead, we tell it like it is. While Bailador Technology Investments, Felix Gold and First LIthium are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.