News

Finexia Financial Group is a non-bank lender operating in the private credit sector, primarily focusing on markets and opportunities that major banks have traditionally dominated but have recently abandoned. The Group has carved out a niche in the childcare sector, developing a unique lending specialisation alongside a robust distribution platform.

In addition to its childcare-focused lending, Finexia offers secured wholesale and commercial lending along with lending against listed equities. Complementing these services is a strong internal distribution capability via Finexia’s income-focused managed funds. These funds provide stable risk-adjusted returns to a diverse investor base that includes other ASX-listed companies, high net worth individuals, family offices, and retail investors. Finexia also holds a comprehensive and flexible Australian Financial Services Licence.

Listed on the Australian Securities Exchange in 2015 as a securities dealer/licensee, Finexia has over the years pivoted and evolved its strategy towards the lending sector. A key development in this strategic shift was the acquisition of Creative Capital Group in 2020, whose team brings a decade of direct private credit experience and over two decades of corporate banking expertise.

Our strategy is clearly focused on becoming the leading private lender to the childcare sector in Australia. The accelerated growth of the Finexia Childcare Income Fund, has been supported by multiple favourable independent ratings, further attesting to its unique position in this niche market.

We offer a specialised form of non-bank lending in a segment that benefits from robust tailwinds and favourable structural characteristics. Our products hold a number of competitive advantages with untapped potential in a market featuring positive demographic trends, clear social sustainability credentials, strong bipartisan political support and low economic sensitivity.

KEY PEOPLE

RELATED STOCKHEAD STORIES

Tech

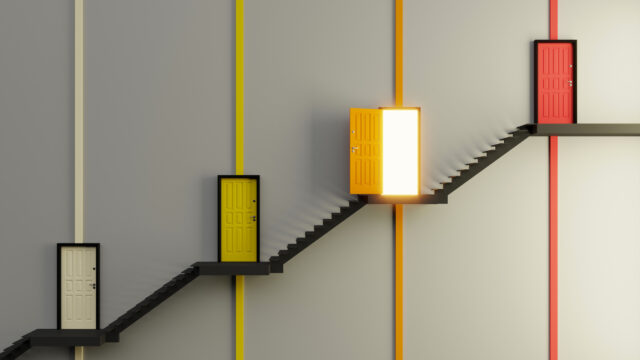

ASX funds and companies opening new doors for investors in private credit – Part 2

Tech

Private lender Finexia sees ‘huge opportunity’ in ‘childcare generation’

News

ASX Small Cap Lunch Wrap: Welcome to the ASX200 where we feast till dawn and everyone’s quite high

News

Closing Bell: ASX completes its strongest week in nearly 2 months

News