ASX Rebalance: Tech in, lithium out of S&P/ASX 200 as uranium stocks enter S&P/ASX 300

Pic: Getty Images

- QBE Insurance elevated to S&P/ASX 20 as gold miner Newmont removed

- Flight Centre and Pro Medicus both make the S&P/ASX 100 in March rebalance

- Several tech companies make benchmark S&P/ASX 200 but not so good for resources

March has arrived, signalling the first month of autumn, Q4 for the Australian financial year and the latest rebalance of some key S&P/ASX indices.

Responsibility for rebalancing falls on S&P Dow Jones Indices, part of credit rating agency S&P Global. Indexes rebalanced in the latest quarterly review included:

- S&P/ASX 20

- S&P/ASX 50

- S&P/ASX 100

- S&P/ASX 200

- S&P/ASX 300

- S&P/ASX All Odinaries

- S&P/ASX All Technologies Index

The March rebalance comes into effect before opening trade on Monday, March 18, 2024.

Of particular note in rebalances the S&P/ASX 200 and S&P/ASX 300 and are ones many fund managers or investors use as a cutoff for investments.

Entering the S&P/ASX 300 is a major milestone for a company, signifying they’ve made it to the big league.

READ: The great rebalancing act and how it can impact share prices

So what are the additions and removals in the March rebalance?

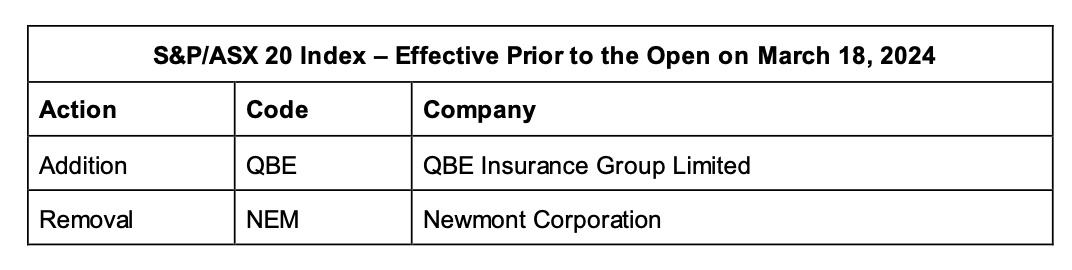

QBE Insurance in, Newmont out of S&P/ASX 20

QBE Insurance (ASX:QBE) was elevated to the S&P/ASX 20 after seeing its share price lift 17% YTD. QBE announced in February FY23 statutory net profit after tax of $1,355m, compared with $587m in FY22.

Adjusted cash profit after tax increased to $1,362m from $664m in the prior year. Strong premium growth continued, with gross written premium growth of 10% supported by group-wide renewal rate increases of 9.7% and targeted new business growth.

The world’s biggest gold miner Newmont Corporation (ASX:NEM) is out of the S&P/ASX 20 after its share price slumped ~19% YTD. NEM recently announced it will divest six of its non core assets, including its Telfer gold mine in the Pilbara to focus on its portfolio of tier one and emerging tier one assets.

There was no change to the S&P/ASX 50 index in the latest rebalancing.

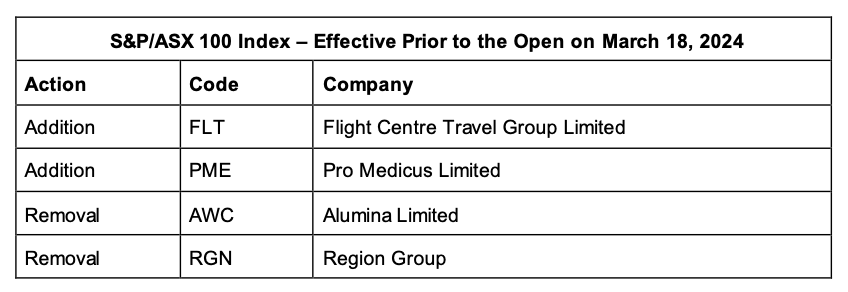

Flight centre and Pro Medicus make S&P/ASX 100

FLT has been elevated to the S&P/ASX 100. The travel stock achieved a $106 million underlying profit before tax (PBT) for H1 FY24, a 565% increase on the pcp. H2 FY24 results are in line with expectations with no change to the financial outlook previously provided to the market.

Health imaging stock Pro Medicus (ASX:PME) will also enter the S&P/ASX 100 with its share price up 3.79% YTD. PME has announced record half year results which met expectations. H1 FY24 net profit was $36.3 million 33.3% higher than the pcp with revenue of $74.1 million, up 30.3% on pcp.

An almost 17% rally YTD has not been enough for Alumina (ASX:AWC) to maintain its spot in the S&P/ASX 100. AWC in February announced it had received a non-binding proposal from Alcoa Corp to acquire the company for a scrip consideration of 0.02854 shares of Alcoa common stock for each Alumina share. The proposal is at a 13.1% premium to the share price of Alumina on February 23, 2024.

Also on the out is REIT Region Group (ASX:RGN) which reported a statutory net loss after tax of $35m for H1 FY24, up by 63.2% on pcp.

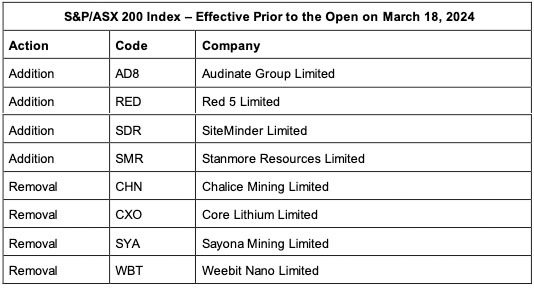

Tech in, lithium out of S&P ASX 200

While several tech companies were elevated to the benchmark S&P/ASX 200 in the March rebalance as investor interest in the sector continues to grow buoyed by the future potential of AI Weebit Nano (ASX:WBT) was ousted.

The heavily shorted semiconductor company reported ~$153k in revenue for H1 FY24 with a loss of $25.2 million, which it attributed to “higher research and development costs due to achieving multiple technology milestones”.

Resource companies including former lithium darlings Core Lithium (ASX:CXO) and Sayona Mining (ASX:SYA) have been removed from the S&P/ASX 200 as falling commodity prices take a toll.

Stanmore Coal (ASX:SMR) was the only resources company added to the benchmark.

“Our inclusion into the ASX 200 is a continued and further acknowledgement of the significant transformation Stanmore has undertaken and also of the financial strength of the company as evidenced by its recently released 2023 full year results,” CEO Marcelo Matos says.

“The announcement will further consolidate our recognition and reach in equity markets going forward.”

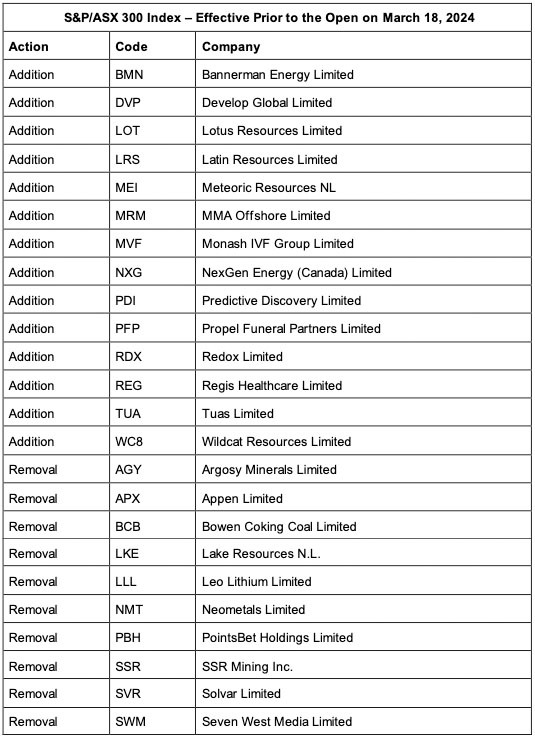

Uranium stocks enter the S&P/ASX300

Bannerman Energy (ASX:BMN) was among uranium stocks promoted to the S&P/ASX 300 in the March rebalance. BMN has seen its share price rise ~9% YTD and more than 76% over the past year as interest in uranium grows.

The cost of uranium has been heading upward, now above US$100/lb and is predicted to continue rising as demand rises for a rapid and cost-effective shift towards clean energy and governments increasingly adopt nuclear fuel to achieve ambitious carbon emission reduction goals.

Uranium stocks Lotus Resources (ASX:LOT) and NexGen Energy (ASX:NXG) will also be added to the S&P/ASX 300.

There were in total 14 new additions and 10 removals to the S&P/ASX 300 in the latest rebalance. Among health stocks added was reproductive medicine company Monash IVF Group (ASX:MVF) along with Regis Healthcare (ASX:REG).

MVF in February announced solid H1 FY24 results, including revenue up 21.7% on pcp to $125.7m and underlying group NPAT increased 18.7% to $15m.

MVF reported EBITDA of $30m, up from $24.3m on pcp with underlying EBITDA of $32.2m while group revenue was $125.7m up 21.7%.

One of Australia’s biggest funeral operators Propel Funeral Partners (ASX:PFP) was also a new addition to the S&P/ASX 300.

PFP recently announced revenue of $102.9m for H1 FY24, up 22.8% on pcp with operating EBITDA of $27.4m, up 18.5% on pcp and pro forma operating NPAT of $11.7m, up 6.7% on pcp.

Big changes to the All ordinaries index

The All Ordinaries Index – which is the oldest index of shares on the ASX and made up of the share prices for 500 of the largest listed companies – also had its annual rebalance for 2024 with more than 90 changes.

A host of stocks across various sectors including tech, biotech and resources join the ranks of the All Ords in the latest rebalance while it seems just as many are dropping out.

You can see the full list here.

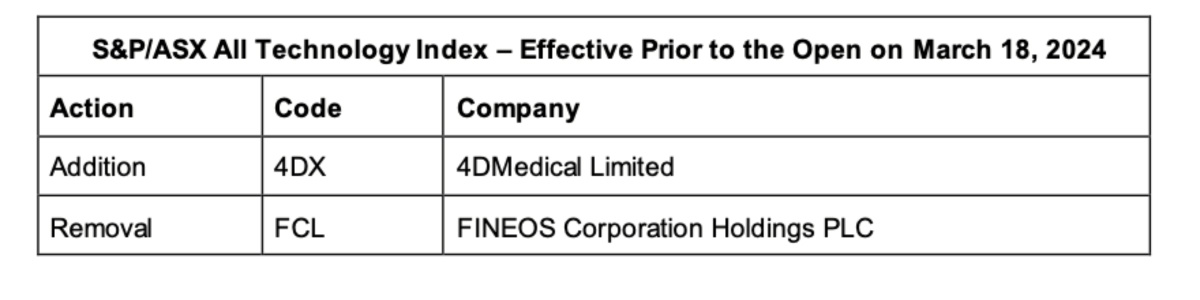

S&P/ASX All Tech Index

Global medtech company 4D Medical (ASX:4DX) which is focused on the commercialisation of its flagship respiratory imaging platform XV Technology has been elevated to the S&P/ASX All Tech Index.

4DX recently announced it will again collaborate with Vanderbilt University Medical Center (VUMC), this time as part of a grant awarded by the US Department of Veterans Affairs.

The company says the Military Exposures Research Program (MERP) seeks to advance military exposure assessments and to understand the effects of military exposures on Veterans’ health outcomes to inform care and policy.

And that completes a mighty rebalance and reorder of the ASX in March 2024.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.