ASX December rebalance: Boss Energy enters S&P ASX 200, troubled Linked Administration booted

News

News

December has arrived in Australia bringing with it scorching heat for most of the country, Christmas festivities, summer BBQs with friends and family, pesky mosquitos and sand between your toes at the beach.

The first month of summer also signals the ASX December rebalance of some key indices.

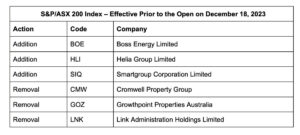

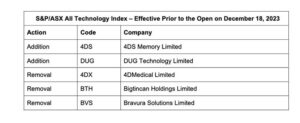

Responsibility for rebalancing falls on S&P Dow Jones Indices, part of credit rating agency S&P Global. Indexes rebalanced in the latest quarterly review included:

The December rebalance comes into effect before opening trade on Monday, December 18, 2023.

READ: The great rebalancing act and how it can impact share prices

Of particular note this quarter is the S&P ASX 200, often used by fund managers and investors as a cutoff for investments.

Uranium developer Boss Energy (ASX:BOE) has been elevated to the S&P ASX 200 after seeing its share price rise ~104% YTD.

BOE recently announced production-grade uranium was produced during the pre-flushing phase of the initial wells at its Honeymoon project and it was on schedule to fill the Pregnant Leach Solution (PLS) processing ponds by year’s end, aligning with the overall development timeline.

Helia Group (ASX:HLI), formerly known as Genworth Mortgage Insurance Australia, and salary packaging company Smartgroup Corporation (ASX:SIQ) have also made it onto the S&P ASX 200, up more than 55% and 73% YTD respectively.

However, being booted from the S&P are diversified real estate investor and fund manager Cromwell Property Group (ASX:CMW), down more than 37% YTD.

“It has been a challenging 12 months for Cromwell and we appreciate that you, our investors, feel this impact acutely, not only in terms of the current Cromwell security price, but also the more prudent approach to distributions which the board has adopted given the uncertainty around progress of asset sales and the need to protect balance sheet liquidity in the current market,” chairman Gary Weiss told the CMW AGM recently.

“Cromwell has taken significant steps in continuing to simplify the business by moving back to key core fund and asset management capabilities.”

Also coming off the ASX is financial technology stock Link Administration Holdings (ASX:LNK) which is the largest provider of superannuation administration services and the second-largest provider of share registry services in Australia.

The LNK share price is down more than 24% YTD with the company announcing mid-year its contract with big superannuation client Hesta won’t be renewed.

LNK also announced in August a net loss of $418 million for FY23 associated with one-time expenses and provisions, primarily associated with the exit from its troubled operations in the UK.

The LNK share price has plunged ~30% YTD.

Semiconductor development company of non-volatile memory technology 4DS Memory (ASX:4DS) has made it onto the S&P ASX All Technology Index with its share price up ~140% YTD.

Also a new addition to the index is DUG Technology (ASX:DUG) which specialise in analytical software development, big-data services and high-performance computing (HPC).

DUG has a global presence, including offices in Perth, London, Kuala Lumpur, and Houston, US – with clients in the resource, government and education sectors and has seen its share price up more than 180% YTD.

Co-founder and MD Dr Matt Lamont told November’s AGM he has never been more excited around DUG’s prospects than now and is leading the pack in technology with its MP-FWI solution with “a fabulous order book with strong market tailwinds in the oil and gas industry”.

“Outside of oil and gas we continue to see opportunities and our product line is strengthened by DUG Nomad as a novel solution to edge supercomputing,” he says.

However, being cut from the index is 4D Medical (ASX:4DX), despite its share price up more than 120% YTD.

4DX recently announced that its XV LVAS scanning device has been included into the U.S. Centers for Medicare & Medicaid Services (CMS).

Bigtincan (ASX:BTH) and Bravura Solutions (ASX:BVS) are also off the list. The BTH share prices has plunged 71% YTD, but BVS has risen ~9% for the same period.

Disclosure: The author held shares in Link Administration at the time of writing this article.