You might be interested in

Mining

Monsters of Rock: BHP's $60 billion Anglo American gambit far from a done deal

News

Closing Bell: ASX clipped -1.3pc on broad selloff; BHP makes a $60bn play for Anglo American

News

News

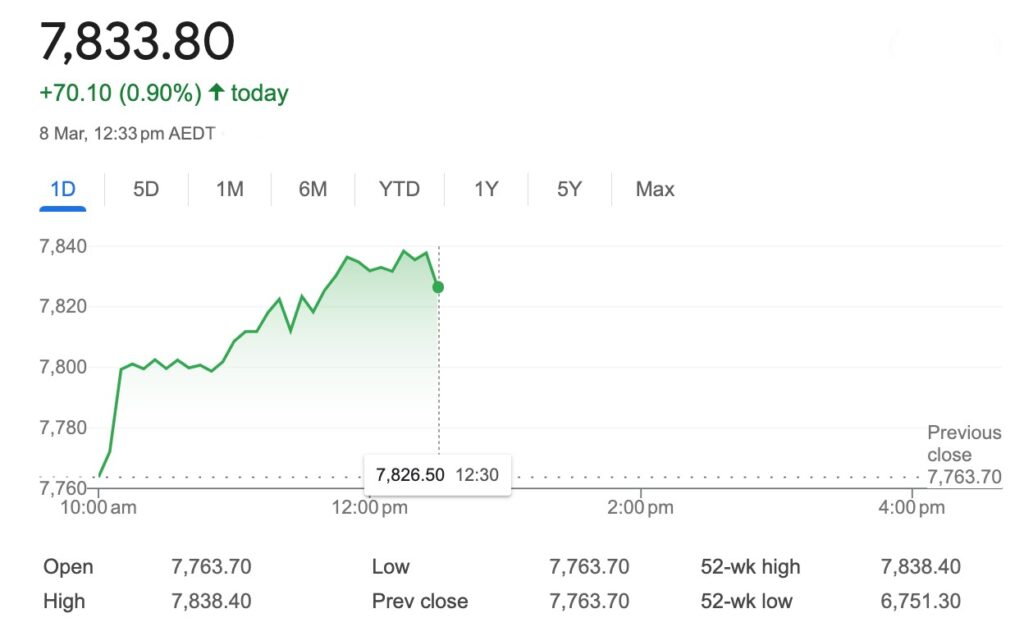

Australian markets couldn’t be stopped from rising in the AM on Friday, following a broad market rally in the States.

At lunchtime the benchmark was lazily back at a new record high, big banks, IT stocks and a broad collection of names lifting the index above 7800.

Over the last month of trade, the benchmark is up almost 2% and has scratched further gains in the last year, up about 6.5%.

At 12.30pm on Friday March 8, the S&P/ASX200 was up 70 points, or 0.90%, to 7833.8.

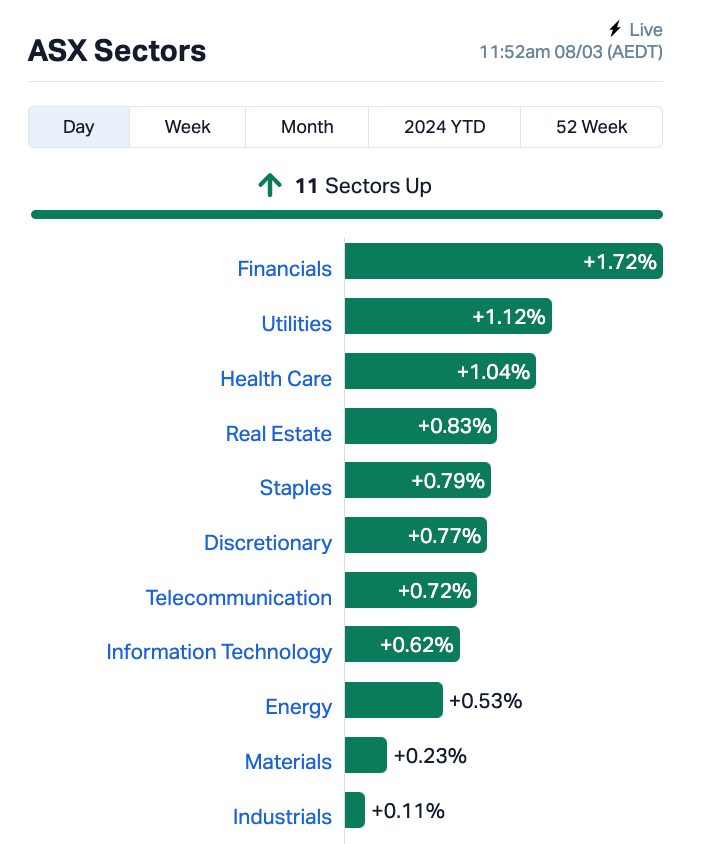

All 11 ASX sectors are ahead at midday.

That’s despite a lot of gossip about hedge funds covering nearly $1 billion in short positions over February who’ve shifted their focus to larger ASX companies resulting in increased shorting activity and heightened market volatility during the recent and otherwise decent earnings season.

That’s led to a shift away from the usual shorted ASX suspects – yes, that’ll be you IGO (ASX:IGO) and Core Lithium (ASX:CXO) .

OFC, that hasn’t applied to Pilbara Minerals (ASX:PLS), which may forever attract heaps of short interest.

Helping business along on Friday in Sydney is what might almost be called a Dovish twitch from the Raptor of La Rochelle, ECB boss Christine Lagarde, who permitted rates to remain on hold overnight.

Perhaps more exciting for traders – Ms Lagrade was out front of an official ECB lowering of both growth and inflation forecasts for the rest of the year.

And gladness – in the form of new record highs for both the S&P500 and the tech-heavy Nasdaq (home of AI-awesomeness) – were quick to ensue.

In local moves, the major banks and insurers making up the Financial Sector were moving on for a second day of trade, led by the Big 4.

Tech stocks were also leading gains – the majors like NextDC (ASX:NXT), Xero (ASX:XRO) and WiseTech Global (ASX:WTC) all finding support.

At the other end of fortune, the Mining Sector is dragging its feet on Friday as iron ore remains a worry and China is the cause of it. The goldies also slipped after some rather terrific gains over the last week in particular.

Materials was the weakest sector with BHP (ASX:BHP) and Fortescue (ASX:FMG) weighing, as are the major gold producers Messrs Northern Star Resources (ASX:NST) and Newmont Corporation (ASX:NEM) – both were more than 0.55% lower at lunch.

On trader’ minds is news China’s biggest copper smelters are expected to meet the shitkicking China Nonferrous Metals Industry Association in Beijing next week, while the National People’s Congress is still fresh, to see what can be done to counter the plunge in ore processing.

The word from Bloomers is that executives from all the leading smelters are expected to implement a joint production cut.

The price of gold clocked its new record high of US$2,141 per troy ounce, driven by what’d be growing anticipation of some US rate cutting.

Pushing that are the more than significant central bank buying of the safe haven and the mission of Chinese investors, sent forth to suck up what they can.

Meanwhile, on Monday the ASX suspended the following companies from quotation for not getting their reporting season data sets in on time.

It’s worth noting the Australian Bond Exchange (ASX:ABE) for one got their numbers in and have skyrocketed in early trade. (See below).

The Aussie dollar is a little stronger and was fetching 66.20 US cents at midday.

Copper Strike (ASX:CSE) is paying 0.6 cents fully franked

Finexia Financial Group (ASX:FNX) is paying 0.5 cents fully franked

Insignia Financial (ASX:IFL) ) is paying 9.3 cents unfranked

Meridian (ASX:MEZ) is paying 5.6172 cents unfranked

Nine Entertainment Company (ASX:NEC) is paying 4 cents fully franked

Summerset Group (ASX:SNZ) is paying 10.5879 cents unfranked

US Masters Residential Property Fund (ASX:URF) is paying 1 cent unfranked

WiseTech Global (ASX:WTC) is paying 7.7 cents fully franked

The price of Bitcoin is a little off its recent record high.

But lookit this chart. For a bit.

Like someone called Stella, Wall Street has got its momentarily lost groove back on Thursday.

Bumptious buying on the S&P500 and the Nasdaq Composite sent those two back to fresh record highs.

Motivation: same, same. More money in the shape of hope over easing inflation with the focal point delivering more of the gains to a tech-addled NYSE.

The S&P500 lifted 1.05% to 5,157.36, while the tech-heavy climbed 1.5% to 16,273.3.

The droppy Dow Jones Industrial Average gained 130.30 points, or 0.34%, to close at 38,791.35. Personally, I would be watching the Nadsdaq but feeling and acting like the Dow.

US optimism found encouragement when the ECB (European Central Bank) under the auspices of (friend of the show) Lagarde lowered annual inflation forecasts as well as growth outlooks overnight.

Christine also told the crew to hold key interest rates steady, boys.

In the language of Lagrade, that’s a bullish signal on the global inflation trajectory.

Christine’s headlines, followed Jerome’s.

The Federal Reserve Chair J. Powell told Congress on Wednesday that he expects interest rates to come down in ’24.

While J. said the Fed won’t be cutting, like, tomorrow, he did tell a largely sonambulant US Senate Banking Committee hearing that the bank isn’t far from the half cup full of confidence it needs to start snipping.

The Nasdaq Composite was just the stage upon which Nvidia (NVDA) and friends of the artificial intelligence ilk were booked to perform.

NVDA stock is up about 13% so far this week and there’s a day to play in New York.

At the other end of the orchard, Apple fell a little – but it made for seven straight losing session.

Costco joined Meta and Nvidia last night among the new one-year club.

Also killing it overnight in what was a fairly broad market rally – AI buds – Micron, and NXP Semiconductors, and a few big US insurers like Prudential.

At the end of play here, we’ll be looking closely at the latest US jobs report.

All US sectors closed higher except for Real Estate and Financials. Tech was the killer bee.

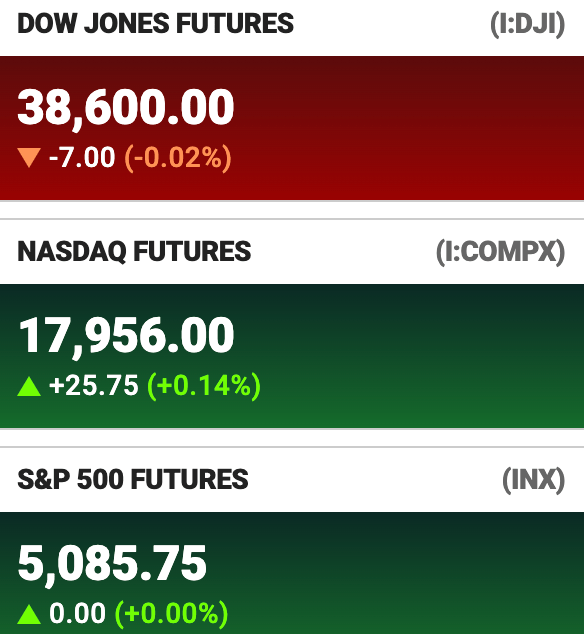

In New York, futures for the three major indices were steady-ish on Friday in Sydney as traders braced for the aforementioned, highly-anticipated and potentially inflation-related and market-moving monthly jobs drop.

US Futures are thusly on Wednesday at lunch in Sydney:

Here are the best performing ASX small cap stocks for 8 March [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap 1CG One Click Group Ltd 0.011 57% 1,821,219 $4,817,252 OLL Openlearning 0.025 47% 1,012,843 $4,553,774 MAG Magmatic Resources 0.064 42% 7,956,184 $13,756,176 ABE Australian Bond Exchange 0.053 39% 434,332 $4,281,388 PWN Parkway Corp Ltd 0.012 33% 4,299,780 $22,619,025 VUK Virgin Money Uk PLC 4.07 33% 7,427,617 $2,039,308,682 IMC Immuron Limited 0.16 28% 12,987,910 $28,474,793 OEC Orbital Corp Limited 0.16 28% 305,937 $18,225,842 AGR Aguia Res Ltd 0.019 27% 1,780,218 $8,692,293 8VI 8Vi Holdings Limited 0.05 25% 22,000 $1,676,457 GMN Gold Mountain Ltd 0.005 25% 6,055,073 $9,111,514 KPO Kalina Power Limited 0.005 25% 1,257,010 $8,840,512 RR1 Reach Resources Ltd 0.0025 25% 535,390 $6,420,594 VAL Valor Resources Ltd 0.0025 25% 307,740 $9,178,027 ZEU Zeus Resources Ltd 0.01 25% 1,725,102 $3,674,248 KNB Koonenberry Gold 0.032 23% 378,081 $3,113,476 PVL Powerhouse Ven Ltd 0.043 23% 267,529 $4,226,011 AD1 AD1 Holdings Limited 0.006 20% 200,000 $4,493,242 MGU Magnum Mining & Exploration 0.019 19% 8,955,249 $12,949,782 AQI Alicanto Min Ltd 0.035 17% 273,939 $18,460,104 HLX Helix Resources 0.0035 17% 205,012 $6,969,438 RML Resolution Minerals 0.0035 17% 11,987 $3,779,990 C1X Cosmos Exploration 0.064 16% 19,780 $3,161,125 3DP Pointerra Limited 0.057 16% 8,487,047 $35,615,924 RAC Race Oncology Ltd 1.185 16% 224,534 $167,416,806

The Aussie (now with an “AI powered”) software-as-a-service (SaaS) edutech OpenLearning (ASX:OLL) says it’s signed a three-year platform SaaS and content licence deal with the Asia Pacific International College.

OLL says the minimum value is $1.07 million. APIC is a higher education institution with campuses in Sydney, Melbourne and Brisbane that offers undergraduate and postgraduate degree courses to over 4,000 students per year.

As part of the agreement APIC will use OpenLearning’s platform to deliver three higher education units in Artificial Intelligence, the content of which will be provided by OpenLearning, to students as part of their Master of Information Technology program.

APIC reckon the addition of these new courses to its Master of IT will “generate an additional $10 million in revenue” for the institute in the next two years.

So it’d be good to buy a few shares in them too.

Up with some abandon after coming out of a trading halt is the Australian Bond Exchange (ASX:ABE), an innovative financial technology and services company providing having dropped its H1 FY24 numbers to the ASX.

CEO Bradley McCosker says ABE is still making “bonds more accessible to Australian private investors” and the mission remains to help service “this largely untapped market in Australia.”

“Our business continues to grow with active client numbers up 12% over the half-year and total client holdings increasing 23%. In addition to secondary market trading activity, we continued to see growth in our popular market-linked securities with $38,000,000 of additional products being sold.”

Australian Bond Exchange Holdings (ASX:ABE) uses its proprietary tech to “provide Australian Investors with direct access to the best of the fixed income asset class in Australia and internationally.”

Magmatic Resources (ASX:MAG) is soaring after executing a Farm-in and Joint Venture agreement with FMG Resources a wholly owned subsidiary of Fortescue (ASX:FMG).

The new buds plan to explore the Myall Project in central west NSW which consists of a contiguous 244km2 tenement covering the northern extension of the Junee-Narromine Volcanic Belt.

“The project hosts significant porphyry-associated copper-gold mineralisation within a similar geological setting to the Northparkes copper-gold mine 50km to the south,” the company says.

Evolution Energy Minerals (ASX:EV1) recently purchased 80% of Northparkes, with the balance held by Sumitomo Metals Mining and Sumitomo Corporation. Over the preceding two years, Magmatic has completed extensive exploration in the Corvette and Kingswood prospect areas of the project, culminating in an initial Mineral Resource Estimate for the area of 110Mt at 0.27% Cu, 0.07g/t Au and 0.8g/t Ag.

In addition, Fortescue will make a strategic investment, subscribing for 75,946,151 shares in MAG, to become a cornerstone investor. Magmatic Resources executive chairman David Richardson is excited.

“Myall has many of the signatures of a Tier 1 copper-gold deposit and Magmatic has recognised the need to partner with a major to further advance the project following the maiden Resource. Fortescue’s cornerstone investment in MAG will allow the Company to simultaneously advance our other two projects at Wellington North and Parkes which are strategically located near Alkane Resources Boda-Kaiser deposits and Tomingley Gold Operations respectively.”

Here are the most-worst performing ASX small cap stocks for 8 March [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap AXP AXP Energy Ltd 0.001 -50% 23,943 $11,649,361 ACS Accent Resources NL 0.006 -40% 1,790 $4,731,273 MRQ MRG Metals Limited 0.001 -33% 2,250,000 $3,707,012 HHR Hartshead Resources 0.007 -30% 38,266,569 $28,086,821 EXL Elixinol Wellness 0.006 -25% 2,327,036 $5,062,973 MCT Metalicity Limited 0.002 -20% 108,995 $11,212,634 VML Vital Metals Limited 0.004 -20% 124,206 $29,475,335 ICL Iceni Gold 0.025 -19% 345,779 $7,643,393 YOJ Yojee Limited 0.045 -18% 361,630 $9,577,321 AL8 Alderan Resource Ltd 0.005 -17% 3,000,000 $6,641,168 ASR Asra Minerals Ltd 0.005 -17% 1,050,000 $9,983,974 EMT Emetals Limited 0.005 -17% 2,000 $5,100,000 IPB IPB Petroleum Ltd 0.01 -17% 100,000 $6,781,469 MOH Moho Resources 0.005 -17% 201,245 $3,235,069 OAR OAR Resources Ltd 0.0025 -17% 178,800 $7,959,933 RBR RBR Group Ltd 0.0025 -17% 1,000,000 $4,855,214 REM Remsense Technologies 0.021 -16% 127,115 $3,217,117 JNO Juno 0.06 -15% 758,301 $12,918,113 ILA Island Pharma 0.061 -15% 294,205 $5,851,330 GTI Gratifii 0.006 -14% 451,520 $9,584,559 IS3 I Synergy Group Ltd 0.006 -14% 600,000 $2,128,563 LNR Lanthanein Resources 0.003 -14% 669,981 $6,492,181 ME1 Melodiol Global Health 0.006 -14% 353,788 $2,750,973 YAR Yari Minerals Ltd 0.006 -14% 15,800 $3,376,505 UBN Urbanise.Com Ltd 0.345 -13% 4,876 $25,351,301

Belararox (ASX:BRX) has received firm commitments to raise $4 million via a placement from new and existing investors to fund ongoing exploration at its TMT copper-gold project in Argentina.

The placement comprises ~14.3 million new fully paid ordinary shares to be issued at 28c/share, together with one free attaching listed option for every two shares issued under the offer.

Proceeds will go towards upcoming geological mapping, surface sampling and geophysical surveys on significant copper-gold targets, as well as establishing infrastructure in readiness for an initial drilling program slated for H2 2024.

Euroz Hartleys, CPS Capital Group and Evolution Capital acted as joint lead managers and bookrunners to the placement.

Proceeds from both capital raisings will be used to complete a 3D seismic survey across the company’s shallow water Aceh gas discoveries and ongoing costs associated with the Mako gas project offshore Indonesia.

At Stockhead, we tell it like it is. While Belararox is a Stockhead advertiser, it did not sponsor this article.