ASX Small Caps Lunch Wrap: Who has tunneled their way into trouble in New York this week?

Tunnel via Getty Images.

Local markets are being feeble today, much to the collective annoyance of investors who have done a lot of work over the years to make it very clear that they would like to increase their wealth, not watch it dwindle slowly away like my desire to finish binge-watching The Wire.

As the chef was plating up today’s lunch, the ASX 200 benchmark was moping around -0.20%, which isn’t terrible… just more of a disappointment than anything else, and clear evidence that a lot more effort could be made – and that the days of “go hard, or go home” are well and truly behind us.

I’ll get into the details of that shortly, but first, there’s this: a bizarre turn of events deep in the heart of New York city, that ended in a brawl between police and a group of young men over a secret tunnel leading into a synagogue.

The first inkling that most New Yorkers had that something had gone awry was when police closed off the entrance to the Chabad-Lubavitch world headquarters in Crown Heights, Brooklyn.

Inside the synagogue, tensions were running pretty high, as engineers from the city worked to determine whether an unauthorised tunnel, dug under neighbouring buildings and into the basement of the synagogue, had caused any structural damage to the buildings above.

According to Associated Press, locals believe that the tunnel was the work of a group of young men attached to the Chabad-Lubavitch movement, who began digging from the basement of a nearby apartment building, “snaking under a series of offices and lecture halls before eventually connecting to the synagogue”.

While the precise reason for the tunnel still hasn’t been determined, media reports suggest that the tunnel was made by supporters of the former head of the movement, Rebbe Menachem Mendel Schneerson, who reportedly had plans to expand the basement synagogue before his death in 1994.

“Supporters of the expansion said the basement synagogue had long been overcrowded, prompting a push to annex additional space that some in the community felt the property’s owners were slow-walking,” AP reports.

News of the tunnel’s existence spread throughout the neighbourhood in the weeks leading up to the police action on Monday, which was sparked by protest action from among supporters of the tunnel.

They had gathered to protest the actions of another faction within the group, who had arrived at the synagogue with plans to seal the tunnel with cement, to prevent possible damage to the buildings above.

And that’s when things got weird, as pro-tunnel worshippers began to vandalise the synagogue, prompting police to move in and arrest nine young men on charges ranging from criminal mischief and reckless endangerment, to obstructing governmental administration.

I had planned to link to video of the incident, because it’s pretty remarkable footage, but… instead I’ll make mention of the fact that tensions are running a little high on social media at the moment for a few different reasons, and I couldn’t find a link to vision of the incident that wasn’t attached to an out-of-control comments section.

So, you’re on your own for that one. I’m out.

TO MARKETS

Local markets have dipped slightly this morning, leaving the benchmark down 0.2% and trending lower as we head towards lunch.

The banner headline for the day, however, is fresh data from The Great Australian Bureau of Counting Things, which has told the nation that Australia’s monthly CPI has dropped for November at 4.3% YoY – 0.1% down on predictions and significantly lower than the 4.9% print of October.

Additionally, Rebecca Marquardt from the ABS reports that the annual trimmed mean inflation was 4.6% in November, a sizeable fall from 5.3% in October.

“Today’s fall in the trimmed mean and the core measure, below 5%, confirms that the disinflation narrative remains firmly in place and expectations of RBA rate cuts in 2024,” IG markets senior analyst Tony Sycamore told Stockhead.

“If Q4 inflation data scheduled for release at the end month paints a similar picture, there is a good chance that expectations of the RBA’s first rate cut are brought forward to June, with a third rate cut added into the rates market for 2024,” Tony continued.

Before the release, the rates market assigned a 100% chance of an RBA rate cut in August before another 25bp rate cut by December.

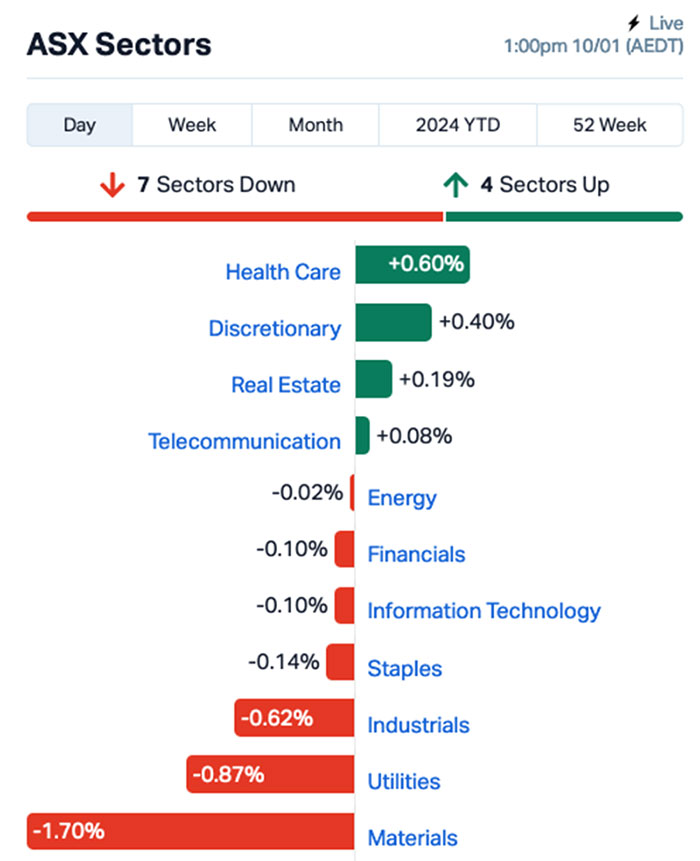

But still, things are sinking for local shares, with Materials and Utilities taking a beating – and a super-quick glance at which of the majors are soiling their grundies this morning revealed a fairly comprehensive list of the nation’s larger lithium players.

Latin Resources (ASX:LRS) is down close to 10% so far, Arcadium Lithium (ASX:LTM) has dropped 8.4% and recent market darling Wildcat Resources (ASX:WC8) has shed just over 5.2% today.

Up the fancy end of town, Alumina (ASX:AWC) is making +13.8% hay off the back of Alcoa’s decision to shut down its Kwinana Alumina Refinery in Western Australia – a move that Alumina says leaves it with “a strong foundation to move forward to create a significantly higher quality refinery portfolio and benefit from the positive long-term outlook for the alumina market.”

And uranium players Paladin Energy (ASX:PDN) and Boss Energy (ASX:BOE) are enjoying more time in the sun, after they got a significant boost from news that French energy giant EDF is set to extend the life of four nuclear power stations in the United Kingdom, and will be upping investment in its British nuclear fleet.

NOT THE ASX

Things were pretty quiet on Wall Street overnight, and the uninspired session left the S&P 500 down by -0.15%. The blue chips Dow Jones index was down by -0.42%, but the tech-heavy Nasdaq climbed by +0.1%.

In US stock news, Earlybird Eddy reports that Match Group Inc – the owner of dating app Tinder – was up 3% after Elliott Investment Management was said to have bought a US$1b stake in the company.

Boeing continued its decline, down another -1.4% after air-safety officials probing last week’s Air Alaska fuselage blowout could not find four bolts, and several other airlines said they found loose parts among their Boeing 737 MAX fleets.

Netflix was down -0.6% after being cut to “neutral” by Citigroup from a “buy”, citing risks in 2024 and 2025 related to revenue and higher cash content costs.

Spanish blood plasma firm Grifols SA crashed by -25% after hedge fund Gotham City questioned the company’s accounting, prompting the Spanish drugmaker to “categorically” deny any wrongdoing.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 02 January [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ME1 | Melodiol Glb Health | 0.002 | 100% | 662,681 | $4,728,824 |

| KM1 | Kalimetalslimited | 0.74 | 41% | 15,631,583 | $40,079,600 |

| BP8 | Bph Global Ltd | 0.002 | 33% | 250,000 | $2,753,345 |

| NVQ | Noviqtech Limited | 0.004 | 33% | 8,824,427 | $3,928,336 |

| SIS | Simble Solutions | 0.004 | 33% | 3,821,511 | $1,808,852 |

| FHS | Freehill Mining Ltd. | 0.012 | 33% | 40,677,343 | $25,648,510 |

| GUE | Global Uranium | 0.13 | 30% | 1,119,641 | $21,220,897 |

| CHK | Cohiba Min Ltd | 0.0025 | 25% | 611,185 | $5,060,460 |

| AKM | Aspire Mining Ltd | 0.145 | 21% | 281,157 | $60,916,438 |

| BMG | BMG Resources Ltd | 0.012 | 20% | 2,998,306 | $6,337,972 |

| YRL | Yandal Resources | 0.155 | 19% | 169,002 | $30,514,400 |

| ICE | Icetana Limited | 0.033 | 18% | 91,821 | $7,409,596 |

| ASR | Asra Minerals Ltd | 0.007 | 17% | 1,355,500 | $9,818,974 |

| AVE | Avecho Biotech Ltd | 0.0035 | 17% | 3,251,402 | $9,507,891 |

| RWD | Reward Minerals Ltd | 0.065 | 16% | 8,000 | $12,759,776 |

| A3D | Aurora Labs Limited | 0.032 | 14% | 2,004,828 | $8,109,026 |

| EPM | Eclipse Metals | 0.008 | 14% | 1,968,000 | $14,437,880 |

| LIO | Lion Energy Limited | 0.016 | 14% | 963,523 | $6,117,689 |

| LSR | Lodestar Minerals | 0.004 | 14% | 1,003,904 | $7,081,891 |

| AWC | Alumina Limited | 1.115 | 14% | 15,556,017 | $2,843,647,789 |

| CR9 | Corellares | 0.025 | 14% | 19,881 | $10,231,999 |

| EMD | Emyria Limited | 0.067 | 14% | 2,282,016 | $21,631,134 |

| CXU | Cauldron Energy Ltd | 0.035 | 13% | 6,742,670 | $35,118,011 |

| MEL | Metgasco Ltd | 0.009 | 13% | 170,187 | $8,511,094 |

| RR1 | Reach Resources Ltd | 0.0045 | 13% | 1,958,620 | $12,841,188 |

Market newbie Kali Metals (ASX:KM1) is absolutely crushing it again this morning, up 38% and bucking the overall sell-off trend that has hit the ASX’s lithium players pretty hard today.

Kali dropped a well-timed announcement about rock chip and soil sampling that was carried out prior to its IPO this week, with results confirming that spodumene has been identified at Spargoville, part of its Higginsville lithium district in WA.

Freehill Mining (ASX:FHS) is enjoying an announcement-free surge this morning, with the iron-copper-gold explorer adding a nifty 33.3% so far for the day.

Global Uranium and Enrichment (ASX:GUE) is riding the uranium surge this morning, as it too took on extra value without an announcement, adding 30%.

And lastly for now, another uranium explorer, Gladiator Resources (ASX:GLA) , took off rapidly in early trade on the back of news that re-analysis of uranium samples from a trenching program at Southwest Corner – part of the Mkuju project in Tanzania – have come back above the detection limit (4245ppm U3O8) returned grades up to 7139ppm.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 02 January [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap AVW Avira Resources Ltd 0.001 -50% 649,998 $4,267,580 TX3 Trinex Minerals Ltd 0.006 -25% 64,381 $11,896,197 SKN Skin Elements Ltd 0.004 -20% 2,059,657 $2,947,430 EMP Emperor Energy Ltd 0.009 -18% 24,900 $3,748,112 YAR Yari Minerals Ltd 0.009 -18% 4,666 $5,305,936 ESR Estrella Res Ltd 0.005 -17% 300,000 $10,556,231 OAR OAR Resources Ltd 0.0025 -17% 10,500 $7,931,183 A1G African Gold Ltd. 0.031 -14% 217,014 $6,095,204 KAL Kalgoorliegoldmining 0.025 -14% 12,094 $4,596,521 BVR Bellavistaresources 0.1 -13% 59,978 $5,705,262 WIN Widgienickellimited 0.1 -13% 132,496 $34,263,681 EXT Excite Technology 0.007 -13% 200,633 $10,633,934 IEC Intra Energy Corp 0.0035 -13% 2,012,267 $6,643,126 C29 C29Metalslimited 0.071 -12% 60,000 $4,371,320 EVZ EVZ Limited 0.15 -12% 4,537 $20,585,626 RVS Revasum 0.115 -12% 10,656 $16,656,254 CSS Clean Seas Ltd 0.27 -11% 49,229 $58,209,348 MBK Metal Bank Ltd 0.024 -11% 83,334 $10,542,401 FLX Felix Group 0.16 -11% 30,000 $36,809,948 NNL Nordicnickellimited 0.125 -11% 19,102 $10,121,638 KRR King River Resources 0.0125 -11% 775,705 $21,749,349 MQR Marquee Resource Ltd 0.025 -11% 130,000 $11,574,763 CAV Carnavale Resources 0.0045 -10% 2,059,000 $17,117,759 NRX Noronex Limited 0.009 -10% 151,164 $3,783,018 ROG Red Sky Energy. 0.0045 -10% 3,000,000 $26,511,136

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.